The Global Market Landscape For Peptide Drug Conjugates

By Aditi Shivarkar, insightSLICE

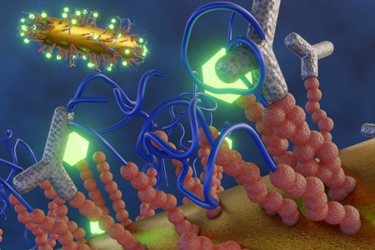

A peptide drug conjugate is a type of drug molecule that combines a peptide with another molecule, such as a small molecule drug or a protein, to create a new compound. The resulting conjugate has properties of both the peptide and the other molecule, which allows for targeted delivery of the drug to specific cells or tissues in the body, increasing efficacy and reducing side effects.

Peptides are short chains of amino acids that can bind to specific receptors on cells, making them ideal for targeted drug delivery. By conjugating a peptide with another molecule, such as a chemotherapy drug or a diagnostic imaging agent, the resulting molecule can be specifically targeted to cells that express the receptor for the peptide.

The conjugation process typically involves attaching the other molecule to the peptide using a linker molecule. This linker can be designed to be cleaved under certain conditions, such as in the presence of enzymes in the target tissue, which releases the drug at the desired location. Based on our new analysis at insightSLICE, the global peptide drug conjugates market size was estimated to be $575 million in 2021 and is expected grow at a CAGR of 16% between 2023 and 2032 to reach global size of US$ 2920 million. Below, I’ll delve into the factors and key trends driving the market.

Factors Driving The Global Peptide Drug Conjugate Market

Increasing Prevalence Of Chronic Diseases

Chronic diseases such as cancer, diabetes, and autoimmune disorders are often difficult to treat with traditional drugs due to their complex nature and the difficulty in targeting specific cells or tissues. Peptide drug conjugates offer a more targeted approach to treatment, delivering the drug payload more precisely and reducing the likelihood of side effects. The increasing prevalence of chronic diseases is driving the development and use of peptide drug conjugates in several ways. According to the WHO, chronic diseases account for approximately 71% of all deaths worldwide, with cardiovascular diseases alone responsible for 17.9 million deaths per year. Similarly, the American Hospital Association reports that approximately 133 million Americans, which is nearly 50% of the population, have at least one chronic illness such as heart disease, hypertension, or arthritis. This figure has increased by 15 million over the past decade, and it is projected to rise to 170 million by 2030.

Advancements In Peptide Synthesis Technologies

Over the years, there have been significant advancements in peptide synthesis technologies, which have led to the development of more complex and diverse peptide drugs. For instance, solid-phase peptide synthesis (SPPS) is a widely used method for synthesizing peptides. It involves the use of a solid support (usually resin) to which the first amino acid is attached. Subsequent amino acids are then added one at a time, building up the peptide chain. SPPS has become the gold standard for peptide synthesis due to its speed, efficiency, and scalability.

Increasing Research And Development Activities

The pharmaceutical industry is investing heavily in research and development of peptide drugs, which is leading to the development of new and innovative drugs. For example, in 2020, the FDA approved 12 peptide drugs for clinical use. Major pharmaceutical companies are investing significant amounts of money into research and development of peptide drug conjugates. For instance, in 2020, AstraZeneca announced that it would invest $125 million in the development of peptide-based drugs. Similarly, in 2019, Novo Nordisk announced that it would invest $500 million in the development of peptide-based drugs for diabetes and obesity.

Key Trends

Rising Demand For Targeted Therapies

The rising demand for targeted therapies is one of the major trends in the global peptide drug conjugates market. The targeted approach has led to the development of more effective and safer treatments for a range of diseases, including breast cancer.

Breast cancer is one of the most common cancers among women worldwide. Traditional chemotherapy for breast cancer often causes adverse side effects due to its non-selective nature. However, peptide drug conjugates have shown promise in providing targeted therapy for breast cancer. One example is the peptide drug conjugate T-DM1. This conjugate combines the anti-cancer drug emtansine with the HER2-targeting antibody trastuzumab. HER2 is a protein found on the surface of breast cancer cells, and T-DM1 selectively binds to HER2-positive cells, delivering the drug directly to the cancer cells while minimizing the risk of adverse side effects.

Clinical trials have shown that T-DM1 is effective in treating HER2-positive metastatic breast cancer, with fewer side effects compared to traditional chemotherapy. In a Phase 3 clinical trial, patients treated with T-DM1 had a longer progression-free survival and a lower incidence of adverse events compared to those treated with traditional chemotherapy.

Collaboration And Partnerships

Collaborations and partnerships between pharmaceutical companies are becoming increasingly common in the development of peptide drug conjugates. These partnerships allow companies to leverage their respective expertise and resources to accelerate the development of new therapies. Here are some examples:

- Bicycle Therapeutics and Genentech: In 2019, Bicycle Therapeutics and Genentech announced a collaboration to develop new peptide-based therapies for cancer, bringing together Bicycle's expertise in peptide drug conjugates and Genentech's expertise in oncology research and development.

- AstraZeneca and Bicycle Therapeutics: In 2019, AstraZeneca and Bicycle Therapeutics formed a collaboration to develop peptide conjugates for respiratory and cardiovascular diseases, combining AstraZeneca's expertise in drug development and commercialization with Bicycle's expertise in peptide drug conjugates.

- Ipsen and EpiVax Oncology: In 2020, Ipsen and EpiVax Oncology announced a collaboration to develop new peptide-based cancer therapies, combining Ipsen's expertise in oncology research and development with EpiVax Oncology's expertise in peptide drug design and development.

