4 Key Trends In Biopharmaceutical Manufacturing In 2016

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Continuous bioprocessing makes its move

A number of top trends are emerging in 2016, as the biopharma industry continues to push the need for improved productivity and efficiency. According to preliminary results from our annual report, BioPlan Associates’ 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production1, one of the hot areas of interest taking shape this year is continuous bioprocessing (CBP). Despite the fact that few suppliers have developed sufficiently robust or scalable equipment, or that there few commercialized technologies available for downstream operations, CBP is emerging as a critical new trend in biopharmaceutical manufacturing. In fact, it is now viewed as a more important trend than single-use systems and downstream processing. However, as noted, integrated, broad up- and downstream technologies remain to be developed and commercialized. Despite this lack of viable options, there is a groundswell of enthusiasm for the concept. This demand is likely to spur additional investment and development in these technologies.

A number of top trends are emerging in 2016, as the biopharma industry continues to push the need for improved productivity and efficiency. According to preliminary results from our annual report, BioPlan Associates’ 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production1, one of the hot areas of interest taking shape this year is continuous bioprocessing (CBP). Despite the fact that few suppliers have developed sufficiently robust or scalable equipment, or that there few commercialized technologies available for downstream operations, CBP is emerging as a critical new trend in biopharmaceutical manufacturing. In fact, it is now viewed as a more important trend than single-use systems and downstream processing. However, as noted, integrated, broad up- and downstream technologies remain to be developed and commercialized. Despite this lack of viable options, there is a groundswell of enthusiasm for the concept. This demand is likely to spur additional investment and development in these technologies.

The Rise Of Continuous Bioprocessing

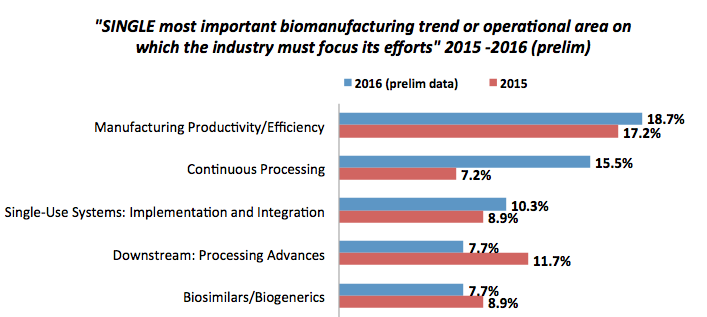

One of the most important trends to emerge from preliminary results of this year’s survey is the increased attention paid to continuous bioprocessing. When we asked respondents to identify the single most important biomanufacturing trend or operational area that the industry must focus its efforts on, continuous bioprocessing was second only to perennial winner manufacturing productivity/efficiency.

In fact, continuous bioprocessing was cited as the top trend in the industry today by more than double the share of respondents as last year2 (15.5% vs. 7.2%).

Figure 1: Single most important biomanufacturing trend or operational area – select responses (Data source: 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production)

The extent of continuous bioprocessing’s popularity this year is also evident when examining the industry’s desired areas for new product development. We identified 24 specific new products and services developed by suppliers and asked industry respondents to cite the top five areas on which they want their suppliers to focus development efforts.

According to our results to date, downstream continuous bioprocessing is the most desired new development area, cited by 37.6% of respondents as being among their top five. This is the first year that we have included continuous bioprocessing in this question, and it’s quite telling that it immediately has vaulted toward the top of the list (at least in preliminary findings), ahead of the consistent winner of previous years, disposable products.

It’s also worth noting that the industry’s desire for continuous bioprocessing innovation is much more focused on downstream (37.6% of respondents) than upstream (24.8%) continuous bioprocessing. That reflects the reality that to this point, continuous bioprocessing has skewed towards upstream processes, with it being far less common to see continuous downstream purification.

Single-Use Applications Continue To Make Their Mark

Although disposable devices appear to be receding in importance relative to continuous bioprocessing, they continue to be an extremely important development within the industry.

Indeed, disposable devices are making sustained inroads into biomanufacturing. Our preliminary results indicate that single-use devices comprise:

- An estimated 41.4% of upstream clinical production, up from 39.3% last year and 38.6% the year before

- An average of 39% of downstream clinical production, representing continued growth from 38.2% last year and 34.1% in 2014

- Some 22.5% of upstream commercial production, up from 17.7% in 2015 and roughly on par with 2014’s 23%

- More than one-fifth (22%) of downstream commercial production, up from 17.3% during each of the two years prior

The considerable rise of disposable applications in downstream commercial production is notable this year. With downstream advances generally lagging upstream in recent years, the industry is looking to various methods to improve its downstream performance, with single-use devices among the leading areas in consideration.

