The "New Normal": Changing Perceptions on Bioprocess Intensification and Continuous Bioprocessing

By Ronald A. Rader, BioPlan Associates, Inc.

Process intensification and continuous bioprocessing are concepts without clear, consistent definitions. What may be  included (or not) often varies greatly and, in some ways, has become more about aspirational goal-setting than actual innovation adoption. For example, process intensification1 includes essentially any new or changed bioprocessing or supporting activity or entity that provides improved yield, productivity, lowers costs, is done in less space, or adds speed – making more using the same or less (costs, equipment, staff, time, space. etc.). There is nothing new about bioprocess intensification – it’s a goal that bioprocessing and all manufacturing organizations strive for and includes not just improving existing processes but also innovating new bioprocesses, such as perfusion replacing batch processing or depth filtration replacing centrifugation. Continuous bioprocessing has been achieved in many other industries, so it is not a new concept.

included (or not) often varies greatly and, in some ways, has become more about aspirational goal-setting than actual innovation adoption. For example, process intensification1 includes essentially any new or changed bioprocessing or supporting activity or entity that provides improved yield, productivity, lowers costs, is done in less space, or adds speed – making more using the same or less (costs, equipment, staff, time, space. etc.). There is nothing new about bioprocess intensification – it’s a goal that bioprocessing and all manufacturing organizations strive for and includes not just improving existing processes but also innovating new bioprocesses, such as perfusion replacing batch processing or depth filtration replacing centrifugation. Continuous bioprocessing has been achieved in many other industries, so it is not a new concept.

Process intensification has also been applied to reducing batch failures and otherwise improving API and drug product quality. At present, discussions of continuous bioprocessing are generally dominated by issues around upstream perfusion and downstream continuous chromatography. This is usually in the context of these replacing batch processing, not simply process intensification.

Trends Promoting Process Intensification

Process improvement and efficiency have emerged as major trends in bioprocessing as the industry has matured over the past couple of decades. Our Annual Report on Biomanufacturing Capacity1 has consistently shown, until last year with the COVID-19 pandemic, that maximizing productivity and efficiency has been the #1 single most important trend. During the current crisis, efficiency has become perhaps more important for both manufacturers and their suppliers. In fact, most of the top bioprocessing trends today generally facilitate efficiency and bioprocess intensification:

- The COVID-19 pandemic is accelerating many trends already in place.2,3 Some COVID-specific trends involving process intensification include strengthening of supply chains; even more single-use systems adoption as flexibility becomes more critical; and increased automation to decrease dependency on having in-house staff.

- Continuing incremental increases in cell culture titers (process intensification) allow use of smaller scale equipment and facilities. Last year, average titer was 3.53 g/L, up significantly from 2008, when titer from the bioreactor was averaging 1.95 g/L.

- Increased downscaling of bioprocessing is accelerating a trend toward smaller-scale new bioprocess lines and facilities, smaller footprints, decreased capital costs, etc.

- Increased adoption of single-use systems even beyond their current rather high usage. This includes most single-use market growth involving production suites with under 2,000 L bioreactors being adopted for commercial scale manufacturing. While not necessarily a productivity improvement, this has been shown to increase flexibility and efficiency in production.

- Increased adoption of modular bioprocessing systems can also speed commissioning of a facility and increase flexibility.

- Better automation, including sensors, data recording and processing, etc.

- Improving options for scaling up and down and related modeling and process optimization

- PAT and other data-rich quality initiatives, often resulting in improved bioprocessing, finding problems, etc.

- Process optimization through improving cell culture methods, culture media, supplements, media optimization methods, etc.

- Improving bioprocessing hardware, including software and control systems

- Increasing adoption continuous bioprocessing technologies, including upstream perfusion and downstream continuous chromatography

- Increased scale of feeder bioreactors and amounts of cryopreserved cells stored in cell banks reducing time and steps with seed trains

Views Of Bioprocess Intensification And Manufacturing Productivity

The BioPlan Annual Survey of Biopharmaceutical Manufacturing Capacity assesses bioprocessing professionals’ views of the state of the industry. Now in its 18th year, we have assessed the changing perspectives of 122 bioprocess decision-makers regarding issues that include bioprocess intensification and decision processes relating to continuous bioprocessing.1

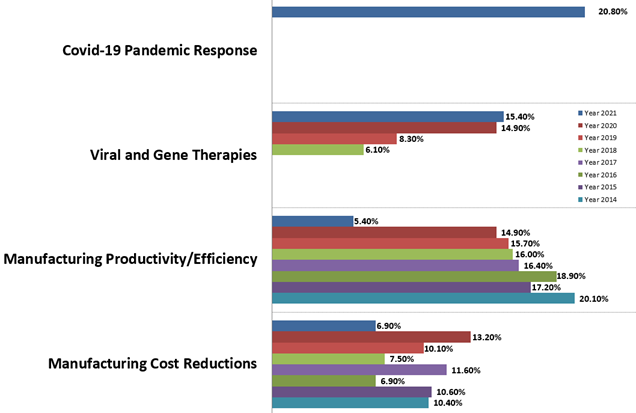

Not unexpectedly during the COVID-19 crisis, the pandemic response was the most frequently cited trend in our study (with 20.8% indicating). Over the past six years, however, “Manufacturing productivity/efficiency,” was the most frequently cited “single-most important operational area.” (This year, we saw a steep decline, with only 5.4% indicating this remains a top area in 2021. In comparison, nearly 15% noted it last year.) We expect a renewed focus on this area again once the crisis is resolved. Responses to many other questions continue to also show high levels of concern and interest in efficiency and intensification.

