Survey Says Downstream Biomanufacturing Bottleneck Is Over

By Ioanna Deni, BioPlan Associates, Inc.

For over 10 years, downstream bioprocessing (DSP) capacity has been considered an Achilles' heel of biomanufacturing, with purification and separation steps notoriously slowing production. According to the 21st Annual Survey of Biopharmaceutical Manufacturing Capacity and Production, these challenges began as upstream titers coming from bioreactors were increasing and productivity was improving. Downstream innovations were slower to keep up.

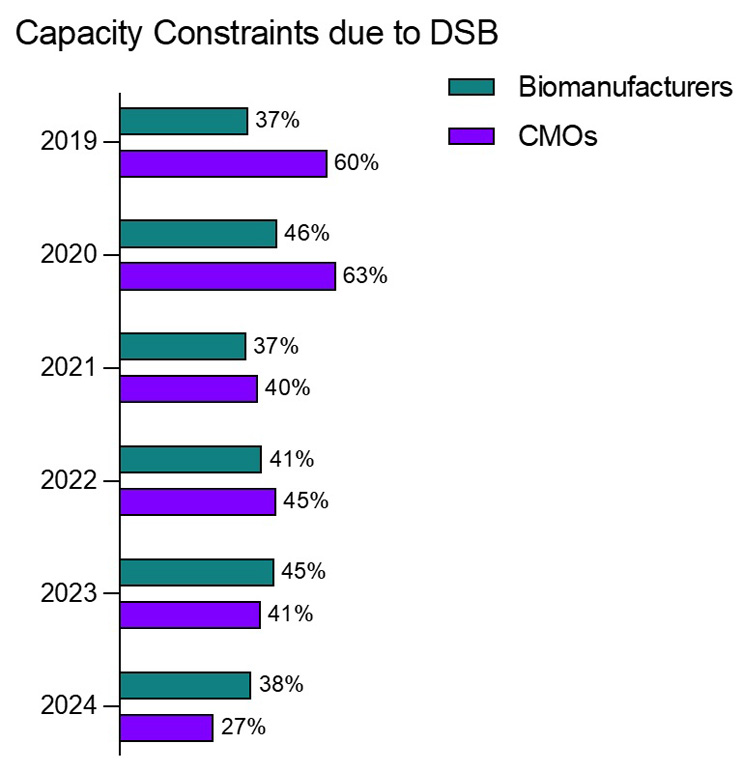

Over the last several years, a notable shift has emerged, signaling more enduring improvements in downstream purification strategies. Today, 38% of eight biomanufacturing facilities are now reporting experiencing only “minor capacity bottlenecks” related to DSP.1 This represents the highest percentage achieved in this category, with production levels maintaining a healthy, efficient flow. Furthermore, instances of severe or moderate downstream bottlenecks are at their lowest levels at both biomanufacturers and contract manufacturing organizations (CMOs). Impressively, downstream processing bottlenecks among CMOs have more than halved since 2019, illustrating the effectiveness of more sophisticated production strategies (Figure 1).

Figure 1: Percentage of biomanufacturers and CMOs with “Serious” and “Some” capacity constraints due to downstream bioprocessing through the years

Source: 21st Annual Report and Survey of Biopharmaceutical Manufacturing Capacity, 2024, BioPlan Associates, Inc.

CMOs – The Leading Edge In Innovation

CMOs have historically faced bigger challenges in capacity caused by DSP. This is often because they must deal with multiple clients’ platforms, purification strategies, and a variety of equipment challenges. Thus, CMOs have consistently reported more severe DSP constraints compared to their biopharmaceutical manufacturing counterparts, with a six to 10 percentage point difference in responses indicating some or severe bottlenecks. This trend has persisted over the past 12 years, making downstream capacity issues a long-standing challenge for CMOs.

The COVID-19 pandemic further exacerbated these difficulties. CMOs and contract development and manufacturing organizations (CDMOs) were particularly hard-hit during this period. One reason for this may be the nature of these facilities, which often work across multiple platforms, each requiring different types of consumables and materials. The pandemic disrupted global supply chains, creating severe shortages of key consumables such as filters, single-use systems, and chromatography resins — critical components for DSP operations. For CDMOs, which were already navigating complex multi-platform production schedules, these shortages led to significant delays and constraints. The unavailability of essential supplies during COVID-19 amplified the impact of existing DSP limitations, making it one of the most challenging periods for CMOs in recent history.

However, as DSP strategies have evolved and supply chain issues have started to stabilize, CMOs are finding more efficient ways to manage these bottlenecks, indicating that lessons learned during the pandemic have informed more resilient and adaptable downstream processes going forward.

