Survey: 30% Of Biopharmas Cite Cost, Productivity As Top Priorities

By Renaud Jacquemart, Ph.D., BioPlan Associates

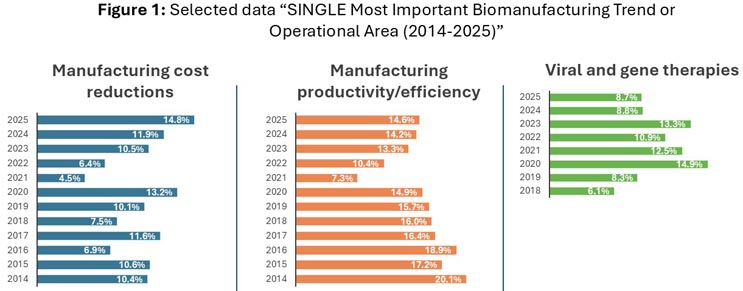

Cost reduction and productivity are, in many ways, two sides of the same coin in biopharma manufacturing. So, our finding that 30% of the industry sees this as the single most important area where improvements are required should strike a chord with the industry. And new product developers and suppliers should take note so their innovations can address these top concerns. According to BioPlan’s 22nd Annual Biomanufacturing Report, 14.8% of respondents selected cost reduction as the “single most needed improvement” in 2025. Nearly the same share (14.6%) chose productivity and efficiency. These two separate top priorities, each claimed by only a minority, are actually closely aligned in financial discipline. Taken together, they account for almost one-third of all responses, far outpacing any other concern.

The Paradox Of Priorities

The numbers invite interpretation. Although only 15% of the industry cites cost reduction as its most important improvement (which means the majority place something else first), cost and productivity together dominate the rankings, well ahead of other more facility-relevant issues such as new modalities or automation.

This is a reflection of the industry’s reality. Cost reduction and productivity both aim at the same outcome: stronger economics and sustainable competitiveness. The paradox is that neither priority commands a majority, but when combined, they define the discipline that guides operational decision-making.

From Initiative To Operating Discipline

BioPlan’s longitudinal data shows that cost reduction and productivity have consistently ranked at or near the top of the list since 2014. What was once discussed as continuous incremental improvement initiatives is now treated as an operational baseline.

A decade ago, companies could talk about “exploring lean” or “investing in productivity programs” as if these were optional. In 2025, they are simply the cost of doing business. Biomanufacturing leaders know that without financial discipline, no amount of scientific promise or market ambition can carry a therapy to commercial scale. This is likely the reason we have seen productivity and efficiency decline from a high of 20.1% in 2014. It is not that efficiency is no longer important but rather that it is no longer a “trend”. It is simply a critical reality.

Source: BioPlan’s 22nd Annual Biomanufacturing Report, Chapter 3.

Cost reduction (14.8%) and productivity/efficiency (14.6%) dominate in 2025, far ahead of other 19 trend issues. Together they form the most consistent operational theme of the past decade.

The Wrong Way To Cut

Not all cost reduction creates value. Tactical belt tightening may save money in the short term but can erode quality and innovation in the long run. It is the corporate version of putting lipstick on a pig.

The organizations that stand out in the survey and in our daily consulting work are those that see cost reduction and productivity as strategic investments. Their goal is not to squeeze suppliers harder or freeze headcount indefinitely. Instead, they invest in design space studies, comparability protocols, and digital controls that reduce variability and enable predictable yields.

The difference is visible in performance. Superficial cost-cutting shows up as friction: missed timelines, CAPAs piling up, workforce fatigue, and even erosion of employee loyalty as teams feel stretched and undervalued. Real discipline shows up as resilience and innovation: cleaner audits, faster transfers, higher lot release success, and new processes that expand capability rather than constrict it.

This Is Nothing New

The central insight is hardly new. Henry Ford, who obsessed equally about productivity and cost, put it simply: “There is one rule for the industrialist and that is: Make the best quality of goods possible at the lowest cost possible, paying the highest wages possible.”

More than a century later, this principle still resonates in bioprocessing. It reminds us that financial discipline is not about cutting corners. It is about building facilities and businesses that support quality, reward people, and ensure sustainability. In 2025, the survey data shows the same truth: Cost and productivity together remain the disciplines that underpin long-term competitiveness.

From Crisis To Systemic Strengthening

The pandemic temporarily reordered operational priorities. In 2022, nearly one in five facilities listed “material sourcing” as their top challenge, reflecting shortages and price spikes. By 2025, only 6.4% still do.

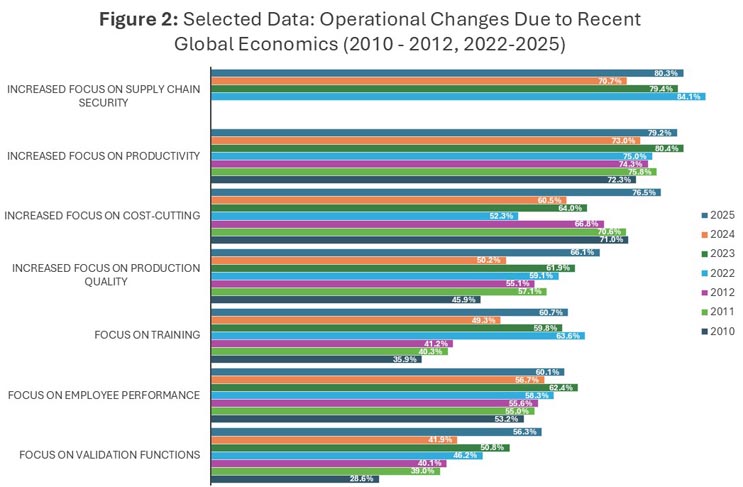

That decline does not mean supply chains are fixed. It means companies have moved from crisis management to structural reinforcement. Figure 2 from the BioPlan report shows that 80.3% of respondents are investing in supply chain security, more than any other operational change.