Figure 1: Selected “Single Most Important Biomanufacturing Trends or Areas, 2014–2021

Evaluating Continuous Bioprocessing

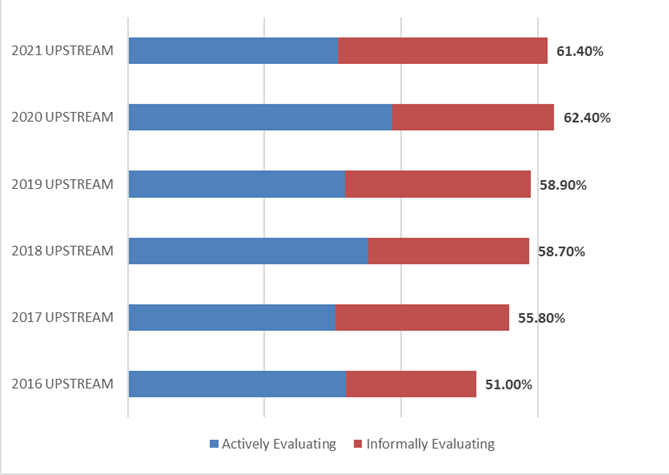

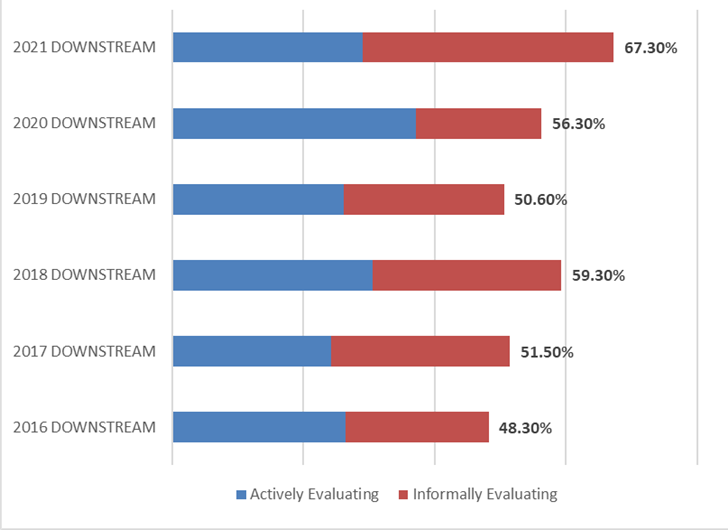

A key factor to gauging the global interest and demand for continuous bioprocessing and process intensification is to measure the percentage of the industry indicating they are actively or informally evaluating technology areas. Over two-thirds of the industry indicated their facility will be evaluating or testing continuous or intensification technologies over the next 12 months. This percentage has risen steadily since 2016, when 48.3% indicated they would be evaluating them. Similar results were found when considering testing or evaluating of upstream continuous technologies (61.4% this year, compared to 51% in 2016).

Figure 2: Percentage of Facilities Evaluating or Informally Testing Continuous UPSTREAM Technologies over the next 12 months (2016-2021)

(Source: 18th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity, 2021, BioPlan Associates, Inc. Rockville, MD (Preliminary Data, February 2021)

Figure 3: Percentage of Facilities Evaluating or Informally Testing Continuous DOWNSTREAM Technologies over the next 12 months (2016–2021)

(Source: 18th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity, 2021, BioPlan Associates, Inc. Rockville, MD (Preliminary Data, February 2021)

Bioprocess Intensification And Capacity

Many facilities are evaluating these innovative technologies because they need to avoid capacity constraints. Capacity, which is tied to production efficiency, is a major challenge in bioprocessing, and technology solutions can be critical. This year, in our study, we found that the number one area that respondents feel needs to be addressed is the adoption and construction of new single-use facilities (noted by 36.9%). Following this was adoption of more automation at facilities. In comparison, developing better continuous downstream technologies was noted by 32.4% in 2021’s preliminary data (compared to 34.1% in 2020).

Process intensification and continuous bioprocessing can be used to address capacity constraints, and the industry is tasking the innovative suppliers with developing better continuous approaches, particularly on the downstream side.

What Should Suppliers Be Developing?

