2023's Market Outlook For Cell And Gene Therapies

By Adam Lohr, partner and life sciences senior analyst, RSM US LLP

In terms of future impact on public health and wellness, genetic modification, cell therapies, and similar technologies have received an increasing level of attention, investment, and at times, criticism. While this nascent space generates a fair level of uncertainty and misunderstanding from society, the level of appeal from a medical perspective is understandable given the potential to impact orphan populations, cure as opposed to treat, and even alter the course of evolution.

While the pandemic and ensuing economic slowdown have had a broad impact on life sciences, including cell and gene therapy companies, it is important for scientists, leaders, and investors to recognize that the expansion of these breakthrough technologies remains the future of the ecosystem.

For the purpose of this article, let’s put aside any discussion of the promise of cell and gene technology and near-term disruptions, but rather focus on the quantifiable market trends, clinical developments, and regulatory landscape that are shaping the sector.*

Cell And Gene Approvals Gain Traction, But Rate Of Regulatory Approval Remains An Issue

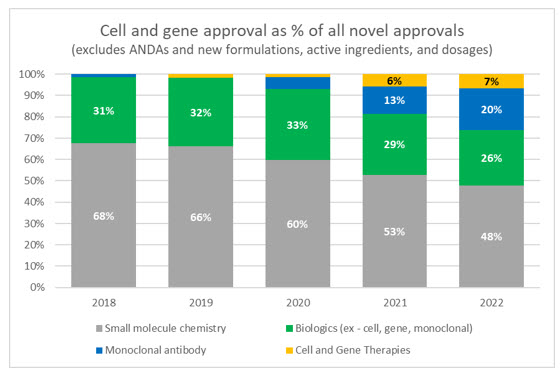

Cell and gene therapies have garnered a significant amount of media attention and investment in recent years, even with a limited amount of real-world deployment and the fact that the first therapy wasn’t approved by the FDA until 2017. Through 2022 there are only 27 FDA approved CGTs, which represents approximately 8% of the 340 approved biologics, only a small fraction of conventional drugs. However, when looking at the makeup of truly innovative and novel drugs being approved, CGTs continue to make up a larger proportion of total approvals.

Source: FDA and Evaluate Pharma

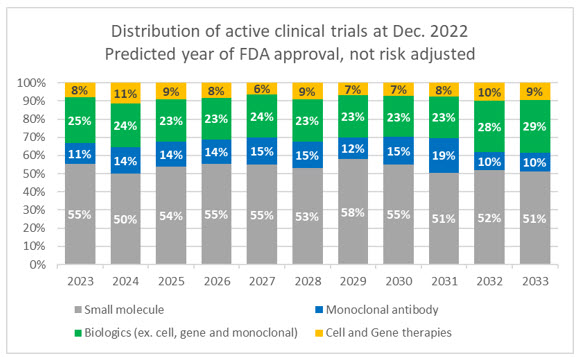

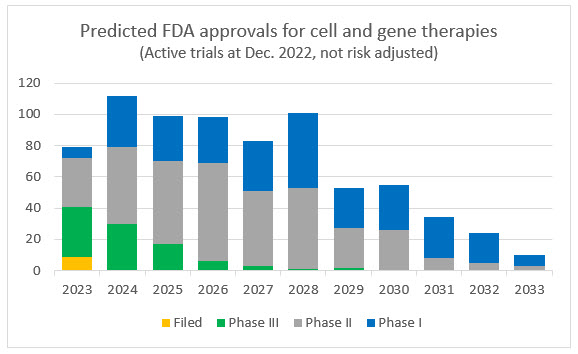

There are over 1,500 ongoing clinical trials for cell and gene therapies registered with ClinicalTrials.gov. Of these, 90% are in Phase 1 and 2 trials, meaning that they are still far from commercialization, and most will likely not reach approval. According to trial data accumulated by Evaluate Pharma, the median time from Phase 1 through filing for approved drugs is nine years, and time in each phase increases significantly when looking at all CGT trials. Additionally, the approximate success rate for CGTs from Phase 2 through approval is only 14%. For comparison, small molecule drugs have a 43% success rate from Phase 2. We also need to consider that the current pool of cell and gene candidates in trials makes up only a fraction, albeit a growing one, of the overall trial landscape.

