Pharmaceutical Company Innovation By The Numbers

By Ed White, vice president and principal analyst, Clarivate

Each year, Clarivate publishes our Top 100 Global Innovators, identifying the companies and institutions globally that have, over the past five years, pushed the boundaries of technology and applied knowledge the furthest. To define “innovation” in this context, we use global invention data, which includes many patent applications and issued/granted patents within that term, and could cover the same discrete technical idea. Many "patents" can cover the same invention; in the U.S., China, Europe, etc.

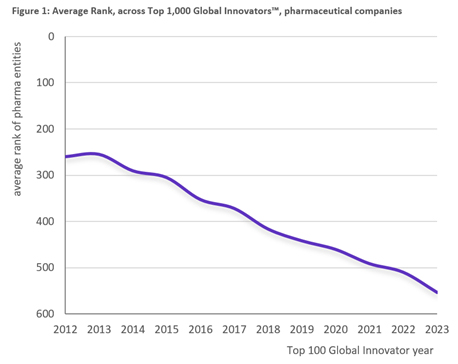

As part of the program, we go beyond the Top 100 itself, and review the average rank (Figure 1) of organizations based on industry tags associated with each company within our Top 1,000. Across telecommunications, semiconductors, software, and pharmaceuticals we track the relative average position of each organization against each other and then review how at the sector level this compares.

This analysis shows a consistent fall in ranking for pharmaceutical firms. Understandably, this raises a very pointed question: is pharmaceutical innovation declining? In a word: no. But the dynamics of innovation in the life sciences is changing.

The Process Of Top 100 Evaluation

To explore those dynamics, we need to both understand the qualification process for the Top 100 Global Innovators and to broaden our view to look at the pharmaceutical invention base globally, and not just those evaluated.

To be considered for Top 100 status, an organization needs to meet a certain threshold of inventive volume — over the last 20 years (500 inventions) and in the last five years (100 granted inventions) — focusing on organizations that are currently producing novel inventions at scale. As the analysis needs to create baseline comparisons across all science and engineering disciplines, alongside qualification is a complete invention scoring calculation for every record in the Derwent World Patents Index, currently at 57 million and growing. Patented ideas are assessed individually across their downstream influence on other organizations, their grant success footprint, their patent protection investment level, and their rarity: where they sit on their individual technology development curve (from low initial activity, through fast growth, to later decline in activity). These factors, combined per record and then per qualifying organization, dictate where in the ranking each organization sits.

Partially, the effect of declining rank is one of scale, as only 28 of the Top 1,000 Global Innovators are pharmaceutical firms. Within the ranking, on average these firms improved their rank by 30 positions; however, the rank increases of other firms in other industries were greater.

The 28 pharmaceutical companies within the Top 1,000 are the following, ordered alphabetically. (Access the report for rank numbers.)

- AbbVie

- Amgen

- Astellas Pharma

- AstraZeneca

- Bayer

- Boehringer Ingelheim

- Bristol Myers Squibb

- Eisai

- Gilead Sciences

- GlaxoSmithKline

- Hanmi Science

- Hisamitsu Pharmaceutical

- Johnson & Johnson

- Lilly

- Lundbeck

- Merck Sharp & Dohme

- Novartis

- Novo Nordisk

- Otsuka Pharmaceutical

- Pfizer

- Regeneron

- Roche

- Samyang Biopharm

- Sanofi

- Santen Pharmaceutical

- Sino Biopharmaceutical

- Takeda

- Teva Pharmaceuticals

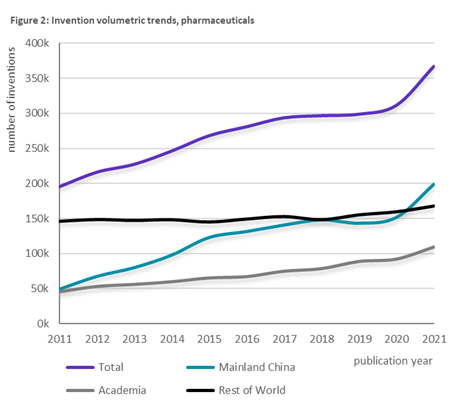

It is here that the wider pharma innovation trend becomes important. Over the last decade, the number of pharmaceutical inventions is approaching double its annual production rate. Largely, this is due to a known patent data point specific to Mainland China: a strong and sustained increase in patent filing activity in the region. While not as extreme in the pharma space (Figure 2 below), this phenomenon is evident across all technologies and disciplines. In 2020, for the first time the number of pharmaceutical-related inventions filed by entities based in Mainland China exceeded the total for all other countries and regions and has increased further still in the most recent year of complete data.

Also placing upward pressure on invention volumes is the level of patent activity from academic institutions. For invention volumes outside Mainland China, the picture is more stable, with a very consistent 150,000 inventions published each year.

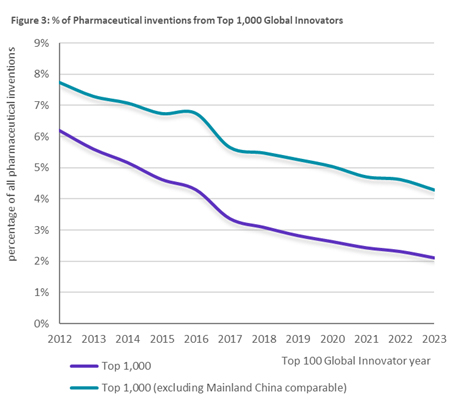

The effect of these volumetric trends is a shift of invention share away from the 28 pharmaceutical companies in the Top 1,000 Global Innovators (Figure 3 below), reducing from 6% of patented ideas globally 10 years ago to just 2% today. Even removing the large Mainland China volumetric increase, the industry experiences the same trend.

Dynamics Of Pharmaceutical Innovation

What we are witnessing is the rapid increase in the collaborative nature of modern life sciences research. Ideation is occurring across a much wider base of smaller organizations, where the investment risk naturally associated with research is being pooled across many more companies and institutions.

This is, to a degree, demonstrated by the doubling in inventive activity in pharma from academia but also underscored by a data point Clarivate explored in the 2023 Top 100 analysis.

For the first time, this year we analyzed the citation interactions from patent applications to peer-reviewed scientific papers within the Web of Science. Taking only those links that were created by the patent examiners themselves, we then looked at the intensity of that citation based on the industry segment associated with the organization applying for the patent.

Analyzing the idea flow from the more fundamental research published in a paper to the technical intellectual asset sought in a patent, this showed a distinct spectrum of intensity that varied considerably based on the discipline and industry. For engineering disciplines such as semiconductors and telecommunications, relatively few references to papers occurred. For more natural science related disciplines, such as chemistry, the reference level was significantly more intense. Top was the pharma segment.

Taken together, this tells a story of a significant shift in the way new ideas, technologies, and therapies are being produced today compared to a decade ago: fragmented, requiring more collaboration; more competitive, and more reliant on the fundamental research occurring in research institutions. Likely, it is narrating an increase in the cross-disciplinary and deeper expertise needed to generate a new formulation today — it is likely more expensive and therefore highly desirable to partner.

What it means for those innovating in the life sciences today is that more intelligence is needed than ever before. With rapidly escalating numbers of ideas, from more locations and languages and from a broader spectrum of smaller organizations, intelligence needs are significantly more acute.