Report: Nearly 40% Of Biomanufacturers Eyeing Continuous Processing

By Yasmin Timol, BioPlan Associates

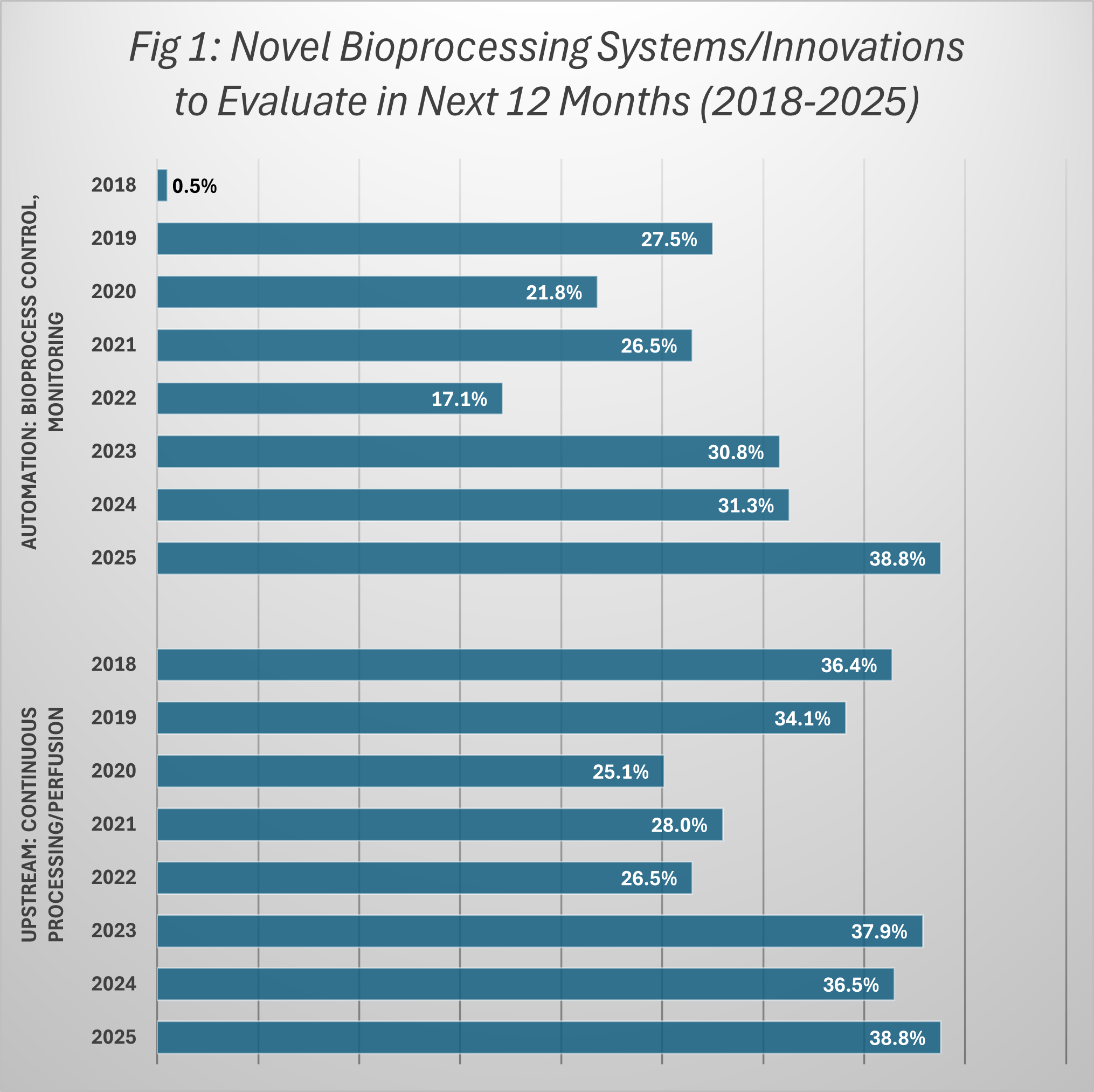

A record 38.8% of bioprocessing facilities report plans to evaluate novel continuous upstream bioprocess technologies in the next 12 months, according to BioPlan Associates’ 22nd Annual Report and Survey of Biopharmaceutical Manufacturing. This is the highest level of planned evaluations recorded since 2018. It also marks a steady upward trend that has persisted for nearly a decade.

