Will ESG Be 2023's Hottest Business Topic In Bio/Pharma?

By Lil Read, GlobalData

Sustainability used to be just about saving the planet. Today it has morphed into an umbrella term for environmental, social, and governance (ESG) issues.

Mentions of ESG and related topics in pharma companies’ filings (earnings transcripts, quarterly and annual filings, investor presentations, and ESG and corporate social responsibility [CSR] reports) more than tripled between 2016 and 2021, according to GlobalData’s Filings Analytics database. 2022 data shows that pharma companies are talking about disclosure of ESG goals, GHG emissions, and tying funding to reaching ESG targets. Similarly, hiring activity for ESG-related roles in the pharma industry has boomed, with GlobalData’s Jobs Analytics database showing that active job openings by pharma companies with “sustainability” in the job title soared in Q3 of 2022 by 33 times compared to a Q3 2019 base level.

While previous decades have witnessed environmental movements, the current wave of sustainability consciousness is unprecedented. Each new climate-related emergency, human rights violation, or corruption scandal reinforces the public opinion that companies must take meaningful steps to address environmental, social, and governance issues. ESG has and will continue to impact how business is conducted globally. Stakeholders are demanding greater transparency and action on the full spectrum of ESG issues, and those companies that take ESG seriously will be better placed to succeed in the future.

What Are The 12 Pillars Of ESG?

Companies must aim to excel in all areas of ESG and avoid being laggards in any one of the 12 pillars outlined below. Companies that perform poorly in environmental and social issues likely do so due to poor governance.

- Environmental: The four environmental performance pillars measure the energy a company consumes, the waste it generates, the natural resources it uses, and the consequences for ecosystems and habitats. An overarching factor is climate change, which is increasing the frequency and force of extreme weather events. The main climate action strategies include emissions reductions, carbon capture and storage, and carbon offsets. Climate change and instability also cause uncertainty that, in turn, increases corporate risk and delays investment, as will be discussed extensively at the COP conference each year.

- Social: Social performance assesses a company’s engagement with its workers, customers, suppliers, and the local community. Its four core components cover human rights, diversity and inclusion, health and safety, and community impact. Inattention to these factors can damage corporate brands and reputations and bring legal and regulatory penalties. Many social challenges are impacting the pharmaceuticals industry. For example, drug pricing may also be considered an ESG metric for the pharma industry.

- Governance: The governance framework’s four pillars are corporate structure, risk management, corruption and bribery, and ethics. Governance assesses how a company uses policies and controls to inform business decisions, comply with the law, and meet obligations to stakeholders. Governance failures, such as aggressive tax avoidance, corruption, excessive executive pay, or relentless lobbying, cause reputational harm and a loss of trust.

Though the pharma industry is heavily regulated, companies still face controversies. The industry has been plagued by issues relating to governance such as fraud, price-fixing, the unlawful promotion of drugs, and kickbacks. The most prominent ethical issues for pharma companies include antitrust, false claims, drug safety, pricing strategies, lack of complaint handling systems, and personal data sharing.

In GlobalData’s 2021 ESG Strategy Survey involving 1,500 ESG leaders from 20 industries, respondents were asked which of the three ESG areas were most important. Almost 70% of pharma respondents selected environment as the most important, followed by governance at 19% and social at 14%. Though these results are not surprising, they are somewhat concerning. Even though all ESG factors are crucial, the existential threat brought about by climate change catapults the environment to the top of the priorities list. Pharma companies can make significant changes to their operations (and reputation) in order to make them more environmentally friendly. However, given that organizations are unlikely to meet their environmental goals without good corporate governance practices, governance’s low rank is a concern.

Climate-Related Disclosure Is Heating Up

The Climate Pledge is a commitment for businesses and organizations to take collective action on the world’s greatest challenge and to work together to build a safe and healthy planet for future generations. Signatories commit to reaching net-zero carbon emissions by 2040 — 10 years ahead of the Paris Agreement. As of October 2022, the climate pledge had 376 signatories, rising sharply from 300 just six months before in March 2022. Of the top 20 biggest pharma companies by market capitalization, only Novartis and GSK are signatories.

However, that is not necessarily cause for concern, because as the name states — this is only a pledge toward reaching this goal.

Signing Up For SBTi Indicates A Clear Intention Beyond Greenwashing

When measuring climate-related action, commitments to the Science-Based Targets initiative, or SBTi, indicate firm climate action beyond just greenwashing (a form of inauthentic marketing in which companies can overstate their green credentials, presenting themselves as environmentally friendly) or making climate pledges. The NGO-led SBTi is open to companies from all sectors and of all sizes, and it encourages companies to commit to specific emissions reduction targets and so mitigate the worst impacts of climate change. This is in contrast to the Climate Pledge, which has no specific targets. SBTi then evaluates an organization’s science-based targets to make sure they are in line with the research and goals behind the Paris Agreement of limiting global temperature rise to 1.5 degrees C above pre-industrial levels. SBTi helps drive valuable climate action by preventing greenwashing. Due to differences across industries, SBTi is now developing sector-specific pathways.

