Survey: SUS Insufficient For 40% Of Biopharma

By Katrina Cordovado, BioPlan Associates

Nearly 40% of single-use technologies (SUTs) users are dissatisfied with a whole range of attributes related to these technologies. Despite growing adoption, perceptions of performance and cost remain at odds. In BioPlan’s 22nd Annual Report survey, nearly four in 10 users, for example, report gaps between cost expectations and actual value they are receiving. System failure rates remain a persistent concern. As the industry pushes for greater flexibility, speed, and reliability, understanding where single-use systems (SUS) deliver — and where they still fall short — is essential to sustaining confidence in the next generation of single-use innovations for bioproduction. As the industry increasingly demands greater flexibility, scalability, and reduced contamination risks, the reliability and consistency of SUTs have become more critical. The findings from two decades of technology analysis identify opportunities to strengthen SUS implementation in next-generation bioproduction.

Single-Use Technology Adoption Apparently Plateauing

Adoption of SUS across biomanufacturing has grown steadily at clinical scale over the past 20 years. Commercial-scale use, driven primarily by the COVID-19 pandemic, saw a rapid adoption of all SUS types. SUS brings many advantages to biomanufacturers, from operational flexibility, lower up-front capital investment, and accelerated clinical timelines to enabling decentralized manufacturing. The pandemic necessitated rapid deployment of these technologies, which put SUS center-stage in bioprocessing as an integral commercial-scale technology.

However, data from users suggests that we may be reaching a plateau, demonstrated by single-digit growth rates as we reach industry saturation points for some SUS devices. As of this year over 90% of manufacturing facilities surveyed were already using SUS at least in some capacity of their operations. This near plateau of growth rates does not suggest that SUT is no longer being used, but rather that it has become the norm, with many new facilities designed and built to accommodate them. Continued expansion will be driven by new facility construction and the development of novel biological products such as cell and gene therapies, which are sustaining the momentum of SUT adoption in biomanufacturing.

These findings matter for biologics sponsors planning manufacturing strategies or facility investments to get new products to market. Single-use adoption rates reveal how peers are finding significant benefits from modernizing production platforms. These trends also suggest where biopharma companies’ future capital and partnership strategies should be focused, such as investing in flexible infrastructure and process development capabilities. High SUS adoption also signals a broader shift toward modular, flexible facilities, which some sponsors may want to consider in their CAPEX planning and long-term infrastructure decisions. These “facilities of the future” are no longer seen as just a conceptional aspiration as they are increasingly being implemented by large pharma and CDMOs bringing them to the forefront of the industry’s mind.

SUS should be considered as a potential cost-saving option for sponsors thinking about building their own facilities, or when evaluating CDMOs that offer fully single-use, hybrid, or fully stainless-steel manufacturing trains. Having at least the option of SUS within a CDMO’s facility can bring sponsors a strong advantage. Not only do SUS processes enable faster turnaround by eliminating cleaning and validation steps, they also provide CDMOs with the option to increase their facility usage, supporting multiple clients and products in parallel and reducing suite wait times for sponsors. SUS can also enable agile process development and faster scale-out rather than scale-up. If development pipeline priorities change requiring rapid development, sponsors can then have the flexibility to leverage SUS to reduce turnaround times and enable multiproduct or small-batch operations.

Performance Under Pressure: Persistent Failure Rates For SUS

While SUS have become more reliable over their years of use, failure rates have not significantly changed. Overall, there appears to be a general worsening of the time-between-failures of most SUS devices.

