Cell & Gene Therapy Bioprocessing: Demand For Better Process Control, Expertise & CMOs

By Ronald A. Rader and Eric S. Langer, BioPlan Associates, Inc.

Manufacturing capacity for both cellular therapies and gene therapy viral vectors remains in short supply. From our research, including interviews with developers, there is a current and worsening capacity crunch. BioPlan Associates, Inc. annually surveys biopharmaceutical manufacturing professionals and publishes data on capacity and other industry concerns.1 The survey, now in its 18th year, includes 147 end users’ responses and also provides input from 101 suppliers/vendors worldwide. This year, we find that the industry continues to demand innovative solutions from its suppliers in key areas, but these can often be slow to develop.

Manufacturing capacity for both cellular therapies and gene therapy viral vectors remains in short supply. From our research, including interviews with developers, there is a current and worsening capacity crunch. BioPlan Associates, Inc. annually surveys biopharmaceutical manufacturing professionals and publishes data on capacity and other industry concerns.1 The survey, now in its 18th year, includes 147 end users’ responses and also provides input from 101 suppliers/vendors worldwide. This year, we find that the industry continues to demand innovative solutions from its suppliers in key areas, but these can often be slow to develop.

Bioprocessing: Current Status

The development and markets for cellular and gene therapies are just getting started, but already problems can be seen in terms of manufacturing at insufficient scales and with insufficient manufacturing capacity available.

Although there have been a few approvals of new cell and gene therapy products, these have generally been for rare or even super-orphan diseases. At present, most of the pipeline products being manufactured remain autologous (customized for individual patients), with some allogeneic (multiple patient doses manufactured per batch).

There are over 1,000 of these products currently in clinical trials, so there is a healthy pipeline, and these markets are expected to grow rapidly. But these sectors, including at R&D scale, are growing faster than bioprocessing capacity, supply, infrastructure, and training can keep up with.

Illustrating the rapid growth in cell and gene therapy, BioPlan has projected that cellular and gene therapy manufacturing capacity will need to increase significantly, relative to current capacity, over the next five years to keep up with clinical manufacturing demand. Although current capacity requirements for cell and gene therapies are relatively small (compared to mainstream biologics, such as mAbs), there is nonetheless around a 5x shortfall in capacity, (5x current capacity would be expected to be used if available), especially from CMOs. This has created production bottlenecks and delays in pipeline development.

Problems inherent with both cellular and gene therapies manufacturing often stem from the fact that relatively few patient treatments are manufactured per batch.

For gene therapies, large numbers of gene therapy viral vectors are currently needed for effective treatments. Viral vectors can currently be manufactured at larger scales than cellular therapies, but with most vectors being defective (non-functional), even 2,000 L bioreactor output can commonly only treat tens or maybe a few hundreds of patients per run or batch. In contrast, a 2,000 L bioreactor running at just 3 g/L can produce 6 kg/run, and, presuming this is a monoclonal antibody with a high dosage of 100 mg, a single 2,000 L run can make 60,000 doses. Unless cellular/gene therapy bioprocessing technologies see process optimization progress soon, there will be problems meeting patient demand if these products are to be used to treat other than rare and orphan diseases.

The state of much cellular therapies bioprocessing remains rather basic, including:

- most every bioprocessing operation is manual, such as manual pipetting;

- use of open systems remains common (e.g., use of vented safety cabinets);

- very few platform processes are in use;

- there is great diversity and little consistency in the bioprocessing being used;

- limited equipment has yet been customized for cellular therapies; and,

- automation is lacking (discussed below).

Further, even with allogeneic manufacturing (a single batch treats multiple patients) of cellular products expected to become more more common (vs. autologous individualized manufacturing), only a limited number of patient treatments will be able to be manufactured.

Gene therapy viral vector bioprocessing is currently much more advanced than cellular therapies, because viral vector manufacture is rather similar to mainstream recombinant manufacturing, including using common closed single-use systems. Mammalian cell culture production of adenoassociated (AAV) or other viral vectors uses most of the same bioprocessing steps and equipment as mainstream bioprocessing at small through large scales. Gene therapy viral vectors, compared to cellular therapies, remain much easier to manufacture at larger scales, with a few facilities having scaled up to 1,000- to 2,000-L bioreactors. However, overall, with the great majority of viral vectors from cell culture being incomplete or otherwise functionally defective, much as with cellular therapies, the only option for treating larger numbers of patients will be to scale out, adding process lines and facilities running in parallel, not scaling up.

