The Process Map To Ensure Biopharma Raw Materials Supply

By BioPhorum

One of the main areas of variability in forecasting and demand planning is a new product introduction (NPI). This can be affected by many factors, such as late queries from regulators, the product’s demand profile, etc. There are also many competing factors involved, e.g., planning a global launch where registration processes are different in each country, with varying timeframes for when approval to launch is given.

One of the main areas of variability in forecasting and demand planning is a new product introduction (NPI). This can be affected by many factors, such as late queries from regulators, the product’s demand profile, etc. There are also many competing factors involved, e.g., planning a global launch where registration processes are different in each country, with varying timeframes for when approval to launch is given.

However, probably the most significant area of variability is planning for the needs of the inbound supply chain to support manufacturing requirements. This is often because companies do not know how much product they will manufacture. Also, the planning discussions between a company’s commercial and manufacturing departments can sometimes be disjointed, contributing to the variability of NPIs.

The costs associated with manufacturing biotherapeutics, including cell and gene therapies, are often hundreds of times greater than small molecule products. For biosimilars, there are huge uncertainties about new product take-up, the drivers, etc. Therefore, a mistake when introducing a new product can be significant. The challenge is to reduce variability while producing the correct amount for the market.

Countries often have divergent standards on how they approve products. For example, some can process regulatory submissions in a few months; in others, it may take two or three years. Therefore, companies must plan properly where they plan to launch new products and must work with their commercial and marketing teams to understand the impact on existing products in those countries. Forecasting and demand planning is therefore critical to introducing a new product, especially its launch plans and the level of understanding of when things need to be done, by whom, etc. Part of this process is looking at what information companies need to collect to support the new product being produced.

There is often a lack of a basic data package for a product being scaled up for clinical or launch supplies and no “one set of agreed numbers” among development and business functions. This can lead to several issues, e.g., capacity and lead time restrictions, oversupply, and late change evaluation and implementation.

At best, these can lead to firefighting and, at worst, missed clinical supply milestones or delayed NPI launches. Suppliers’ abilities to respond effectively can be severely restricted.

There are many benefits of a comprehensive and robust NPI process, including:

- standardized planning/tracking of documents

- earlier planning, data gathering, and collaboration

- capturing risks at each stage

- a business review process that includes “innovation” discussions

- producing a “life cycle” document for a material requirement.

A stepwise process can be used as a guideline for introducing a material to support new drug substance manufacture and can be used in conjunction with detailed company-specific NPI procedures. The process we describe in this article is also relevant best practice for cell and gene therapy manufacturers.

Stage Gate Process

The materials supply process contains many common requirements throughout the early to late clinical phases. Inherent in each phase is the ongoing development of a “life cycle materials strategy,” which records information such as key actions, decisions, and material needs at each stage, etc. Therefore, the requirement for suppliers to partner early in this risk-based process is critical.

To support the delivery of each stage gate, the following structure is used:

- Inputs – the collection of documents/participating functions that support the stage gate delivery.

- Process – the tasks that need to be delivered.

- Outputs – the deliverables completed to close the stage gate.

The stage gate process formally divides the materials introduction and supply process into four distinct phases, which are:

- Establishing product life cycle materials requirements

- Materials evaluation

- Supplier selection and qualification

- Manufacture and business review

This process will help companies plan for success and consider issues such as having the right volume of raw materials available over the product’s life cycle and how they will work with the supply base to make sure both can grow at the same rate.

It should be used toward the end of the development process and Phase 3 trials. This is critical because companies often do not spend enough time planning for new products with development teams nor do they consider how the manufacturing process will work once a product becomes a commercial entity.

This process will support teams involved in new product cycles and help them consider the management of the whole process – from understanding the supply chain and how products come to market to what sort of conversations they need to have.

