Is Early Automation The Key To Scalable Cell Therapy Manufacturing?

By Tiago Aguiar

Despite cell therapy’s growth and extraordinary potential to treat a wide array of diseases, commercial viability remains an ongoing challenge. Companies are under pressure to demonstrate not just that these therapies work but that they can be manufactured sustainably and at scale. Balancing product quality, regulatory compliance, and cost-effectiveness is critical to ensuring that patients continue to have timely and affordable access to these treatments. In this environment, automation emerges as a pivotal strategy for mitigating manufacturing risks, reducing costs, and maintaining the levels of consistency that large-scale manufacturing demands.

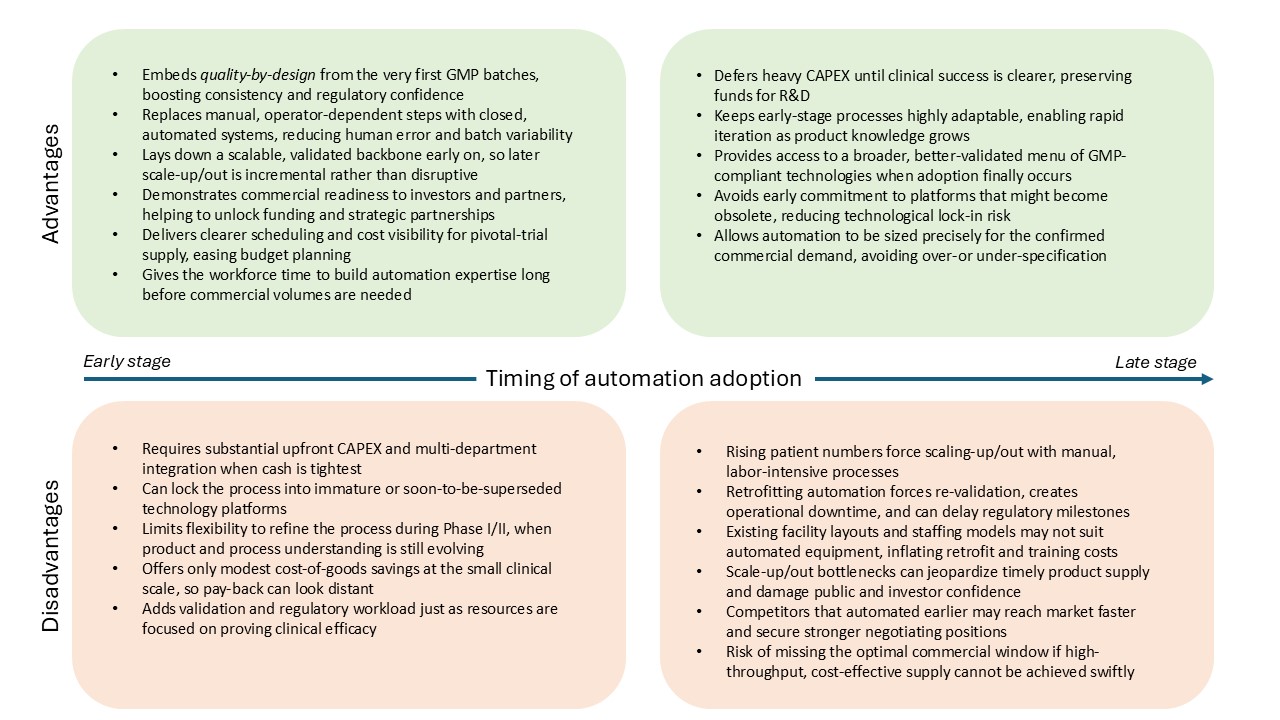

However, deciding when to invest in automation remains a pivotal question. Early adoption can streamline processes and lay strong foundations for future growth, but it also comes with challenges. Up-front capital costs and reduced flexibility during Phase 1/2 clinical trials, while knowledge of your process and product is still limited, can be daunting. Meanwhile, late adopters may defer large expenditures and keep their processes more adaptable for a time, but they run the risk of encountering bottlenecks and inefficiencies when they attempt to scale up or scale out, as well as showing reduced commercial viability to investors during development of their therapies.

Understanding the significance of the timing decision is critical, not just for operational efficacy but for capturing the attention of investors and regulators alike. By planning an automation strategy from the start, companies can better position themselves for success in a field where time-to-market, product quality, and cost can determine the viability of a therapy.

Automation Emerges As A Strategic Enabler

The cell therapy sector has expanded rapidly in recent years, thanks to breakthroughs in areas such as CAR-T therapies and regenerative medicine. This upsurge has intensified competition, while also spotlighting the complexity of manufacturing operations in delivering these advanced treatments. Today’s investors and regulators demand concrete evidence that a company’s processes can be scaled without sacrificing quality or patient safety.