Source: Evaluate Pharma, RSM US

Of these current active CGT trials:

- 33.0% are gene-modified cell therapies

- 31.8% are cell therapies

- 18.3% are DNA and RNA therapeutics

- 15.5% are gene therapies

- 1.4% are genome editing

These current CGT trials are in the following indications:

- Cancer: 59.8%

- Cardiovascular: 6.2%

- Immunology: 5.7%

- Dermatology: 4.7%

- Neurology: 4.3%

- Infections: 4.0%

- Musculoskeletal: 3.7%

- Other: 11.5%

Of all the active CGT trials as of December 2022, the majority of sponsors expect to file an application with the FDA over the next six years, approximately 16% are in Phase 3. Given the known challenges in the development and approval process, many of these trials will be abandoned and the tail will extend, but pipeline remains robust and new trials are starting at an increasing rate.

Source: Evaluate Pharma

Note: The above two charts are intended to provide context and directional clarity. Counts indicate company reported data and analyst estimates and are not adjusted for risk of abandonment, failure, or delays in trials and the approval process.

Only 40 novel drugs were approved by the FDA in 2022, the lowest annual mark since 2016 and, of those, three were CGTs. While those overall numbers are low, proponents of CGT should celebrate that only two were approved in the previous year, and this represents the largest ever proportion of CGTs to new drugs being approved.

We anticipate that the rate of FDA approvals will increase in the coming years as challenges such as COVID-19, labor shortages, and political tensions (domestically and internationally) abate. The FDA has made it a priority to increase the rate of approvals, and as the backlog of hopeful filers grows, so should the number of FDA nods.

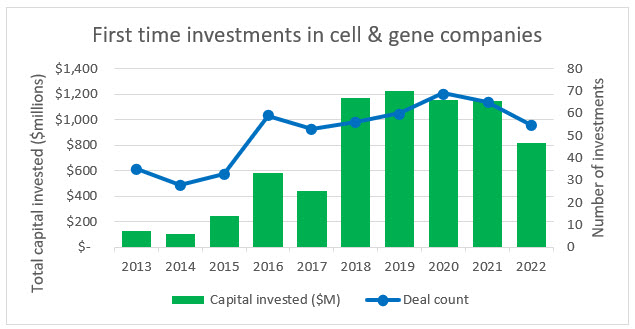

Cell And Gene Companies Not Immune To Muted Investment Landscape

Last year was a disappointing year for life sciences deals, especially coming off the record-breaking numbers we saw in 2020 and 2021. CGT companies were not immune to these market conditions, and private financings and initial public offerings did slow from their 2021 peak. However, the long-term trends in the sector indicate growing support and interest for CGTs, not just from innovative leaders and early-stage investment, but also from the public markets.

Source: PitchBook, RSM US

Over the last decade there has been a steady increase in the number of first-time investments into CGT companies (a proxy for new company starts). And while there was a 34% decrease in biopharma starts between 2021 and 2022, the decline in CGT was only 15% (similar to other industries in the U.S. economy). This indicates that even in an increasingly volatile economy where capital is tight and risk aversion is high, many founders and investors still believe in the future of CGT within in the life sciences space. It is these new companies that are going to be the future of the space and they are a key reason that clinical trials, FDA approvals, and a proportion of CGT public offerings will continue to increase throughout the decade.

