Trends In Single-Use System Adoption In The Biopharma Industry

By Ilene Roizman, BioPlan Associates, Inc.

To maintain a competitive edge in biologics production, contract manufacturing organizations (CMOs) are continually searching for better, more innovative manufacturing strategies. According to our 16th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production,1 the speed of single-use equipment adoption by CMOs is outpacing that of biopharma innovators for small- and mid-scale bioprocessing, and it is being used for larger-scale commercial manufacturing at an increasing rate. For example, CMOs are somewhat more likely to adopt single-use bioreactors than biodevelopers, at a rate of 87 percent vs. just under 80 percent. This allows them to stay competitive, especially for R&D and clinical trials, with better efficiency and at lower cost.

With the advancement of technology, knowledge, and experience in the single-use field, continued progress and market expansion across the biopharma sector (CMOs and innovators) are expected. Beyond that, adjacent sectors are seeing expansions and adaptations that have been implemented in mainstream biologics production. Among these, cell and gene therapy and the production of cosmetics and food derived from plant cell and tissue cultures are now occurring at manufacturing scales.

Compared to traditional equipment, single-use equipment, which is generally made of plastic parts sterilized by gamma irradiation, is used once and then discarded. Over more than a decade of combined industry experience, the benefits of single-use vs. fixed stainless steel have been demonstrated, including lower capital investment and operational costs and greater flexibility. With SUS, bioprocessing and progressive manufacture of multiple products at multiple scales in the same areas can be set up rapidly. Product lines have expanded from basic storage bags to complex bioreactors, so that almost all bioprocessing, particularly upstream, can be done with single-use systems.

Industry Trends

Whereas only a few single-use systems, generally limited to 100 L, were available less than 20 years ago, single-use bioreactors and mixers are now available at ≤ 2,000 L scale. Systems above 2,000 L exist, but they are generally not practical or cost-effective due to engineering limitations. As more companies offer an increasing range of product options, 1,000 L bioreactors are on track to be become the industry standard for new product large-scale and much commercial-scale manufacturing.

Stainless-steel facilities still dominate, accounting for about 85 percent of the market, with single-use at about 15 percent. Over the next five to 10 years, the proportion is expected to shift to about 70 to 75 percent stainless and 25 to 30 percent single-use, including growth in the SUS market of up to 300 percent. These projections take into account that downstream applications will remain limited over the next five years, with some increased adoption of SUS continuous chromatography and increased use for commercial manufacturing. The numbers also reflect likely market growth from new players entering bioprocessing, including in developing countries and biosimilar developers.

It is anticipated that commercial-scale GMP manufacturing will show the most dramatic growth. The single-use market for commercial applications is projected to grow to over $1 billion/year in the next five years, driven by products using SUS that are currently in development receiving approval and graduating to commercial-scale manufacturing. New products will continue to mostly be monoclonal antibodies, which generally require manufacture of 100 kilograms or more. This will increasingly involve parallel tracks, continuous bioprocessing, and/or multiple facilities worldwide anchored by 500- to 2,000-L SUS bioreactors.

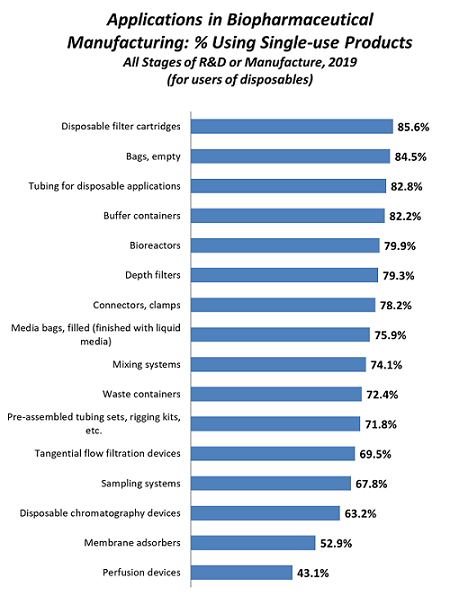

The most frequently used single-use products at any stage/scale are shown in Figure 1. Simpler devices, such as filter cartridges, bags, and tubing top the list. But it is significant that many facilities are adopting major bioprocessing systems, including nearly 80 percent using bioreactors, more than 70 percent using mixers, and nearly 70 percent using tangential flow filtration.

Figure 1: Usage of disposables in biopharmaceutical manufacturing at any stage of manufacture.1

Among the reasons for adopting single-use, respondents considered the following either “very important” or “important”:

- Eliminates cleaning requirements

- Reduces the time to get a facility up and running

- Reduces capital investment in facilities and equipment

- Decreases the risk of cross-product contamination

- Allows flexibility with a modular approach

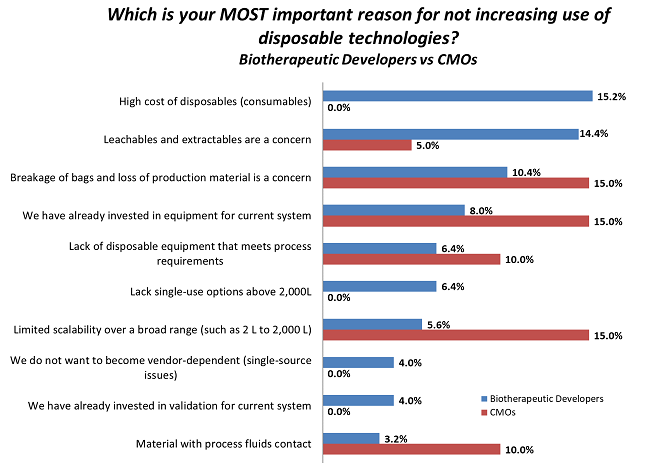

Reasons for not increasing the use of disposables are shown in Figure 2. The top three reasons given by CMO respondents were “Breakage of bags and loss of production material is a concern,” “We have already invested in equipment for current system,” and “Limited scalability over a broad range (such as 2 L to 2,000 L), all at 15 percent. For biodevelopers, the top three reasons were: “High cost of disposables” (15.2 percent), “Leachables and extractables are a concern” (14.4 percent), and “Breakage of bags and loss of production material is a concern” (10.4 percent).

Figure 2: Top reasons for not increasing use of disposables, biotherapeutic developers vs. CMOs1

Restricting progress in the expansion of single-use systems—besides the inherent conservatism in this highly regulated industry—are vendors’ hesitancy and end users’ distress over incremental improvements and other changes in established product lines. Changes in bioprocessing products already in use can require extensive validation studies, more regulatory filings, costly testing, new SOPs, etc. Innovations in single-use equipment will more likely originate from small companies or new major suppliers and developers less attached to aging technologies. In this industry, new technologies are generally implemented by totally new facilities and process lines, not retrofitting.

With increased use of SUS will come further concerns about cost, particularly as more bioprocessing professionals purchase SUS. However, we found from other survey research that purchasers of bioprocessing equipment do not necessarily consider price a primary concern. End users prefer to purchase the best equipment they can get and are willing to pay more, as long as the premium is not excessive. We also note that CMOs generally pass costs of manufacturing on to their clients, so costs can become secondary to CMOs.

Other Advancements Promote Growth In SUS Adoption

Overall, bioprocessing professionals realize that SUS has improved bioprocessing. Over two-thirds of survey respondents cited SUS as providing “some” or “significant” improvement in their bioprocessing within the past year.

Still, according to our survey, end users continue to express a desire for improved single-use systems, as they recognize that the equipment they’re using is often first-generation or otherwise not optimal. As with most emerging technologies, once new and better products and systems are introduced and become the norm, demand for further improvement continues until a general level of satisfaction is reached. In the bioprocessing industry, end users are apparently concerned that innovation in single-use supplies has been slow in coming. This is fully expected and normal in such a highly regulated environment. More diverse technologies and products will become available as single-use manufacturing advances and continues to proliferate.

Currently in active development are a number of individualized biologics and personalized medicines, including patient-specific cellular and gene therapies, cultured tissues and organs, and cancer and other therapeutic vaccines. Their one-off nature and need for sterility position these products to be manufactured using single-use equipment. Significant growth in cellular and gene therapy capacity and facilities can be expected in the coming years, despite a current shortage that will become an actual capacity crunch.

Another growing trend is modular facilities. With processes housed in connectable, portable cleanrooms or isolator units, whole portable manufacturing facilities can be constructed and operational in a matter of months or even weeks. With modular systems using SUS equipment and providing much the same advantages as single-use, the market is expected to grow dramatically. This includes “plug-and-play” factories, with whole production lines and facilities fully cloneable. With an increasing demand for domestic biopharmaceutical manufacture over the next decade, modular facilities will become more common in developing countries, particularly China and India.

Conclusion

Upstream bioprocessing at large and commercial scales is projected to be the fastest growing segment of the single-use equipment market as products now in development using SUS move up to commercial manufacturing. As demonstrated by the annual BioPlan survey and confirmed by many other sources, adoption of single-use systems, generally in place of fixed stainless-steel systems, will continue. In addition, as cellular and gene therapies emerge, we will likely see SUS technologies created and adapted explicitly for these personalized applications.

While developed countries will experience most of the growth in SUS, developing countries will see much faster SUS growth rates as well. For example, in China, many of the new bioprocessing facilities expected to be constructed to meet both domestic demand and the country’s desire to become an exporter of biopharmaceuticals will be primarily SUS facilities.2 The future for SUS technologies continues to be defined by the expanding global need for better, cheaper, and faster biologics production.

References:

- Langer, E.S., et al., 16th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates, Rockville, MD, USA, April 2019.

- Directory of Top 60 Biopharmaceutical Manufacturers in China, 2nd edition, BioPlan Associates, Feb. 2017, 357 pages (also online database).

Photo courtesy of GE Healthcare Life Sciences

About the Author:

Ilene Roizman is the communications manager at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. She is a skilled writer — able to distill highly technical information in medicine and science. Her medical expertise includes editing of textbooks and research papers for international science and medical journals. You can reach her at iroizman@bioplanassociates.com or 301-921-5979.

Ilene Roizman is the communications manager at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. She is a skilled writer — able to distill highly technical information in medicine and science. Her medical expertise includes editing of textbooks and research papers for international science and medical journals. You can reach her at iroizman@bioplanassociates.com or 301-921-5979.

Survey Methodology:

The 2019 16th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trend analysis from 221 responsible individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) in 24 countries. The methodology also included over 120 direct suppliers of materials services, and equipment to this industry. This year's study covers such issues as: new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the major markets in the U.S. and Europe.