New Strategies For Eliminating Capacity Bottlenecks Due To DSP

Historically, capacity bottlenecks caused in DSP have been a persistent challenge for biopharmaceutical manufacturers. Upstream fixes often shifted bottlenecks to DSP, causing further delays and inefficiencies down the line. These bottlenecks have proven particularly troublesome because, despite numerous efforts to resolve them, no solution has provided a long-lasting impact.

Some bioprocesses that often present DSP bottlenecks included:

- Batch-based processing: Traditionally, biomanufacturers relied heavily on batch processing for downstream purification. However, this method often caused inefficiencies and delays between production stages. The lack of flexibility and the downtime required for cleaning and validation between batches contributed to bottlenecks, especially during scale-up.

- Inadequate filtration technologies: Early filtration systems, particularly for ultrafiltration/diafiltration (UF/DF), were not built for the demands of large-scale production. These systems frequently became overwhelmed, reducing throughput and contributing to DSP bottlenecks. Moreover, the need for frequent filter replacements further increased downtime and costs.

- Buffer preparation: In many cases, DSP was hindered by the manual preparation of buffers, a labor-intensive process that has been prone to errors. These delays in preparing buffers for chromatography, filtration, or other purification steps remain and even in 2024 they impact overall capacity in 21.4% of surveyed biomanufacturing facilities.

Investing in scalable, flexible technologies such as single-use systems, DSP continuous bioprocessing, and advanced filtration systems, companies are experiencing fewer disruptions and are better equipped to handle increased production volumes. This shift signals that biomanufacturing is entering a new era of downstream processing where efficiency and long-term capacity solutions are finally being realized, particularly for CMOs, where these gains are most pronounced.

Some of the innovations include:

- Continuous bioprocessing: In contrast to the batch-based approach, continuous bioprocessing offers a more flexible, efficient alternative. By enabling an uninterrupted flow of product through the purification process, it minimizes downtime and increases throughput. This approach is being adopted by the highest percentage of biomanufacturing facilities in 2024, 34.5%. Continuous bioprocessing also allows manufacturers to reduce the physical footprint of operations, improving overall capacity without the need for additional infrastructure.

- Single-use technologies: The adoption of single-use systems (SUS) has revolutionized downstream processing by reducing the need for cleaning, validation, and maintenance. Single-use components, such as disposable bioreactors and filtration units, minimize cross-contamination risks, reduce turnaround times, and offer scalability for various production volumes. Many of these SUS are being adopted by facilities; in 2024, for instance, single-use disposable TFF membranes are being adopted by 24.4% of surveyed biomanufacturing facilities. This wide adoption is allowing CMOs and biomanufacturers alike to meet growing demand without significant capital investment.

- Advanced filtration and membrane technologies: Innovations in filtration technologies have led to more efficient UF/DF systems, enabling faster processing times and improved yields. High-capacity filtration membranes and crossflow filtration techniques are now being employed to reduce the bottlenecks caused by outdated filtration systems. Additionally, automated buffer management systems are being introduced to streamline buffer preparation and delivery, further eliminating inefficiencies.

- Efficiency-based research and development: A significant contributor to reducing DSP bottlenecks is the industry's focus on research and development aimed at enhancing overall process efficiency. By optimizing processes to achieve greater yields, biopharmaceutical developers are effectively opening up existing capacity. CMOs especially can take advantage of increased efficiencies to maximize their available capacity without needing to expand infrastructure. Biomanufacturers can capitalize on the extra capacity generated through improved yields, reducing the need for further investments in additional capacity.

By focusing on SUS, continuous bioprocesses, and process optimization, the biomanufacturing industry is beginning to see substantial gains in downstream capacity. This new approach has had a profound impact on addressing bottlenecks, allowing companies to meet the growing demands of the market more effectively.

Together, these strategies mark a departure from the previous piecemeal approaches, creating a more resilient, scalable framework for biopharmaceutical production and significantly improving DSP capacity.

Upstream mAbs Titer Balancing DSP Performance

Protein A chromatography remains a cornerstone of DSP for monoclonal antibodies (mAbs), playing a critical role in the purification of these therapeutic proteins. Protein A binds specifically to the Fc region of antibodies, enabling high-purity separation of mAbs from other process impurities. This selective affinity makes Protein A a vital step in achieving the quality standards necessary for clinical and commercial use. However, the performance of Protein A in downstream processes must balance with upstream production titers to avoid capacity bottlenecks and maintain operational efficiency.

