COVID-19 Spurs Growth Of China's Domestic Bioprocessing Suppliers

By Vicky Xia and Leo Yang, BioPlan Associates

The COVID-19 pandemic nearly brought the global economy to a halt in 2020. However, that has not been the case for global bioprocessing suppliers. Not unexpectedly, this segment has seen strong demand for products and services across the board, as demand for vaccine production has stressed the global supply system.

Just as the U.S. and European bioprocessing supply systems have seen more robust growth than ever before, China’s domestic demands for single-use bags, cell culture media, and purification resins are all on the rise. BioPlan’s Top1000Bio database1 of global bioprocessing facilities has tracked industry capacity and employment growth over 15 years. China’s domestic facility and capacity growth has expanded over the past four years at around 20%, compared to 12% in the U.S. and Europe. Investments in and focus on biotechnology have pushed this global expansion, and demand for supplies for COVID-19 vaccines and therapeutics has created bottlenecks. Even before the pandemic, the supply chain for bioproduction was experiencing stress, with increasing lead times and low inventories for many products. The pandemic disruptions have accelerated the growth of suppliers’ capacity, both in Western countries and in China.

In spring 2021, Lepure, a Shanghai-based single-use supply vendor, started operation of its Lingang facility.2 In May 2020, OPM, a Chinese biologics CDMO and cell culture media producer with a production site in Zhangjiang, also expanded commercial-scale production for GMP-grade cell culture media in Lingang, Shanghai. The planned annual capacity is in thousands of tons, and liquid media can reach millions of liters.3

Investors are aware of these emerging opportunities. The bioprocessing supply market has long been dominated by multinational corporations (MNCs); for example, Cytiva, Thermo Fisher, Merck, etc., have a combined greater than 80% share of the cell culture media market.3 This has created interest in bioprocessing supply in China, where domestic vendors with the capability and capacity are finding friendly capital markets.

OPM completed two rounds of fundraising in March and August of 2020, totaling $61.8 million (RMB, which is renminbi, 400 million).4 Thousand Oaks Biopharmaceuticals, another biologics CDMO as well as a cell culture media producer, completed a similar C-round financing deal in March 2021. The company claims it has occupied ~10% of the China serum-free cell culture media market and has signed long-term collaboration deals with major biopharmaceutical companies in China. The company also stated it would use the funds raised to build what it claims would be the largest global cell culture media production site.

On June 23, 2021, Suzhou Nanomicro Tech, a domestic leader in resin, completed a successful IPO in the STAR market, raising $54.9 million (RMB 355 million). On the day of its IPO, the stock rose by 1,273%, showing investors’ strong confidence in the company.5,6 There are also drivers besides financial gains; at the end of 2019, WuXi Biologics acquired over 50% ownership of Bestchrome, another leader in the resin sector, in an effort to strengthen its supply chain stability.7

How Big Is China’s Bioprocessing Supply Market?

Figure 1: Market Size of China’s Biopharmaceutics and Bioprocessing Supplies (Upstream) 7

Source: CITIC Construction Investment Time, August 2021. Click here to view in RMB.

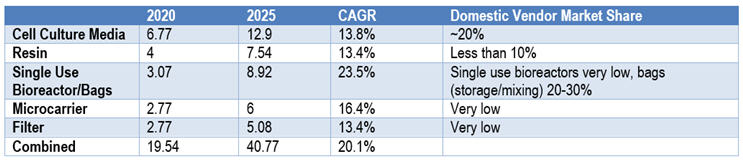

According to China Securities, the overall global bioprocessing equipment and supply market is ~$20 billion with CAGR over 10%, of which equipment consists of ~46% and consumables ~54%.8

In 2021, China’s upstream bioprocessing supply market reached ~$1.9 billion (RMB 12.7 billion) and is projected to reach $4.1 billion (RMB 26.5 billion) in 2025 with CAGR over 20% (growth driven by vaccines for COVID-19 excluded). The upstream bioprocessing supplies include cell culture media, certain resins, single-use bioreactors/storage bags and accessories, microcarriers, filter/filter membranes, etc.

