Analysis Of The Non-alcoholic Steatohepatitis (NASH) Drug Pipeline & Market: The Second-Wave Candidates

By Mavra Nasir, Ph.D., Crystal Hsu, and Peter Bak, Ph.D., Back Bay Life Science Advisors

In Part 1 of this three-part series, we discussed non-alcoholic steatohepatitis (NASH), the market for treatments, the first wave of NASH drugs (at Phase 3) poised to change the management paradigm, and the currently ambiguous pricing/reimbursement landscape. Here in Part 2, we now look to the most promising second wave of NASH drugs, many of which have demonstrated improved safety and/or efficacy compared to the first wave.

Nash Drugs: The Second Wave

FGF21 Stimulants

BIO89-100 (89bio)

Efruxifermin (EFX; Akero Therapeutics)

Pegbelfermin (Bristol Myers Squibb/Ambrx Inc.)

Fibroblast growth factor 21 (FGF21) is a starvation induced pleiotropic hormone with numerous beneficial metabolic effects, including enhancement of insulin sensitivity and reduction of triglycerides and cholesterol in mouse models of diabetes and obesity.1,2 Similar outcomes have also been observed in obese nonhuman primates and humans with Type 2 diabetes.3,4 While the exact mechanism of action in non‑alcoholic fatty liver disease (NAFLD) has not been fully elucidated, emerging mouse data suggests that FGF21 may directly act on hepatocyte cells to modulate liver metabolism, which could be beneficial to patients with NASH.5

With the release of topline data from 89bio and Akero in the second half of 2020, the competition within the FGF21 stimulant pipeline has intensified. While both programs provide a compelling package, additional data will be needed to robustly compare across trials. So far:

- At comparable doses, 89bio’s agent demonstrated a 70% reduction in liver fat in treatment versus placebo arms6 compared to 63% for Akero’s Efruxfermin (EFX).7

- Unlike 89bio, Akero has released fibrosis data from a small number of patients, with around half the subjects in the treatment group experiencing at least one-stage improvement in fibrosis, albeit not statistically significant.

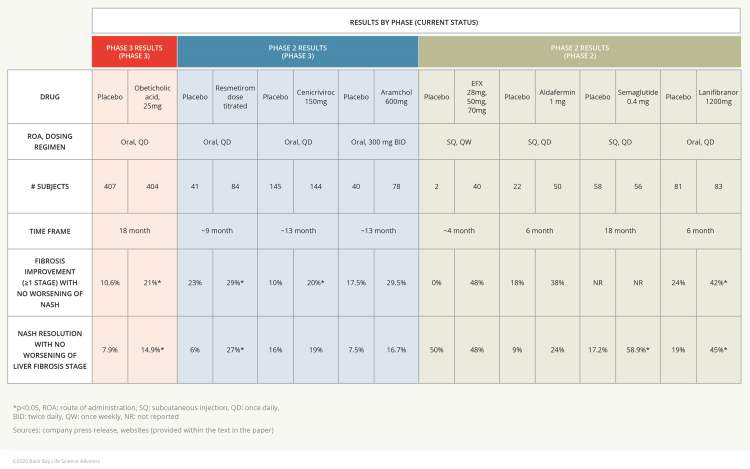

Figure 1: Comparison of efficacy data (fibrosis improvement NASH resolution)

- 89bio also tested a once fortnightly dosing regimen which led to a 60% reduction in liver fat. While 89bio’s fortnightly dosing schedule may constitute a more attractive option, EFX did demonstrate higher efficacy at 70 mg.

- The frequency of GI events in treatment groups was less for BIO89-100 than EFX (pooled doses): diarrhea (BIO89-100 9.5% vs. EFX 36%), nausea (BIO89-100 4.8% vs. EFX 33%), vomiting (BIO89-100 0.0% vs. EFX 16%), and increased appetite (BIO89-100 15.9% vs. EFX 22%). Considering the FDA’s decision in June 2020 to not approve obeticholic acid (OCA), a superior safety profile (such as decreased rate of nausea, diarrhea, vomiting) may provide 89bio a leading edge if fibrosis improvement is demonstrated and safety data is replicated in later-stage trials.

