2 Things Every Emerging Biopharma Needs To Know About Supply Chain

By Ray Sison

There is an inside joke in drug product development: We enter our careers with visions of discovery and world-changing  accomplishment. Then, one day we wake up in supply chain. With the world's sudden focus on supply chain, notably for healthcare and the drug development industry, supply chain professionals may yet have their moment.

accomplishment. Then, one day we wake up in supply chain. With the world's sudden focus on supply chain, notably for healthcare and the drug development industry, supply chain professionals may yet have their moment.

For clinicians on the front lines with potential effective therapies who are exploring how to develop new drug products, as well as development-stage companies looking to manage clinical supply chains and transform their organization for product launch, a basic framework is needed in order to integrate supply chain operation into a business strategy.

In the opinion of some supply chain specialists, outside the profession there is a fundamental lack of understanding of supply chain. Specifically, there is a misunderstanding of the key difference between “the” supply chain (SC) and the activity of supply chain management (SCM). This must be properly understood as an important backdrop in any SC/M discussion. For simplicity, SC and SCM together will be called SC/M. The SC is simply the chain and nodes of suppliers, manufacturers, and distributors that supply product (clinical or commercial). SCM is a cross-functional discipline that balances business, technical, operational, quality, and regulatory issues in a dynamic environment to continually optimize the SC.

The Three Ps: People, Process, Platform

SC/M does not exist as an isolated function. It reacts to and informs a project or business at all levels. For those not used to SC thinking, start with this framework:

People

These are the resources with specialized skillsets assigned to various defined functions working toward a prioritized set of goals. In a startup or transitioning company, questions that should be addressed might include:

What existing internal and external resources are positioned to set up the SC and perform the SCM function?

- What does it cost and how much time will it take to set up and manage a SC?

- As product launch approaches, how will the people, functions, and skillsets need to evolve?

- When does it make sense to optimize and/or risk manage a supply chain?

Process

Within a quality system, key processes are driven by standard operating procedures (SOPs), work instructions, or checklists. These will be the backbone of defined processes executed by resources toward the goals of SC/M. To maintain a level of flexibility, informal methods and means of communication will also be needed as part of a specialized skillset. Again, in a startup or transitioning company, questions to be addressed include:

- What existing internal and external processes are available to facilitate the SC flows? (Hint: If the SC is outsourced, the Master Service/Supply Agreements and Quality Technical Agreement will list responsibilities for each party).

- How does a tool, technology, or innovation integrate and/or facilitate these processes?

- To what degree do external processes need oversight?

- What happens when goals, technology, or processes change? (Which comes first?)

Platform

This is a term that encompasses systems and technology in the broadest sense; in this setting, it is the SC itself. As defined above, the SC is the chain and nodes of suppliers, manufacturers, and distributors that supply product. Further, the matrix of companies de facto sets boundaries around people and processes (e.g., internal and external) and how they interact. Questions include:

- How are suppliers/partners identified and contracted for work?

- How does each node contribute to cost?

- Are the business objectives of each supplier aligned with company objectives for future growth?

- What are the capabilities and limitations of each node in the SC?

The flow of information, goods, and money through the interaction of PPP is how the SC/M operates. Once this is understood, meaningful discussions on how to build, grow, and transition an operation are possible. A supply chain will follow the product life cycle of a drug product, having different attributes and goals that are fit for purpose at each stage.

