Life Sciences Deal-Making Gets Creative, Aims At Early Stages Amid COVID-19

By Jeff Stoll and Kristin Pothier

Life sciences companies remain unabated when it comes to creatively making deals during the COVID-19 pandemic, particularly among those targeting biopharma companies with early-stage assets.

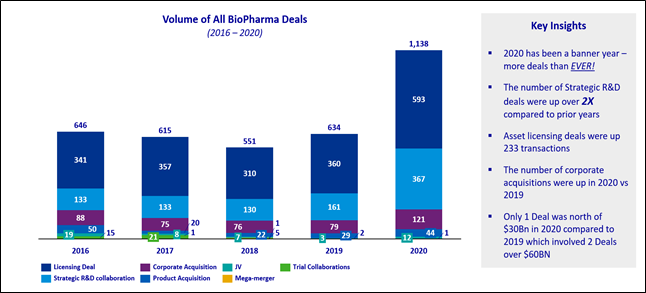

In the KPMG 2021 Healthcare & Life Sciences Investment Outlook, we tallied 1,138 acquisitions, licensing, and R&D deals announced in 2020, an increase from 634 in 2019. In 2020, we saw 121 company acquisitions globally versus 79 in 2019.

The dollar value of the deals was smaller than in 2019, but the volume of deals shows that investors don’t want to miss early-stage opportunities.

Our survey of life sciences executives and investors found that 71% were interested in targeting early-stage assets, compared with 39% who favored late-stage assets with greater certainty of near-term revenue. Only 29% were interested in significantly sized acquisitions/mergers and 23% were interested in commercial stage assets.

While there is a great deal of risk in early-stage assets, biopharmaceuticals are in an era of unprecedented innovation, highlighting many next-generation technologies in cell and gene therapeutics. Within the emerging cell and gene therapy category, we found 141 deals that were either acquisitions, joint ventures, licensing (the bulk of deal volume), or strategic R&D collaboration, an increase from 83 in 2019.

In 2020, biopharmaceutical companies frequently engaged in deal structures that deferred the real deployment of capital into the future. For example, all the strategic R&D collaborations we tracked involved small up-front payments with deferred, larger capital outlay contingent on the innovative biotech company achieving various development milestones.

For example, Bayer paid an up-front consideration of $2 billion for AskBio’s cell and gene therapy platform – which will be followed with up to $2 billion, based on continued development of the platform.

AstraZeneca agreed to pay $1 billion to Daiichi Sankyo for its antibody drug conjugate targeting multiple tumor types in staged payments: $350 million due upon completion with $325 million after 12 months and $325 million after 24 months of the agreement. Additional payments of up to $1 billion are tied to regulatory approvals and up to $4 billion could be paid for sales-related milestones.

While these are substantial deals tied to getting products commercialized, one concern among 61% of executives surveyed is that the competition over a limited number of high-value or highly innovative assets was affecting valuations. COVID-19 was cited as a factor in valuations among only 19% of investors and executives. Development of vaccines continued apace, despite some disruption in clinical trials last year due to COVID-19.

The sector proved to be resilient in the face of COVID-19. In fact, the biopharma sector grew by 2.2% in 2020, which topped the annualized rate of 1.9% in recent years, according to IBIS World. The sector’s growth has largely been from biologic medicines, with 93% of the sector’s net drug spending growth coming from biologic drugs since 2014. In 2017, according to data from the IQVIA Institute, biologic drugs represented 2% of all U.S. prescriptions, but 37% of net drug spending.

While recent comments by the Federal Trade Commission have promised increased scrutiny around pharmaceutical company mergers, suggesting a link between drug price increases and M&A, the above data raises the question about whether this FTC perspective misses the mark in light of this pricing data. Much of the growth in drug pricing has come from innovative products targeting unmet medical needs or for small patient populations and is potentially less related to M&A activity. A deeper analysis is merited, but the preliminary data suggest an alternative trend is most likely the underlying story.