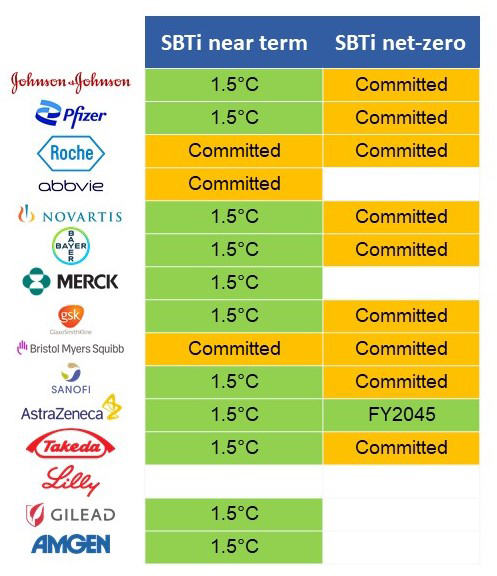

AstraZeneca was one of the first seven companies (across all industries) to receive validated net-zero targets and is committed to being fully net-zero by 2045. Other large pharma companies, including Johnson & Johnson, Pfizer, Novartis, Bayer, Merck, GSK, Sanofi, Takeda, Gilead, and Amgen have near-term SBTi emissions targets in keeping with limiting global warming to 1.5 degrees above pre-industrial levels, in line with the Paris Agreement.

The table above shows the top pharma companies by market capitalization and their SBTi commitment status. The green 1.5 degrees C status indicates that the company has committed to reduce its emissions within 5–10 years of setting the target, in line with limiting global warming to 1.5 degrees above pre-industrial levels. The amber committed status indicates that a company has committed to reducing emissions but has not set a target. In the case of AstraZeneca, the green FY2045 SBTi net-zero target indicates that the company has plans in place to reach net-zero greenhouse gas emissions across the value chain by financial year 2045. In the case of Eli Lilly, no SBTi commitments have been made, and abbvie, Merck, Gilead, and Amgen are yet to make SBTi net-zero commitments.

Good ESG Strategy Is Vital For Long-Term Profitability

ESG is not just greenwashing or CSR-washing. Pressure is building from all angles, and this is causing a new market mechanism to emerge. Fortunately, this mechanism promises to drive progress, which GlobalData has named the “ESG action feedback loop.” Previously, companies often operated with only their shareholders in mind, acting solely for profit without considering their impact on the environment and the communities they serve. However, as the consequences of climate change have become increasingly apparent, there has been a significant demand from other stakeholders that companies become more transparent about their environmental impacts. This is true of all the 12 pillars of ESG.

The concept behind the ESG and climate action feedback loop is that companies take positive ESG action and disclose this to all their stakeholders, including their investors and their customers, while publishing their initiatives and targets. Stakeholders choose to support the most effective companies, meaning that ESG action wins further stakeholder loyalty and this in turn drives competitive advantage, which incentivizes further action and more participation. This mechanism is already working. Non-governmental organizations have been instrumental in driving action through schemes such as the Science Based Targets initiative.

For more information, check out these related reports from GlobalData:

- The factors that can contribute negatively to a company’s ESG performance, along with mitigating actions for each of these contributing factors, can be found in the ESG Framework report.

- There are further insights specific to the pharma industry available in the ESG in Pharma report.

- GlobalData Thematic Intelligence’s Climate Change report covers the factors driving climate change, and the frameworks in place to help mitigate it, including the Paris Agreement and Science-Based Target initiatives.

About The Author:

Lil Read, Ph.D., is a senior analyst in GlobalData’s Thematic Intelligence team. During her two years at GlobalData, her research areas of focus have been on artificial intelligence (AI) and data analytics; environmental, social, and governance issues (ESG); and Web3. Before joining GlobalData, she completed a cross-discipline Ph.D. at the University of Cambridge on how marine plankton grow biominerals in response to changing climates.

Lil Read, Ph.D., is a senior analyst in GlobalData’s Thematic Intelligence team. During her two years at GlobalData, her research areas of focus have been on artificial intelligence (AI) and data analytics; environmental, social, and governance issues (ESG); and Web3. Before joining GlobalData, she completed a cross-discipline Ph.D. at the University of Cambridge on how marine plankton grow biominerals in response to changing climates.