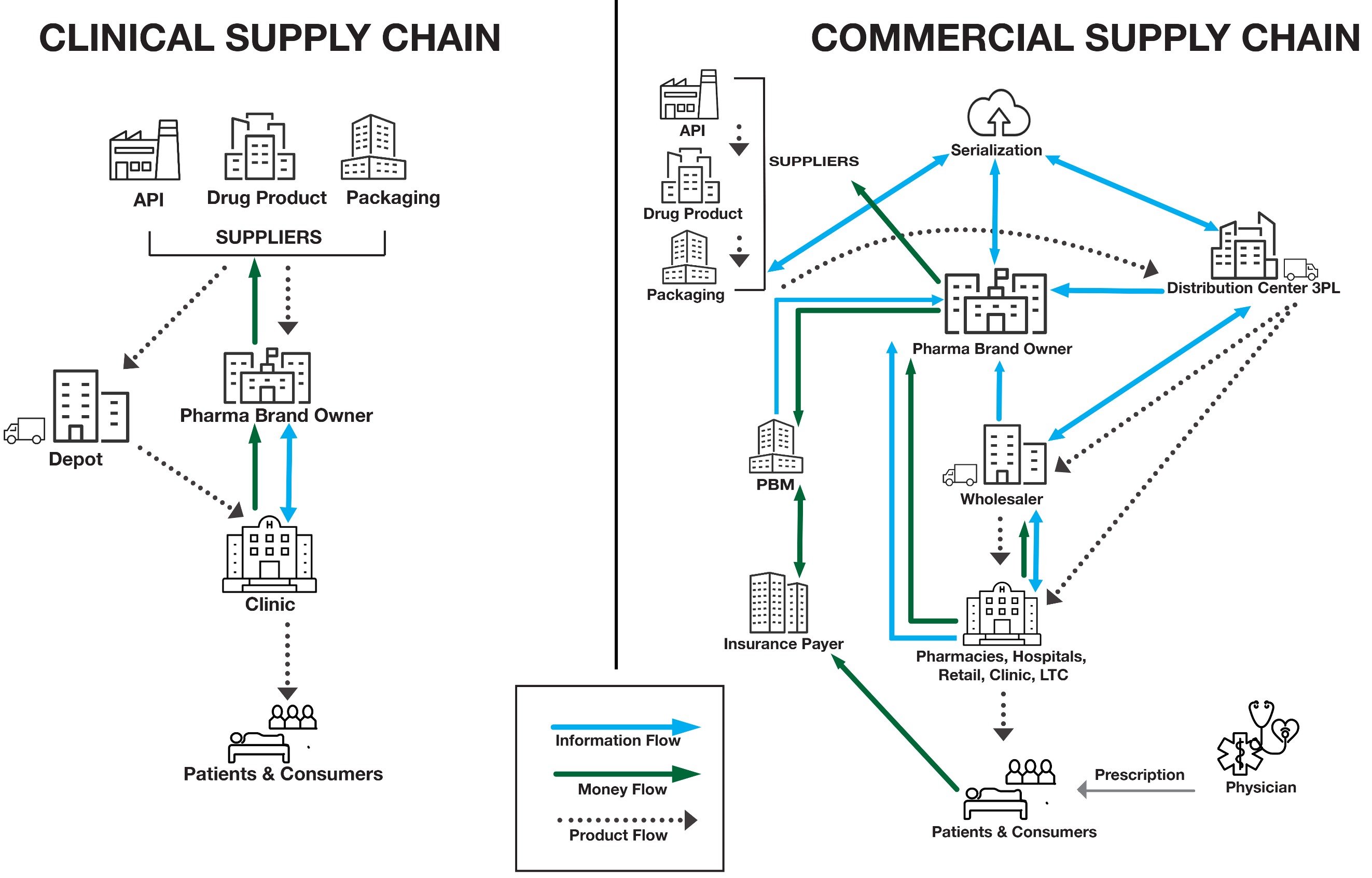

Figure 1 depicts two scenarios where the goal is to get drugs to patients. Immediately, a clinical SC and a commercial SC appear different. On one hand, a clinical SC must contend with processes that are not yet in control and suppliers that may have only limited capabilities. On the other hand, a commercial SC requires management of complex money flow and the movement of large quantities of materials in a tightly controlled environment.

Figure 1: Illustration of flow in clinical vs. commercial SCs

What is clear from the illustration is that, not only for the two examples, but for any given SC scenario, the PPP must be designed around specific skillsets, functions, and attributes (strategies) to optimize success in meeting its goals.

SC/M Strategy: Fit For Purpose

At each stage of a product life cycle or in a scenario where SC disruptions occur, SC/M functions and goals must be designed to meet the needs at that point in time for each product. Table 1 breaks down how SC/M can be set up in parallel with a drug product's life cycle.

