Active ADC Space Challenges Development Strategies

By Matthew Pillar, Editor, Bioprocess Online

On the back of advances in payload and linker technologies, antibody-drug conjugate development has exploded in recent years. The funding has followed, in the form of several recent financing rounds in the $20 million to $70 million range. Analysts are pegging their CAGR at 16% and beyond. But, while the face value of ADC activity represents a bright spot in an otherwise sluggish biotech investment environment, the challenges of doing business in a crowded and hotly competitive market are playing out.

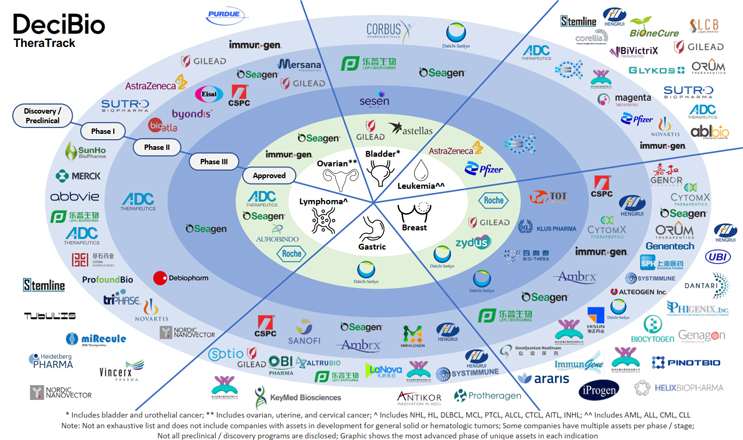

Using DeciBio’s TheraTrack, our friend Joe Daccache, Ph.D. over at DeciBio Consulting with the help of Phillip Leclaire, put together an infographic that illustrates ADC developer activity in six indications where ADCs have already been approved. Though not comprehensive, it’s surely close and it’s a pretty dramatic visual, particularly in the breast cancer space.

Daccache and I caught up to discuss trends and considerations for doing business in the ADC arena.

ADC players in currently-approved indications

An Imbalance Of Unique Targets

In breast cancer, the 46 represented ADC programs have disclosed just a dozen unique targets among them, which creates an awfully challenging case for differentiation on the funding and commercialization paths. By way of contrast, in lymphoma, where 29 ADC programs are represented, we see 15 unique targets. In leukemia, where 26 programs are represented, we see 13 unique targets. Those are healthier ratios for competition.

The impact of low target differentiation in breast cancer plays out in stories like Ambrx, which cited competition and undistinguished efficacy as reasons for suspending its anti-HER2 ADC program (ARX788), almost two years after the FDA granted the program fast track status. Ambrx resurrected the now phase 2 program in March of this year, but Daccache’s research shows 11 breast cancer ADC programs that have been suspended indefinitely. Interestingly, there have been far more suspended programs in leukemia (16) and lymphoma (28). These hematological cancers have historically been considered more straightforward cancers to pursue as initial entry points into the market and have seen large investments, but they can present significant challenges / risks such as being more aggressive tumors with higher relapse rates.

As noted, ADC funding is a bright spot, but beyond the survival of their clinical programs, developers in the busy breast cancer space should look ahead to the potential of their candidate(s) in the marketplace. With four approvals and four more getting close, there won’t be a revenue opportunity for follow-on ADCs that don’t show significant efficacy advantages.

Hot Pursuit Of Payloads

The payload differentiator is a bit brighter in breast cancer. Seventeen unique payloads are represented among the 46 programs. That’s still a poorer ratio than we see in leukemia (18 unique payloads to 26 programs) and lymphoma (15 unique payloads to 29 programs), but the sheer volume of payload research represented across the ADC landscape is inspiring.

Payload classes are getting pretty creative. Small molecules, protein toxins, peptides, and enzymes are being joined by alpha, beta, and gamma-emitting radioisotopes/radionuclides, an area Daccache is particularly bullish about. While he says radioisotopes create inherent manufacturing and regulatory challenges, they also present patient- and payer-centric advantages, and improving technology promises to reduce the manufacturing and regulatory concerns. “In addition to showing promise in efficacy, radio isotopes offer a significant advantage in their elimination of the necessity for companion diagnostics. They can be tracked in-vivo, revealing their exact location and binding data in real-time.” This, he says, presents specific advantages in metastatic situations, where care providers can locate the distribution of targets throughout the body simultaneously, without a biopsy requirement. “While radioisotopes have historically demonstrated high toxicity, advances have led to variations with shorter half-lives, and therefore better safety profiles,” says Daccache.

We also discussed advances in DAR (drug-antibody ratio) and its influence on the resurgence of ADCs. Daccache cited Dantari, whose preclinical anti-HER2 ADC helped land a $47 million series A late last year, as setting a high watermark for DAR with its 60 molecule-per-antibody candidate. Historically, he says, researchers have waffled over whether a high DAR in fact correlated to improved efficacy, or merely introduced stability challenges and increased risk. “Improvements to linker technology is minimizing the debate,” says Daccache. “With better control of the payload and a reduction in off-target effects, we can better research the effect of DAR on efficacy, and there’s growing belief that higher DARs will, in fact, drive better efficacy.”

Are CROs/CMOs/CDMOs A No-Go?

Manufacturing represents another significant ADC development business decision. While Daccache says outsourced manufacturers are paying very close attention to the ADC development space (and with program volume like that, why wouldn’t they?), he also notes that very few of them are equipped to facilitate the variety of payloads, linkers, and targets the crowded space is pursuing. “Outsourcing partners are trying to suss out demand for these variables and permutations before committing to acquiring the expertise and infrastructure they’ll need to open up this line of business,” he says. In the meantime, there’s little-to-no external support for ADC development. That rate-limiting factor only underscores the ADC’s promise. It’s remarkable that a modality with such slim external development and manufacturing support is spawning so many active companies and programs. As outsourced expertise and capacity comes online, we anticipate the field of new/emerging biopharmas adding ADCs to their development pipelines will explode.

These are just a handful of the business considerations ADC development presents. The field is as exciting as the science is complex, but within all those variables and permutations lies the advantage of agility. The aforementioned Ambrx offers a fine example. While its anti-HER2 candidate was hung up, it pivoted to make significant progress in its Phase 1 ARX517 Anti-PSMA ADC for prostate cancer, a space where an ADC has yet to be approved. Now under the leadership of Dan O’Connor, Ambrx is posting positive results on both fronts.

Shameless plug: tune in to the Business of Biotech on May 22, 2023 for a 1:1 with O’Connor, and if ADCs are your game, give Joe Daccache a follow.