In Search Of The Unicorn: Do End-To-End C(x)DMOs Really Exist?

By Bernardo Estupiñán, Drug Biologics Consulting

Over the years, we have seen the progression of the biologics contract services go from contract manufacturing organizations (CMO) to what I call today the CxDMO: the contract analytical/research/testing development manufacturing organization. In a 2019 article published by DCAT on end-to-end CMO/CDMO business models, panelists pointed out that in this effort to capture a bigger portion of the value chain, this growth in the services sector has been both organic and inorganic; service providers have been adding to their repertoire of capabilities, aiming to become “one-stop,” “full-service,” or “end-to-end” providers. What does “end-to-end” or “full-service’ or “one-stop” mean, and does such a service organization truly exist?

Focusing on the mammalian biologics segment, we analyzed public information and our proprietary database in search of the answer by looking at 80 service providers supporting projects ranging from early discovery to commercial manufacturing.

Starting From A Basic Question: Who Can Support The Manufacturing Of The API?

This is a simple question until you realize there is more than just manufacturing of the API; it is the tip of the iceberg. GBI Biomanufacturing recently published a very comprehensive guide for choosing the right monoclonal antibody manufacturer. What we often see is the finished product in a vial or prefilled syringe on the shelf at the pharmacy or the doctor’s office. The path to this endpoint is important, with timeline and cost implications. This is the value chain service providers want to capture. Previously, service providers had a defined role in bringing a product to the market. Companies were supporting either the discovery, development, or manufacturing stages, but never all three.

Today, as evidenced by some of the more than 30 criteria or capabilities we track in evaluating service providers, every service provider aims to support all three stages by expanding their services and decreasing their dependence – and their sponsors’ reliance – on third-party providers. As a result, we have seen a changing evolution in the acronym from CMO to CDMO to today’s CRDMO, CADMO, and CTDMO (hence, CxDMO). What this evolution in terms shows is that the drug product on the shelf of the pharmacy or the doctor’s office is more than API manufacturing. It shows the value chain associated with this product requires analytical, research, development, and manufacturing steps for both clinical studies and market supply.

Dissecting The Unicorn: The Development Landscape

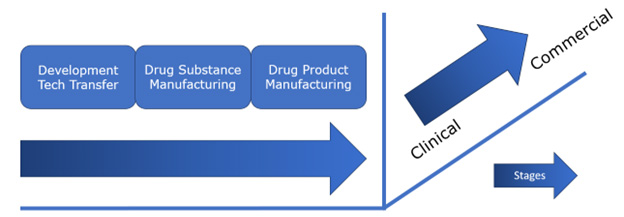

Figure 1: Stages in the development of a mammalian-expressed biologic product from discovery to drug product manufacturing to support clinical studies and the market.

Figure 1 simplifies the development landscape when bringing a mammalian-expressed biologic from discovery to the market with one objective: delivery of a safe product to a patient in need. We have grouped the mammalian biologic development landscape into clinical and commercial stages, with each stage in turn consisting of a development/tech transfer stage, a drug substance manufacturing stage, and a drug product manufacturing stage. Each stage itself is composed of several components or capabilities (Table 1). In evaluating CxDMOs to determine if they are a one-stop, full-service, or end-to-end service provider we accessed publicly available information from each provider and matched their offerings against a series of components or capabilities required for each stage.

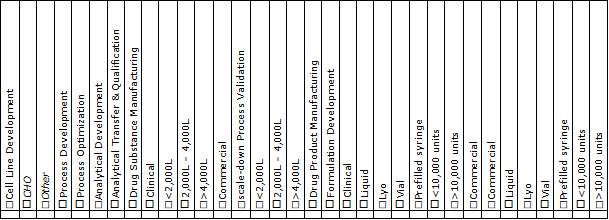

Table 1: Mammalian CxDMO capabilities.