Table 1: SC/M Life Cycle Scenarios

|

SC Scenario |

Function/Goal |

Attributes |

Span |

|

Clinical |

Facilitate API, drug product, and packaging development in parallel with clinical activities. |

Just-in-time delivery. Flexibility around technology and controls, targeted spending on innovation. Loose supply chain. |

1 to 8 years, based on development needs. |

|

Launch |

Demonstrate commercial viability of the SC. |

Flexibility and rapid responsiveness around operations and timelines, commercial capability to troubleshoot non-optimized processes. |

2 to 5 years, starting from Phase 2 to Phase 3 of development through the first 1 to 3 years of commercial supply. |

|

Commercial |

Maintain commercial reliability and control costs within the SC. |

Balance supply and demand in the context of market conditions and corporate goals. |

Based on product life cycle. |

|

Risk Management |

Maintain commercial reliability in foreseeable adverse environments. |

Diversified matrix of suppliers at various levels of utilization maintained throughout the product life cycle. |

Dependent on market forces, corporate objectives and strategy. |

|

Pandemic Response |

React during a pandemic to an unpredictable environment with limited information. |

Leverage formal and informal PPP to seek alternatives to weaknesses and breakdowns of critical segments of the SC. Facilitate delivery of goods with disruptions in staffing. |

A variation of the Risk Management Supply Chain, it may inform and embed itself into the future of critical drug product SC/M. |

Consider each SC scenario in the framework of the PPP. Personnel, and their functions and skillsets, may be different from one scenario to the next and processes will be developed for the specific activities within the scenario. Suppliers will be selected according to the requirements at each stage, with deliberate decisions about future planning. They should be maintained or replaced as needed. In a dynamic environment, the scenarios will evolve, overlap, and co-exist throughout a product and corporate life cycle, i.e., every SC/M will be unique. Moreover, SC/M can be basically seen as existing in either a steady state or a transitional state.

In one example of how SC/M integrates into a startup strategy, a team of physicians observes that an existing molecule shows some efficacy in mitigating symptoms and improving outcomes in a disease. While carrying out an academic trial using a compounding pharmacy, they see promise and decide to pursue an IND to begin formal, larger trials. They have the foresight to understand that more drug product is needed to support multiple clinics. If they intend to commercialize a new drug product, they need to form a company and think through what they want to achieve as a business. Then they need to plan how their organization needs to be structured in order to meet their goals. Using a SC/M perspective, the framework allows them to create a cross-functional road map and begin making decisions about assigning duties to existing staff or making tactical hires to execute the plan. Once they can support the clinical trials with a relatively stable PPP, they would be temporarily in a steady state SC until growth or disruption forces a change in scenario.

In another case, a startup company has a fast-track drug completing Phase 1 trials and the possibility of filing within 12 months. The board of directors is deciding if it makes sense to go it alone and launch the drug or whether to derive immediate value by exiting. Again, the SC/M framework is a tool that allows them to map out scenarios. By evaluating their current staff and external partners (point A) they can determine what the organization would need to look like to support launch (point B) and what it might become to support an ongoing operation (point C). Knowing themselves, the culture they created, and the capabilities of third parties they have contracted are important inputs in addition to the all-important financials in decision making. With a thorough evaluation, they can judge the likelihood of success by either staying the course or exiting. Transforming the organization from a development-stage company to a specialty pharma would enter the PPP into a transitional state.

Conclusion

Pharma executives work together with their team and SC professionals to form cross-functional strategies integrating SC/M concepts into development and commercialization activities. In the process, they produce a road map for growth in the product and company life cycle that accounts for PPP. By clearly defining scenarios, functions, and goals for SC/M, strategies can be structured to align with corporate goals.

It goes without saying that corporate strategy drives all activities and sets priorities within the company. But in today’s environment it is impossible to ignore larger forces in the market. World events influence political and regulatory policy, which in turn impacts corporate directives and priorities. In drug product development and SC/M we do not yet know how the pharma industry or individual companies will modify their SC strategies or if the national or international regulatory environment will seek to drive change on a larger scale in response to the COVID-19 pandemic. What is evident is that crises drive change and innovation. In order to accept change and commercialize innovation in pharmaceutical drug development, we need to be open to new ideas, technology, and processes while building on what we know and what we know works.

Anticipating the challenges and managing change among the SC scenarios will be the topic of future articles that include: SC best practices for early drug product development, SC launch readiness, make vs. buy, and others. If you have suggestions on specific topics or feedback, please feel free to leave a comment below.

About The Author:

Ray Sison is VP of Pharmaceutical Outsourcing and Tech Transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CDMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies, helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.

Ray Sison is VP of Pharmaceutical Outsourcing and Tech Transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CDMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies, helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.