Financing For Emerging Biotechs: Recent Trends & Predictions For 2023

By Rich Ramko and Ashwin Singhania, EY

After a stellar 2020 and 2021, overall early-stage financing for small and midsize biotechs declined significantly in 2022. This drop-off was due to a range of factors, including unfavorable clinical news, rising interest rates, and investors shifting their focus out of life sciences.

Given these and other challenges, in early 2023 venture capital investment and IPO activity have remained particularly stagnant, despite the robust fundraising and cash reserves we see today among investors and biopharma companies. Over the next 12 to 18 months, the sector likely will experience more turbulence as smaller, less mature biotechs with insufficient cash reserves grapple to survive and institutional investors hold out for improvements such as healthier valuations.

Below are our latest insights into the sector’s dealmaking landscape for 2023 and beyond, along with key actions for emerging biotech leaders to take in this uncertain environment.

How We Got Here: Biotech Through The Pandemic Years

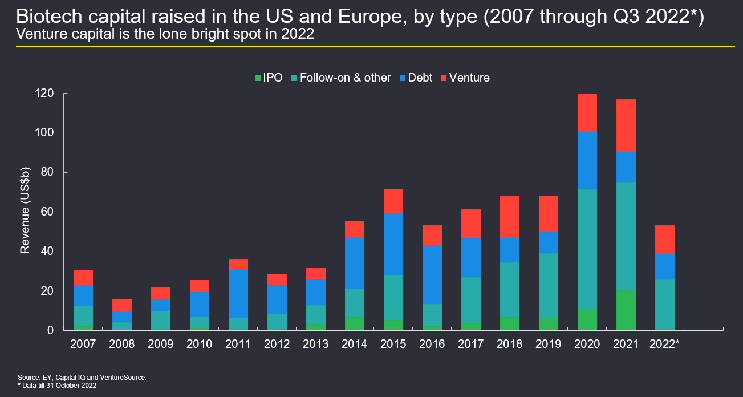

The biotech sector’s blockbuster levels of funding in 2020 and 2021 resulted from a confluence of extraordinary factors, including the success of the mRNA vaccines for COVID-19. In addition, as hospitality and other industries faltered during the global pandemic, investors had plenty of liquidity but fewer viable opportunities for investment. As such, in 2020 and 2021, a diverse roster of investors developed a huge appetite for biotechs (see Figure 1 below), including those with less mature operations, technologies, and/or management teams.

Figure 1: Biotech capital raised in the U.S. and Europe, by type (2007–Q3 2022). Data available as of February 2023 is only through Q3 2022.

But for investors with low risk tolerance, the emergence of unfavorable clinical news in 2022 prompted a swift exit from biotech. For example, clinical holds were abundant at the start of 2022, with 15 full or partial holds reported in the first eight weeks. By year-end, however, the total (44) was short of 2021’s full-year count (49). In addition, platform companies were seen as less desirable by investors starting last year due to both an oversaturation of funding for these companies during the last boom cycle and their long road to ROI.

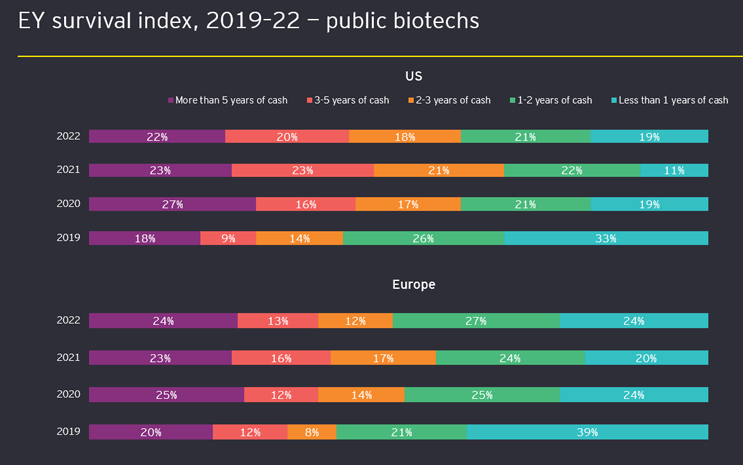

As a result of these and other concerning developments, valuations plummeted and significantly slowed the sector’s deal market. Relatedly, we estimate that a combined 40% of emerging biotechs in the U.S. and Europe had less than one year of cash on hand at the end of 2022 (see Figure 2 below), signaling a tough investment climate in early 2023.

