The Industry's Positive Outlook For ADCs In 2024

By Tyler Menichiello, Chief Editor, Bioprocess Online

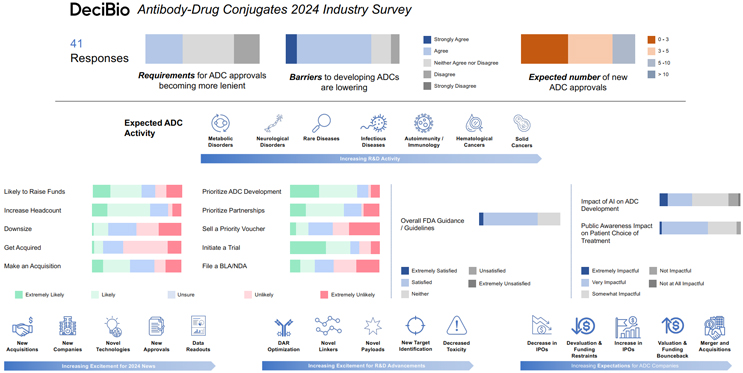

In case you missed it: last month, we published a 2023 antibody-drug conjugate (ADC) roundup recounting the 76 deals made in the space — ranging from licensing agreements to collaborations and acquisitions. Around that time, DeciBio sent out its ADC 2024 Industry Outlook Survey. I recently discussed the results of this survey with DeciBio’s in-house ADC expert, Dr. Joe Daccache. These results are made up of responses from over 40 executives working at large biopharma companies — including Merck, Bayer, AstraZeneca, Novartis, Pfizer, and Eli Lilly. While these results aren’t wholly representative of the industry, they shed light on Big Pharma’s positive attitude towards ADCs heading into 2024 — even more positive than last year.

Regulatory Satisfaction

Nearly half (45%) of respondents think the requirements for ADC approvals will stay the same in 2024, while 32.5% think requirements will become “somewhat more lenient.” Along that vein, 75% of respondents somewhat-to-strongly agree that the barriers to developing ADCs are lowering, while 17.5% “neither agree nor disagree.” All in all, these results bode well for continued advancement in the space.

Increasing Investment In ADC R&D

The majority (75%) of respondents said it’s somewhat-to-extremely likely that their company will prioritize the development of ADCs and/or divert more resources towards ADC R&D in 2024. Roughly the same percentage (72.5%) said it is somewhat-to-extremely likely that their company will increase investment in ADC R&D in 2024. These data are similar to last year’s, though slightly more in favor of internal development versus the licensing deals and acquisitions that seemed to dominate the ADC market in 2023. While these results suggest an increase in internal development compared to previous years, 2024 is likely to see a continuation of both deals and internal R&D.

In terms of ADC development in 2024, 45.3% of respondents expect the most R&D to take place in solid cancers, followed by blood cancer (14.67%), autoimmunity and immunology (14.67%), infectious diseases (8%), and rare diseases (8%). This isn’t too surprising, given that HER3, HER2, Claudin 18.2, Trop2, and Nectin-4 were the most popular (publicly disclosed) therapeutic targets in licensing deals last year — all of which are implicated in solid cancers.

As far as which advancements in ADC R&D people are looking forward to the most in 2024, 42.1% of respondents ranked “decreased toxicity” as their most anticipated, followed by “new target identification” (21.05%), and “new payloads” (18.42%). Looking more broadly, respondents ranked the top three things they were most excited about for ADCs in 2024, and they were “new data readouts” (51.28%), “new approvals” (20.51%), and “novel technologies” (15.38%).

72.5% of respondents believe that artificial intelligence (AI) will have an impact on ADC development in 2024, while 15% said it will not, and 12.5% were neutral on the matter. In all, 27.5% will have some answering to do when the robots take over.

ADC Market Predictions: Capital, M&A, And Partnerships

When asked what 2024 holds for the ADC space, 40.32% of survey respondents said they anticipate an increase in M&A activity (up 6.32% from last year). About the same percentage (42.5%) indicated that their company is likely to make an acquisition related to ADCs this year (down 13.5% from last year), while only 12.5% think their company is likely to be acquired.

Along with an increase of M&A, 30.65% of respondents said they expect to see a bounce back in valuation and funding this year, and 24.18% foresee an increase in IPOs. More than half (55%) of respondents said their companies are likely to raise funds in 2024, while 27.5% said their company is unlikely to raise funds, and 17.5% were unsure.

Roughly 30% of all ADC deals DeciBio tracked last year were collaborations and partnerships, and 2024 may see even more, as 60% of survey respondents said it is somewhat-to-extremely likely that their company will invest in partnerships for the development of ADCs over internal development. You may be asking, “but I thought more than 70% of respondents said their company was going to invest in internal R&D?” I guess time will tell.

A Growing Workforce

65% of respondents said it’s somewhat-to-extremely likely their company will increase headcount this year, which is a positive sign for the sector’s growth. A quarter of them, however, said it is unlikely, and 20% said their company may actually downsize.

Clinical Focus For ADCs

Most respondents (82.5%) expect to see less than five ADC approvals in 2024, but an optimistic 17.5% expect to see 5 to 10. The vast majority of those surveyed (90%) believe patient or public awareness has an impact on patients’ choice of treatment and/or enrollment in clinical ADC trials. This statistic may warrant some consideration, as the survey suggests that 2024 will see an increase in clinical-stage ADCs.

While 67.5% of respondents said their company is likely to initiate at least one ADC clinical trial this year, only 35% said they’re likely to file at least one BLA/NDA with the FDA for an ADC asset. The majority (62.5%) said they’re unlikely to file for at least one accelerated approval, and the same percentage said they’re unlikely to sell a priority review voucher in 2024.

Overall, the industry outlook for ADCs this year seems positive. The perception is that barriers to development are lowering, which Daccache sees as a result of increased activity in the space. As more ADCs enter the clinic, and as more late-stage clinical ADCs gain approval, the space will only continue to mature.