As single-use devices gain more prominence in downstream purification, the vision for a fully single-use facility comes closer to being realized. This is due to downstream purification likely being the primary roadblock to a fully SUS facility.

As such, alongside the greater use of disposable devices in downstream commercial production this year, we also see more enthusiasm regarding the prospects for a fully single-use facility. Our preliminary results indicate that more than six in 10 respondents agree that they expect to see a 100% single-use (disposable) facility in operations within five years. By comparison, slightly fewer than half shared that sentiment last year.

Budgets Shifting To Certain Key Areas

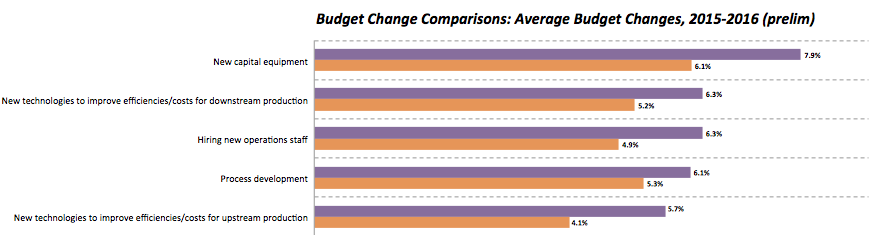

Our preliminary data suggests that budgets are growing in most areas, with some considerable differences from last year. In particular, budget growth for new capital equipment is estimated at 7.9% this year according to our early results, up from last year’s leading 6.1% average growth.

Biomanufacturers also look to be spending more on innovation this year, hiking their budgets by around 6% for new technologies to improve efficiencies and costs for both downstream (6.3%) and upstream (5.7%) production.

Along with a focus on production operations, the industry is planning an increase of 6.3% in spending on hiring new operations staff, marking a strong climb from last year’s estimated growth of 4.9%.

Other areas where budget increases show marked differences from last year include hiring new scientific staff, general budgets for in-house biopharmaceutical manufacturing, and basic R&D for new therapeutic products. In fact, budget growth for basic R&D has more than doubled from last year’s average (4.3% vs. 1.9%).

Figure 2: Selected biomanufacturers’ budget change, preliminary data (Data source: 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production)

Outsourcing Of Testing Services, Production Operations On The Rise

Budgets for outsourcing of biopharmaceutical manufacturing are also increasing, but this is one of the only areas in which budget increases fail to match last year’s estimates. This may simply reflect a move towards more equilibrium after an outsourcing budget rebound in recent years. Still, tempered budget growth doesn’t mean that outsourcing is diminishing. Instead, our preliminary data suggests growing comfort with outsourcing again this year, as 22 of the 24 activities we measured have seen an uptick in the proportion of companies reporting outsourcing them to some degree.

One interesting trend to emerge from our early analysis of results to-date has been the particular areas in which outsourcing activity appear to be on the rise: testing services and production operations. For example, we are seeing considerable increases in the proportion of companies outsourcing the following activities:

- Analytical testing of other bioassays

- Product characterization testing

- Cell line stability testing

- Host cell protein analysis testing

Conclusion

The biopharmaceutical manufacturing industry continues to undergo shifts that are transitioning it towards more flexible, automated platforms. Our survey results are reflective of these shifts, evidenced by a sharper focus on continuous bioprocessing as a key trend, as well as the industry’s desire for innovation in downstream and upstream continuous bioprocessing.

Paralleling the move towards greater automation is a shift towards more flexible production processes, with single-use applications comprising a greater share of clinical and commercial production operations this year. As single-use devices make greater inroads — particularly in downstream purification and in commercial-scale manufacturing — the prospects of a modular, fully single-use facility are nearing reality.

Respondents’ budget plans appear to support these trends. While outsourcing budget growth appears to be slowing, the industry is allocating more funding towards new capital equipment, innovative technologies, and process development. In all, it is shaping up to be an optimistic year for the biopharmaceutical manufacturing industry.

References

- 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production

- 12th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, April 2015, Rockville, MD

About The Author

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, Md., in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. You can reach him at elanger@bioplanassociates.com or 301-921-5979.

Survey Methodology

The 2016 13th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trend analysis from over 200 responsible individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) in 28 countries. The methodology also included over 150 direct suppliers of materials, services, and equipment to this industry. This year's study covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world's major markets in the U.S. and Europe.