- Pfizer and GlycoMimetics: In 2020, Pfizer and GlycoMimetics announced a collaboration to develop new peptide-based therapies for blood disorders, combining Pfizer's expertise in drug development and commercialization with GlycoMimetics' expertise in peptide drug design and development.

These partnerships are enabling companies to pool their resources and expertise, leading to faster development of new therapies. This collaborative approach is particularly important in the development of peptide drug conjugates, which require expertise in both peptide synthesis and drug development.

Market Segment Insights

Product Segment Insights

Based on the product, the global peptide drug conjugates market can be segmented into lutetium, melflufen, ANG1005, BT1718, CBX-12, and other pipeline products. Among these, Lutathera (lutetium) is the largest segment.

Lutetium is used in the production of Lutathera, a peptide drug conjugate that is used in the treatment of certain types of cancer, such as neuroendocrine tumors. Lutathera is considered a breakthrough therapy in the treatment of neuroendocrine tumors and has received approval from regulatory agencies in several countries. Lutathera obtained FDA approval in 2018 for the treatment of gastroenteropancreatic neuroendocrine tumors (GEP-NETs). This approval marked a significant milestone in the development of peptide drug conjugates and has contributed to the growth of the lutetium segment.

Pharmaceutical companies have increased their investment in the development of lutetium-based therapies, which has led to the development of new and improved therapies. For example, in 2020, Progenics Pharmaceuticals received FDA approval for its lutetium-based therapy, PyL, which is used in the diagnosis and treatment of prostate cancer.

Type Segment Insights

Based on type, the global peptide drug conjugates market can be segmented into therapeutic and diagnostic. Among these, the therapeutic segment is currently dominating the market owing to the increasing demand for targeted therapies for the treatment of various diseases. Here are some relevant examples:

- Oncology: The therapeutic segment dominates the market due to the high demand for peptide-based therapies in the field of oncology. For example, ADCETRIS, a CD30-directed antibody-drug conjugate, is used to treat Hodgkin’s lymphoma and systemic anaplastic large cell lymphoma.

- Metabolic disorders: Peptide drug conjugates are being used to treat metabolic disorders such as diabetes and obesity. For example, semaglutide, a glucagon-like peptide-1 (GLP-1) receptor agonist, is used to treat type 2 diabetes.

- Cardiovascular diseases: Peptide drug conjugates are being developed for the treatment of cardiovascular diseases such as hypertension and heart failure. For example, omapatrilat, a vasopeptidase inhibitor, is used to treat hypertension.

- Infectious diseases: Peptide drug conjugates are being developed for the treatment of infectious diseases such as HIV and tuberculosis. For example, T-1249, a fusion inhibitor, is used to treat HIV.

Geographic Segment Insights

Geographically, North America has been the dominant region in the global peptide drug conjugates market due to several factors, including:

- Presence of well-established pharmaceutical companies: North America is home to some of the world's largest pharmaceutical companies, which have invested heavily in the development of peptide drug conjugates. These companies have the resources and expertise to bring new therapies to market within optimum turnaround times.

- High prevalence of chronic diseases: North America has a high prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases, which require long-term treatment. Peptide drug conjugates offer targeted and personalized treatment options, making them a preferred choice for patients and healthcare providers.

- Favorable regulatory environment: The regulatory authorities have established clear guidelines and processes for the approval of peptide drug conjugates, making it easier for pharmaceutical companies to bring new products to market.

On the other hand, Asia-Pacific is the fastest-growing segment in the global peptide drug conjugates market due to several factors, including:

- Growing demand for targeted therapies: The demand for targeted therapies is increasing in Asia-Pacific due to the rising prevalence of chronic diseases and the need for more effective and safer treatments.

- Increasing investment in healthcare: Governments and private organizations in Asia-Pacific are investing heavily in healthcare infrastructure and research and development. This investment is driving innovation and the development of new therapies for a range of diseases, including peptide drug conjugates.

- Favorable regulatory environment: The regulatory environment in Asia-Pacific is becoming more favorable for the development and commercialization of peptide drug conjugates. Regulatory authorities are establishing clearer guidelines and processes for the approval of these therapies, making it easier for pharmaceutical companies to bring new products to market.

Competitive Insights

Companies operating in the global peptide drug conjugates market have adopted several growth strategies to expand their market share and increase their revenue. In addition to the partnerships/collaborations and the expanded investments in developing new peptide-based drugs discussed above, some of the key growth strategies adopted by these companies include:

- Geographical expansion: Companies are expanding their geographical presence by entering new markets and establishing a presence in regions with high growth potential. This enables companies to tap into new customer bases and increase their revenue.

- Acquisitions and mergers: Companies are acquiring or merging with other companies to gain access to new technologies, expertise, and product pipelines. These acquisitions and mergers enable companies to expand their capabilities and product offerings and increase their market share.

- Marketing and promotional activities: Companies are investing in marketing and promotional activities to increase awareness and educate healthcare professionals and patients about the benefits of peptide drug conjugates. This enables companies to increase demand for their products and drive sales.

Overall, these growth strategies enable companies to expand their market presence, develop new products, and increase their revenue in the global peptide drug conjugates market.

About The Author:

Aditi Shivarkar is principal consultant at insightSLICE, a market intelligence and strategy consulting company. She has been a part of the research industry for 13 years and is skilled in market research, communications, project management, and quantitative and qualitative data analysis. She works across various domains, including healthcare, industrial automation, consumer goods, IT, and telecom.