Development/Tech Transfer

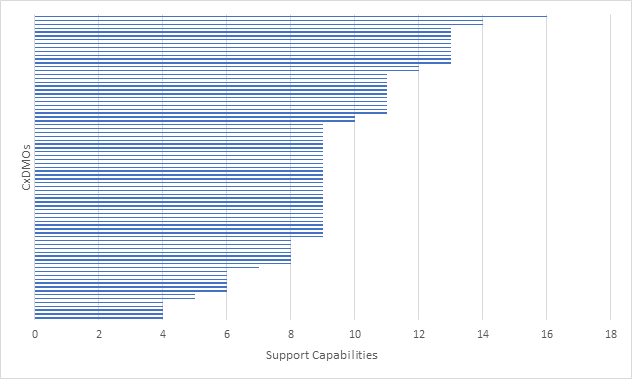

At clinical stage, activities in development/tech transfer include discovery, cell line or strain development, and analytical development, as well as process development to support upstream and downstream manufacturing. At commercial stage, activities include analytical and process transfer and qualification, process optimization, and scale-down process characterization. Development/tech transfer activities support both drug substance and drug product manufacturing. In total, we evaluated seven capabilities at this stage, and the results are shown in Figure 2.

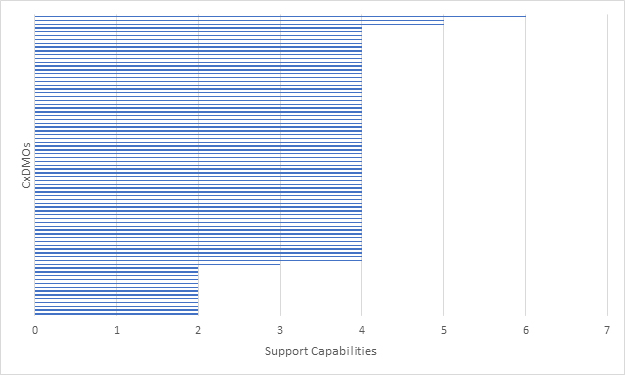

Figure 2: Mammalian CxDMOs supporting development/tech transfer based on seven capabilities.

For clinical projects, the key capabilities at this stage include cell line development (primarily CHO) as well as process and analytical development. For commercial projects we were looking at process optimization, analytical transfer, and qualification. No CxDMO that we evaluated met all the criteria established at this stage and very few were able to support clinical and commercial programs.

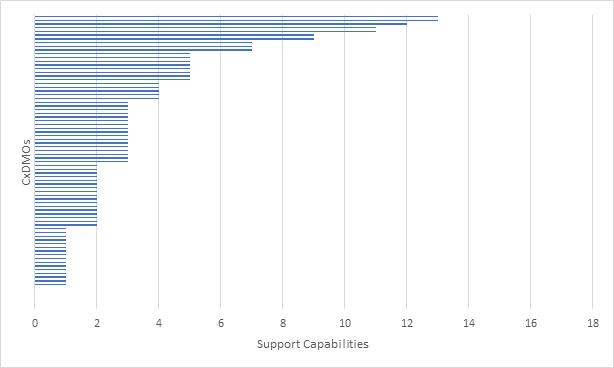

Drug Substance Manufacturing

At clinical stage, activities in drug substance manufacturing are focused on API manufacturing at sufficient quantities to support clinical Phase 1 and Phase 2 studies. At commercial stage, once a determination is made in terms of scale of manufacturing, activities are focused on a confirmation run for Phase 3 studies following scale-up and at-scale process performance qualifications (PPQ) for the biologic license application (BLA) and subsequent approval. As a result, scale of manufacturing is a very critical component. In total, we evaluated 10 capabilities at this stage and the results are shown in Figure 3.

Figure 3: Mammalian CxDMOs supporting drug substance manufacturing based on 10 capabilities.

For clinical projects, the key capabilities at this stage were manufacturing at <2,000 L but with the ability to provide >2,000 L capacity. We did not confirm if the CxDMO had actually run clinical programs. In addition, in-process control testing and batch release were assumed. For commercial projects we were looking for the ability to perform scale-down process characterization and validation as well as a larger at-scale process performance qualification. We did not confirm if the CxDMO had actually run commercial programs. In addition, as with clinical projects, in-process control testing and batch release were assumed. What the graph shows is that CxDMOs offer a range of manufacturing scales, from < 2,000 L for clinical programs and > 4,000 L for commercial programs.