Stage Gate 1 – Establishing Product Life Cycle Material Requirements

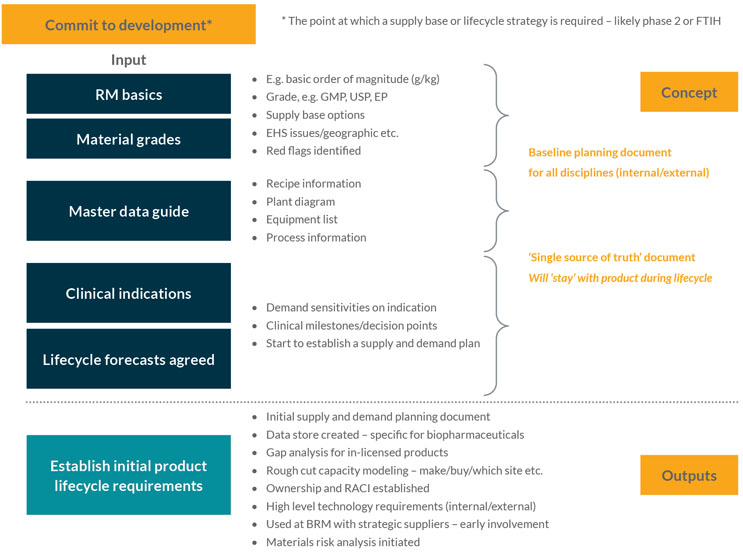

This stage is likely to start when significant company resources are committed to product development, e.g., first time in human (FTIH) studies. It is when the basic data requirements for materials to support the introduction of drug substance supply are collated and projections throughout a product’s development and commercial lifetime are estimated (see Figure 1).

Figure 1: Establishing product life cycle material requirements

Stage Gate 2 – Materials Evaluation

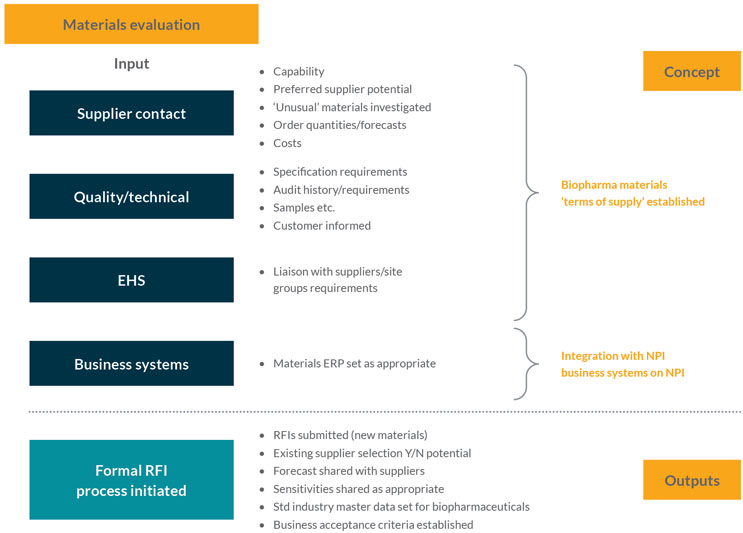

This stage focuses on getting ready to gather information from the supplier base. Using technical data from the product development team, the stage initiates formal requests for information (RFI) on materials from suppliers, who may eventually support the full production volume. The stage tries to ensure the supply chain is resilient for those materials and that suppliers can support the predicted or proposed growth of the product over its life cycle (see Figure 2).

