From Preparation To Compliance: DSCSA Implementation Takes Big Steps In 2025

By Eric Marshall and Elizabeth Hassett, Leavitt Partners

2025 marks the 12th year of the 10-year implementation of the Drug Supply Chain Security Act (DSCSA) requirements for enhanced drug traceability. At first blush, that may appear to be a missed deadline, but, in reality, it’s a necessary recognition of the complexity of pharmaceutical traceability across a vast, diverse supply chain. Tremendous progress has been made since implementation began, and 2025 is shaping up to be a pivotal year as the industry transitions to a phase of full, or near-full, compliance.

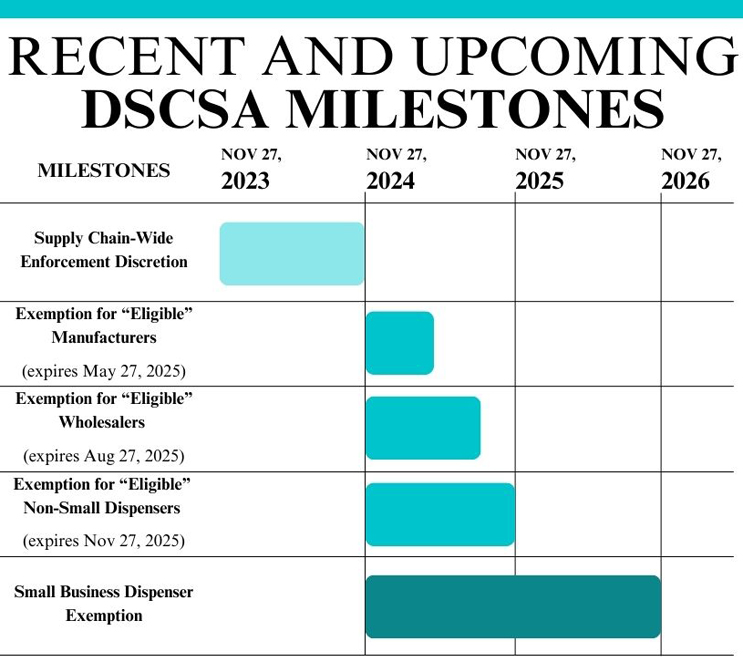

We say near-full because, in the fall of 2024, FDA announced a set of phased exemption periods from certain DSCSA requirements for eligible authorized trading partners. The exemption periods follow a one-year FDA-issued stabilization period, which ended on November 27, 2024. The phased exemption periods expire on different dates throughout 2025, marking a series of milestones for DSCSA implementation and an especially important year for trading partners across the supply chain as they continue to strengthen their DSCSA systems and processes. For additional background on the DSCSA, reference this prior guest column.

Important dates for stakeholders eligible for exemptions include:

![]() May 27, 2025: Expiration of the Exemption Period for Eligible Manufacturers and Repackagers.

May 27, 2025: Expiration of the Exemption Period for Eligible Manufacturers and Repackagers.- August 27, 2025: Expiration of the Exemption Period for Eligible Wholesale Distributors.

- November 27, 2025: Expiration of the Exemption Period for Eligible Dispensers with 26 or More Full-Time Employees.

- November 27, 2026: In addition to the phased exemption periods listed above, dispensers with 25 or fewer full-time employees are exempt for an additional year.

The above phased exemption periods reflect FDA’s continued efforts to limit potential supply chain disruptions while maintaining pressure on trading partners to finalize their systems and processes to meet the DSCSA’s interoperable traceability requirements. After more than a decade of effort, trading partners are closing in on the interoperable exchange of data for tens of billions of drug package sales and purchases — the scope and granularity of which is unrivaled in any other industry.