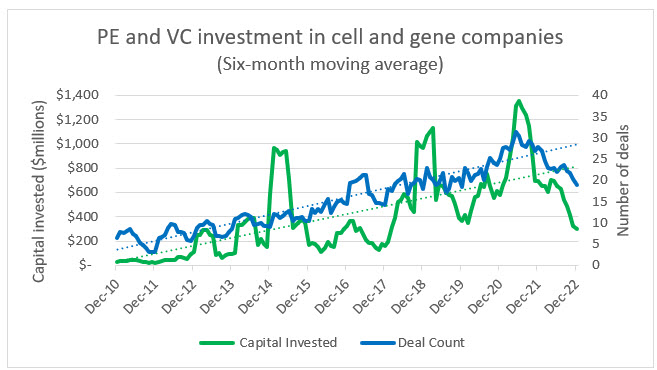

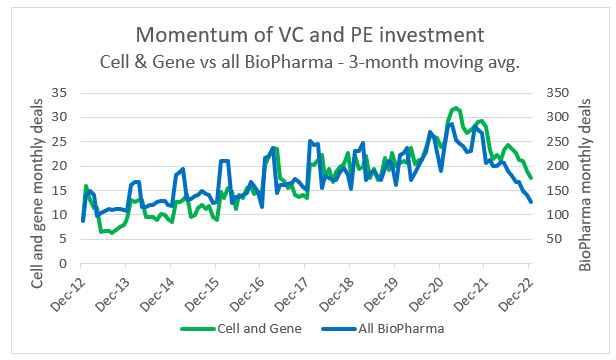

As seen in the following analysis, cell and gene investment has gained momentum for years, and over that time it has been subject to peaks and troughs. The critical point to remember, especially within the context of rising interest rates, inflation, market volatility, and geopolitical tensions, is that CGT companies are built on the premise of decades-long development cycles and the understanding that if a viable product is identified, the odds of FDA approval are relatively low. These conditions require CGT leaders to plan, protect, and persevere in a way that other sectors of the economy that operate on much shorter business cycles may not.

Source: PitchBook, RSM US

Source: PitchBook, RSM US

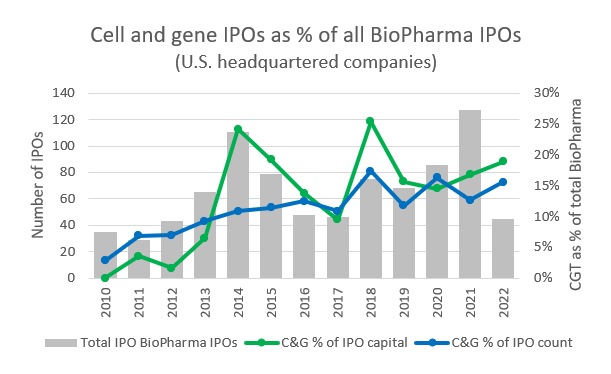

Source: PitchBook, RSM US

Private equity and venture capital investment continues to flow into both biotech and CGT and away from conventional pharma companies. This is likely due to growing competition in the pharma space and the continued shift toward biologics and bespoke therapies. Within this ecosystem, CGT has also managed to grow at a slightly faster rate than biotech in terms of number of deals, but the average investments in biotech do trend higher. This is due to the risk premium sought by investors in CGT companies and the fact that there are many more late-stage biotechs with a nearer-term prospect of commercialization. We anticipate that as the CGT space matures there will be an exponential shift in private investment away from biopharma.

These private investments are also expected to drive more CGT companies into the public markets, where life sciences as an industry represents roughly a third of all IPOs since 2017. Within the biotech space, CGT companies have also represented a consistently increasing proportion of IPOs. This trend is likely to continue with the shift in public perception and familiarity with cell and gene therapies and the broader push for highly personalized healthcare.

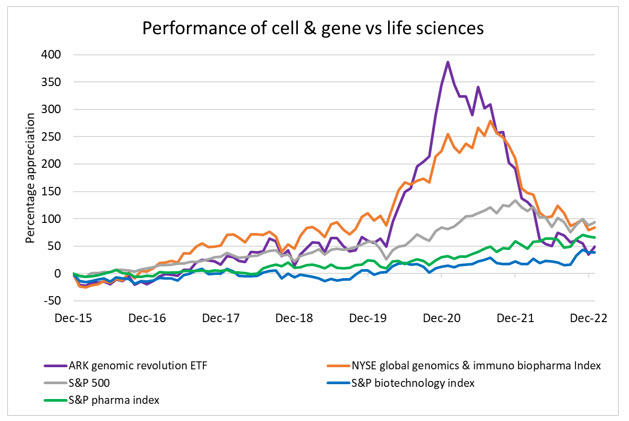

With that said, it is important for public investors (and business leaders) to separate hype from the science and recognize the long, complex road to regulatory approval and profitability. Using two of the largest cell and gene focused indices as benchmarks against their biotech and pharma peers, it’s clear that expectations for future value are robust but on par with what biotech experienced as it emerged half a decade earlier. The pandemic, however, spurred a rush into CGT and related therapeutics and caused massive overvaluations. As the pandemic ebbed and markets normalized, the CGT sector is still outperforming biopharma and the broader market.

