Will Point-Of-Care Manufacturing Unlock The Value Of Autologous Cell Therapies?

By Kerim Ozbilge, Edward Sullivan, and Brian Gavin, Ernst & Young LLP (EY US)

Autologous cell therapies (AuCTs), in which a patient’s cells are cultured and expanded outside the body and reintroduced into the same patient,1 lead the cell and gene therapy (CGT) revolution. A recent wave of CAR -T therapy approvals in hematologic cancers is driving market growth, and other indications continue to be investigated.2

CAR-T therapies offer superior efficacy and potential cures. They minimize risks from systemic immunological reactions, bio-incompatibility, and disease transmission associated with cells not cultivated from the patient.3 But their vein-to-vein journey is risky, costly, and time-sensitive, involving many steps and exchanges among different value chain stakeholders, e.g., apheresis centers, healthcare practitioners, manufacturers, cold chain shippers, and treatment centers. With the growing number of AuCT clinical trials and product approvals, these complexities make it challenging to produce these treatments at scale, limiting patient access.

To shorten the treatment journey, which takes two to three weeks on average, and reduce risks and costs, the CGT industry is redesigning the value chain, from reconfiguring reimbursement strategies to streamlining manufacturing. AuCT manufacturers are expanding their production footprint from a centralized single-site global manufacturing model to a more distributed multi-site regional model. While a necessary improvement, the regional model is still capital-intensive and does not significantly shorten the treatment journey or reduce risks and costs.

A promising model that appears to be emerging is point-of-care (PoC) manufacturing in major cancer and academic medical centers and hospital networks. PoC compresses the vein-to-vein process, brings production closer to the patient, and has the potential to address other ongoing concerns, such as reduction of risks and costs.

In theory, PoC manufacturing makes sense. But in practice, it raises important questions, such as how biopharma companies and hospitals will work together to ensure product quality, process control, and regulatory compliance at each PoC site. This article will discuss key considerations and evolving solutions that can unlock the potential and accelerate the adoption of PoC manufacturing, namely, advanced manufacturing and digital technologies.

AuCT Market Continues To Grow, With CAR-Ts Leading The Way

The global autologous cell therapy market was valued at $4.3 billion in 2021 and is projected to reach $29.1 billion by 2031, growing at a CAGR of 21% from 2022 to 2031.4 AuCT is not a new medical concept. Common applications include stem cell transplantation and tissue engineering and reconstruction.5

Besides ever-increasing cancer rates, recent AuCT market growth can be attributed to advancements in cell therapy R&D and demonstration of clinical promise, which has led to increased investments, particularly for the development of CAR-T therapies. In response, global regulatory bodies are accelerating approval of these therapies to treat patients with unmet medical needs. The FDA, for example, approved six CAR-T therapies in five years, from 2017 to 2022.6

Barriers To AuCT Scalability, Accessibility

The promise of AuCTs is immense, providing breakthroughs for diseases with previously limited or nonexistent therapy options. However, the current centralized manufacturing model presents challenges to scalability, including:

- Production complexity and unpredictability. Even though the batch size is for a single patient, production – involving genetic modification, expansion, and cryopreservation – is significantly complex, historically entailing many manual processing steps and quality checks. Among the challenges is product stability; there are strict rules regarding temperature control and tight infusion windows following thawing. Manufacturers must also contend with many variables, including long production ramp-up lead times and schedule delays and changes, while balancing limited manufacturing capacity with therapy manufacturing slot optimization.

- Long lead times. While the “collection to injection” process relies on precision and efficiency to ensure product safety, efficacy, and viability, it can take two to three weeks, which is challenging for patients whose prognosis worsens over time.

- Complex logistics. Many steps and stakeholders are required to sustain the cold chain, all while maintaining the chain of identity and chain of custody for each individual batch.

- High costs. The many labor-intensive manufacturing steps, additional quality testing, and numerous handoffs between value chain parties mean that the cost of delivering these single-lot therapies is extremely high compared with traditional biologics.

The Move Toward PoC Manufacturing

In principle, where speed, safety, reliability and affordability are concerned, moving to PoC manufacturing offers some advantages. Two network model options where patient cells are harvested, modified, and reinjected at the same or adjacent site are appearing to emerge as promising options:

- Hub model. Commercial manufacturing is co-located with clinical research in major cancer and academic medical centers or hospital networks, which feature scaled on-site or adjacent production facilities that cater to multiple therapies. Patients travel to these major centers for treatment.

- Fully distributed model. The commercial manufacturing process is standardized to the point where even local hospitals can handle production without significantly augmenting their capabilities. Instead of investing in major manufacturing infrastructures, these hospitals feature pods – portable automated manufacturing units. This model makes it more convenient for patients, who can be treated closer to home.

