Top Trends In The Biopharmaceutical Industry And Bioprocessing For 2019

By Ronald Rader and Eric Langer, BioPlan Associates, Inc.

The biopharmaceutical industry and its bioprocessing component continue to incrementally and over time dramatically expand in most aspects, including:

expand in most aspects, including:

- product revenue

- number of marketed products, both innovative and follow-ons

- types/classes of marketed products (e.g., cellular and gene therapies)

- number, types, and locations of players/companies

- capacity, process lines, and facilities

- R&D expenditures

- percent of pharmaceutical R&D targeted to biopharmaceuticals

- productivity (higher titers and yields)

- staffing/head count.

Trends are naturally broad and extend over years, with new ones developing and becoming evident slowly, over years.

This article presents trends and findings from our 15th (2018) Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, and discusses the impact of some of these trends.1 This survey and study provides a composite view and trends analysis from 222 responsible individuals at biopharmaceutical manufacturers and CMOs in 22 countries and includes over 130 direct suppliers of materials, services, and equipment to this industry.

Industry Trends

Perhaps the most important trend, one that ultimately drives many or most of the others, is the continued expansion of biopharmaceutical industry sales, revenue, and profits. BioPlan’s and other’s studies confirm industry revenue and many other parameters continue to grow at about ≥12 percent annually. Industry worldwide revenue is now at ~$275 billion/year and will exceed $300 billion in 2019. The importance of biopharmaceuticals as a portion of total pharmaceutical revenue also is continuing to expand, with ≥40 percent of overall pharmaceutical industry R&D (thoroughly dominated by Big [Bio]Pharma companies) and products in the development pipeline being biopharmaceuticals (versus drugs), and this percentage expected to further incrementally increase. Biopharmaceuticals have simply proven themselves to be readily developable products with eager markets. Despite threats, we expect no major expansion of government price controls on biopharmaceuticals next year, including in the U.S.

The number of biopharmaceutical players and companies continues to grow. This growth is likely more rapid than the overall industry’s ≥12 percent annual growth, which results in near doubling every five years. Growth in players is largely driven by hundreds of new developers of follow-on products (biosimilars, biogenerics, biobetters) and cellular and gene therapies, and by new international players, particularly in China and other Asian countries.2, 3, 4

Growth in products and developers in the cellular/gene therapies area is and will be so rapid that we have reported a current and worsening bioprocessing capacity crunch. The major exception to the expansion of the number of players is in the biopharmaceutical CMO sector, with industry consolidation continuing and increasingly fewer companies, very few small- and midsize CMOs not yet part of a much larger company, and hardly any new mainstream (e.g., recombinant proteins/monoclonal antibodies [mAb] versus specialized) CMOs being founded or coming online in recent years.

The number of marketed biopharmaceutical products continues to expand. This includes the FDA being on track to approve ≤25 products in 2018, while 2017 was a record year with 34 approvals.5 We can expect to see larger numbers of biosimilars and cellular/gene therapy products in coming years. Within five years, the majority of marketed recombinant biopharmaceuticals will shift to biosimilars. Biosimilars are expected to further increase as the U.S. and other major markets start to grant biosimilar approvals with full interchangeability with their reference products, as interchangeables are expected (right or wrong) to be better quality-wise than biosimilars lacking interchangeability.

The types or classes of marketing biopharmaceuticals continues to expand. Besides follow-ons and cellular/gene therapies, we are starting to see increased approvals of antibody-drug conjugates, antisense and RNAi oligonucleotides (most synthetic, not actually biopharmaceuticals), pegylated proteins, and more novel antibody structures. Biopharmaceutical types or classes will further increase as diverse novel products enter the market, particularly antibodies with substantially modified backbones.

Outsourcing, particularly contract manufacturing, is slowly increasing, with developers tending to prefer outsourcing more of their products in development, particularly less important products, e.g., biosimilars and those requiring use of novel bioprocessing technologies where expertise and manufacturing capacity remains limited, such as cellular and gene therapies. BioPlan survey data now shows the majority of respondents report their facility outsources at least some API/product manufacturing.1 The worldwide biopharmaceutical CMO industry is now ~$3.5 billion/year and growing at ≥12 percent annually. The most dramatic growth (from a negligible baseline) will be in China, as current laws not allowing third-party manufacturing are changed, with just a few well-connected companies now allowed to offer CMO services as part of a government-sponsored trial program.4

Bioprocessing-Related Trends

Capacity and manufacturing process lines and facilities continue to increase, again generally tracking the overall ≥12 percent annual industry growth. Overall, worldwide biopharmaceutical capacity is now over 16.3 billion L. This includes 6 million L (37 percent) in North America, 5.5 million L in Western Europe (33 percent ), and 4.7 million L (25 percent) in the Asia-Pacific region.6 Outside major markets, fastest growth (from a low baseline) is in China, which will soon surpass India in bioprocessing capacity. Further and dramatic growth in bioprocessing capacity is expected in China, which has a long way go to supply its own domestic needs for biopharmaceuticals, besides many Chinese developers targeting eventual GMP manufacturing for major markets. China needs the equivalent of multiple supersized (Samsung- or Celltrion-like) facilities just to begin to catch up with its own domestic biopharmaceutical market needs. However, to date, facilities in China remain restricted in size, with even the largest and new recombinant manufacturing facilities being relatively small, none having over 100,000 L capacity. We do not expect significant GMP manufacturing in China and exports to major markets for five to 10 years.