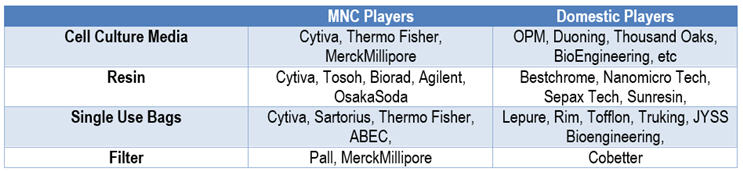

Table 1: Major Vendors in Bioprocessing Supplies

Though the majority of domestic vendors of bioprocessing supply are relatively young companies established between 2005 and 2010, they have been growing very robustly in recent years. While the bioprocessing supply market used to be dominated by MNC companies, domestic vendors are winning market shares from their MNC counterparts, especially in single-use bags (for mixing and storage) and cell culture media and are starting to gain importance in resin as well.

We can use cell culture media as an example. During the pandemic, domestic vendors of media at least doubled their revenue from 2019. In 2017, the total Chinese cell culture media (CCM) market was $170 million (1.1 billion RMB), which is over 33% more than the revenue in 2016; of that, 89% was imported.

Today (2020-2021), the CCM market size in China is over $309 million (RMB 2 billion), and domestic Chinese vendors claim a combined market share close to 20%.9 Industry insiders project the trend to continue, at least in the cell culture media sector.

Table 2: Chinese Market Size and Market Share of Bioprocessing Supplies (in hundreds of millions of USD)

The Switch From Global Suppliers To Domestic Is Happening

The acceleration of the shift toward domestic suppliers in China was almost inevitable, given the massive market potential, rapidly growing economy, and demand for better healthcare. Some of the factors creating this shift include:

COVID-19, Demand Rise, And Supply Chain Stability

COVID-19 has boosted market demand for bioprocessing supplies, and it has also provided a path forward for domestic vendors in China’s biopharma industry. As a heavily regulated industry, biopharma developers are usually more cautious in shifting to domestic vendors that have little-known track records. Yet during the pandemic and subsequent lockdown, many MNC vendors had difficulties ensuring stable supply chain and lead times, as the majority of their products have to be imported into China. End users in China complained that they couldn’t get supplies on time, and sometimes the lead time for certain supplies of high-frequency use (single-use supplies, filter, etc.) could be over a year, making it almost impossible to manage inventory. Many end users realized that they would have to have a backup option that would often offer a much shorter lead time and better supply chain stability. As a result, they added supplies from domestic vendors into their procurement platforms for trial use. Quite a few domestic vendors stood the test and have now become a more mainstream option for end users in China.

Volume-Based Procurement (VBP) And Cost Control Pressure

As more domestic biopharma developers enter commercial scale, they naturally become more cost sensitive compared to the R&D and early clinical stages, where the focus is on speed of development. The ongoing volume-based government procurement program is trying to lower drug prices, which has made cost control a greater concern. And this makes lower-cost domestic vendors more attractive.

For example, Sintilimab from Innovent Bio, the first PD-1 mAb to enter the national drug reimbursement list, was hit with a price reduction of 64% ($41,000 to $15,000 per year, or RMB 270,000 to 97,000 per year). Before the volume-based procurement program, cell culture media (CCM) comprised 12.5% of total mAb manufacturing costs and manufacturing costs comprised 15% of total revenue, making CCM costs only 1.9% of total revenue.10 After the VBP program, with drug price reductions of 64%, manufacturing costs comprise 42% of total revenue and CCM costs make up 5.3% of total revenue. If the VBP program reduces drug prices by 80%, costs will comprise 75% of total revenue and CCM costs will hit nearly 10% of total revenue. This very significant profit margin reduction will impact vendors, and these cost controls will increase the interest in shifting toward domestic vendors.

More Timely Service

Domestic vendors are also known for more timely service. Their after-sales service team in some cases can be easier to reach. They can also work on weekends when necessary, which is a practice most MNC vendors do not follow.

Policymakers Push For Domestic Substitution

Policymakers in China also want to see more domestic substitution taking place in bioprocessing supplies, especially for those supplies for vaccine production. China has a long history of endorsing a self-reliance policy, and the COVID-19 pandemic demonstrated the effects of a weak supply chain. Trade wars have made policy makers and end users more aware of supply chain security issues.