To illustrate the relative early state of cellular and gene therapy bioprocesing, the following data show results from a new survey question added this year asking “How do you expect to commercially manufacture your [cellular or gene] therapies?”

Table 1: 18th Annual Survey responses concerning “How do you expect to commercially manufacture your [cellular or gene] therapies?”

|

Technology |

Desktop, <30 L |

30-90L |

100-499 L |

≥500 |

|

Cellular therapy |

20.0% |

21.3% |

21.3% |

20.0% |

|

Gene therapy |

15.8% |

22.4 |

22.4 |

25.0% |

With only 20 to 25% even planning to commercially manufacture at >500 L scale, this shows the extent to which cellular and gene therapy developers are currently self-inhibited, setting low targets for production volume, with current products being developed to treat small numbers of patients. So far, the great majority of gene therapy developers are working at most at 200 or 500 L scales, with a few having scaled up to 2,000 L bioreactors. A minority, fewer than half of respondents, expect to commercially manufacture their products even at ≥100 L scale. But with even 2,000 L often only producing enough vectors for hundredss (or few) patients, gene therapy is like cellular therapy, and manufacturing will similarly need to be scaled out, with many production lines running in parallel at facilities worldwide. Considerable scaling out will be the general approach to cellular and gene therapy commercial manufacturing, as only 15% cited expecting to have a “single worldwide facility.”

What’s Needed In Bioprocessing?

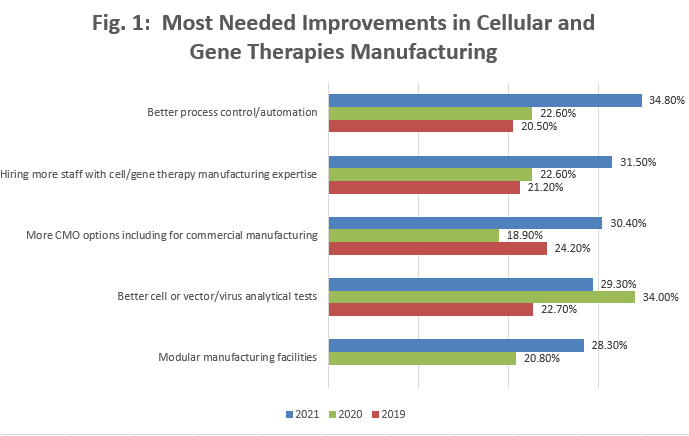

Of course, more capacity is needed – more process lines and facilities. But there are many needs involving the bioprocessing. Results from asking survey respondents to select what improvements (in systems, platforms, infrastructure, etc.) are “most needed in cell and gene therapy manufacturing” are shown in Figure 1. The current topmost cited selections are shown, along with results from 2019 and 2020 showing a trend for increases in the top-cited needs.

Figure 1: Selected options: 18th Annual Report, “Most Needed Improvements in Cellular and Gene Therapies Manufacturing”

This year, 2021, the top six most cited responses were:

- Better process control/automation

- Hiring more staff with cell/gene therapy manufacturing expertise

- More CMO options, including for commercial manufacturing

- Better cell or vector/virus analytical tests

- Modular manufacturing facilities

- More CMO options, including for clinical manufacturing

These top responses, in many respects, were related either to needs for better knowledge (automation, manufacturing expertise, analytical testing) or more manufacturng capacity (more CMO options for clinical and commercial manufacturing, more modular facilities). Note: the need for CMOs is cited twice, for both commercial and clinical manufacturing.

The top three most cited needs are each briefly discussed below.

Better Process Control/Automation

As survey responses show, automation is the most needed improvement in cellular and gene therapy bioprocessing. In fact, it is hard to envision much of a long-term future market for cellular products, unless much more automation can be applied to enable manufacture of larger batches that can be applied to larger markets, including moving to allogeneic from the currently predominant autologous products manufacturing.

Automation is particularly needed to provide a digital record of manufacturing (increasingly demanded by regulators); support more consistent and better standardization of this bioprocessing; increase speed of process development and commercial products manufacturing; lower manufacturing costs (critical); and support PAT, QbD, and other bioprocessing quality improvement programs. Currently, it is not uncommon for a cellular therapy to require man-weeks of manually processing cells to manufacture a single patient’s treatment.

Even with efficient platform processes, extensive automation will be needed to support commercial manufacturing, particularly if cellular therapies will ever treat other than rare or orphan diseases.