Currently, option 1, the hub model, is more common. Academic medical centers are forming partnerships with CMOs or investing in their own facilities. Biopharma companies and hospital networks are partnering with CDMOs on the hub model to create PoC multi-therapy manufacturing networks.

According to results of a comparison analysis published in 2020 in the Journal for ImmunoTherapy of Cancer, “on-site manufacturing of autologous cell therapies resulted in similarly effective treatments in far less time compared with commercially manufactured therapies – 9 to 10 days from apheresis to reinfusion compared to 1 to 2 months for commercial CAR-T products.”7

In addition to much shorter lead times, a one-stop vein-to-vein treatment journey has the potential to improve product safety and stability, traceability, handling, and overall coordination. It can also lead to easier scheduling, less waste, and more productivity. And it can improve patient access by broadening therapies’ geographic scope while reducing costs.

At the same time, PoC manufacturing raises a new crop of questions, including:

- How can providers and biopharma ensure product quality and process standardization across multiple PoC sites? Maintaining process control and product quality in cell therapy manufacturing is challenging when it’s done on one site. Providers will also be contending with multiple diseases, therapies, and protocols.

- Are provider networks ready for this new responsibility? Commercial manufacturing is a new skill set, involving significant operational changes and challenges, e.g., new facilities, new expertise (such as chemistry, manufacturing, and controls), new equipment, technologies, employees, and training. Currently, clinical manufacturing facilities at hospital networks are not inspected by the FDA and are not held to the same standards as commercial facilities.

- How will regulatory approval and compliance work? Site-specific approvals across a network of PoCs could result in delays or the need for regulatory bodies to augment capacity. Compliance will also become more complicated in this decentralized model. The FDA is looking to CGT stakeholders for input as they configure this new normal.8

- Will PoC manufacturing really save costs? Cost will continue to be a factor, given demand and capacity uncertainty; the complexity of ensuring consistency across PoC sites, such as good manufacturing practices (GMPs) standardization and the many quality activities across a network of sites; and decreased economies of scale, which will require new operating models to manage activities such as sourcing, inventory management, and capacity planning.

Technology: The PoC Enabler

Recent developments in cell manufacturing production equipment and data management are enabling AuCT PoC manufacturing to achieve new levels of performance and efficiency. Advanced manufacturing equipment, combined with digital data and analytics platforms, are enabling PoC-based manufacturing alternatives that deliver faster and less expensive services with much broader availability, to make a difference in the lives of patients.

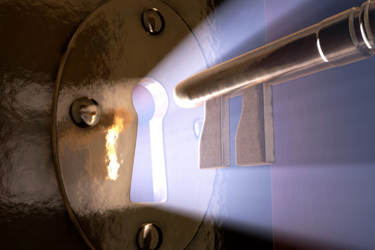

Advanced manufacturing equipment. Highly automated cell therapy manufacturing equipment provided at patient scale using a self-contained, single-use integrated workflow platform is a reality today. Several leading suppliers are offering existing or developing platforms for use by academic centers, contract manufacturers, and therapy developers, within clinical and scale-up to commercial manufacturing environments.

This equipment enables greater CGT manufacturing efficiency and quality, while minimizing operator touch points, risks, and costs. To maintain therapy quality while driving overall process efficiency, the equipment is capable of managing the manufacturing process in a smarter manner. This not only streamlines the production process but also enables greater process reliability. These platforms, which can be delivered under reduced cleanroom requirements, contribute to improved process consistency, schedule adherence, and, potentially, pathways to regulatory approvals.

A variety of closed automated systems have already been introduced or are being developed by CGT thought leaders that enable the production of cell therapies, including:9

- An integrated turnkey platform for automated, closed, and flexible commercial cell therapy manufacturing

- A PoC system that integrates proprietary cell expansion technology with end-to-end closed process automation

- An automated cell processing platform that provides scalable GMP-compliant manufacturing of cell therapy products on a single device and within a single process setup

Advanced digital data and analytics platforms. Advanced data acquisition, analytics, and decision intelligence technologies (aka control towers/digital twins) are being paired with advanced manufacturing equipment to deliver higher-quality and improved yield while shortening production time. Real-time process data verification and in-line process analytics focused on critical to quality parameters are examples of advanced digital technologies being applied to CGT manufacturing that drive higher-quality therapeutic products and improved process consistency. Fully automated process data collection also enables creation of batch records in electronic format, as well as automated workflows that provide exception-based batch record review and dispositioning.

