Overcoming The Manufacturing Hurdles Of Cell & Gene Therapy

By Ronald A. Rader, BioPlan Associates, Inc.

A number of innovative cellular and gene therapies are in development, and R&D and investments in these fields are rapidly growing. Although the number of approvals and markets remain very small — negligible by the standards of the mainstream (bio)pharmaceutical industry — this is likely to change as the first clinical trials are successfully concluded.

rapidly growing. Although the number of approvals and markets remain very small — negligible by the standards of the mainstream (bio)pharmaceutical industry — this is likely to change as the first clinical trials are successfully concluded.

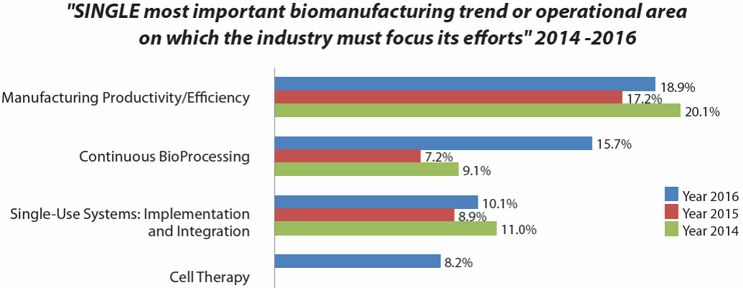

In our 13th Annual Survey of Biopharmaceutical Manufacturing1, biomanufacturing professionals cited “cell therapy” as fourth among the most important trends where the biopharmaceutical industry needs to focus its efforts (Fig. 1). This is very significant, considering the small size of these industry sectors. Further, very few mainstream biopharmaceutical professionals have had any actual involvement with these products, so it is not unexpected that this was the first year that cell therapy made the list.

Figure 1: Bioprocessing areas where industry needs to focus its efforts (selected data from BioPlan survey results)

The cell and gene therapy sectors are growing very rapidly, but with growth starting from relative near zero baselines, particularly in terms of product manufacturing. This includes estimates that only about 10,000 patient units of cell/gene therapies per year are currently being produced worldwide, both for clinical trials and marketed (ignoring well-established blood/cellular products, e.g., stem cell/bone marrow transplants, manufactured by hospitals and blood banks).

The vast majority of cell and gene therapies in development are targeted to orphan, often super-orphan, indications. For example, Strimvelis, the first gene therapy approved in the European Union last year, has an EU market of 15 rare genetic disease patients. The novelty of these therapies and problems encountered in clinical trials have repeatedly slowed progress for years. Further, the incredible costs for many of these products (due to manufacturing complexity, discussed below) has made it easier for developers to target rare, generally fatal diseases, where efficacy is more dramatic. Many of today’s developers are academic research facility spin-offs, and some are primarily interested in showing proof-of-principle and feasibility of a general approach. Thus, there is a lack of needed expertise in development of manufacturing platforms appropriate for broad, large-market therapeutics.

The technologies currently used for manufacture of most cell and gene therapies are outright primitive, often using what are essentially open (vs. closed, aseptic) systems — e.g., manual pipetting with cell cultured in flasks, roller bottles, etc., rather than modern bioreactors. Cell isolation, manipulation, and culture is yet to be automated, and current manufacturing is incredibly labor-intensive and expensive. For example, a single autologous (see sidebar) unit often requires weeks of work by multiple staff in a dedicated cleanroom.

The technologies currently used for manufacture of most cell and gene therapies are outright primitive, often using what are essentially open (vs. closed, aseptic) systems — e.g., manual pipetting with cell cultured in flasks, roller bottles, etc., rather than modern bioreactors. Cell isolation, manipulation, and culture is yet to be automated, and current manufacturing is incredibly labor-intensive and expensive. For example, a single autologous (see sidebar) unit often requires weeks of work by multiple staff in a dedicated cleanroom.

This is among the reasons that likely will make cell/gene therapies the most expensive of all pharmaceutical products. Compared to current therapeutics, many or most cell and gene therapies will be curative, with a single dose or single manufactured unit. This need for only a single one-time dose combined with unprecedented manufacturing costs — cost of goods sold (COGS) of a single unit alone is roughly comparable with those of a commercial-scale bioreactor run producing many thousands of doses — could lead insurers to avoid reimbursing for these therapies.

Manufacturing platforms and common, proven methods adoptable to manufacture of multiple products are nearly nonexistent. However, viral vector manufacture is likely the most advanced technology, as it is rather similar to conventional viral vaccine production. But even here, with a few facilities scaling-up to manufacturing vectors in 1,000 to 2,000 L single-use bioreactors, this intense bioprocessing still usually results in a few hundred doses.