Historically, early-stage biotechs have often prioritized scientific proof-of-concept over operational planning, believing that manufacturing considerations can wait until later. However, as the industry matures and as we observe the successes and the failures in the field, the importance of robust, scalable processes has never been clearer, and an ever-increasing focus on cost-effectiveness has emphasized the need for a smooth transition from clinical research to commercial markets, establishing commercial viability (together with safety and efficacy) as the third core pillar required for the success of a cell therapy.

Against this backdrop, automation emerges as a strategic enabler. Implementing automated manufacturing technologies has been proved to enhance process reproducibility and consequentially boosting manufacturing robustness, while helping reduce human interaction and error and managing the complexities of scaling cell therapy manufacturing processes. While automation was once seen primarily as a late-stage investment, demonstrating commercial viability from an early stage should now be considered a critical area of focus, especially in current markets where investment in cell therapy development has slowed down. Many forward-looking companies are taking this into account and have automation as a central strategic concern from the very start.

The question of precisely when to automate, and how to navigate the potential pitfalls, is one that will determine which therapies come to market faster, more efficiently, and ultimately have sustained commercial success post-approval.

Unpacking Automation’s Advantages

The growing need for automation is rooted in both the scientific and commercial realities of cell therapy manufacturing. On the science side, drug products consisting of living cells are extremely complex, and the industry is still building its body of knowledge. The patient-unique starting material (e.g., apheresate, solid tumour resection) introduces a high level of variability in the process, and recruiting and retaining GMP manufacturing operators with deep process and product expertise remains a persistent industry challenge.

These considerations are further compounded by the need to work under GMP compliance and inside environmentally controlled cleanroom suites. In this backdrop, highly manual processes can introduce unwanted variability, jeopardizing manufacturing operations and, ultimately, product quality. Automated systems, by contrast, can maintain more consistent environments, ensuring process parameters are not only tightly monitored but also controlled, which are all vital requirements for manufacturing products that are of high quality and meet the desired target product profile.

Breaking Down The Timing Decision

From a commercial standpoint, automation can deliver essential cost savings in two ways: first, by trimming the cost-of-goods in some cases (but not always!) and second and most importantly, by reducing the cost of manufacturing operations, which includes operator involvement and labor costs, facility and cleanroom costs, out-of-specification batch write-offs, and other quality costs such as testing and documentation.

In a traditional setup, a large number of operators are required to work long hours to perform process unit operations such as cell activation, gene editing (e.g., transduction), cell expansion, media feeds or changes, and downstream operations such as cell washing, formulation, and fill/finish. But as operations scale, associated costs and the likelihood of human error can rise dramatically.

Automated devices and closed systems help standardize processes, cutting down on training needs and enabling more predictable manufacturing scheduling and budgeting. Over time, the operational efficiencies gained from automation can substantially improve a company’s cost structure, which is paramount when a therapy is moving from tens to thousands of patients and batches per year.

The huge variety of therapeutic areas being targeted and of manufacturing processes being developed adds complexity to the decision: a high-throughput autologous CAR-T cancer therapy facing thousands of batches per year will highly benefit from automating labor-intensive steps such as cell expansion, whereas a low-volume gene-modified therapy for a rare disease can tolerate more manual touchpoints and defer heavy CAPEX.

In light of this complexity, it is generally good practice to automate the high-risk, high-touch stages first, and keep lower-impact unit operations as manual until the scale or the risk profile demands automation.

Yet, the question remains: when should companies automate?

Early adoption sets a stable foundation right from the Phase 1/2 clinical trial stage. Though this approach may initially appear costly, with a lower cost-reduction impact when operating at small-scale, and at a period of juggling uncertain clinical outcomes and evolving processes, it pays its dividends in the long run. Early investment in automation uniformizes processes and operations, easing the transition to later clinical phases and commercial-scale manufacturing. Streamlined and automated processes signal as well a long-term commitment to efficiency and demonstrate a focus on commercial viability, which attracts investor and partner discussions, providing a competitive edge in the current market.

On the other hand, flexibility is essential early-stage while product and process are still being explored. Manual operations are generally more easily adaptable to process changes, and automation does not have a big impact on manufacturing costs during the early stage of Phase 1/2 trials where as few as 10 patients can be dosed. Without much forward thinking and planning, it can therefore seem to make sense at an early stage to defer capital expenditure to a time when the therapy’s likelihood of success might be clearer, conserving resources for research and clinical trials.