Figure 2: EY survival index: public biotechs’ cash reserves (2019–22). Data available as of February 2023 is only through Q3 2022.

As emerging biotechs now await the return of meaningful institutional investment to the sector, developing a deeper understanding of today’s financing environment and preparing for the road ahead will be key. And while the deal market described above is certainly less than ideal, historical financing data for the sector indicates that the picture may not be as dire as some have feared.

The amount of biotech capital raised in the U.S. and Europe in the first three quarters of 2022 was largely consistent with that raised in the years preceding the pandemic, indicating that the outsized performance seen in 2020 and 2021 was an anomaly. Additionally, the slowing debt activity reflected in Figure 1 is fairly typical as interest rates rise, and the follow-on offerings activity shown is consistent with current stock prices. Given these factors, the overall financing environment for 2022 represents a relative return to normalcy for biotech, with a few notable exceptions.

During the fever pitch that was the deal market for biotechs in 2020 and 2021, an incredible number of companies went public. Many did so much earlier in the development process than is standard. Early-stage products often have several stops and starts as they go through the clinical trials and regulatory approval processes, which veteran investors have come to expect and understand. Funds and investors focused on the sector tend to factor this level of risk into their investing decisions and often have a better appetite for riding out the ups and downs of getting a biotech product approved and to commercialization.

During 2020 and 2021, several funds that didn’t typically invest in biotech jumped into IPOs where the company that was going public only had products in the earlier stages of development. This early investment was followed in many cases by disappointing clinical or development news for a number of these companies and an investor base that is very hesitant to put additional capital into an already higher-risk asset category. Ultimately, these developments led to a market pullback that continues today, with a biotech IPO market that is now virtually nonexistent after previously comprising a significant portion of overall investment into the sector.

While a small number of deals with major insider participation have emerged recently, along with a handful of successful secondary offerings, these bright spots may not overcome the ongoing impact of underperforming early-stage biotechs, as shown in Figure 2. Some of these underperformers may merge to preserve cash and see another day, some may be acquired, and others may not survive into calendar year 2024. For the broader biotech IPO market to pick up, investors first will need to start seeing a return from the sector, which we expect to come in a variety of ways such as good clinical news that leads to successful secondary offerings, an increase in M&A activity, and finally successfully completed offerings by companies with later-stage, de-risked assets.

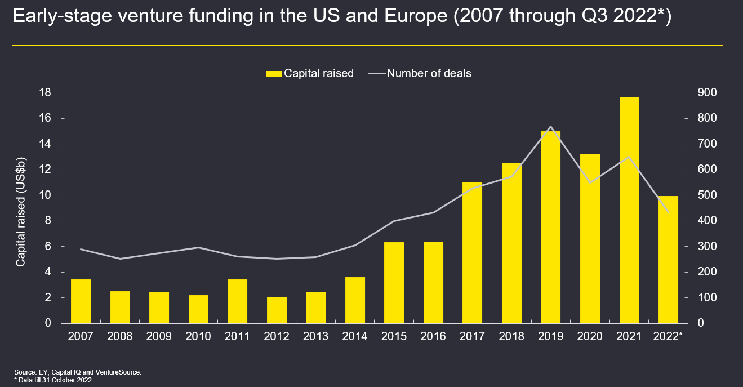

VC investment, another significant financing vehicle for emerging biotechs, has also slowed recently, as investors conserve their cash for more promising investments and their own proven portfolio companies. As shown in Figure 3 below, the drop in VC activity was significant in 2022, with many investors seeking higher-quality investments for the same reasons as noted above with regard to biotech IPOs. Despite this markedly slower pace of investment, VC fundraising remains robust, and a few deals have seen large valuations, signaling a rush by investors toward quality over quantity.

Figure 3: Early-stage venture funding in the U.S. and Europe (2007–Q3 2022). Data available as of February 2023 is only through Q3 2022.