Source: Bloomberg, RSM US

The adage that the “stock market is not the economy” holds true even in an emerging space like CGT, and we recognize that it is only one of many indicators about how institutional and retail investors are feeling about the long-term prospects of the space. Coming out of the pandemic and moving through this next business cycle, we anticipate that investors in the public, private, and corporate spheres will pay closer attention to traditional catalysts such as clinical trials, regulatory approvals, and partnerships with experienced drugmakers. The good news, as we have discussed, is that all these inflection points have been coming at a more regular cadence as the market matures and the number of experienced participants increases.

Other Avenues For Securing Capital

Source: Evaluate Pharma, RSM US

While we do expect continued expansion of the CGT space and renewed investment in the form of VC, M&A, and public investment, deal activity is likely to remain sluggish in 2023 as economic and geopolitical uncertainty plays out. Many investors and buyers are looking for later-stage companies and lower-risk assets at currently subdued multiples, as well as opportunistic targets that need a cash infusion.

From the perspective of many CGT leaders, if they are able to stick to milestones and manage their cash runway (many bolstered by fluid capital and high valuations during the pandemic), they should be able to ride out the current dearth of deals. For those that cannot or decide that an alternative source of capital outside of VC or the public markets is in their favor, they should be encouraged by the massive amounts of dry powder held by their large-cap biopharma peers. The 30 largest life sciences companies accumulated tens of billions in dry powder during the pandemic, and many of them are looking at aging pipelines with billions in potential sales coming off patent in the next five years.

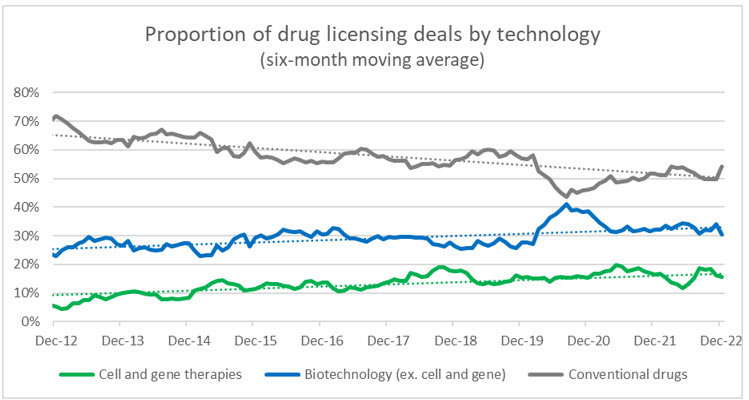

We anticipate that this will spur strategic corporate players to identify acquisitions or partnerships that will modernize pipelines and provide a technological accelerator for future research and development. Cell and gene therapies are undoubtably a significant part of this plan, and as more CGTs have positive clinical readouts and receive FDA approval, we will also see a more rapid shift in preference away from conventional drug and biotech companies. Using drug licensing deals as a proxy, over the last decade CGTs have gone from 5% of all licensing deals to 15% (biotech went from 23% to 33%, and conventional dropped from 72% to 52%).

Forecasted Sales Growth Rate Of C>s Far Exceed Biopharma

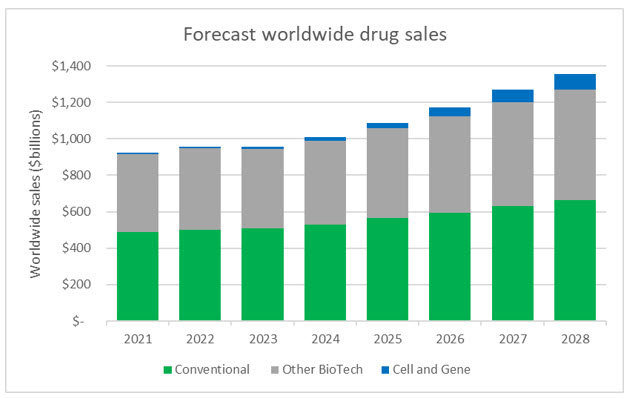

In addition to providing altruistic benefits for public health and the treatment of rare diseases, cell and gene therapies will also help usher in the next generation of drugs and become a driving force in drug sales. While CGTs represented slightly more than 1% of worldwide sales in 2022, the forecasted growth rates are staggering. Sales of conventional drugs and non-CGT biologics are expected to achieve 5% CAGR (compound annual growth rate) from 2022 to 2028, while CGTs are forecasted to achieve CAGR of 46%, with approximately $86 billion in sales by 2028.