Figure 2: Materials evaluation

Stage Gate 3 – Supplier Selection And Qualification

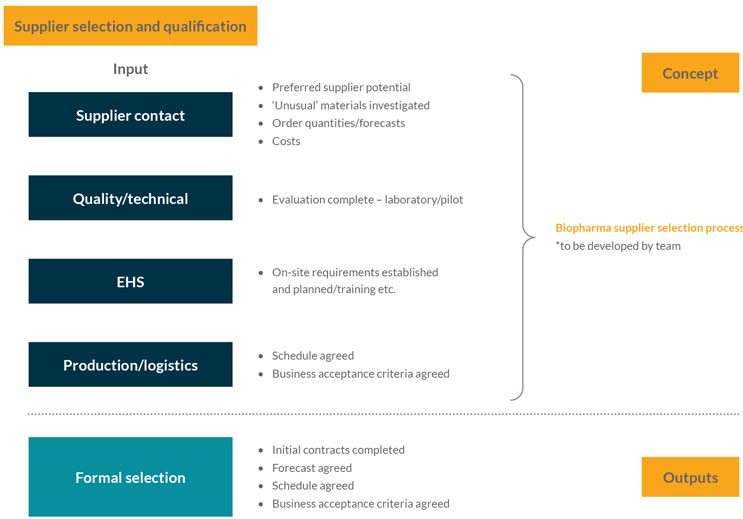

This stage focuses on securing the material supply agreements with suppliers and is where strategies for supply chain resilience and robustness should be considered. It assesses the RFI information from suppliers (gathered in Stage Gate 2) and starts to develop the supply chain resilience strategic approach, which includes actions such as dual and second sourcing for key materials. The team should also engage with the supplier’s QA organization, consider developing an audit or qualification strategy, and use facilities such as the Rx-360 Joint Audit Program (see Figure 3).

Figure 3: Supplier selection and qualification

Stage Gate 4 – Manufacture And Business Review

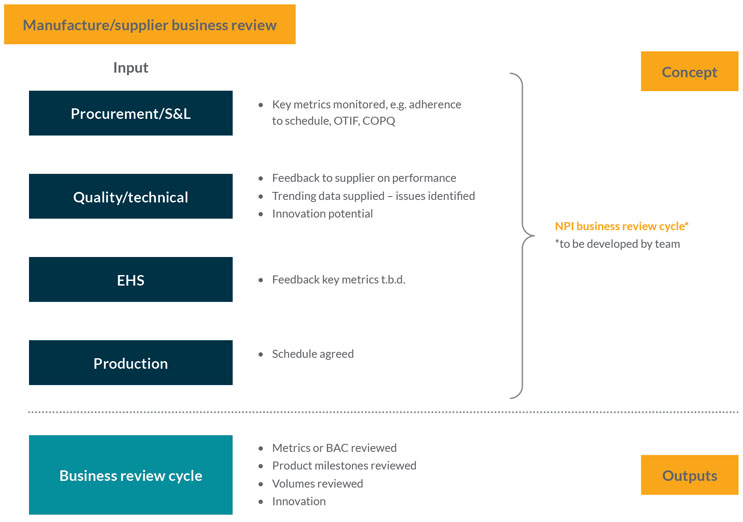

This stage is an operational performance review of the supply chain for raw materials supporting the production process. It gathers relevant performance metrics, e.g., whether materials have been delivered on time, in full, etc. It aims to ensure that any trends or future issues are being monitored and managed so that the inbound supply chain is engineered correctly and that there is a smooth and consistent supply (see Figure 4).

A feedback loop is critical in this process. The stage assesses the history of supply and investigates the detail of any problems, e.g., two out of 20 batches were delayed. It asks questions such as “What was the reason for the delay?” and “Is it something we should be concerned about in the future?”. These issues should then be discussed with suppliers.

Figure 4: Manufacture and business review

Conclusion

The NPI process is one of the best opportunities to capture all the correct information on raw materials from the supply chain to support the development of the new product through its life cycle. Done correctly, it avoids retrospective work that might be needed at different stages of the product when issues occur. Therefore, when working with development, manufacturing, operational, and quality teams, it is an essential risk mitigation practice to ensure a successful outcome for the NPI.

The process ensures that all the master data information needed to support the use of raw materials is present and correct and that you can plan those materials with a robust, resilient supply chain that supports the supply of the materials for your production facilities.

It is a critical activity to support any new product being brought to the market. The variability of demand during the pandemic is high, so it is important to know that you can flex up and down rapidly in response to market demand. Therefore, it is crucial to share information with your suppliers and their supply chains so they understand your needs and expectations when introducing a new product, either into a single market or globally.

This article is a summary of a recent BioPhorum publication on the topic. To read more, check out the full report, Guidelines for materials introduction supporting drug substance delivery.