Continuous upstream bioprocessing (CBP), which is often centered on perfusion technologies, enables a production environment where cells are continuously supplied with fresh media while waste products are removed, allowing for sustained high productivity. This contrasts with traditional fed-batch processes and offers potential benefits in efficiency, consistency, and cost-effectiveness.

The survey findings point to a significant shift in industry priorities. Although perfusion technologies were a mainstream technology in the 1980s, batch production took the lead, as the complexity and logistics of continuous processes created challenges. Suppliers have addressed many of the challenges and now CBP is a focus of interest for more than one in three facilities worldwide. This rise reflects not only maturing technology but also an evolving mindset among manufacturers toward evaluation and potential adoption of continuous technologies. The data suggests that the industry is approaching an inflection point, one that could redefine upstream bioprocessing strategies in the years ahead.

Continuous Upstream Processing As A Sustained Industry Priority

The growth in interest around continuous upstream processing is not a recent spike, but, instead, it’s part of a consistent long-term trend. Since 2018, more than one-third of facilities surveyed each year have indicated plans to test vendor innovations in this area. This willingness to evaluate dropped substantially during COVID but has returned to pre-COVID levels of interest in the past few years.

In 2025, 38.8% of respondents report they will be evaluating perfusion technologies in the coming year, a slight increase from the 36.4% recorded in 2018, but notable for its stability and persistence over time.

Source: 22nd Annual Report on Biopharmaceutical Manufacturing, BioPlan Associates, Inc., April 2025.

This interest is also finally expanding beyond casual interest and exploration to demand for innovations from suppliers that will meet facilities’ needs. The proportion of facilities actively evaluating upstream continuous bioprocessing has risen steadily, from 29.5% in 2023 to 33.5% in 2024, and now 37.1% in 2025. At the same time, informal evaluations such as early-stage assessments or feasibility considerations have grown from 24.0% in 2023 to 29.1% in 2025. These shifts suggest that facilities are increasingly moving from passive awareness toward deliberate investigation and potential adoption.

Equally telling is the contraction in the proportion of facilities not engaging with continuous upstream processing at all. In 2016, 34% of respondents reported they were not evaluating or considering upstream continuous processing. By 2025, that figure has dropped to just 11.4%, underscoring how deeply the concept has penetrated industry thinking.

This sustained interest reflects a convergence of factors: the maturation of perfusion and other upstream continuous technologies, the need for greater production flexibility, and a desire to optimize resource use. In combination, these trends position continuous upstream processing not as an experimental alternative but as a credible and increasingly mainstream option for modern biomanufacturing strategies.

Automation As The Critical Enabler For Adoption

The momentum behind continuous upstream processing is being reinforced by investment and rapid advances in automation and bioprocess control. In 2018, fewer than 1% of facilities reported plans to evaluate automation specifically for continuous bioprocessing. By 2025, that figure has surged to 38.8%, according to BioPlan’s Annual Report, highlighting how quickly automation has shifted to a central driver of adoption.

In perfusion-based continuous upstream processing, automation is not simply a tool for efficiency, it is a necessity. Continuous systems operate under tightly controlled conditions, with precise regulation of flow rates, nutrient supply, and waste removal over extended periods. Even small deviations can impact cell health, productivity, and product quality. Automated control systems, integrated with advanced monitoring and real-time analytics, make it possible to maintain stable culture environments, respond instantly to process deviations, and ensure consistency across production runs.

Budgets For Automation

Budget data reinforces automation’s strategic importance. For 2025, it ranks among the top areas of planned investment across surveyed facilities. Bioreactor automation alone has grown dramatically over the past 14 years, from just 9.4% of facilities reporting implementation in 2011 to 38.6% planning to have it in place this year. This rise parallels broader industry priorities: addressing skilled labor shortages, reducing manual interventions, and enabling around-the-clock operations without compromising oversight or quality.

Automation also plays a critical role in overcoming one of the most persistent barriers to continuous upstream processing adoption: operational complexity. In 2025, 66.1% of respondents cited operational complexity as a concern for perfusion-based systems, which is a significant challenge, but one that automation directly mitigates. By simplifying process management and embedding decision-making logic into the system, facilities can reduce operator burden while increasing reproducibility and compliance.

The alignment of rising continuous upstream processing evaluations with growing automation investment suggests a reinforcing cycle. As more organizations gain experience with automated continuous systems, confidence in commercial-scale adoption is likely to build. This interplay between technological capability and operational readiness may prove decisive in accelerating the transition from evaluation to widespread implementation.