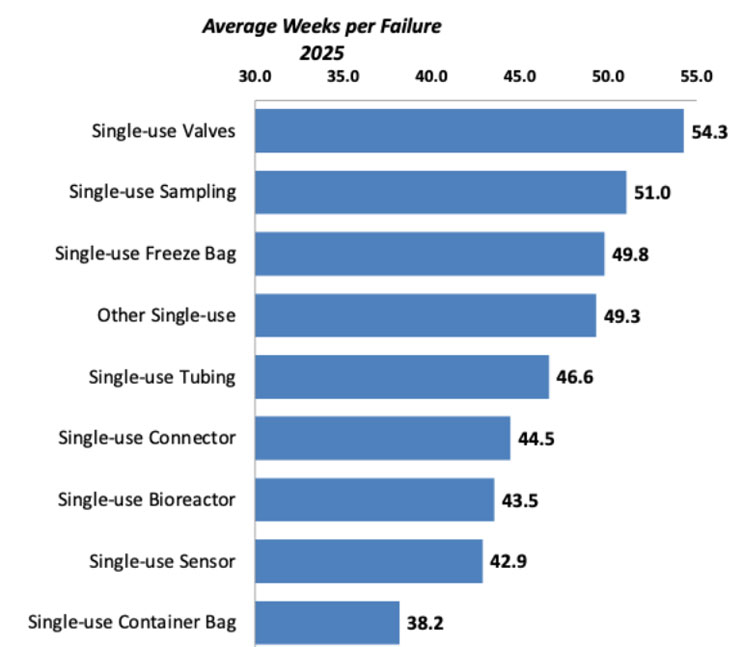

The least frequently failing devices include: valves, freezer bags, and tubing, while the most frequent failures involve sensors, connectors, and container bags. Frequent failures of these components can have significant economic impacts. For example, sensor failures can lead to batch loss, connector failures cause consumable loss and downtime, and container bag failure leads to intermediate product loss. This can result in millions of dollars of lost material and productivity.

Fig 1. Average Weeks Before Failure of SUS Devices, 2025

Source: 22nd Annual Report on Biomanufacturing Capacity and Production, April 2025.

Being aware of potential failures is critical for quality and risk management planning. Data on component or system failures highlights operational reliability and areas where quality risks remain underappreciated. It also directly informs risk assessment and vendor qualification, which is critical for GMP compliance and business continuity. Understanding where failures occur helps develop contingency plans and strengthen supplier qualification processes. Increasing scrutiny around leachables /extractables and validation challenges means that vendor reliability directly affects regulatory compliance and batch release timelines. Getting access to data on specific vendor failure rates can be very valuable for risk assessments and evaluating different supplier options.

10 Years Comparing Value Of SUS: Today Vs. 2015

Cost of SUS used to be a concern pre-COVID. When COVID's supply chain effects triggered shortages of these devices worldwide, cost became almost a non-issue. We are only now returning to a pre-pandemic price, availability, and value environment.

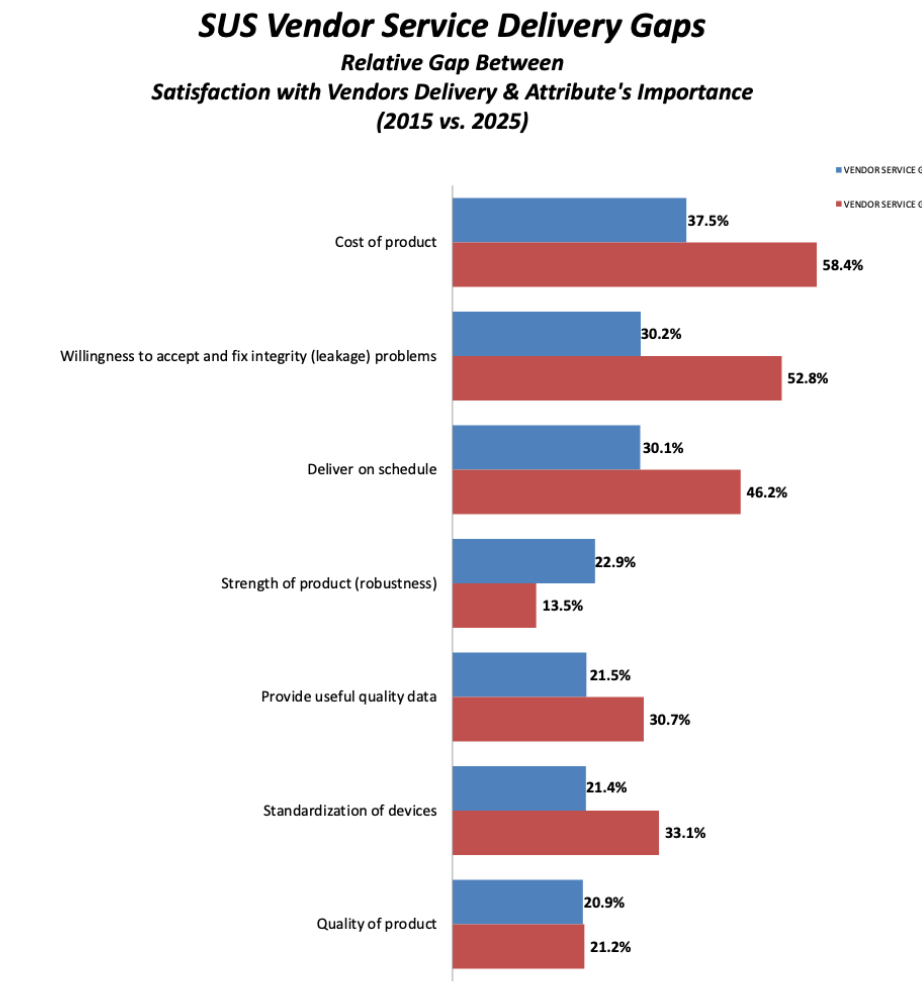

To estimate the importance of certain attributes around single-use technologies, in BioPlan’s survey of facilities we asked first about the importance of key SUS attributes such as performance, cost, etc. We then asked end users about their satisfaction with how vendors are delivering these attributes. The bigger the gap, the more dissatisfied respondents were around important attributes.

