Bear Biotech Market Dampens Promise Of Live Biotherapeutics

By Matthew Pillar, Editor, Bioprocess Online

4D Pharma (AIM: DDDD, NASDAQ: LBPS) finds itself against the ropes of late. In late June, its shares on London’s AIM stock exchange were suspended and the company received a delisting notice from NASDAQ, removing 4D pharma’s securities from listing and registration effective July 7.

At issue is the company’s struggle to make good on $13.9 million in debt called in by Oxford Finance, which had granted 4D a credit facility worth up to $30 million in July 2021. As a result, Oxford called 4D into administration, an insolvency procedure akin to bankruptcy. 4D vows to work with joint administrators James Clark and David Pike of Interpath Advisory on a plan to salvage the company, which has multiple phase I and phase I/II trials in progress.

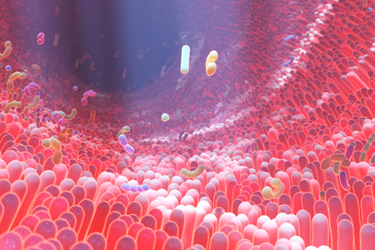

This kind of news isn’t uncommon in today’s bear biotech market, but 4D’s struggles illustrate a particular kind of pain being felt by early-stage biopharma innovators. The company’s founding in 2014 marked an early entry into the promising new modality of live biotherapeutics—live organisms such as bacteria applied to the prevention, treatment, or cure of a disease or condition. It’s a market pegged to grow to $3.6 billion in product sales by 2030.

In early May 2022, a couple of months before 4D’s financial struggles came to a head, CEO Duncan Peyton joined me on episode 96 of the Business of Biotech podcast. Peyton shared 4D’s research into the microbiome’s modulation of systemic diseases well beyond the gut, where so much microbiome research has been focused to date, and it looked promising. Among its six active clinical trials, it had partnered with Merck on a Phase I/II investigation of the combination of its single-strain MRx0518 bacteria with Keytruda in patients with advanced or metastatic non-small cell lung cancer, kidney cancer, bladder cancer or melanoma. MRx0518 was also being studied in a phase I trial at the University of Texas MD Anderson Cancer Center. 4D was conducting a Phase I/II clinical study of MRx-4DP0004 in patients with asthma. The company’s research gave it cause to explore its platform in inflammatory indications like rheumatoid arthritis, MS, and more.

This kind of work has big implications for the understanding of the gut microbiome’s role in indications well beyond C. diff, Crohn’s Disease, and other localized gut diseases. The gut-brain axis is a largely unexplored frontier, and companies like 4D are its front-line scouts. Importantly, the work also seeks to further the progress of a long-challenging biologic administration problem that many biopharma companies have failed to solve: can live bacteria play a role in efficacious oral delivery of biologic payloads?

Investor Discernment Is Crippling Innovation

While the development and manufacturing of single-strain bacteria for human therapeutic use is a relatively straightforward cell bank, separation, freeze dry, and encapsulation process, CMOs and CDMOs aren’t particularly keen on introducing live bacteria to their production environments. Between that apprehension and what Peyton considered unacceptably long lead times, 4D decided to build its own manufacturing facility in Northwest Spain. It had built out its executive management team to at least nine in the C-suite, employed more than 100, and incurred the ongoing expense of six active clinical trials. Even when capital is cheap and investors are deep-pocketed, these are expenses that will take many feet of launch space from a cash runway. Fast-forward to what’s now beginning to look like a protracted period of financier discernment, and extending that runway becomes a formidable challenge.

Where the financial formula broke down for 4D Pharma will provide fodder for plenty a pundit making a living on retrospective analysis. It’s not a lone struggler within the space it plays. In April, microbiome therapeutics company Finch Therapeutics announced a 20% cut to its workforce. That same month, Flagship Pioneering-backed microbiome pioneer Kaleido Biosciences packed up shop on the heels of an FDA warning letter and its lack of cash.

What’s clear and true is that periods of biotech capital market discernment require an equal or greater part financial discernment on the part of biotech leaders. Central tenets that are all too passively managed in the good times become glaringly important in the bad times; raise money always, meter expenses to preserve cash, and create a backup plan through diversification of products. To that end, European microbiome therapeutics company Microbiotica and MA-based Axial Therapeutics seem to be on rolls, Microbiotica having landed a $67 million Series B in Q1 2022 and Axial, which is studying a phase 2b autism candidate, grabbed a $37 million Series C in Q4 2021.

Worth noting is that 4D Pharma wholly-owned subsidiaries 4D Pharma Research Limited, 4D Pharma Cork Limited, 4D Pharma León S.L.U., and 4D Pharma Delaware Incorporated remain solvent. We wish the company the best as it strategizes its next move, in hopes for the advance of the important work it’s been doing in such a promising growth market. In the meantime, learn more about 4D Pharma’s clinical program and manufacturing strategies on episode 96 of the Business of Biotech podcast.