The number of process lines and, to a lesser extent, new facilities will continue to increase, again at the overall industry rate of ≥12 percent annually. This includes a growing number of single-use facilities, most anchored by 2,000 L bioreactors, coming online, with these facilities expected to support commercial manufacturing by scaling-out, using multiple 2,000 L bioreactors and process lines in parallel. Just in the past year, we have identified over 20 new facilities or major expansions among CMOs involving a total of ~180,000 L added multiple ≥1,000 L single-use bioreactor capacity. We expect CMOs and developers to continue adding and building new multi-2,000 L single-use bioreactor-based process lines and facilities in coming years. Single-use-based manufacturing has matured and proven to be a very viable, if not preferred, alternative to stainless steel-based process lines. Conversely, we expect the number and portion of stainless steel-based capacity and new facilities to decrease as more new products being developed with single-use graduate to commercial manufacturing using single-use process lines.

One trend we are not seeing is an increase in the diversity of commercially used expression systems, with most products still mammalian, mostly CHO-expressed, and with most microbial products still using E. coli with inclusion bodies. If anything, the industry is concentrating even more on mammalian bioprocessing, with more graduate students now learning this versus microbial manufacturing. As the number and diversity of products increase in coming years, the percent that are mammalian-expressed relative to microbial products will tend to increase, despite microbial manufacturing often being quicker, simpler, and cheaper. Contributing to less use of microbial, there continues to be a shortage of microbial CMO capacity in the U.S. There simply are few CMOs in the U.S. versus Europe offering GMP microbial manufacturing at late-stage or commercial scales. This will likely worsen, as few new U.S. CMOs come online and the U.S. continues to have a relative shortage of available bioprocessing professionals with relevant training and expertise.

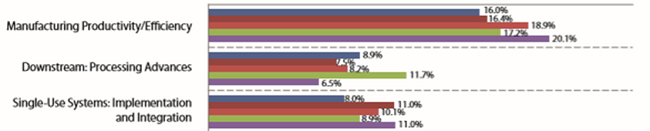

Bioprocessing productivity continues to increase, primarily in the form of continued incremental increases in upstream titer. As shown in Fig. 1, manufacturing productivity/efficiency has remained the top concern cited by survey respondents for years.

Figure 1: Single most important biomanufacturing trend or operational area, 2014-

2018 (Source: 15th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, April 2018 1)

In our 2018 survey, the largest portion of responses cited increased productivity as the single most important trend or operational area. The average titers reported at both clinical and commercial scales were 3.20 g/L. However, downstream processing remains a relative problem area for many, with nearly all constraints or bottlenecks involving downstream processing. As shown in Fig. 2, facility constraints are now cited by 50 percent of survey respondent as the top area to be addressed to avoid capacity constraints, with this remaining the top-cited constraint since 2008. A large portion, 42 percent, expect (or hope) continuous downstream processing will address many current manufacturing constraints.

Despite continuing incremental advances in bioprocessing productivity, mostly upstream, the industry is continuing efforts to reduce manufacturing costs. This includes 64 percent of 2018 survey respondents having implemented programs to reduce operating costs at their facility within the past year. Working to reduce bioprocessing costs has become routine. Associated with this, 2018 was the first year in which we surveyed to identify the average cost/gram for recombinant protein manufacture – now $307/gram for respondents’ primary recombinant protein product, usually a mAb. This is not expected to significantly increase or decrease, with continuing productivity increases largely offset by rising bioprocessing costs (equipment, labor, etc.).

References:

- Langer ES, et al. Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, 15th Edition. BioPlan Associates: Rockville, MD, April 2018; www.bioplanassociates.com/15th.

- Rader, R.A., Biosimilars/Biobetters Pipeline Directory, database.

- Xia, V.Q., et al., Directory of Top 60 Biopharmaceutical Manufacturers in China, 2nd edition, BioPlan Associates, Rockville, MD, Feb. 2017.

- Xia, V.Q., et al., Advances in Biopharmaceutical Technology in China, BioPlan Associates, Rockville, MD.

- Rader, R.A., BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets: U.S. Approvals, 2002-present, BioPlan Associates, Rockville, MD; www.biopharma.com/approvals.html.

- Rader, R.A., Langer, E.S., Top 1000 Biopharmaceutical Facilities Index, BioPlan Associates, Rockville, MD; www.top1000bio.com.

About the Authors:

Ronald Rader is senior director of technical research at BioPlan Associates. He has more than 35 years of experience as a biotechnology and pharmaceutical, particularly biopharmaceutical, information specialist, analyst, and publisher. Publications/information resources he has been responsible for include the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, BIOPHARMA, Biopharmaceutical Products in the U.S. and European Markets, and the Biosimilars/Biobetters Pipeline Directory. You can reach him at info@bioplanassociates.com or (301) 921-5979.

Ronald Rader is senior director of technical research at BioPlan Associates. He has more than 35 years of experience as a biotechnology and pharmaceutical, particularly biopharmaceutical, information specialist, analyst, and publisher. Publications/information resources he has been responsible for include the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, BIOPHARMA, Biopharmaceutical Products in the U.S. and European Markets, and the Biosimilars/Biobetters Pipeline Directory. You can reach him at info@bioplanassociates.com or (301) 921-5979.

Eric Langer is president and managing partner at BioPlan Associates, a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. He is the editor of numerous studies, including “Biopharmaceutical Technology in China” and “Advances in Large-scale Biopharmaceutical Manufacturing.” You can reach him at elanger@bioplanassociates.com or (301)921-5979.

Eric Langer is president and managing partner at BioPlan Associates, a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. He is the editor of numerous studies, including “Biopharmaceutical Technology in China” and “Advances in Large-scale Biopharmaceutical Manufacturing.” You can reach him at elanger@bioplanassociates.com or (301)921-5979.

Survey Methodology:The 2018 15th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trends analysis from 222 responsible individuals at biopharmaceutical manufacturers and CMOs in 22 countries. The methodology also included over 130 direct suppliers of materials, services, and equipment to this industry. This year's study covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trends analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the major markets in the U.S. and Europe.