This year, we found, for example, the biggest gap between importance and vendor satisfaction was around cost of SUS, at 37.5%. Although this gap has decreased significantly from 58.4% in 2015, vendors still have a long way to go. This big chasm suggests that users are concerned about cost of SUS, yet their expectations regarding value and cost are not being met by vendors. For many, SUS may still appear cost-prohibitive unless the long-term savings and value proposition are clear. The message from peers is clear: while single-use adoption has advanced rapidly, value-based pricing has not kept pace, and vendors must either reduce or justify costs through measurable performance and life cycle benefits to remain competitive.

Meanwhile, over the last 10 years, our data shows that vendors have been addressing gaps in areas such as willingness to accept and fix integrity problems, with a 30% gap in 2025 (53% in 2015). Delivering on schedule also had a shrinking gap, at 30% in 2025 (46% in 2015). Gaps have also shrunk for vendor ability to provide useful quality data at 22% in 2025 (31% in 2015) and standardization of devices at 21% in 2025 (33% in 2015). These data points suggest that vendor service delivery is getting closer to meeting end users’ value expectations.

At the same time, data suggests an increasing gap in product robustness, at 23% in 2025 (14% in 2015), suggesting vendors need to improve product reliability to meet users’ expectations. However, satisfaction with product quality is not a gap that significantly changed over the last 10 years, at 21% in 2025 (21% in 2015), indicating that products consistently continue to meet users’ technical needs. Although vendors have taken steps to address key attributes, gaps still need to be addressed in areas beyond just cost dissatisfaction.

Fig 2. Percentage Point Gap between Importance of SUS Product Attributes and Level of Satisfaction, 2015 vs. 2025

Source: 22nd Annual Report on Biomanufacturing Capacity and Production, April 2025

The industry is heading toward more fully single-use bioprocessing facilities, as hybrid plants become more common. Every company evaluating their manufacturing strategy must assess whether perceived cost savings and flexibility outweigh current failure or performance risks. Companies proactively optimizing their SUS strategies can improve scalability, reduce downtime, and strengthen investor confidence in manufacturing readiness. At the same time, adoption trends can also push vendors to bring down costs or optimize sales models to help CDMOs and sponsors realize the cost-value benefit of SUS. However, cost is not the only issue vendors must address, with service delivery gaps persisting in their willingness to accept and fix problems, delivering on schedule, product robustness, ability to provide robust quality data, and standardization of devices.

Conclusions: Considerations When Selecting SUS

Over the past several years, closed processes, automation, and continuous manufacturing have gotten a lot of attention in the industry. The next generation of SUS may need to address these trends as the industry redefines facility design.

Our findings underscore where the industry is heading: toward more modular, rapid, and risk-managed manufacturing models. Suppliers that address the emerging segment trends and needs around automation and continuous bioprocessing will be in a better long-term competitive position. Understanding and addressing SUS failure rates and vendor performance is not only vital for ensuring quality and supply continuity but also for guiding facility investments, regulatory readiness, and sourcing strategies. As SUTs continue to evolve, proactive engagement with leading vendors and data-driven evaluation of system reliability will be key to maintaining competitive, compliant, and resilient manufacturing operations. Staying ahead will require active engagement between vendors and end users to ensure single-use innovation and adoption create a competitive advantage for all industry stakeholders.

About the Author:

Katrina Cordovado has extensive experience in biomedical commercialization, including contributing to commercial strategy initiatives for biomanufacturing tools companies, CDMOs, and life sciences organizations. She has designed and implemented strategies aligned with overall corporate development goals, drawing on expertise in market analysis, business development, and marketing strategy. Contact her at kcordova@bioplanassociates.com or 301-921-5979.

Katrina Cordovado has extensive experience in biomedical commercialization, including contributing to commercial strategy initiatives for biomanufacturing tools companies, CDMOs, and life sciences organizations. She has designed and implemented strategies aligned with overall corporate development goals, drawing on expertise in market analysis, business development, and marketing strategy. Contact her at kcordova@bioplanassociates.com or 301-921-5979.