DSCSA Implementation Is Progressing, With Most Trading Partners Working Toward Full Enhanced Traceability

With the expiration of the first phased exemption period less than a month away, manufacturers, repackagers, and trading partners across the supply chain are taking action to tie up their systems and processes in preparation for the expiration. FDA and the Partnership for DSCSA Governance (PDG) recently hosted a town hall, during which stakeholders discussed DSCSA implementation with a focus on the upcoming exemption expiration and the implications of that expiration not only for manufacturers and repackagers but for downstream trading partners. The takeaway from the meeting was clear: stakeholders have made substantial progress since the stabilization period, and the phased exemption periods have been highly valuable for players across the supply chain. No participating manufacturers asked FDA to extend the exemption period for eligible manufacturers, and, at this time, there is no reason to believe manufacturer compliance will be further extended.

Although it appears “all systems are go” for the May manufacturer deadline, some areas of potential challenge should be monitored. First, while we are unlikely to see broad-scale exemptions for manufacturers extended, individual manufacturers and repackagers may seek relief from certain DSCSA requirements through FDA’s Waiver, Exception, and Exemption (WEE) request process. Individual WEEs create exception processes throughout the supply chain, and a high volume of WEEs could potentially create significant challenges. At this time, there are no signals that a problematic number of WEEs are being pursued, but it is an important area to monitor.

Second, the transition to full compliance among manufacturers will enable a significant increase in data capture and exchange between wholesalers and pharmacies. That is generally an important and positive step; however, it will bring far greater visibility to the serial-number-level accuracy of data being provided by manufacturers. There is general optimism with regard to manufacturer data quality, but as greater visibility is achieved in the second half of 2025, it is possible that data quality challenges will spike. For example, a wholesaler may receive aggregated cases of serialized product and infer the contents without identifying package-level aggregation discrepancies. As the process moves downstream and wholesalers ramp up outbound data exchange, they will increasingly identify those aggregation discrepancies in their outbound processes. Any significant uptick in data quality issues would also drive staffing levels to meet those challenges, creating challenges in onboarding and training.

DSCSA In 2025: Surrounded By Noise But Remains Largely Steady

There is no doubt that the current political environment and governmental restructuring have created significant uncertainty across the healthcare industry. However, as an overarching regulatory scheme, DSCSA implementation remains steady and the direct impacts on its implementation at FDA have been limited. That is not to say that DSCSA implementation will not be impacted by the broader FDA environment. Most notably, the current environment has become increasingly difficult for FDA to issue regulations and guidances that do not have a significant deregulatory impact. President Trump’s Executive Order 14192, “Unleashing Prosperity Through Deregulation,” requires that for every new regulation issued, agencies — including FDA — must identify at least 10 existing rules, regulations, guidance documents, and/or policy statements to be repealed or amended (the “1-In-10-Out Directive”) and that the net fiscal impact of those actions be significantly less than zero. As a result, it is unlikely FDA will be in a position to issue non-critical DSCSA guidance or regulation.

Notably, the 1-In-10-Out Directive could impact the finalization of FDA’s long-awaited and overdue proposed rule, “National Standards for the Licensure of Wholesale Drug Distributors and Third-Party Logistics Providers.” As required by the DSCSA, the licensure rule would establish national standards for the licensure of wholesale drug distributors and third-party logistics providers, simplifying interstate commerce and compliance with the myriad of licensure standards that exist while maintaining stringent security requirements and states’ authority to carry out that licensing.

The 1-In-10-Out Directive could also impede or delay finalization of another important FDA proposed rule: “Revising the National Drug Code Format and Drug Label Requirements.” In it, FDA proposes to amend its regulations governing the National Drug Code (NDC) to avoid running out of the labeler codes used to identify a product’s manufacturer, which are expected to run out within the next decade — a risk some are likening to that of Y2K. The proposal would replace the current NDC 10-digit format with a 12-digit format. To be sure, the NDC will impact healthcare systems far, far beyond the DSCSA, but the clarity this rule will provide is essential given the short timeline available for the rule’s complex implementation.