CMOs Leading The Adoption Curve

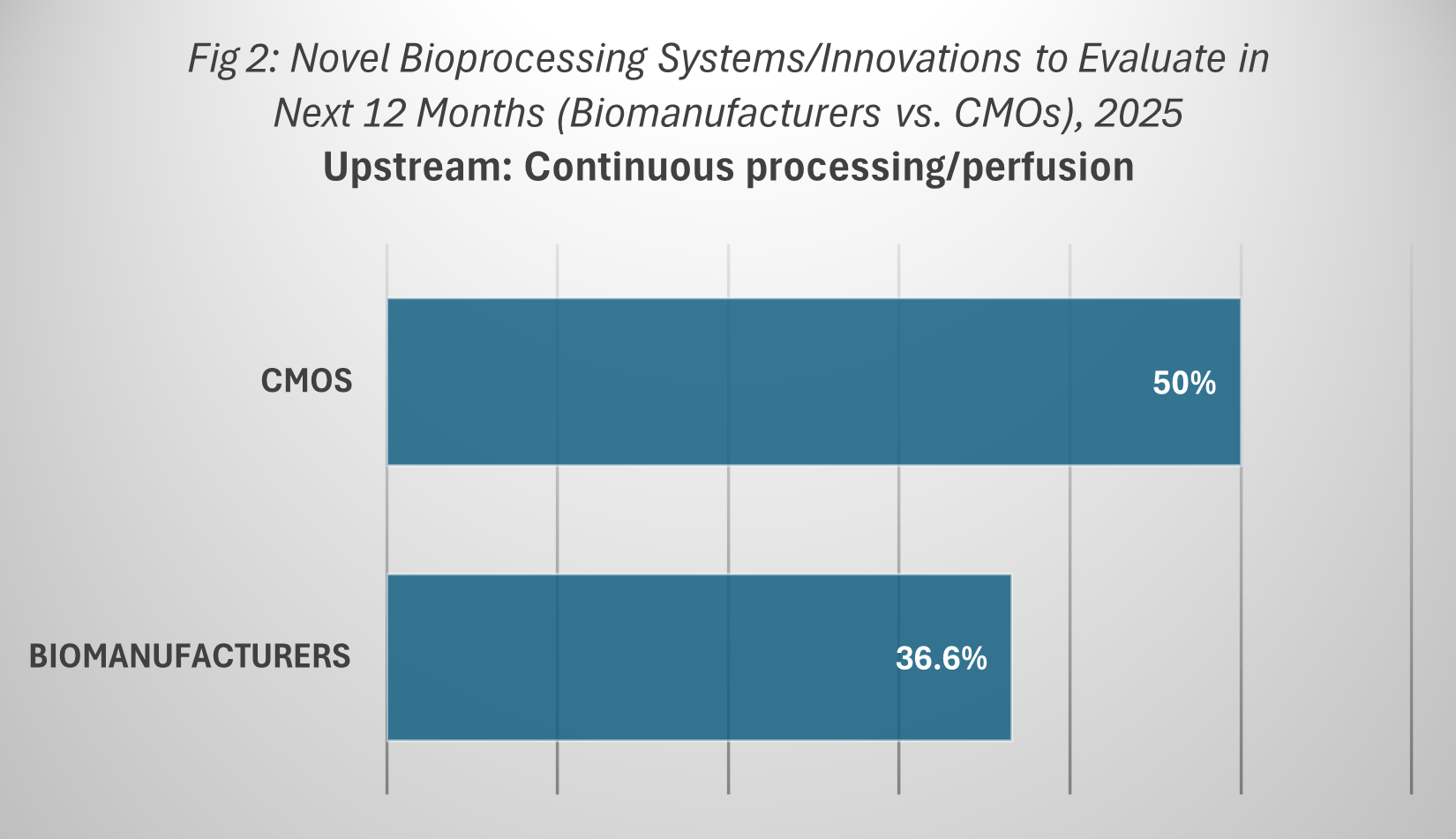

Contract manufacturing organizations (CMOs) are emerging as some of the most active participants in the evaluation and adoption of continuous upstream processing. According to BioPlan’s Annual Report, 50.0% of CMOs plan to evaluate continuous upstream processing or perfusion technologies in 2025. This compares to 36.6% of in-house biomanufacturers, underscoring a notable gap in adoption intent between service providers and product originators.