In contrast, proof-of-concept studies for BMS/Ambrx’s pegylated FGF21 stimulant have shown statistically significant improvements in liver fat reductions in treatment versus controls groups (-6.8%) after 16 weeks, but the magnitude is considerably small compared to Akero and 89bio’s agent.8 Eyes are on the two Phase 2 trials (Falcon 1 and Falcon 2) evaluating FDA approved NASH specific endpoints to provide persuasive efficacy data for this program.

FGF19 Analog

Aldafermin (NGM Biopharmaceuticals)

Another agonist of the endocrine FGF family under investigation as a NASH therapeutic is FGF19. Similar to FGF21, the pleiotropic effects of FGF19, such as inhibition of insulin-induced hepatic lipogenesis and inhibition of bile acid synthesis from cholesterol via cytochrome P450 7A1, provide a rationale for clinical investigation in NASH patients.9,10

NGM Biopharmaceuticals’ engineered FGF19 demonstrated positive efficacy data in Phase 2b studies of NASH patients with F2-F3 fibrosis, although statistical significance was not achieved for either endpoint (see Figure 1).11

- Approximately 38% of patients in the treatment arm showed fibrosis improvement of ≥1 stage with no worsening of NASH, compared to 18% in the placebo arm.

- Additionally, 24% of patients in the treatment arm achieved resolution of NASH with no worsening of liver fibrosis as compared to 9% in placebo.

- Statistically significant improvement of liver fat content reduction using the non-invasive MRI-PDFF was demonstrated (39% in treatment vs. 8% in placebo).

NGM also initiated a Phase 2b study, designed to evaluate Aldafermin in NASH patients with F4 liver fibrosis and well-compensated cirrhosis. Overall, the outlook for NGM’s pipeline lead is promising, with a Phase 2b/3 study underway to test efficacy in a larger cohort before moving on to ~2,000 patient pivotal trials.

NGM was backed by Merck after signing a $450 million research and development deal in 2015.12 While Aldafermin is wholly owned by NGM, Merck collaborated with NGM to develop a differentiated preclinical asset (NGM313) for obese, insulin resistant NAFLD patients. After positive Phase 1b data read-out, Merck paid $20 million to NGM and acquired the global rights to NGM313/MK-3655, a fibroblast growth factor receptor 1c-beta-klotho (FGFR1c/KLB) agonistic antibody with once a month dosing.13 While Phase 2b/3 studies have yet to be initiated, Merck plans to develop the drug for both NASH and patients with Type 2 diabetes. Although Merck is behind other big players in the NASH space, the differentiated mechanism of action and once monthly dosing regimen may bolster value for the program as it nears pivotal trials.

FXR Agonists

Tropifexor (Novartis)

EDP-305 (Enata Pharmaceuticals)

PXL007/EYP001 (Poxel/Enyo Pharma)

Farnesoid X receptor (FXR) has demonstrated a crucial role in modulating inflammation in NASH, since the seminal description of FXR knock-out (KO) mice exhibiting increased bile acid levels, steatosis, fibrosis, and inflammation.14 Recent data points to FXR-mediated inhibition of key factors in the inflammatory pathway (such as NF-κB15, Mcp-116) and induction of lipocalins17 to ultimately inhibit the pro-inflammatory cascade leading to NASH.

Although this data is promising, the pharmacological effects of FXR agonists (OCA, Intercept Pharmaceuticals) in NASH patients studied to date are accompanied with dermatological side effects,18 with some researchers attributing this to the steroidal nature of the candidate.19 Despite this, there are several additional FXR agonist candidates in Phase 2.

With a similar mechanism of action as OCA, Tropifexor and EDP-305 are vying to stand out against the lead NASH agent. While Tropifexor has already demonstrated a superior tolerability profile in NASH patients, recent data from Enata in patients with primary biliary cholangitis (PBC) raise concerns for the program.20 Approximately 3% of patients dropped out in the lower dose arm and ~18% in the higher dose arm, leading Enata to axe the program and refocus on NASH.