Despite generally using common equipment and processing, viral vector manufacturing, like cellular therapies, needs readily adoptable/adaptable manufacturing platform technologies, and, in addition, is lacking automation. This includes sensors and instrumentation. For example, how does one measure viral vector quantity and production in real time, determine the number and portion of fully formed and functional vs. defective vectors, etc.?

More Staff And Expertise

As also reported in the annual survey, hiring of staff, particularly those with desired manufacturing-related expertise, is becoming much more difficult. Considerable specialized knowledge is generally required to work with cellular or gene therapies. Particularly with celluar therapies, with all the manual manipulations involved, developers concede that they must generally use overqualified personnel, e.g., Ph.D.-level, for nearly all the bioprocessing. Knowledgeable and experienced staff are the single most critical asset for any biopharmaceutical developer or manufacturer, particularly in such new and fast-growing areas.

Biopharmaceutical manufacture is specialized, is not taught in universities, and requires hands-on experience. Staff with experience with cellular therapies and viral vector manufacturing remain scarce, with the trend for scarcity relative to need expected to increase dramatically as these sectors grow.

Already, companies moving into these areas, both developers and CMOs, are competing for a very limited pool of experienced workers. Some companies (the smarter ones) recognize the critical need for staff expertise and apparently are “banking” relevant staff, hiring them as soon as possible, often even before facilities for them to work in are online. This is done defensively, knowing that if not done, competitors will surely grab those most knowledgeable and/or with hands-on expertise and that development programs are worthless without staff with relevant expertise.

More CMOs

So far, relative to demand, there are few CMOs offering significant cellular and/or gene therapy bioprocessing services. More CMOs are entering the field and the number and intensity are expected to ramp up in coming years as more cellular and gene therapy products enter world markets. CMOs are particularly needed to provide cellular and gene therapy bioprocessing services, with this by far the preference within industry.

For example, BioPlan research has shown that ≥90% of cellular and gene therapy developers would much prefer to outsource all or most of their product manufacturing, both clinical and commercial. However, the shortage of CMOs with relevant capacity and staff expertise has increasingly been forcing an growing number of developers to decide to manufacture internally, with the CMO option simply not practical. This includes the average wait times for CMOs to start new cellular/gene therapy projects now ≥18 months. An increasing number of companies are booking blocks of CMO time and capacity starting even years in the future.

Currently, it is product developers, not universities, CMOs, or others, that have developed and possess most cellular and gene therapy bioprocessing technologies, with relatively few sharing or even selling/licensing their proprietary technologies. As in most new pharmaceutical areas, most product developers are smaller companies, with few having the facilities and knowledgeable staff needed to do their own bioprocessing, particularly at GMP. These companies effectively have no option other than to use CMOs.

And most of the largest players would also much prefer to outsource their cellular or gene therapies manufacturing to CMOs, leaving the time- and investment-intensive development of the related specialized faciilties, expertise, bioprocessing platforms, etc. to others.

Besides needing to develop more capacity and various options (cited above) that are currently missing or in shortage, CMOs are needed in these sectors to select among and further refine existing technologies and transfer these to clients. This includes CMOs needing to adopt developer/client company platforms, developing their own technologies, and more widely offering, licensing, transferring, and supporting more advanced bioprocessing.

References

1) Langer, E.S., et al., Annual Report and Survey of Biopharmaceutical Manufacturing and Capacity, 18th annual, BioPlan Associates, April 2021 www.bioplanassociates.com/18th .

About The Authors:

Ronald A. Rader is senior director of technical research at BioPlan Associates, Inc. He has 35+ years’ experience as a biotechnology and pharmaceutical — particularly biopharmaceutical — information specialist, analyst, and publisher, and he has been responsible for the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets, and the Biosimilars/Biobetters Pipeline Directory. You can reach him at rrader@bioplanassociates.com or (301) 921-5979.

Ronald A. Rader is senior director of technical research at BioPlan Associates, Inc. He has 35+ years’ experience as a biotechnology and pharmaceutical — particularly biopharmaceutical — information specialist, analyst, and publisher, and he has been responsible for the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets, and the Biosimilars/Biobetters Pipeline Directory. You can reach him at rrader@bioplanassociates.com or (301) 921-5979.

Eric S. Langer is the president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD, in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. You can reach him at elanger@bioplanassociates.com or (301) 921-5979.

Eric S. Langer is the president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD, in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. You can reach him at elanger@bioplanassociates.com or (301) 921-5979.