Source: 22nd Annual Report on Biopharmaceutical Manufacturing, BioPlan Associates, Inc., April 2025.

This difference reflects the competitive dynamics of the CMO market. As service providers, CMOs are under constant pressure to differentiate themselves and attract clients by offering access to advanced manufacturing capabilities. Continuous upstream processing, with its potential for higher productivity, improved consistency, and reduced operating costs, fits directly into this strategy. By being early adopters, CMOs can market themselves as innovation leaders and deliver measurable value to their client base.

The willingness of CMOs to move quickly also stems from their operational flexibility. Unlike in-house manufacturers, whose production platforms may be deeply embedded in existing facility infrastructure, CMOs often operate multi-product environments where modular or flexible systems are a necessity. This environment lends itself more readily to trialing new process technologies such as continuous upstream processing.

The influence of CMOs extends beyond their own operations. As they implement continuous processes and demonstrate their reliability at commercial scale, they effectively de-risk the technology for sponsor companies. Data and operational experience gained through CMO projects can help refine industry best practices, accelerate regulatory familiarity, and build confidence among manufacturers still in the evaluation phase.

In this way, CMOs are not only advancing their own competitive positioning but also shaping the broader trajectory of continuous upstream processing adoption across the biomanufacturing sector. Their leadership may prove critical in translating industry interest into widespread, standardized use of these technologies.

A challenge for CMOs is that the skills, knowledge, and equipment to manage continuous processes need to be in place, but this is expensive to bring online. Without a pipeline of products and drug innovators specifying a continuous platform, CMOs have a problem: CMOs need the customers, but customers won’t come unless CMOs can demonstrate they have the continuous equipment and competence in place.

Downstream Bottlenecks Threaten To Throttle Upstream Gains

While interest in continuous upstream processing continues to grow, the ability to fully capitalize on its benefits is constrained by downstream capacity. In many facilities, upstream production capabilities now exceed the throughput that downstream purification systems can handle. This imbalance creates a critical bottleneck, limiting the scalability of end-to-end continuous manufacturing.