In October 2020, the 13th Standing Committee of the National People’s Congress passed the Biosecurity Act, which emphasizes that municipal governments should support research and development for key technology/products. In May 2021, the Shanghai municipal government also announced plans to sponsor innovative drugs as well as advanced medical equipment and the bioprocessing supplies industry. Municipal governments are supporting domestic bioprocessing supply vendors by providing access to cheap land, bank loans, etc. As a result, we have seen more domestic growth, such as with OPM and Lepure starting new facilities in Shanghai and elsewhere. Policy makers are also urging the state-owned developers, mostly vaccine developers, to support domestic vendors in their procurement processes. However, there is no mandatory requirement for Chinese developers to purchase from domestic vendors.

Industry insiders have no consensus as to how far this wave of domestic substitution will go, whether it is a direct effect of the pandemic, and whether supply chain disruptions will return to favoring global vendors in the future. Some think that with domestic price advantages, global vendors will lose significant market share in single-use bags, media, etc. Others do not agree, as they see these global companies also taking steps to manufacture locally to help solve the supply chain issues in the event of another disruption. Time will tell whether the pandemic’s impact on supply patterns in China are transient or permanent. However, it is virtually assured that the trend toward domestic supplier growth and domestic substitution will continue.

References

- Top1000bio.com, BioPlan Associates, Inc. Global database of bioprocessing facilities, Rockville, MD, USA (see www.top1000bio.com)

- “Lechun Bio-Lingang Factory is officially in operation!” Dandelion Forum Press release. April 2021.

- “Zhangjiang little giant Optima Bio: Committed to solving the stuck neck problem on the tens of billions track”. Sohu.com, September 2021

- “Optima completes 100 million RMB Series C financing.” Yibang Power Network. March 2020.

- Newseed. September 2021.

- “Nanomicro Technology was successfully listed today: the opening rose by more than 1000%, and the latest market value is about 36 billion yuan.” Sohu.com. June 2021.

- “WuXi Biologics takes 300 million yuan in control of Burgron, a purification filler company, to accelerate the layout of the entire industry chain.” Sohu.com, December 2019.

- He, Juying. “Consumables of the Biopharmaceutical Industry Chain Series Report: Workers must first sharpen their tools if they want to do well”. CITIC Construction Investment Time, August 2021.

- Analysis of Cell Culture Media Market in China, Guo Shuang, Qiang Yun Capitol, https://zhuanlan.zhihu.com/p/186213004

- BioPlan Internal Study, with various industry experts

About The Authors:

Vicky Qing Xia is project director at BioPlan Associates. She has an MS in biology from the University of Texas-Houston and an MBA from the University of Pittsburgh. She has experience in consulting and business development, as well as alliance management in China’s biopharmaceutical industry. Her expertise includes developing research and analysis on multiple global market segments, and she has managed a team of industry experts and projects.

Vicky Qing Xia is project director at BioPlan Associates. She has an MS in biology from the University of Texas-Houston and an MBA from the University of Pittsburgh. She has experience in consulting and business development, as well as alliance management in China’s biopharmaceutical industry. Her expertise includes developing research and analysis on multiple global market segments, and she has managed a team of industry experts and projects.

Leo Cai Yang, project manager at BioPlan Associates, has business development experience in the biotech and pharma segments and 10 years of experience in market research. He graduated from East China Normal University with a bachelor’s degree in biotechnology in 2006 and has worked with equipment manufacturers in the pharmaceutical and medical device industries in Switzerland, Austria, and Germany. He has also served as project manager for studies involving new biopharmaceutical technology applications in China, including analysis and strategy development.

Leo Cai Yang, project manager at BioPlan Associates, has business development experience in the biotech and pharma segments and 10 years of experience in market research. He graduated from East China Normal University with a bachelor’s degree in biotechnology in 2006 and has worked with equipment manufacturers in the pharmaceutical and medical device industries in Switzerland, Austria, and Germany. He has also served as project manager for studies involving new biopharmaceutical technology applications in China, including analysis and strategy development.