As the industry awaits NASH-specific results, Enata may still face an uphill battle, considering the FDA’s rejection of OCA. Even if efficacy is comparable to Tropifexor, the latter’s cleaner safety and tolerability profile could allow it to emerge as the preferred FXR agonist. In collaboration with Pfizer, Novartis is in Phase 1 trials evaluating combining Tropifexor with one or more of Pfizer’s ACC inhibitor (PF-05221304), DGAT2 inhibitor (PF-06865571), and a KHK inhibitor (PF-06835919).21 The Swiss giant is focusing its efforts on the FXR-agonist program and recently made headlines by offloading its FGF21 simulator (LLF580) to Boston Pharmaceuticals in an undisclosed deal.22

Despite Tropifexor’s potential as a safe anti-inflammatory and anti-steatotic NASH drug candidate, it is important to note that published data have not demonstrated statistical significance, making cross-trial comparisons inconclusive. Furthermore, Poxel and Enyo’s PXL007/EYP001 recently entered Phase 2 studies after demonstrating significant improvements in NASH parameters (e.g., fibrosis, steatosis, ballooning, inflammation, and NAFLD activity score [NAS]) in a murine model (Phase 1 safety study was conducted in hepatitis B).23 While neither Poxel/Enyo or Enata can match Novartis’ resources, additional efficacy/safety data will be key for all programs to establish their mark as a frontrunner with this mechanism of action, given the volatility of the NASH pipeline.

Glucagon-like Peptide-1 (GLP-1) Agonist

Semaglutide (Novo Nordisk)

Glucagon-like peptide-1 (GLP-1) agonists are currently used for diabetic patients and work by improving insulin sensitivity and promoting weight loss.24 They have also shown direct effect on the lipid metabolism of hepatocytes and reducing hepatic steatosis.25,26

Expert in diabetes care, Novo Nordisk is yet another Big Pharma company hoping for a NASH win. After announcing promising Phase 2 results in the first half of 2020, Novo’s CSO stated, “Semaglutide looks to become a stand-alone and maybe an anchor drug in the future for NASH.”27

The study met the NASH resolution endpoint but failed to hit the key secondary endpoint of at least one stage of liver fibrosis improvement with no worsening of NASH. In addition, rates of adverse events, such as GI complications, were similar to prior studies of semaglutide.24 With an already strong metabolic disease franchise, Novo is well-positioned to make a name in NASH if efficacy data from Phase 3 studies pans out favorably.

Peroxisome Proliferator-activated Receptor (PPAR) Regulator

Lanifibranor (Inventiva)

Peroxisome proliferator-activated receptor (PPAR) regulators are nuclear receptors consisting of three isotypes (PPAR-α, PPAR-β, PPAR-δ) primarily involved in lipid metabolism and inflammation. Synthetic PPAR-δ agonists (thiazolidinediones)28 and PPAR-α agonists (fenofibrates)29 are indicated as a treatment for Type 2 diabetes.

Dysregulation of PPAR isoforms has been observed in limited NASH specific studies. One study using 125 human liver samples demonstrated that PPAR-α gene expression negatively correlates with NASH severity and insulin resistance and positively with adiponectin.30 Another study using liver biopsies also showed negative correlation between severity of hepatic and reduction in PPAR-β/δ mRNA.31

In clinic, the PPAR-isoform selective agonist mechanism of action for NASH has experienced more disappointments than success in the last two years, with only Inventiva’s Lanifibranor still in development. The failures of Elafibranor (Genfit, Phase 3)32 and Seladelpar (CymaBay, Phase 2)33 have raised skepticism for this class of agents in NASH as a monotherapy. Lanifibranor is a pan-PPAR agonist, while Elafibranor targets PPAR alpha and delta, and Seladelpar is only delta subtype selective. Recently published positive data from Inventiva demonstrated statistically significant efficacy in both FDA preferred NASH endpoints (see Figure 1).34

Regardless, mean weight gain of 2.7 kg was observed at the highest dose of 1,200 mg, and 2.4 kg at 800 mg, along with 14 patients experiencing oedema (12 of those received Lanifibranor). While there were no dropouts, Lanifibranor’s tolerability profile will be under scrutiny as data from Phase 3 matures.