In addition, these control towers and digital twin platforms aggregate data across the end-to-end value chain, from T cell collection through manufacturing and infusion, to enable real-time visibility as well as predictive and prescriptive decision intelligence support. These solutions, which are powered by Internet of Things (IoT) sensors, cloud computing, blockchain, process analytical technology, and advanced analytics, conduct real-time process data collection at the source, while monitoring and managing critical process parameters. This comprehensive real-time monitoring of the production process reduces waste while increasing operational trust and reliability.

At the same time, these solutions enable paperless manufacturing by digitizing overall manufacturing process records and integrating production directly with lab information management systems and quality management systems. They also provide source data for broader operational analytics.

To manage variability in the value chain, e.g., changing demand or raw material allocation, artificial intelligence)-based support mechanisms can improve decision-making so that manufacturers can better allocate limited capacity. Similarly, they can manage and even predict schedule deviations, thereby lowering potential risks.

Advances in autologous cell therapy manufacturing and digital technologies are enabling operating models that colocate autologous cell therapy production with the point of care. Across sites, this approach drives better process control and consistency; enables centralized data monitoring and trend analysis; and creates efficiencies that lead to reduced costs. Exactly which models take precedence, how much larger a role PoC facilities will play, and how this will impact biopharma, regulatory approvals/compliance, and cost remain to be determined. But the end result – significantly compressed vein-to-vein lead times and commercial scalability – is on its way to becoming a reality.

References

- Kazmi, Batool, Inglefield, Christopher, Lewis, Mark, “Autologous cell therapy: current treatments and future prospects,” Wounds, 21 September 2009.

- Shraddha, M., Onker, S., “Autologous Cell Therapy Market,” October 2022, via Allied Market Research.

- Kazmi, Batool, Inglefield, Christopher, Lewis, Mark, “Autologous cell therapy: current treatments and future prospects,” Wounds, 21 September 2009.

- Shraddha, M., Onker, S., “Autologous Cell Therapy Market,” October 2022, via Allied Market Research.

- Kazmi, Batool, Inglefield, Christopher, Lewis, Mark, “Autologous cell therapy: current treatments and future prospects,” Wounds, 21 September 2009.

- “Approved Cellular and Gene Therapy Products,” U.S. Food and Drug Administration, 17 April 2023.

- Amorosi, Drew, “Point-of-care manufacturing delivers effective CAR T cells faster,” Healio, 5 May 2020.

- "Distributed Manufacturing and Point-of-Care Manufacturing of Drugs,” U.S. Food and Drug Administration Center for Drug Evaluation and Research, accessed 19 April 2023.

- Challener, Cynthia A., “Bedside Cell Therapies: Point-of-Care Manufacturing Is Slowly Becoming a Reality,” Pharma’s Almanac, 15 November 2022.

About The Authors:

Kerim Ozbilge is an EY partner in the Supply Chain Advisory Services practice with 23 years of advisory experience driving organizations through their business transformation objectives for improving supply chain and operational efficiency, resiliency, and profitability. For the last 13 years, he has served life sciences clients, including cell & gene therapy companies, by helping them improve their business processes, implement supporting digital capabilities, and drive operational efficiencies across supply chain and technical operations functions.

Kerim Ozbilge is an EY partner in the Supply Chain Advisory Services practice with 23 years of advisory experience driving organizations through their business transformation objectives for improving supply chain and operational efficiency, resiliency, and profitability. For the last 13 years, he has served life sciences clients, including cell & gene therapy companies, by helping them improve their business processes, implement supporting digital capabilities, and drive operational efficiencies across supply chain and technical operations functions.

Edward Sullivan is a senior manager in EY’s Manufacturing Technology practice, where he focuses on helping life sciences organizations digitize their laboratory and manufacturing operations. He has 25 years of experience defining and implementing solutions for leading life sciences research and manufacturing organizations.

Edward Sullivan is a senior manager in EY’s Manufacturing Technology practice, where he focuses on helping life sciences organizations digitize their laboratory and manufacturing operations. He has 25 years of experience defining and implementing solutions for leading life sciences research and manufacturing organizations.

Brian Gavin is a senior director within EY-Parthenon’s Strategy & Transactions practice focusing on deals, commercial manufacturing & distribution, operating model design, and enterprise transformation. Prior to consulting, Gavin worked at Merck & Co. in technical operations supporting commercial vaccine supply and completed graduate research in cell & gene therapy at the University of Pennsylvania.

Brian Gavin is a senior director within EY-Parthenon’s Strategy & Transactions practice focusing on deals, commercial manufacturing & distribution, operating model design, and enterprise transformation. Prior to consulting, Gavin worked at Merck & Co. in technical operations supporting commercial vaccine supply and completed graduate research in cell & gene therapy at the University of Pennsylvania.

The views reflected in this article are the views of the authors and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.