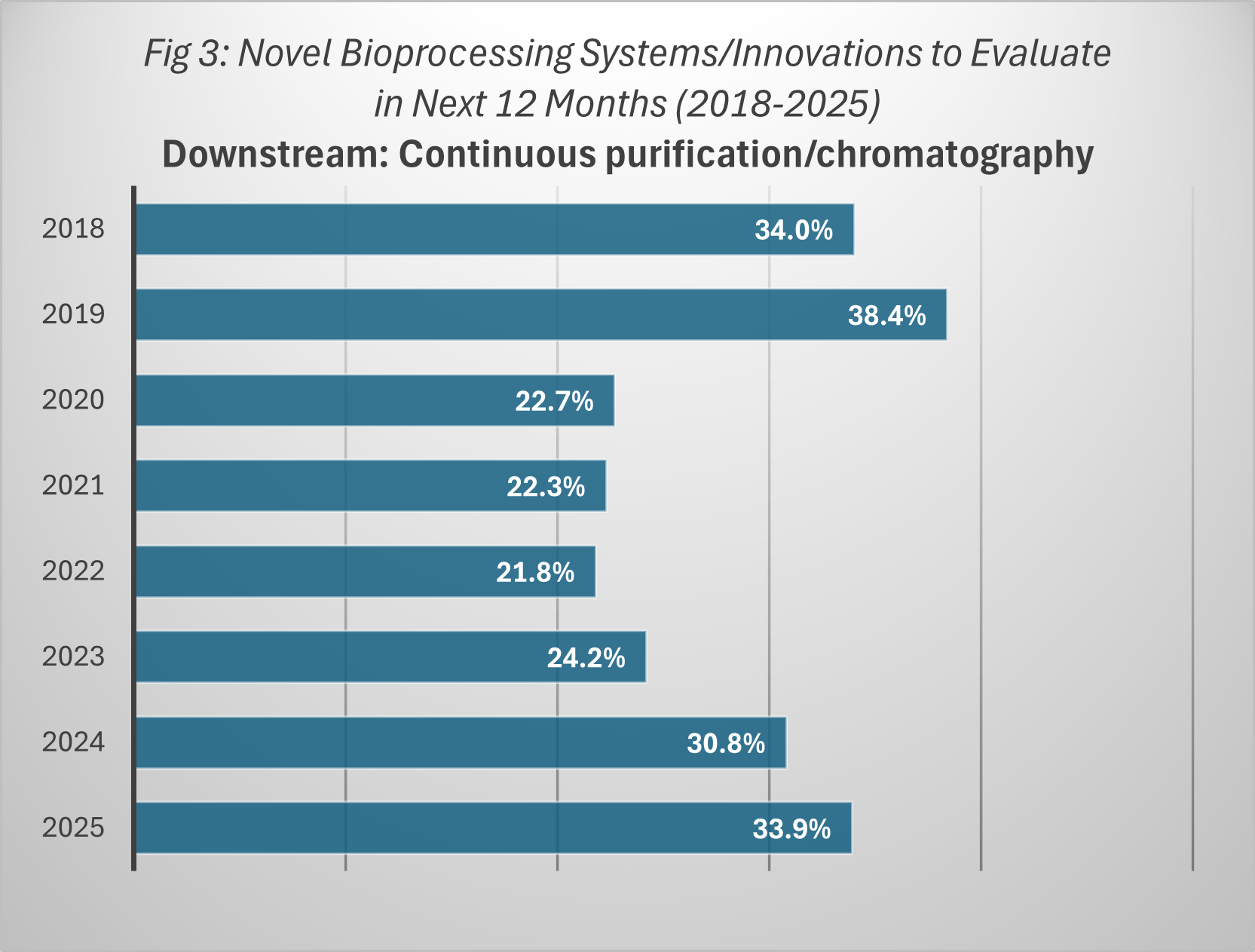

One area of downstream innovation, continuous chromatography, has shown notable progress in recent years. Adoption rates have risen from 24.2% of facilities in 2023 to 30.8% in 2024, and 33.9% in 2025, according to BioPlan’s Annual Report. While this growth is encouraging, it lags behind the pace of upstream continuous processing evaluations, where active interest levels have reached record highs. Without comparable gains in downstream processing, facilities risk creating upstream capacity that cannot be fully utilized.

Source: 22nd Annual Report on Biopharmaceutical Manufacturing, BioPlan Associates, Inc., April 2025.

The challenge lies not only in technology readiness but also in process integration. Continuous downstream systems must be synchronized with upstream operations to ensure consistent product flow, maintain quality standards, and comply with regulatory requirements. This requires sophisticated process control, coordinated automation strategies, and, often, facility redesign or retrofitting, all of which can add complexity and cost.

Some manufacturers are exploring hybrid approaches, combining continuous upstream with semi-continuous or intensified batch downstream processes as interim solutions. While these strategies can deliver partial efficiency gains, they fall short of realizing the full potential of a fully continuous bioprocess.

For the industry to move beyond evaluation toward widespread adoption, downstream innovation will need to accelerate. Aligning upstream and downstream capabilities will be essential to achieving the productivity, cost efficiency, and flexibility that continuous manufacturing promises. Until then, the downstream bottleneck remains one of the most significant challenges in the path toward an integrated continuous bioprocessing model.

Conclusion

The record 38.8% of facilities planning to evaluate continuous upstream processing in 2025 marks a pivotal moment for the bioprocessing industry. After years of steady interest, this technology is approaching the threshold between selective pilot adoption and broader industry integration. The drivers are clear: maturing perfusion platforms, growing automation capabilities, and the strategic leadership shown by CMOs.

Yet, the pathway to widespread implementation is not without obstacles. Operational complexity, while being addressed through advanced control systems, remains a consideration. Downstream capacity, particularly in purification, continues to lag behind upstream gains, posing a challenge to achieving end-to-end continuous manufacturing.

Over the next several years, the interplay between upstream innovation, automation investment, and downstream process development will determine the pace of adoption. Organizations that position themselves early, gaining operational experience and building internal expertise, are likely to capture the greatest benefits in productivity, cost efficiency, and manufacturing flexibility.

About The Author:

Yasmin Timol is a project manager and market researcher at BioPlan Associates Inc. She is an experienced applied and industrial chemist with a master’s degree in biotechnology. Her background spans business development and project management in biotechnology, with a focus on translating technical insights into strategic growth. She brings market research expertise to support innovation and commercial development in bioprocessing and emerging life sciences technologies.

Yasmin Timol is a project manager and market researcher at BioPlan Associates Inc. She is an experienced applied and industrial chemist with a master’s degree in biotechnology. Her background spans business development and project management in biotechnology, with a focus on translating technical insights into strategic growth. She brings market research expertise to support innovation and commercial development in bioprocessing and emerging life sciences technologies.