One-Stop Shop Or Best of Breed? 3 CDMO Selection Case Studies

By Ray Sison

When outsourcing drug product development or back-end supply chain (SC), maintaining control of the process is  essential. One way to establish control is by defining objectives and developing a stepwise plan to achieve them. Outsourcing options can include targeting either a bundled set of services from a one-stop shop (1SS) or seeking out a specialized best of breed (BoB) CDMO with expertise in specific niche technologies. Your choice of a strategy can influence a company's operations and organizational structure, i.e., the complexity of your drug product and SC will often dictate the people and processes needed to operate efficiently. It makes sense to define the strategy that best fits the product requirements and aligns with the corporate objectives.

essential. One way to establish control is by defining objectives and developing a stepwise plan to achieve them. Outsourcing options can include targeting either a bundled set of services from a one-stop shop (1SS) or seeking out a specialized best of breed (BoB) CDMO with expertise in specific niche technologies. Your choice of a strategy can influence a company's operations and organizational structure, i.e., the complexity of your drug product and SC will often dictate the people and processes needed to operate efficiently. It makes sense to define the strategy that best fits the product requirements and aligns with the corporate objectives.

However, as much as controlling the process is desirable in selecting a CDMO, the marketplace is constantly changing, adding an element of unpredictability. When this happens, work hard to control the things that can be controlled, but be prepared to adapt to events that are out of your control by revisiting your search criteria and priorities. Keep your colleagues within your organization informed of changes and unexpected events. Encourage transparency from your counterparts at the CDMOs and hold them accountable for keeping you in the loop.

Pros And Cons Of Outsourcing Approaches

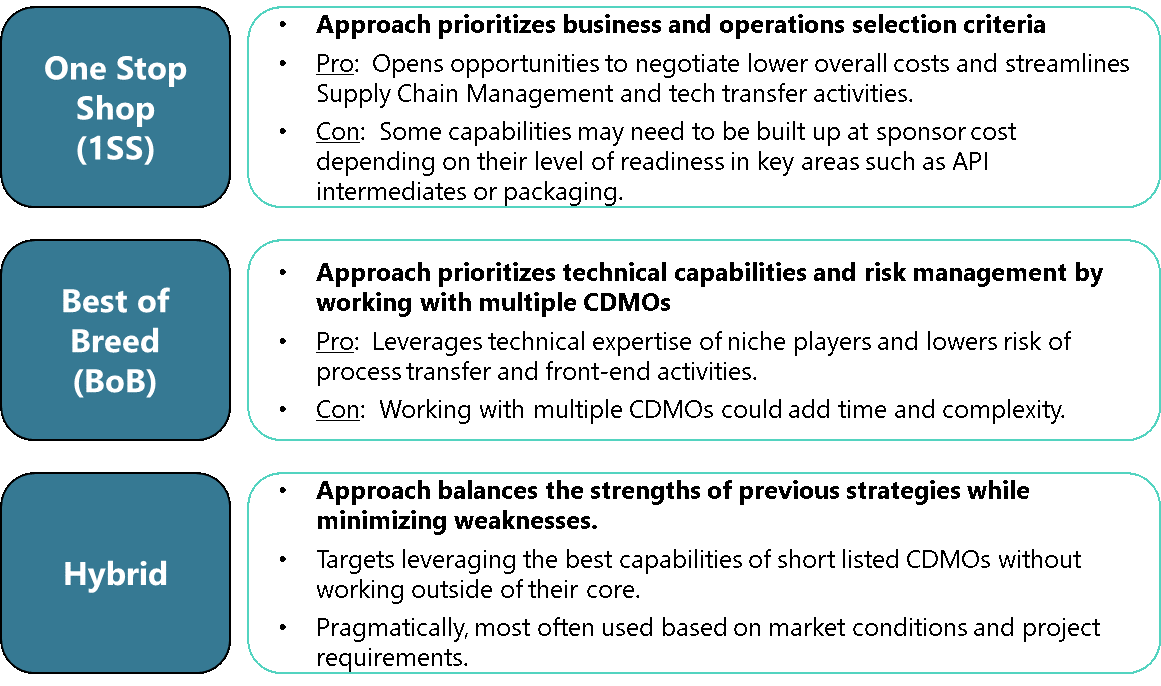

The CDMO landscape continues to trend in opposite directions: 1SS bundled services or specialized BoB. These two approaches are healthy for the industry and provide options for the wide array of companies looking to outsource. Innovative companies can find highly specialized services that are customizable to their needs. For others with different product requirements and priorities, forming trusted partnerships with a 1SS might be the ideal fit. Figure 1 highlights the pros and cons of each approach.