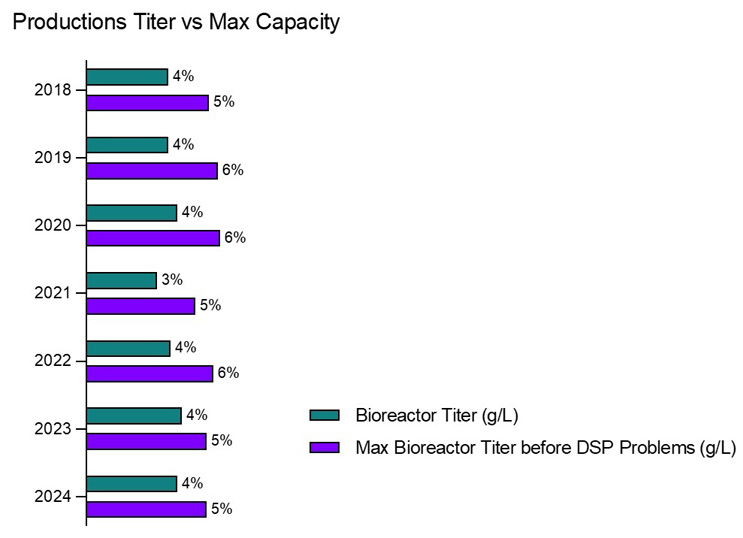

In 2024, the average upstream bioreactor titer for mAbs has leveled off at 4.0 g/L, according to BioPlan’s 21st Annual Survey of Biopharmaceutical Manufacturing Capacity and Production (Figure 2). This includes titers across all scales of production, including early-stage clinical processes, which have generally shown higher yields in newer processes. The estimated maximum titer before downstream bottlenecks occur has remained steady at 5.3 g/L. This number has changed little over the past six years. This ceiling reflects the threshold where DSP capacity begins to struggle with the increased volume of product, particularly during the Protein A purification step.

Figure 2: mAb production titer vs. max capacity (2018-2024)

Source: 21st Annual Report and Survey of Biopharmaceutical Manufacturing Capacity, 2024, BioPlan Associates, Inc. Rockville

One interesting observation in 2024 is the overbuild in available downstream processing capacity relative to bioreactor capacity, which has dropped to 132%, down from 151% in 2022. This means that for every unit of upstream production, there is 132% of the required downstream capacity available — indicating a more balanced approach compared to prior years. Historically, facilities had built their DSP systems to handle roughly 150% of their upstream capacity, largely to mitigate potential bottlenecks in Protein A purification and other DSP steps. This overbuild, while providing a safety net, often represented an inefficiency in facility design and resource allocation.

The leveling of average titers at around 4.0 g/L and the consistent DSP capacity ceiling of 5.3 g/L suggests that many biomanufacturers are finding a better balance between upstream yield improvements and downstream processing performance. The decrease in DSP overbuild further suggests that companies are optimizing their downstream processes, relying less on excessive capacity and more on technological improvements and process efficiencies to manage increasing upstream titers.

This trend points to a maturing understanding of how to integrate advancements in upstream production with DSP performance. As upstream titers continue to hover around the 4.0 g/L mark, the challenge moving forward will be to refine downstream processes, particularly Protein A chromatography, to keep pace with potential future increases in bioreactor yields while maintaining cost-efficiency and avoiding bottlenecks.

Outlook For Capacity Bottlenecks In DSP

The outlook for DSP in biomanufacturing is positive. We see incremental and significant improvements in DSP performance already. Advancements in column technology, better design strategies, and improvements in resins are driving these changes.

In the short term, technological developments in purification and recovery processes will likely be instrumental in overcoming current DSP challenges. Innovations such as the use of disposables in downstream applications, particularly in chromatography, or resins with enhanced protein capture capabilities, offer promising solutions. With greater bioreactor productivity, higher titers, and increased production volumes, the industry is well positioned to meet the growing demand for biopharmaceuticals efficiently and sustainably.

However, realizing these advancements will likely depend on fostering closer vendor-manufacturer collaborations and hiring the correct experts to handle the innovations. Hiring and innovation are becoming the next focus of biomanufacturing to ensure longevity for DSP.

About The Author:

Ioanna Deni is a contract market research scientist for BioPlan Associates. She is an experienced quantitative market research analyst with a Ph.D. in biomedical sciences and extensive experience in biopharmaceutical life science research. Her research background includes quantitative and qualitative market research expertise as an AI and healthcare specialist at Intelligence Ventures. Reach her at info@bioplanassociates.com, 301-921-5979. Learn more about BioPlan at www.bioplanassociates.com.

Ioanna Deni is a contract market research scientist for BioPlan Associates. She is an experienced quantitative market research analyst with a Ph.D. in biomedical sciences and extensive experience in biopharmaceutical life science research. Her research background includes quantitative and qualitative market research expertise as an AI and healthcare specialist at Intelligence Ventures. Reach her at info@bioplanassociates.com, 301-921-5979. Learn more about BioPlan at www.bioplanassociates.com.