However, companies that choose to adopt technologies at a later stage will have to face the urgency to scale up/out and the consequent bottlenecks that come with it, such as highly cumbersome and time-consuming operations, staff shortages, facility limitations to adapt, and quality variations, all of which can hamper the timely delivery of products and erode the company’s public image and confidence.

Therapies that cannot be scaled quickly and cost-effectively risk missing their commercial window, especially in crowded therapeutic areas. Investors are scrutinizing not just the therapy’s clinical merit but also its manufacturability and underlying financial model. A well-automated process is often viewed as a hallmark of readiness, signalling that a company can manage large-scale manufacturing without compromising on safety or quality. Internal investment in strong, capable process development teams that can steer decisions on manufacturing processes and champion automation is therefore critical.

Many cell therapy companies must also contend with the limitations of existing technologies. If the desired automated solutions are not fully mature, not fully GMP compliant, or not widely validated, companies may feel compelled to wait rather than implement a system that might soon be superseded by a better alternative. In an ever-evolving market with a constant stream of new suppliers and new technologies, it is key to stay on top of the game by enabling process development teams to continue exploring the market for opportunities. Despite these uncertainties, clarity of vision and an early-stage strategic plan that anticipates automation at some point of the life cycle can help chart the best course of action.

Early Or Later, Both Approaches Have Serious Challenges

Even with its considerable promise, automation is by no means a perfect solution. Adopting automated technologies in cell therapy involves complex and lengthy integration periods, requiring cross-departmental cooperation and specialized training. The initial outlay is substantial, and it may be difficult to secure funding if investors perceive the risk of adopting novel platforms as too high, especially in the current environment where cost-cutting is a priority. Meanwhile, regulatory concerns must be meticulously addressed; when new equipment imposes extra validation steps, it is often less burdensome to rely on tried-and-tested technologies.

Late adopters who prefer to refine processes manually before committing to automation may still face significant challenges. Transitioning from manual operations to automated ones at a later stage can disrupt established workflows, demanding revalidation and significant operational downtime. This can affect a company’s ability to meet clinical or commercial milestones. Moreover, as competition in the cell therapy market increases, delayed automation might leave a company lagging behind rivals that have more efficient, highly replicable processes in place.

The industry’s rapid pace of technological change creates another hurdle: companies risk locking themselves into specific platforms that may become obsolete. Balancing the need for near-term solutions against the uncertainty of future developments is a delicate but inevitable aspect of strategic planning.

Conclusion

Automation decisions are strategic inflection points that can define the trajectory of a cell therapy company. When undertaken early, automation can offer a more controlled, consistent manufacturing environment, reduce long-term costs, and instill confidence among investors and regulators. Delaying automation may afford flexibility in the initial stages and conserve capital, but it carries the risk of encountering bottlenecks and inefficiencies when the stakes are highest and at the pivotal moment when commercial viability can make or break a company.

Ultimately, there is no one-size-fits-all approach. The optimal timing for automation depends on a company’s specific therapeutic pipeline, financial constraints, and risk appetite. What is increasingly clear is that neither regulators nor investors will accept vague assurances about how a process will scale. They want evidence that key manufacturing challenges are being tackled head-on and that a therapy can feasibly move from bench to bedside in a cost-effective, reproducible manner.

By laying the groundwork for automation from the outset, companies can reduce unwelcome surprises later on. Those that skilfully navigate this path, balancing near-term needs against long-term ambitions, will be best positioned to deliver transformative cell therapies to patients around the world.

About The Author:

Tiago Aguiar is a bioprocessing professional with over a decade of experience in process development and GMP manufacturing operations for advanced therapy products. He has led multidisciplinary teams in the automation and scale-up/out of manufacturing processes, contributing to successful clinical and commercial programmes. His experience spans technology transfer and CDMO management across multiple phases of development. With a background in biological engineering, he has held key technical roles at Orchard Therapeutics, Autolus Therapeutics, and Achilles Therapeutics, and has authored peer-reviewed publications on the bioprocessing of advanced therapies. Connect with him on LinkedIn.

Tiago Aguiar is a bioprocessing professional with over a decade of experience in process development and GMP manufacturing operations for advanced therapy products. He has led multidisciplinary teams in the automation and scale-up/out of manufacturing processes, contributing to successful clinical and commercial programmes. His experience spans technology transfer and CDMO management across multiple phases of development. With a background in biological engineering, he has held key technical roles at Orchard Therapeutics, Autolus Therapeutics, and Achilles Therapeutics, and has authored peer-reviewed publications on the bioprocessing of advanced therapies. Connect with him on LinkedIn.