THR-β Agonist

VK2809 (Viking Therapeutics)

Currently in Phase 2b trials, the selective thyroid hormone receptor beta agonist, VK2809 under development by Viking Therapeutics, has fallen behind completing target enrollment by the end of 2020 due to the COVID-19 pandemic.35

Data presented in August 2020 showed meaningful reductions in median liver fat content in VK2809-treated patients versus placebo (45.4% versus 18.7%) at 16 weeks.36 Given that Resmetirom leads the pack with a similar mechanism of action and comparable dosing/safety data, VK2809 will likely need to win on efficacy to gain market share if Madrigal secures a NASH win.

NASH Drugs: The Third Wave?

In addition to the first- and second-wave drugs included in our analysis, the following programs are under consideration to target the disease:

- Long-acting antidiabetics: Korea-based Hanmi Pharmaceuticals is developing a long-acting glucagon, GIP, and GLP-1 triple agonist (HM15211) with once weekly administration for NASH patients (Phase 2 ready). Hanmi also entered into a $860 million deal with Merck for a different dual agonist (Efinopegdutide, a GLP-1/glucagon receptor dual agonist).37 Hanmi is studying the dual approach for Type 2 diabetes and Merck is developing the candidate in NASH. This collaboration indicates Merck is building a diversified portfolio for NASH and likely waiting for the initial rollout of NASH drugs to address remaining regulatory and pricing questions.

- Stem cell modulators: After raising $44.9 million in Series D financing, the Belgium-based cell therapy company Promethera is advancing HepaStem, an intravenously administered mesenchymal stem cell therapy for F3-F4 NASH patients.38 While mouse data have shown anti-fibrotic and anti-inflammatory signals, feasibility and efficacy in NASH remain to be demonstrated,39 as data from the 24-patient Phase 2 study initiated in May 2019 have yet to read out.

- Mitochondria: CohBar, a California-based clinical-stage biotechnology company, is developing mitochondrial-based therapies for diseases linked to aging and metabolic dysfunction, including NASH and obesity. The lead candidate, CB4211, is a novel-optimized analog of a naturally occurring mitochondrial peptide (MDP) in Phase 1 trials, with the first patient recently dosed in August 2020.40 Given the uncertain and resource-intensive development pathway for NASH, CohBar will likely leverage the differentiated mechanism of action to identify a strategic partner to de-risk clinical development.

In Part 3, we will review the NASH M&A and transaction landscape and identify trends for companies looking to build a NASH pipeline. We will also dive into the potential market access dynamics that will complicate commercial success for novel NASH assets, considering the lack of marketed analogs and ambiguity over clinical relevance of surrogate endpoints.

References:

- Xu, J. et al. Fibroblast growth factor 21 reverses hepatic steatosis, increases energy expenditure, and improves insulin sensitivity in diet-induced obese mice. Diabetes (2009) doi:10.2337/db08-0392.

- Coskun, T. et al. Fibroblast growth factor 21 corrects obesity in mice. Endocrinology (2008) doi:10.1210/en.2008-0816.

- Kharitonenkov, A. et al. The metabolic state of diabetic monkeys is regulated by fibroblast growth factor-21. Endocrinology (2007) doi:10.1210/en.2006-1168.

- Gaich, G. et al. The effects of LY2405319, an FGF21 Analog, in obese human subjects with type 2 diabetes. Cell Metab. (2013) doi:10.1016/j.cmet.2013.08.005.

- Fisher, F. M. et al. Integrated regulation of hepatic metabolism by fibroblast growth factor 21 (FGF21) in vivo. Endocrinology (2011) doi:10.1210/en.2011-0281.

- 89bio Announces Positive Topline Results from its Phase 1b/2a Trial of BIO89-100 in NASH. GlobeNewswire https://www.globenewswire.com/news-release/2020/09/14/2092850/0/en/89bio-Announces-Positive-Topline-Results-from-its-Phase-1b-2a-Trial-of-BIO89-100-in-NASH.html (2020).

- All AKR-001 Dose Groups Met Week 12 Efficacy Endpoints in NASH Phase 2a BALANCED Study. PR Newswire https://www.prnewswire.com/news-releases/all-akr-001-dose-groups-met-week-12-efficacy-endpoints-in-nash-phase-2a-balanced-study-301032199.html.