Patient Protection In Real Life

DSCSA implementation often feels like an overly complex IT implementation, but it is paying dividends for patient safety in very real ways. For example, high demand and low supply of GLP-1 medications have been a classic recipe for risk. Hundreds of counterfeit GLP-1 medications have been uncovered and removed from the U.S. supply chain in recent months. The verification and traceability tools established under the DSCSA are helping trading partners and regulators identify those counterfeits more quickly and limit counterfeit products making it to patients. This latest outbreak should serve as a reminder to stakeholders throughout the supply chain — and the public — that DSCSA implementation is more than an exercise in the face of increasing threats, it is very real progress in helping keep the U.S. supply chain among the safest and most secure in the world.

Conclusion

After a long decade of striving to achieve full DSCSA implementation across the supply chain, it is remarkable to see live interoperable systems and processes that are facilitating data exchange, verifying products, and promptly responding to requests for additional transaction information. Despite current uncertainty surrounding much of the healthcare system, DSCSA regulations and implementation remain steady. As the year progresses, continued collaboration and communication between trading partners will be of the upmost importance to finalize DSCSA implementation and protect the supply chain and patients across the country.

About The Authors:

Eric Marshall is a principal in the Washington, D.C. office of Leavitt Partners and the executive director of the Partnership for DSCSA Governance (PDG), a public-private partnership between industry and FDA that is committed to implementing supply chain security protections in the U.S. At Leavitt Partners, he advises healthcare coalitions on health policy and provides consulting services to drug and device companies. A regulatory lawyer by training, he is an industry specialist in the areas of drug, device, and diagnostics regulation. A portion of his practice is focused on domestic and international supply chain security. Marshall leads Leavitt Partners’ alliance practice, helping the firm and clients with industry collaboratives committed to advancing sound health policy initiatives. Prior to joining Leavitt Partners, he practiced law, counseling healthcare and life science clients on regulatory, compliance, and transactional matters.

Eric Marshall is a principal in the Washington, D.C. office of Leavitt Partners and the executive director of the Partnership for DSCSA Governance (PDG), a public-private partnership between industry and FDA that is committed to implementing supply chain security protections in the U.S. At Leavitt Partners, he advises healthcare coalitions on health policy and provides consulting services to drug and device companies. A regulatory lawyer by training, he is an industry specialist in the areas of drug, device, and diagnostics regulation. A portion of his practice is focused on domestic and international supply chain security. Marshall leads Leavitt Partners’ alliance practice, helping the firm and clients with industry collaboratives committed to advancing sound health policy initiatives. Prior to joining Leavitt Partners, he practiced law, counseling healthcare and life science clients on regulatory, compliance, and transactional matters.

Elizabeth Hassett is an associate at Leavitt Partners in Washington, D.C. and an advisor for the Partnership for DSCSA Governance (PDG), a public-private partnership between industry and FDA focused on drug supply chain security. At Leavitt Partners, she advises clients and alliances on topics intersecting health law and policy, with a focus in life sciences, FDA, and rare disease. Previously, she was a law clerk at the Centers for Medicare and Medicaid Services (CMS) and the Maryland Office of the Attorney General. Hassett received her MPH at the University of Pittsburgh and is finishing her law degree at the University of Maryland.

Elizabeth Hassett is an associate at Leavitt Partners in Washington, D.C. and an advisor for the Partnership for DSCSA Governance (PDG), a public-private partnership between industry and FDA focused on drug supply chain security. At Leavitt Partners, she advises clients and alliances on topics intersecting health law and policy, with a focus in life sciences, FDA, and rare disease. Previously, she was a law clerk at the Centers for Medicare and Medicaid Services (CMS) and the Maryland Office of the Attorney General. Hassett received her MPH at the University of Pittsburgh and is finishing her law degree at the University of Maryland.

May 27, 2025: Expiration of the Exemption Period for Eligible Manufacturers and Repackagers.

May 27, 2025: Expiration of the Exemption Period for Eligible Manufacturers and Repackagers.