Figure 1: Pros and cons of different types of CDMOs

CDMOs that have focused on growth have done so by integrating both vertically and horizontally to offer an ever-widening array of contract services. These services can range from custom API synthesis through drug product development, manufacturing, packaging, and distribution. At their best, CDMOs offer a single source for all of a company’s outsourcing needs with common contracts, lower overall costs, and a predictable experience both technically and operationally. At their worst, they can actually be more expensive for limited-scope projects, be stubborn negotiators on low-value contracts, and may provide uneven levels of service and quality across sites.

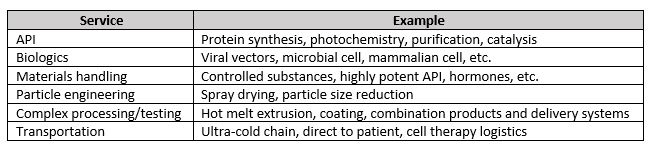

Then there are niche CDMOs that differentiate their services by offering highly specialized capabilities and expertise such as those identified in Figure 2. This specialization often requires not only unique equipment and proprietary technologies but also the resident expertise to leverage them. In my experience, these types of CDMOs are often not publicly traded and not run by executives and boards. They are typically founded and run by technical experts with a passion for their art. They are looking to push the boundaries of existing technology and will take on any project or client that can exploit their skills. Because of this specialization, they may not offer a wide range of dosage forms or bundled services. At their worst, they may not fully appreciate budgets and timelines, lacking professional project management and internal operations.

In the constantly changing marketplace, successful niche companies are either acquired by fast-growing 1SSs or they endeavor to become one. Facilities change ownership, management evolves, investors tip the scales, and it may all be happening behind the scenes during a selection process. In any event, during the process, CDMOs need to be vetted with predefined criteria and clear objectives – this is the part you can control. When the unexpected hits, you can go back to your team and brainstorm how changes impact your criteria, priorities, and decision-making. Below, I present three case studies that demonstrate how every project is unique. The goal is to strike a balance that is the best fit.

Figure 2: Examples of CDMO specialization

Case Study #1: Commercial Manufacturer, Make vs. Buy

In this project, I worked with a client to outsource the development and manufacturing of a monographed drug product. The drug had more than one API and was available in two formats: sterile solution for injection and sterile lyophilized powder for reconstitution. The pharma company had internal resources and facilities to develop and manufacture the product but was considering outsourcing if the business case was more favorable.

Ideally, development and commercial manufacturing done by a 1SS CDMO would have been the best fit for this project from an operations and budget standpoint. It would avoid the time and cost associated with the tech transfer of both the process and analytical methods. Also, since the company traditionally did not outsource, a single CDMO would minimize the resources needed to manage the project.

From the start, we knew it would be challenging to decide on a true 1SS. For one, the APIs could not be obtained from a single source. Secondly, it turned out that the majority of the high-volume sterile manufacturing CDMOs did not bundle development services at a single site. We identified more than 10 CDMOs with services that included:

- Sterile API manufacturing

- Formulation and analytical test method development (sterile solutions)

- Formulation and analytical test method development (lyophilization)

- Commercial fill/finish (sterile solutions)

- Commercial fill/finish (lyophilized powders)

During the process, at least four of the CDMOs on the list announced mergers and one announced it was no longer taking on new projects. When confronting market events such as mergers, evaluate how they might impact the breadth and quality of services, short-term disruptions in operations, and long-term changes stemming from possible management transitions. Using this approach, we narrowed the list.

The final selection consisted of separate API suppliers and a lyophilization specialist to develop the powder that would work with another development lab focused on the sterile injectable and analytical methods. A high-volume CDMO was selected for commercial manufacture and release testing. In this case, the technical requirements of the project required bringing in BoB CDMOs and that outweighed the streamlined advantages desired from a 1SS. Although we did not realize this at the project outset, we were able to adjust as information came in by basing decisions on our objectives and selection criteria. Ultimately, we were able to make recommendations backed up by proposals, contracts, and a viable SC.