- Bristol-Myers Squibb. Bristol-Myers Squibb’s BMS-986036 (Pegylated FGF21) Shows Consistent Improvement in Liver Fat, Liver Injury and Fibrosis in Patients with Nonalcoholic Steatohepatitis (NASH) in Phase 2 Trial. Press Release https://news.bms.com/news/details/2017/Bristol-Myers-Squibbs-BMS-986036-Pegylated-FGF21-Shows-Consistent-Improvement-in-Liver-Fat-Liver-Injury-and-Fibrosis-in-Patients-with-Nonalcoholic-Steatohepatitis-NASH-in-Phase-2-Trial/default.aspx (2017).

- Kliewer, S. A. & Mangelsdorf, D. J. Bile acids as hormones: the FXR-FGF15/19 pathway. Dig. Dis. 33, 327–331 (2015).

- Musso, G. et al. New Pharmacologic Agents That Target Inflammation and Fibrosis in Nonalcoholic Steatohepatitis–Related Kidney Disease. Clin. Gastroenterol. Hepatol. (2017) doi:10.1016/j.cgh.2016.08.002.

- NGM Bio Announces Positive Preliminary Topline Liver Histology and Biomarker Data from 24-Week Phase 2 Study (Cohort 4) of Aldafermin in NASH Patients, Including Statistically Significant Achievement of Composite Endpoint of Both Fibrosis Improvement and . GlobeNewswire (2020).

- Garde, D. Merck bets big on NGM with a $450M handshake. Fierce Biotech https://www.fiercebiotech.com/partnering/merck-bets-big-on-ngm-a-450m-handshake (2015).

- Taylor, N. Merck bags global rights to NGM NASH drug, plans phase 2b trial. Fierce Biotech https://www.fiercebiotech.com/biotech/merck-bags-global-rights-to-ngm-nash-drug-plans-phase-2b-trial (2019).

- Sinal, C. J. et al. Targeted disruption of the nuclear receptor FXR/BAR impairs bile acid and lipid homeostasis. Cell 102, 731–744 (2000).

- Kim, D. et al. A dysregulated acetyl/SUMO switch of FXR promotes hepatic inflammation in obesity. EMBO J. 34, 184–199 (2015).

- Li, L. et al. Activation of farnesoid X receptor downregulates monocyte chemoattractant protein-1 in murine macrophage. Biochem. Biophys. Res. Commun. (2015) doi:10.1016/j.bbrc.2015.10.056.

- Porez, G. et al. The hepatic orosomucoid/α1-acid glycoprotein gene cluster is regulated by the nuclear bile acid receptor FXR. Endocrinology 154, 3690–3701 (2013).

- Intercept Pharma. Intercept announces positive topline results from pivotal Phase 3 regenerate study of obeticholic acid in patients with liver fibrosis due to Nash. Press Release https://ir.interceptpharma.com/news-releases/news-release-details/intercept-announces-positive-topline-results-pivotal-phase-3 (2019).

- Verbeke, L., Nevens, F. & Laleman, W. Steroidal or non-steroidal FXR agonists – Is that the question? Journal of Hepatology (2017) doi:10.1016/j.jhep.2017.01.013.

- Bell, J. After trial failure, Enanta narrows its focus to NASH. BioPharma Dive https://www.biopharmadive.com/news/enanta-pbc-trial-fail-nash-drug/577584/ (2020).

- Novartis. Novartis announces clinical collaboration with Pfizer to advance the treatment of NASH. Press Release https://novartis.gcs-web.com/Novartis-announces-clinical-collaboration-with-Pfizer-to-advance-the-treatment-of-NASH (2018).

- Boston Pharmaceuticals. Boston Pharmaceuticals Licenses NASH Development Candidate from Novartis. Press Release https://static1.squarespace.com/static/5a08e9999f8dced56200bb89/t/5f4ddc

b9ca6144701ab3a98f/1598938297927/PR_BostonPharma_Novartis-NASH_FINAL.pdf (2020). - Radreau, P. et al. In vitro and in vivo characterization of EYP001, a novel, potent and selective FXR agonist now in a Phase 2 clinical trial in NASH. in AASLD The Liver Meeting (2019).