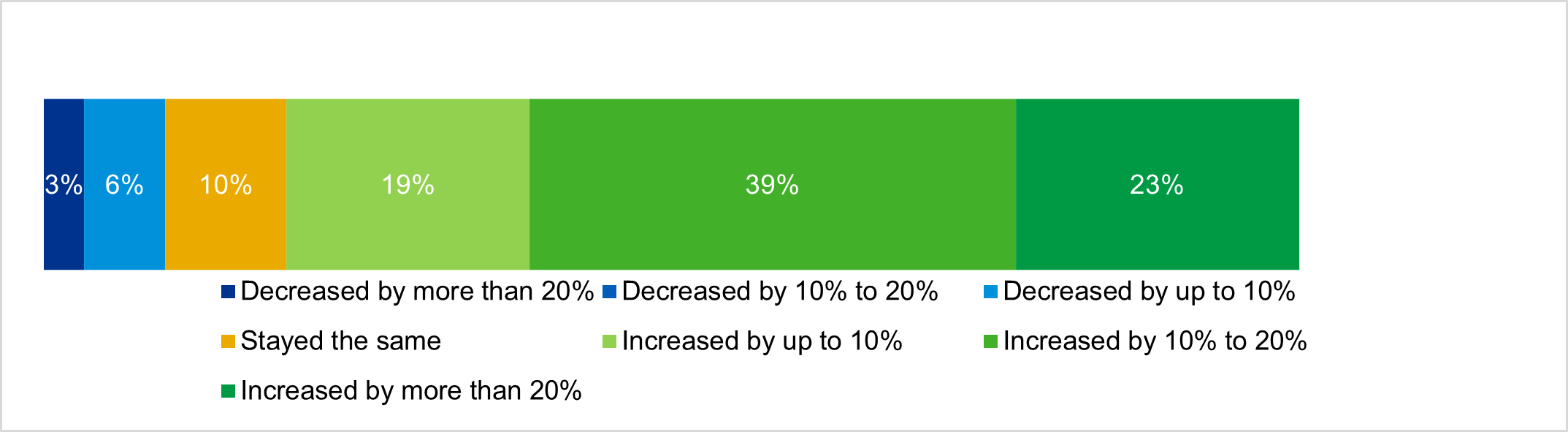

KPMG’s 2021 Healthcare & Life Sciences Outlook found 51% of biopharma companies are expected to have growing valuations this year, while the outlook for pharma services (CROs, medical communications, etc.) was slightly more bullish at 52% (p. 8). The most bullish expectations for life sciences were found in the diagnostics sector, where 63% of executives expect valuations to increase this year.

3 Questions To Ask Yourself

While there may be expectations of growing valuations and a willingness to take on early risk by investing in earlier stages of drug development or biotech platforms, investors in the early stage of biopharma need to ask themselves the following three questions:

1. Am I Adequately Pricing Risk?

Drug development has always been a risky business. As valuations are expected to grow as strategic, private equity, venture capital, and SPACs chase the same assets, there is a risk of overpaying for an acquisition. Innovation in the life sciences business is profoundly reshaping the economics of the sector but is essentially turning a life sciences investment into a three-dimensional chessboard. On the plus side, the use of data and analytics is allowing drug makers to find more precise indications for medications during clinical trials to heighten the odds of success. Acquirers are also often looking for a drug to take on multiple indications. And finally, a more fundamental factor is tied to the complexity of manufacturing many of these new cell- and gene-based medicines. This puts a premium on expertise and talent, which is as mobile as it has ever been.

2. What Will The Treatment Class/Therapeutic Category Look Like In Five Years?

This question is closely connected with the first, since competition is a risk. An innovative treatment today could easily be supplanted by new products that have superior clinical outcomes, lead to fewer side effects, are easier to use (a tablet versus an injectable), and/or can actually cure a condition. It is important to have a broad perspective about the size of the potential patient population, the current treatments, and what is in the pipeline, with the likely time that products will hit the market.

3. Will The Payers Cover The Cost Of Innovation?

As wonderful as innovation can be on the scientific front, a medicine that produces a marginal benefit versus a generic drug will face a difficult time being added to a health benefit plan’s formulary list. This is a difficult dilemma for makers of innovative products, which can cost hundreds of millions of dollars to develop and commercialize, faced with the economic barrier of an inexpensive older drug. Some manufacturers have developed pricing approaches connected with perceived value from avoided hospitalizations. However, data collection needs to be sophisticated about how medical outcomes are being measured and how the treatment is being priced. Drug makers and CROs need to account for this issue during the development of these products by gathering pharmacoeconomic data during clinical trials so this can be presented to payers to aid their decisions on formularies. On the other hand, drug makers can sidestep this question by meeting unmet medical needs with their new products.

Innovation has fueled much of the investor excitement around this sector, especially in oncology, immunology, neurology, and infectious diseases. Unlike the dot-com boom of the late 1990s, medicines are not websites that can easily be replicated. While there may be some deals and investments that fail, investors know that the early-stage companies operate under a balancing act of managing the “cash burn,” while advancing prospective treatments through clinical trials to commercialization. For the sector, these are exciting times. We’ve seen pharma companies develop vaccines within a year, shortening a development process that has taken as long as eight years. The science behind the vaccines – messenger RNA (mRNA) – raises new possibilities of additional treatments and cures. This is just one significant technology of several platforms that are targeting how medical care can improve for all of us.

Source: KPMG analysis; Informa: Strategic Deals 2020.

Valuations increased significantly in 2020, according to biopharma executives

Source: KPMG, 2021 Healthcare and life sciences investment outlook; n=31.

About The Authors:

Jeffrey Stoll is KPMG’s lead partner for life sciences in deal advisory and strategy for the U.S. market. His primary focus is helping corporate and private equity clients through the entire transaction process, including inorganic growth strategy, target investment thesis/strategy, commercial due diligence, and supporting post-merger integration by aligning the operational integration workstreams to align with the deal strategy and value drivers.

Jeffrey Stoll is KPMG’s lead partner for life sciences in deal advisory and strategy for the U.S. market. His primary focus is helping corporate and private equity clients through the entire transaction process, including inorganic growth strategy, target investment thesis/strategy, commercial due diligence, and supporting post-merger integration by aligning the operational integration workstreams to align with the deal strategy and value drivers.

Kristin Pothier is KPMG’s global healthcare and life sciences strategy and deal advisory leader. She has 25 years of experience in research and strategy consulting and M&A diligence in medical innovation in the healthcare and life sciences industries. Her primary areas of focus are deal advisory and corporate strategy for pharmaceutical, diagnostics, and consumer health companies, investors, and medical institutions worldwide.

Kristin Pothier is KPMG’s global healthcare and life sciences strategy and deal advisory leader. She has 25 years of experience in research and strategy consulting and M&A diligence in medical innovation in the healthcare and life sciences industries. Her primary areas of focus are deal advisory and corporate strategy for pharmaceutical, diagnostics, and consumer health companies, investors, and medical institutions worldwide.