This focus is also directly linked to cost and productivity. Volatile inputs lead to volatile costs. Fragile supply chains erode efficiency. By institutionalizing resilience (dual-sourcing APIs, building buffer inventories, qualifying regional suppliers) companies are not only preventing disruption, they are stabilizing economics.

Source: BioPlan’s 22nd Annual Biomanufacturing Report, Chapter 3.

Top areas with greater focus are supply chain security (80.3%), productivity (79.2%), and cost-cutting (76.5%). This reflects a shift from post-COVID crisis response to systemic resilience.

Modalities And Manufacturability

The discipline-first mindset also explains recent shifts in modality focus.

- Viral and gene therapies, which captured 13.3% of “most important” votes in 2023, slipped to 8.7% in 2025.

- Cell therapies dropped from 9.4% to 6.8%.

- Antibody-drug conjugates rose from 6% in 2024 to 8.7% in 2025.

The decline does not mean advanced therapies are abandoned. It means boards and regulators are recalibrating priorities based on manufacturability and affordability. The FDA’s recent move to publish Complete Response Letters, many citing CMC deficiencies, reinforces the point.

Science alone is not enough. Without a credible, efficient, and cost-conscious manufacturing pathway, sponsors cannot bring products to market sustainably. We see this daily: Investment committees are asking not only “does it work?” but “can it be made reliably at a cost that patients and payers can bear?”

What peers are doing differently in 2025

- Hardening the supply chain: Eight in 10 facilities are investing in supply chain security. Clients are embedding multi-vendor strategies and stress-testing suppliers to stabilize costs and minimize volatility.

- Getting more from existing assets: Nearly 80% report a greater focus on productivity and cost-cutting. In practice, this means DOE, right-first-time transfers, and digital process monitoring. We are often asked to quantify yield gains and validate comparability, proving that small improvements accumulate into strategic savings.

- Resetting capital choices: Expansion is no longer reflexive. Companies are scrutinizing whether a new suite is needed or whether smarter scheduling and better asset utilization can deliver the same output at lower cost.

The People And Systems Behind The Numbers

Productivity gains are not just about steel and sensors. They hinge on people. As modalities grow more complex, so do the skills required to run them. Training, retention, and organizational design are now central to cost and productivity outcomes.

Automation tells a similar story. Only about 5% of respondents rank it as their single top issue. Not because it is unimportant but because it is normalized. We see this in facilities we assess or design: automation today is treated as plumbing, not strategy. While this may change as better technology is developed that integrates hardware, systems, and software, today, the winners are those who harness automation to drive repeatability and cost discipline rather than treating it as a bolt-on trend.

Conclusion: The Industry’s True North

BioPlan’s 22nd Annual Report highlights what matters most to bioprocessing professionals. Cost reduction and productivity may appear as two separate categories, but they are really two sides of the same coin. Together they define the industry’s pursuit of sustainable economics. Suppliers who consider this dynamic will develop technologies that support their customers’ objectives.

Superficial cost cutting is merely a cosmetic change that won’t disguise its fundamental shortcomings. True financial discipline, by contrast, strengthens quality, enables resilience, fuels innovation, and creates long-term competitiveness. The lesson is clear: Biomanufacturing’s true north is neither cost nor productivity alone. It is the disciplined integration of both, aimed at building an industry that is efficient, resilient, innovative, and economically sustainable for the future.

About The Author:

Renaud Jacquemart, Ph.D., MBA, is a senior advisor at BioPlan Associates. He is a commercial leader and biopharmaceutical product development expert with 25 years of international experience. As CEO of Omnium Global, his expertise spans the full life cycle of biologics, from early-stage development to commercialization, with a focus on cost-effective, scalable solutions. From go-to-market strategies and M&A to operational excellence in a regulated landscape, he has played pivotal roles in driving growth, fundraising, and market expansion for biopharmaceutical companies. Reach him at rjacquemart@bioplanssociates.com or by phone at 301-921-5979.

Renaud Jacquemart, Ph.D., MBA, is a senior advisor at BioPlan Associates. He is a commercial leader and biopharmaceutical product development expert with 25 years of international experience. As CEO of Omnium Global, his expertise spans the full life cycle of biologics, from early-stage development to commercialization, with a focus on cost-effective, scalable solutions. From go-to-market strategies and M&A to operational excellence in a regulated landscape, he has played pivotal roles in driving growth, fundraising, and market expansion for biopharmaceutical companies. Reach him at rjacquemart@bioplanssociates.com or by phone at 301-921-5979.