We then looked at how many CxDMOs were able to support the progression from development/tech transfer to drug substance manufacturing (Figure 4). The overall distribution did not change much, which suggests that most CxDMOs with drug substance manufacturing capabilities also provide development and tech transfer. However, no CxDMO that we evaluated met all the evaluation criteria and very few met most of the evaluation criteria.

Figure 4: Mammalian CxDMOs supporting progression from development/tech transfer to drug substance manufacturing based on a combined 17 capabilities.

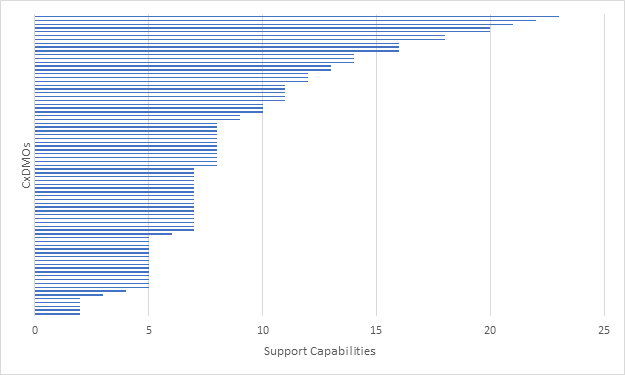

Drug Product Manufacturing

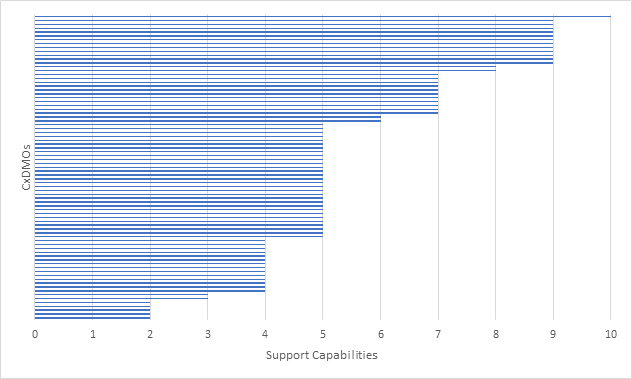

At clinical stage, activities in drug product manufacturing included formulation development, stability studies, and filling the API primarily in either vials or prefilled syringes (PFS) to support Phase 1 and Phase 2 studies. We assumed some logistics capabilities such as bulk packaging, but this was not a selection criterion. At commercial stage, activities were focused on validation studies and PPQs, secondary packaging and labeling, and distribution logistics in order to ready the product for market launch. As with drug substance manufacturing, scale of manufacturing was a critical component. Secondary packaging and distribution were assumed, but this was not a selection criterion. In total, we evaluated 17 capabilities at this stage and the results are shown in Figure 5.

Figure 5: Mammalian CxDMOs supporting drug product manufacturing based on 17 capabilities.

For clinical projects, the key capabilities were manufacturing at <10,000 units, either vial or PFS. We did not confirm whether the CxDMO adhered to Annex1 requirements and assumed that stability studies were supported. In addition, in-process control testing and batch release were also assumed. For commercial projects we were looking for ability to manufacture at >10,000 units, either liquid or PFS, as well as lyo. Process validation capabilities were assumed, and we did not confirm whether the CxDMO had actually run commercial programs. In addition, as with clinical projects, in-process control testing and batch release were also assumed. What the graph showed was that a large number of CxDMOs had limited drug product manufacturing offerings at both clinical and commercial scales. No CxDMO that we evaluated met all the criteria and very few CxDMOs met some of the criteria.

We then looked at how many CxDMOs were able to support the progression from drug substance manufacturing to drug product manufacturing. (Figure 6). The overall distribution did change, suggesting that some CxDMOs providing drug substance manufacturing also provided drug product manufacturing, but the range of capabilities was not well defined. What remained constant was that no CxDMO that we evaluated met all evaluation criteria and very few met most of the evaluation criteria.

Figure 6: Mammalian CxDMOs supporting drug substance and drug product manufacturing based on a combined 27 capabilities.