Suppliers are stepping up to the challenge, as well. But even suppliers have limited resources and must focus their R&D development on the areas where there will be the greatest demand. In our study, we found that “Continuous Bioprocessing, Downstream” was noted by 33.9% of the industry as where suppliers should be focusing their development efforts. This was the #1 area of interest this year, beating out improved protein A resins and automation and software.

The industry is, in fact, investing heavily in these developments, with companies like Pall, Cytiva, Millipore, Sartorius, and many others continuing to advance the development and applications for downstream technologies. This includes increasing scales from R&D to process development, and full GMP factory scale in perfusion mode. Downstream, some are showing they have been able to reduce protein A costs very significantly compared with traditional batch columns.

And upstream economics of perfusion are showing benefits with a number of platforms. Intensified perfusion bioreactors are being evaluated not just for their technical benefits. In perfusion bioprocesses, cells are grown to very high densities through optimized feeding. Products are harvested continuously using alternating tangential-flow (ATF) filtration (developed by Refine Technologies and Repligen).

Lag Time Between Technology Evaluation And Adoption

Despite the explicit interest in these new continuous technologies, actual budgets and expenditures on these novel technologies by end users appear to be lagging. For example, when asked what the top three new budget expenditures were last year, we found continuous bioprocessing upstream, or downstream, were not at the top of the list. In fact, these areas were beat out by expenditures in automation, cell culture media, and single-use bioreactors, among others. So, even though interest is high, it is likely going to require time, patience, and resources on the part of suppliers who are developing these new technologies before they will be fully integrated into GMP bioprocessing. This is partly because changing a manufacturing strategy and paradigm requires deeper evaluation of impacts on overall bioprocessing strategy than less invasive technologies, such as cell culture modifications.

Other BioPlan research continues to confirm that actual adoption of continuous bioprocessing remains relatively low, with adoption now rapidly increasing, but from a relatively low baseline, and often not for API production. Today, most perfusion technologies are being adopted for improving seed train operations; perfusion is rarely adopted at more than 500 L, which tends to be a current cutoff for most single-use perfusion systems. Most adoption is at small- or mid-scales, with most users reverting to single-use or even stainless steel-based bioprocessing for commercial manufacturing.

Reasons For Hesitation In Adopting Continuous And Process Intensification Technologies

The primary reason facilities may be hesitating in adopting perfusion technologies is the process operational complexity. In fact, when asked their concerns regarding perfusion vs. fed-batch processes, we found that 67% of respondents considered the operational complexity involved in perfusion to be a bigger concern than in batch processing. Other critical comparative factors were that process development was considered a challenge by 66%, and upstream development and characterization times were longer (noted by 61%). The various costs associated with perfusion were noted as a concern by only 39%. But there is still limited in-use data from economic modeling, and the relatively few case studies associated with the economics of perfusion technologies have not been made available to a large extent.

Conclusions

Process intensification is an ongoing trend within the bioprocessing sector. While a great deal of attention is being directed toward the concept of continuous bioprocessing, we are seeing the consistent introduction of incremental process intensification steps. Process intensification is real, generally recognized when it happens, and remains a factor in achieving a major goal in bioprocessing: more efficient, faster, less costly bioprocessing. However, adopting these novel manufacturing strategies is not only a function of the economics but also of the ability to manage increasingly complex processes in a regulated environment.

We find the bioprocessing industry continues to be excited about the potential opportunities, and the industry’s interest in evaluating these technologies is clearly growing. But at present, with relatively few biopharma professionals adopting full perfusion or continuous downstream purification technologies at larger scale, both decision makers and their suppliers are carefully watching how these technologies will actually be implemented for next-generation pipeline therapeutics.

References

1) 18th Annual Report and Survey of Biopharmaceutical Manufacturing and Capacity, BioPlan Associates, April 2021 (in preparation).

2) Rader, R.A., Langer, E.S., “Bioprocessing Year In Review: 11 Key Trends Accelerated By COVID-19, Dec. 11, 2020, https://www.bioprocessonline.com/doc/bioprocessing-year-in-review-key-trends-accelerated-by-covid-0001

3) Covid-19 Impact on Bioprocessing, BioPlan Associates, 16 pages (a free White Paper), https://bioplanassociates.com/reports-studies/covid-19-impact-on-bioprocessing-white-paper-bioplan-20200605/.

About The Author:

Ronald A. Rader is senior director of technical research at BioPlan Associates, Inc. He has 35+ years’ experience as a biotechnology and pharmaceutical — particularly biopharmaceutical — information specialist, analyst, and publisher, and he has been responsible for the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets, and the Biosimilars/Biobetters Pipeline Directory. You can reach him at rrader@bioplanassociates.com or (301) 921-5979.

Ronald A. Rader is senior director of technical research at BioPlan Associates, Inc. He has 35+ years’ experience as a biotechnology and pharmaceutical — particularly biopharmaceutical — information specialist, analyst, and publisher, and he has been responsible for the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets, and the Biosimilars/Biobetters Pipeline Directory. You can reach him at rrader@bioplanassociates.com or (301) 921-5979.