- Mosenzon, O. et al. Efficacy and safety of oral semaglutide in patients with type 2 diabetes and moderate renal impairment (PIONEER 5): a placebo-controlled, randomised, phase 3a trial. Lancet Diabetes Endocrinol. 7, 515–527 (2019).

- Gupta, N. A. et al. Glucagon-like peptide-1 receptor is present on human hepatocytes and has a direct role in decreasing hepatic steatosis in vitro by modulating elements of the insulin signaling pathway. Hepatology (2010) doi:10.1002/hep.23569.

- Bernsmeier, C. et al. Glucose-induced glucagon-like peptide 1 secretion is deficient in patients with non-alcoholic fatty liver disease. PLoS One (2014) doi:10.1371/journal.pone.0087488.

- Novo’s Nash play takes shape. Intelligence Pharma https://intelligencepharma.wordpress.com/2020/05/08/novos-nash-play-takes-shape/ (2020).

- Phillips, L. S. et al. Once- and twice-daily dosing with rosiglitazone improves glycemic control in patients with type 2 diabetes. Diabetes Care (2001) doi:10.2337/diacare.24.2.308.

- Ting, R. D. et al. Benefits and safety of long-term fenofibrate therapy in people with type 2 diabetes and renal impairment: The FIELD study. Diabetes Care (2012) doi:10.2337/dc11-1109.

- Francque, S. et al. PPARα gene expression correlates with severity and histological treatment response in patients with non-alcoholic steatohepatitis. J. Hepatol. (2015) doi:10.1016/j.jhep.2015.02.019.

- Zarei, M. et al. Hepatic regulation of VLDL receptor by PPARβ/δ and FGF21 modulates non-alcoholic fatty liver disease. Mol. Metab. 8, 117–131 (2018).

- Genfit. GENFIT: Announces Results from Interim Analysis of RESOLVE-IT Phase 3 Trial of Elafibranor in Adults with NASH and Fibrosis. Press Release https://ir.genfit.com/news-releases/news-release-details/genfit-announces-results-interim-analysis-resolve-it-phase-3 (2020).

- CymaBay Therapeutics. CymaBay Therapeutics Halts Clinical Development of Seladelpar. Press Release https://ir.cymabay.com/press-releases/detail/476/cymabay-therapeutics-halts-clinical-development-of-seladelpar (2019).

- Inventiva’s lanifibranor meets the primary and key secondary endpoints in the Phase IIb NATIVE clinical trial in non-alcoholic steatohepatitis (NASH). GlobeNewswire https://www.globenewswire.com/news-release/2020/06/15/2048284/0/en/Inventiva-s-lanifibranor-meets-the-primary-and-key-secondary-endpoints-in-the-Phase-IIb-NATIVE-clinical-trial-in-non-alcoholic-steatohepatitis-NASH.html (2020).

- Viking Therapeutics. Viking Therapeutics to report financial results for second quarter 2020. http://ir.vikingtherapeutics.com/2020-07-22-Viking-Therapeutics-to-Report-Financial-Results-for-Second-Quarter-2020-on-July-29-2020 (2020).

- Viking Therapeutics Presents New Data from Phase 2 Study of VK2809 in Patients with Non-Alcoholic Fatty Liver Disease (NAFLD) and Elevated LDL-Cholesterol at The Digital International Liver Congress 2020. BioSpace https://www.biospace.com/article/releases/viking-therapeutics-presents-new-data-from-phase-2-study-of-vk2809-in-patients-with-non-alcoholic-fatty-liver-disease-nafld-and-elevated-ldl-cholesterol-at-the-digital-international-liver-congress-2020/ (2020).

- Terry, M. Merck and Hanmi Ink $870 Million NASH Deal. BioSpace https://www.biospace.com/article/merck-and-hanmi-pharma-ink-licensing-deal-for-potential-nash-drug/ (2020).

- Promethera Attracts Sony Innovation Fund by IGV and Pegasus Tech Ventures as New Investors in Final Closing of Series D. Businesswire https://www.businesswire.com/news/home/20191215005038/en (2019).

- Bruno, S. et al. Human liver-derived stem cells improve fibrosis and inflammation associated with nonalcoholic steatohepatitis. Stem Cells Int. 2019, (2019).