Collaboration agreements, which have traditionally yielded higher ROI than M&A, have also been a major source of financing for early-stage biotech companies. These agreements often entail a cash infusion at the beginning followed by supplemental financing as predetermined milestones are achieved. While potential biobucks saw an increase in 2022, the number of alliance and up-front payments declined during the same period. This drop is largely in response to the market conditions and clinical data challenges discussed above, as biopharma companies continue to see the robust cash reserves and product pipeline deficits that initially motivated them to seek out strategic partnerships with smaller, more innovative biotechs. As overall conditions improve over the next year or more, interest in collaboration agreements will also resurge.

Key Focus Areas In 2023 And Beyond

As the biotech sector awaits the return of capital activity, potential financers will be watching closely for improvements such as high-quality clinical data, strong secondary offerings, and consolidation through merger, M&A, and other activity. But regulatory and industry headwinds may also place pressure on emerging biotech leaders.

First, although FDA approvals dipped in 2022, Phase 3 pipelines remain healthy, indicating that this decline is likely related to the timing of clinical trials and/or other factors. While the first eight months of 2022 saw only two or three new molecular entity (NME) approvals per month, September through December saw a notable uptick at five or six approvals per month on average. Additionally, while no immediate impact is expected from the Inflation Reduction Act, emerging biotechs should know that the coming pricing controls under this legislation will exert downward pressure on leading-class products and fundamentally change the calculus around financing innovation. This legislation also may cause delays in partnerships and M&A as larger biopharmas rethink their portfolio strategies. Biotechs are also contending with a staggeringly high volume of technologies, representing a golden age of innovation but also complicating R&D investments. For example, there are over 3,000 technologies related to cell and gene therapy. For both investors and biopharma companies, determining which ones will succeed can be daunting and prompt a wait-and-see approach.

In 2023, it is imperative that biotechs seek to preserve capital and focus on achieving important milestones on leading projects. This does not mean decreasing investments in R&D, but rather looking holistically across the business to reduce operational costs while maintaining innovation spending. Today’s digital, outsourcing, and intelligent automation capabilities are on full display in other industries, and while biotech is a pioneer in innovation, its adoption of these digital tools has lagged significantly over the years. Back-office processes, automation, and utilizing shared services are proven examples for lowering administrative spending. Together, these strategies can meaningfully move the needle on costs, allowing biotechs to fund continued innovation.

Lastly, as companies merge or dissolve, biotechs should focus on upgrading talent and capabilities. Companies should identify the capabilities and skills they need now to survive and for future growth and establish a build vs. buy strategy, deciding when to hire and when to develop from within. To help existing talent grow, organizations should promote in-role growth, skills development, and internal mobility to ensure motivation and job satisfaction. Above all else, each biotech needs to define its own purpose and core values and allow those to drive the culture of the company. This is ultimately the only way the industry can engage with, recruit, and retain the talent it will need in the future.

By implementing the actions listed above and making investments to drive the improvements that investors and biopharma companies are eager to see, emerging biotech leaders can get ahead of today’s financing challenges. Those who do so will be better prepared to innovate and drive value when the deal market corrects course later this year or in early 2024.

About The Authors:

About The Authors:

Rich Ramko is the EY U.S. biotech leader and life sciences leader for the EY U.S.-West region. In this role, he counsels biotech, medtech, and pharmaceutical clients on financial, business, operational, governance, and strategic matters. He has significant SEC-related experience, particularly with respect to IPO and secondary offerings, complex accounting issues, and the SEC comment letter process. He holds a BBA in accounting from Middle Tennessee State University.

Ashwin Singhania is a principal in EY-Parthenon with 20 years of strategic consulting experience in life sciences. He works with biopharma companies by supporting corporate growth and commercial brand strategy, and his experience includes new product launches, executing commercial due diligence, and creating strategic approaches to therapeutic areas. He holds a BS in molecular biology from UC-Berkeley and an MBA from Columbia Business School.

Ashwin Singhania is a principal in EY-Parthenon with 20 years of strategic consulting experience in life sciences. He works with biopharma companies by supporting corporate growth and commercial brand strategy, and his experience includes new product launches, executing commercial due diligence, and creating strategic approaches to therapeutic areas. He holds a BS in molecular biology from UC-Berkeley and an MBA from Columbia Business School.

The views reflected in this article are the views of the author(s) and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.