Source: Evaluate Pharma

While the total dollar amount invested in cell and gene is only a fraction of what is put into conventional drugs and biologics, it is important to recognize the spillover effects of this growing capital. Investor interest drives innovation, encourages startups, and attracts experienced talent from competing sectors. This in turn leads to results in the lab and investment portfolios. We saw this happen in the early days of biotechnology, as competition among conventional pharmaceuticals increased and pipelines and market interest shifted toward biologics. We anticipate a similar story will play out as cell and gene emerges as its own defined sector in the life sciences ecosystem and attracts more talent, investment, and pipeline.

Reimbursement And Value-Based Pricing

We have thoroughly covered market dynamics from a capital market and clinical trial perspective, but any macroeconomic uncertainty in 2023 pales in comparison to the challenge of market access and reimbursement for these cutting-edge drugs.

While last year may have been a low point in terms of capital market activity, it did see the approval of some of the three highest priced drugs, all gene therapies and all with a wholesale price of around $3 million. The very nature of CGT is what supports the pricing of these drugs, which are incredibly expensive and risky to develop, target small populations, and seek to replace a lifetime of treatments with a single curative dose. These therapies are ushering in a new era of care but are light-years ahead of reimbursement systems and government pricing contracts. There are efforts to make the growing number of CGTs available to patients, such as through up-front payments and subscription agreements with Medicare and manufacturers to value-based contracts that will rebate a majority of a therapy’s cost if a patient fails to achieve certain endpoints.

One of the largest challenges for cell and gene companies when negotiating pricing is the lack of certainty on the part of insurers. These are completely unique and relatively untested drugs compared to their conventional biopharma peers, and the ultimate efficacy may not be known for years or could vary widely between patients, as each therapy is tailored to an individual’s genome. Additionally, at least in the United States, patients are able to switch between a number of public and government insurance options, and insurers may be hesitant to pay for treatment for a patient who may eventually leave their coverage. The solutions to this problem far exceed the scope of this note (or its author) but I do encourage all CGT leaders to consider their pricing and reimbursement strategy well in advance of seeking approval and, to the extent possible, become actively involved in the conversation with payors, providers, advocacy groups, and regulators.

Keeping A Long View

Market volatility, global economic uncertainty, and operational challenges of an emerging market are unavoidable challenges that cell and gene companies will face as they shape the future of healthcare. While business leaders and the scientific community must contend with these risks, it is important to keep in mind the incredible potential of this sector and the underlying reasons that investment and research have been flowing into CGT at an increasing rate.

Over the last few years, the cell and gene space has seen consistently increasing numbers of clinical trials, new market entrants even in times of uncertainty, growing proportions of public and private investment, record drug licensing deals, and a burst of FDA approvals. There is no doubt that challenges lay ahead in 2023, but there are undeniable catalysts for growth in the CGT sector and signs that cell and gene therapies will play a large role in shaping the future of life sciences.

*Note to the reader: An inherent challenge with analyzing data for the cell and gene sector is the classification of what technologies should be included and what companies are pure cell and gene versus biotech or pharma with a diverse pipeline. There are also classification differences between sources and scientific publications. To the extent possible, the focus in this article is on those drugs and companies in the cell therapy, gene therapy, gene-modification, and DNA and RNA therapeutics space (collectively “cell and gene therapy” or CGT). Where appropriate, comparative data visualization between CGT and broader sectors in the biopharma space have been provided. The reader is encouraged to consider trends and market shifts as opposed to strict readings of the values reported.

About The Author:

Adam Lohr is an audit partner and senior analyst in the life sciences industry for RSM US LLP, based in the firm’s San Diego office. He was selected as a senior analyst in RSM’s Industry Eminence Program, which positions its senior analysts to understand, forecast, and communicate economic, business, and technology trends shaping the life sciences industry.

Adam Lohr is an audit partner and senior analyst in the life sciences industry for RSM US LLP, based in the firm’s San Diego office. He was selected as a senior analyst in RSM’s Industry Eminence Program, which positions its senior analysts to understand, forecast, and communicate economic, business, and technology trends shaping the life sciences industry.