- CohBar Announces First Subjects Dosed in its Phase 1b Clinical Trial for CB4211 Under Development for NASH and Obesity. GlobeNewswire https://www.globenewswire.com/news-release/2020/08/24/2082665/0/en/CohBar-Announces-First-Subjects-Dosed-in-its-Phase-1b-Clinical-Trial-for-CB4211-Under-Development-for-NASH-and-Obesity.html (2020).

About The Authors:

Mavra Nasir, Ph.D., consultant at Bay Life Science Advisors, supports strategic engagements across a range of therapeutic areas including rare diseases, hematology/oncology, and metabolic diseases for biopharma and medtech companies of all sizes. She has leveraged her scientific background and analytical expertise to help provide meaningful solutions to drug developers. Nasir joined Back Bay after receiving her Ph.D. in quantitative biomedical sciences from Dartmouth College. She has published research in non-invasive infectious disease diagnostics using advanced mass spectrometry and machine learning and presented at multiple national and international conferences. Nasir received her BSc in biological sciences from McGill University and MS in bioinformatics from New York University. Connect with her at info@bblsa.com.

Mavra Nasir, Ph.D., consultant at Bay Life Science Advisors, supports strategic engagements across a range of therapeutic areas including rare diseases, hematology/oncology, and metabolic diseases for biopharma and medtech companies of all sizes. She has leveraged her scientific background and analytical expertise to help provide meaningful solutions to drug developers. Nasir joined Back Bay after receiving her Ph.D. in quantitative biomedical sciences from Dartmouth College. She has published research in non-invasive infectious disease diagnostics using advanced mass spectrometry and machine learning and presented at multiple national and international conferences. Nasir received her BSc in biological sciences from McGill University and MS in bioinformatics from New York University. Connect with her at info@bblsa.com.

Crystal Hsu, consultant at Back Bay Life Science Advisors, guides biotech, pharmaceutical, and medical device companies across an array of therapeutic areas. She has expertise in global pricing and market access, launch and go-to-market strategy, profit and revenue optimization, and landscape assessments for life science companies. Hsu has experience in evaluating market opportunities for life science companies in China. She graduated from Emory University’s Goizueta Business School with a BBA in finance and strategy & management consulting. Connect with her at info@bblsa.com.

Crystal Hsu, consultant at Back Bay Life Science Advisors, guides biotech, pharmaceutical, and medical device companies across an array of therapeutic areas. She has expertise in global pricing and market access, launch and go-to-market strategy, profit and revenue optimization, and landscape assessments for life science companies. Hsu has experience in evaluating market opportunities for life science companies in China. She graduated from Emory University’s Goizueta Business School with a BBA in finance and strategy & management consulting. Connect with her at info@bblsa.com.

Peter Bak, Ph.D., SVP at Back Bay Life Science Advisors, has more than 10 years of experience with a broad range of research approaches — cellular, molecular and biochemical — and fields, from immunology and infection through oncology. He leads a diverse portfolio of projects with a focus on liquidity planning and positioning, strategic franchise building, M&A, and licensing strategy and buy-side diligence. Bak’s research career in immuno-oncology began at Dartmouth Medical School, where he received his Ph.D. in microbiology and immunology, and continued at MIT, as an American Cancer Society Postdoctoral Fellow at the Koch Institute of Integrative Cancer Research. He holds a BA in biology from The College of the Holy Cross. Connect with him at info@bblsa.com.

Peter Bak, Ph.D., SVP at Back Bay Life Science Advisors, has more than 10 years of experience with a broad range of research approaches — cellular, molecular and biochemical — and fields, from immunology and infection through oncology. He leads a diverse portfolio of projects with a focus on liquidity planning and positioning, strategic franchise building, M&A, and licensing strategy and buy-side diligence. Bak’s research career in immuno-oncology began at Dartmouth Medical School, where he received his Ph.D. in microbiology and immunology, and continued at MIT, as an American Cancer Society Postdoctoral Fellow at the Koch Institute of Integrative Cancer Research. He holds a BA in biology from The College of the Holy Cross. Connect with him at info@bblsa.com.