The nascent nature of the cell and gene therapy segment is demonstrated by the relative lack of industry or institutional knowledge about how, when, or where companies will commercially manufacture products in development. Many in the segment consider a few hundred doses/year manufactured by their facilities to be rather high output, and sufficient to support mid-stage clinical trials. Few developers or suppliers have considered how the industry will commercially manufacture their products, including how this can be done such that products will be cost-effective for patients and payers. With current total cell/gene therapy production about 10,000 patient units/year, orders of magnitude growth in manufacturing capacity will be needed, first for later-stage trials and then even more for commercial manufacturing.

Staffing, facilities/cleanrooms, and bioprocessing expertise are just some of the major concerns and likely future bottlenecks for growth in cell and gene therapies. Manufacturing live cells as end-products is much more complex and problem-prone than producing non-living proteins, antibodies, etc. Bioprocessing professionals with any experience in cell and gene therapies are relatively rare. Gene/cell therapy manufacturing-related positions need very high levels of scientific expertise, despite often being repetitive and stressful. Today, essentially all staff members appear to be overqualified. Even when experts in conventional bioprocessing are hired, it’s been reported that six months of additional training is needed. Persons with any expertise in process development for cell and gene therapies are in particularly short supply.

Ongoing trends will further confound growing of manufacturing capacity to levels needed to support even just a few non-orphan-type products. And many industry observers have described a pending capacity crunch, if and when product approvals occur. Contract manufacturing organizations CMOs involved in cell and gene therapies are likely to experience increased demand, so manufacturing capacity may be at a premium in coming years, as facilities, cleanrooms, and staff remain busy. On the other hand, current production levels are rather low in absolute terms (e.g., a few hundred patient units for clinical trials) and few have the need to manufacture more.

Further confounding the manufacture of products needed for R&D and, eventually, commercial manufacturing is a lack of adequate manufacturing infrastructure, facilities, and capacity. Multiple sources have indicated that cell and gene therapy manufacturing will grow rapidly over the next 10 years. Existing capacity is already too small, and serious capacity crunches could well occur. Besides current products advancing in development, we can expect a large number of new players to enter the field in coming years, particularly if new technologies, automation, facilities, etc. provide viable options for cost-effective commercial manufacturing. Big (Bio)Pharma companies, those best suited to develop, manufacture, and market these complex products, have yet to enter these fields in any significant way, but this will change as proof of concept, clinical, and commercial acceptance is worked out.

The manufacturing capacity situation with cell and gene therapies could be likened to the monoclonal antibodies industry sector of the early 1990s, when the industry faced potentially serious capacity crunches. All available/idle worldwide capacity at the time was insufficient to manufacture what would be needed to support just a few blockbuster (>$1 billion/year) products. At the time, both developers and CMOs responded, constructing many ≥100,000 L manufacturing facilities anchored by multiple ≥10,000 L bioreactors. Now, about 20 monoclonal antibodies have blockbuster markets. Growth in cell and gene therapies manufacturing, if supported by comparable expansion of bioprocessing infrastructure, could be even quicker than the monoclonal antibodies capacity expansion. Although most existing facilities are likely to expand, these expansions are being funded to support later-phase trials, not commercial manufacturing.

In the meantime, until industry responds by building needed capacity, we can expect the current lack of manufacturing capacity and options to cause disruptions in these nascent industries. This includes potential difficulties with investors, as they realize many of the very small companies active in these industry sectors, mostly research boutiques, simply have no viable options to cost-effectively manufacture their products for commercially viable markets.

Further, to what extent will insurers consider these treatments cost-effective and pay for these treatments? We have already seen how manufacturing difficulties can create problems, such as with the pioneering autologous gene therapy Provenge for prostate cancer, whose developer experiences bankruptcy due in major part to manufacturing difficulties. With costs of manufacturing (COGS) reported at up to ~75% of sales prices, concerns about expense and cost-effectiveness became very significant. Cell and gene therapies have a very promising future, and these therapies could revolutionize many disease treatments. But a lot of work remains to prepare for this future.

References:

- 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates, Inc. (Rockville, MD), April 2016.

About The Author:

Ronald A. Rader is senior director of technical research for BioPlan Associates, Inc. He has over 25 years’ experience as a biotechnology and pharmaceutical information specialist and publisher, including editor/publisher of Antiviral Agents Bulletin, editor in chief of the journal Biopharmaceuticals, and editor of many data resources including Biopharmaceutical Products in the U.S. Market, now in its 12th edition, and the first biosimilars database For more information, contact BioPlan Associates, Inc. at 301-921-5979 or www.bioplanassociates.com.

Ronald A. Rader is senior director of technical research for BioPlan Associates, Inc. He has over 25 years’ experience as a biotechnology and pharmaceutical information specialist and publisher, including editor/publisher of Antiviral Agents Bulletin, editor in chief of the journal Biopharmaceuticals, and editor of many data resources including Biopharmaceutical Products in the U.S. Market, now in its 12th edition, and the first biosimilars database For more information, contact BioPlan Associates, Inc. at 301-921-5979 or www.bioplanassociates.com.