Case Study #2: Innovator Company, Innovative Process

In this project, an innovator company that built a portfolio of several products around a platform technology was looking for scalable coating capabilities and the expertise to carry the technology forward. The company had developed a proprietary process with a development CDMO that required “hot-rodding” coating equipment through a few novel modifications. The product attributes, as well as many of the operational and technical requirements, pointed to a BoB CDMO strategy. But since spray coating is widely known, it made sense to include 1SS CDMOs in the selection process to create value by including packaging. We sent RFPs to five highly qualified CDMOs.

Interestingly, during technical calls and correspondence there was a common thread: The process required operating outside validated ranges, so it needed to be redeveloped. It was mildly frustrating on two fronts because 1) More than one CDMO failed to appreciate that the IP-protected process would not accommodate significant changes and 2) They also assumed that the process developed by the innovator and its existing CDMO partner was flawed. The differentiator in this case study was the flexibility of the CDMO to meet client expectations and the working rapport between the technical teams.

What we learned in the process is that sometimes a CDMO needs to run a process a few times before it can begin to contribute technically. In hindsight, commissioning feasibility runs with at least two CDMOs could have benefitted the program. Today, with constrained travel due to the COVID-19 pandemic, limited-scope feasibility work is a useful tool to differentiate between CDMO finalists if and when appropriate. As for 1SS vs. BoB, the process was so novel that traditional expertise did not appear to matter as much as a willingness to be open minded.

Case Study #3: Size Matters

A few years ago, I was asked by a clinical-stage innovator company to help place its project. As a new class of drugs, the new chemical entity dose range was to be in the tens of grams. The drug product would be reconstituted in water and taken as an oral solution. In order to quickly dissolve, the powder had to be spray dried. The clinical study required metric tons of material.

While many CDMOs had lab and pilot-scale equipment, few companies could manage large volumes. Those that had commercial capabilities were being highly selective about the projects they took on. It was difficult to arrange introductory meetings for my client and negotiations were challenging. Here, by relying on established relationships, we were able to get key CDMOs to the negotiating table.

We sent RFPs to the major players. In addition, we included two or three CDMOs that recognized the potential in spray dry technology and were willing to invest heavily to expand their operations. The motivated CDMOs brought on industry subject matter experts and some freshly minted Ph.D.s to attract the additional business. There was a big push at the time to bring on capacity. The activity around spray drying benefitted the client and its project immensely by providing short- and long-term options.

In this project, we found that timing and technology mattered. The client was operating in a space that required a hot technology that many CDMOs were currently acquiring. This gave us not only options but also negotiation leverage as they needed to secure projects to justify their planned investments. It is important to be aware of the current state of the market when outsourcing.

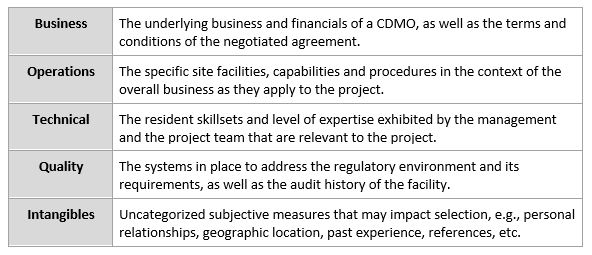

Figure 3: CDMO selection criteria categories buyers should evaluate

Conclusion

To demystify the CDMO selection process, maintaining control by clearly defining objectives and criteria gives a better chance of success. Start by evaluating each potential contractor on each of the categories noted in Figure 3, but to understand the CDMO landscape, there is no substitute for experience. For many projects, trusted relationships with a handful of 1SSs and BoB CDMOs might be the answer, but placing difficult projects often requires some depth of experience with the broader CDMO landscape. This includes not only understanding the technical aspects of a project but also the capabilities of each facility and its operators, as well as knowledge of each CDMO’s business objectives and relationships with top leadership and their organizations.

About The Author:

Ray Sison is VP of Pharmaceutical Outsourcing and Tech Transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CDMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies, helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.

Ray Sison is VP of Pharmaceutical Outsourcing and Tech Transfer at xCell Strategic Consulting. He began consulting in 2011 after recognizing a need for expertise in pharmaceutical outsourcing among the discovery- and clinical-stage pharma companies he served as a business development representative for Patheon and MDS Pharma Services. Based on his experience, Sison provides insight to the CDMO’s business and operations, helping his clients negotiate and achieve better outcomes. Additionally, he has developed sound processes and templates to streamline CMO procurement to save time and cost. In this series of articles, as well as online webinars, he continues to share best practices and case studies, helping improve the outsourced business model. You can reach him at rsison@xcellstrategicconsulting.com or connect with him on LinkedIn.