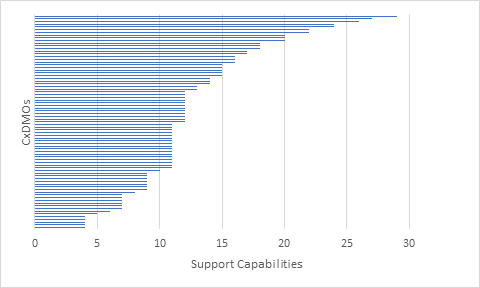

We finally looked at how many CxDMOs were able to support the progression from development/tech transfer to drug substance manufacturing to drug product manufacturing (Figure 7). The results showed that very few CxDMOs were able to support such progression. No CxDMO that we evaluated met all the evaluation criteria and very few met most of the evaluation criteria.

Figure 7: Mammalian CxDMOs supporting progression from development/tech transfer to drug substance manufacturing to drug product manufacturing based on a combined 34 capabilities.

What became evident was that as a project progressed from development to clinic and from clinic to commercial, the number of CxDMOs able to support such progression decreased. A common denominator in this analysis showed that no CxDMO that we evaluated met all the criteria, which is not to say that they don’t provide them. The most likely scenario is that most CxDMOs were not making this information available on their websites and public outlets.

In Search Of The Right Service Provider: Is The Unicorn Really What You Need?

We looked at a large number of service providers, many of them pitching themselves as “full-service,” “end-to-end,” or “one-stop” service providers and few pitching themselves as specialists focused on core competencies that can support the different stages of a project. Offering various platforms to support different product modalities is not end-to-end, full-service, or one-stop; offering all the support necessary to take a project from discovery to clinic or from clinic to market or from discovery to market is.

If you are considering working with a CxDMO, does it focus on development/tech transfer? Clinical? Commercial? What we know after this data-driven analysis is that it is never all three at once. It ultimately comes down to being able to answer “want vs. need” questions and correctly defining the objective of each project:

- Do I need a specialist or a generalist?

- Is an end-to-end CxDMO a want or a need?

- When is an end-to-end CxDMO needed?

- What are the inherent risks of working with an end-to-end CxDMO?

- Are we using the right terminology?

The CxDMO In Unicorn’s Clothing: Finding The Right Unicorn

Over the past 20 years we have seen a positive evolution in the biologic therapeutics market. The increase in demand for development and manufacturing has had high single-, low double-digit growth. With biotech pushing the limits of what can be achieved, be it higher titers, lower cost of production, and, more importantly, shorter time to clinic, service providers, eager to retain clients, have responded. This is particularly true when it comes to timelines and speed to clinic. Having been part of the accelerated timelines to clinic wave a few years back, it became evident that these timelines only work in fully integrated CxDMOs. Many CMOs adopted the CDMO terminology and started pitching their “end-to-end” or “one-stop” or “full-service” capabilities. The fine print, however, was always “as long as you are able to manufacture the master cell bank (MCB)” or “provided the clinical fill/finish site has available capacity” — or some combination thereof.

It is difficult not to associate the term “end-to-end,” “one-stop,” or “full-service” CxDMO with the term “jack of all trades,” implying that this industry has transitioned from a specialist model to a generalist model. The reality is that regardless of which CxDMO one chooses, specialist service providers will still play a critical role in getting the finished product to the pharmacies or doctors’ offices.

The question remains: do “end-to-end” or “full-service” or “one-stop” CxDMOs really exist or are they the unicorn of our industry? To paraphrase George Orwell in his 1945 novel Animal Farm: “They are all unicorns. Some are more unicorns than others.”

About The Author:

Bernardo Estupiñán is principal at Drug Biologics Consulting. He has global leadership experience in R&D, manufacturing, quality control, market research, and global marketing/business development within the Asia, European, North American, and Latin American markets. He has expertise in product development, analysis, strategic marketing, business plan preparation, and international business development. At Drug Biologics Consulting, he launched CDMO Advisor, which provides free access to users looking for CxDMOs for their projects. He can be reached at bestupinan@drugbiologis.com.

Bernardo Estupiñán is principal at Drug Biologics Consulting. He has global leadership experience in R&D, manufacturing, quality control, market research, and global marketing/business development within the Asia, European, North American, and Latin American markets. He has expertise in product development, analysis, strategic marketing, business plan preparation, and international business development. At Drug Biologics Consulting, he launched CDMO Advisor, which provides free access to users looking for CxDMOs for their projects. He can be reached at bestupinan@drugbiologis.com.