Cell & Gene Therapies: How Can Our Knowledge Of 2023 Inform Our Predictions For 2024?

By Carl Schoellhammer, DeciBio Consulting

The cell and gene therapy (CGT) boom sparked by the pandemic is a distant memory. Lowered valuations, pipeline cutbacks, and a withering 2023 created stormy seas. Could we finally be witnessing a break in the clouds with brighter times ahead? Let’s dissect the industry and make our predictions for what 2024 holds for advanced therapies.

Facing a colossal > $300B in revenue with near-term loss of exclusivity, the pharmaceutical industry is looking to advanced therapies to help fill the impending gap. Large pharma is now fully immersed in cell and gene therapy, with diverse development programs scattered across pipelines. Collaborations with mRNA leaders exploring next-generation gene therapy applications (e.g., Eli Lilly purchasing opt-in rights to Verve Therapeutic’s programs from Beam Therapeutics) further highlight the industry’s evolution. Despite a weak macroeconomic environment and subdued activity in 2023 (as anticipated) with the sector “heads-down” focusing on maturity, 2024 promises a potential turnaround. Let’s explore each modality’s prospects.

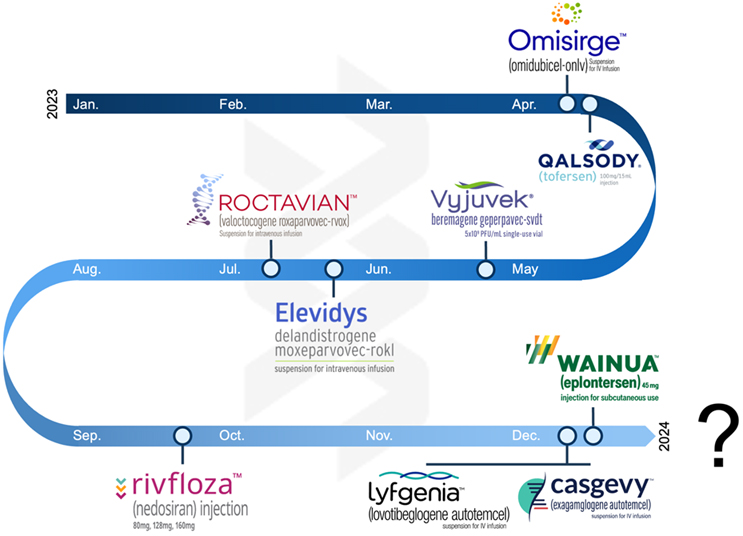

Figure created by Carl Schoellhammer

Oligos And mRNA Forge Ahead With Approvals, Innovation, And Alliances

In the oligo arena, 2023 saw a handful of approvals for rare disease indications, including Rivfloza (Novo Nordisk), Wainua (Ionis Pharmaceuticals/AstraZeneca), and a surprise nod for Qalsody (Ionis Pharmaceuticals/Biogen), which rebounded from a Phase 3 miss. M&A was quiet, as expected, with Novartis’ acquisition of DTx Pharma standing out.

2024 should be livelier across the board. We expect to see several approvals and BLA filings, including approval of Ionis’ Olezarsen. While we do not expect many acquisitions, those companies with differentiated delivery technology (à la Novartis-DTx) and cash-flush pharma companies that are feeling left out of this space, are the exceptions.

mRNA is in a different place as a modality. On paper, the pipeline is heavily focused on vaccine applications for both infectious disease and cancers. Under the surface, however, companies are pushing boundaries. Exploring gene modulation beyond vaccines — embracing insertion, knockout, epigenetic strategies, CRISPR, and prime editing — reveals a dynamic landscape.

While this work is far from the clinic and even further from approval, we expect to see considerable investment and new company formation. Expect to also see partnerships and collaborations with large pharma entering the fray as these companies achieve various proof-of-concept points. Tool development, particularly around better assays, and analytical techniques to assess activity, potency, and durability, also will be a key focus. Companies offering novel starting materials including plasmids and templates also will attract attention from large strategics. As respondents in our 2024 new year’s survey resoundingly declared, brace yourself for mRNA’s data readouts and the entry of large pharma.

Cell Therapies See A Sharpened Focus

In 2023, cell therapies carved out a robust niche. We witnessed, as we predicted, three new product approvals (Casgevy, Lyfgenia, and Omisirge — Casgevy representing the world’s first product utilizing CRISPR-based editing) and continued pipeline development. The sector also has continued its shift beyond oncology, making strides in inflammation and immunology. A significant portion of companies now sport pipeline candidates for indications beyond oncology, which started as the primary application for cell therapies mere years ago.

We also saw a maturing tools landscape with considerable focus on CMC, analytical methods, and assays to define potency and activity of products. This aligned with our predictions from last year and what we covered in detail throughout the year here and in our cell therapy manufacturing market report. ElevateBio and Cellares secured hefty funding rounds, while acquisitions, such as Sartorius snagging Polyplus, underscored the vitality in tools and reagents.

In 2024, we anticipate a heightened emphasis on tools, assays, and bioprocessing in the cell therapy arena. Service providers and CDMOs will continue to bulk up their novel, differentiated offerings through acquisition. This is in parallel with a regulatory environment that we believe will be taking a closer look at cell therapies given the notice late last year around T cell malignancies. There also will be greater institutionalization of the distributed manufacturing model, leveraging what we call “constellations” of centers located near (not within) clinics.

Investment in applications beyond oncology will persist, potentially triggering new acquisitions as companies position themselves in emerging indications. Simultaneously, the field will diversify beyond T cells to novel cell types such as NK cells. We do expect some headwinds, however, with respect to how broad this modality can go. While the risk-reward calculation is clear in late-stage cancers, challenges may arise in immune-related diseases. Hence, 2024 could see industry focus on manufacturability and scalability, ensuring these groundbreaking therapies reach a broader patient base in previously approved indications.

Viral Gene Therapies Navigate The Winds Of Change

Viral gene therapies are in a state of flux. Proven for in vivo delivery of genetic payloads to diverse targets, persistent concerns about immunogenicity, redosability, safety, and commercial viability linger in the backdrop. 2023 saw the approval of Roctavian and Elevidys, as expected. It also saw continued paring of pipelines to focus on those most viable treatments. While most of the year was relatively quiet, there were bright spots, including new company formation (Siren Biotechnology) and partnerships (SpliceBio working with Spark and 4DMT working with Astellas). However, the specter of potential safety concerns looms large, aggravated by the concurrent ascent of mRNA as a formidable non-viral gene therapy contender. The field now stands at a pivotal juncture, compelled to address these challenges head-on, focusing intently on safety protocols, manufacturability, and the standardization of potency and titer assays.

So, what lies on the horizon? We anticipate a robust concentration on novel uses of AAV, leveraging its proven ability as a delivery vehicle. Expect to see investment in splicing capabilities, dual vector strategies, and other methodologies to circumvent payload limitations. Manufacturing tools also will take the spotlight, with a particular emphasis on refining separations technologies and optimizing producer cell lines to achieve high titers of pure product. Finally, on the pipeline front, we expect to see at least two new approvals, including Pfizer’s Beqvez (just approved in Canada); Janssen’s (ex. MeiraGTx) botaretigene sparoparvovec; and RegenxBio/AbbVie’s wet AMD candidate, RGX-314, with continued paring and refocusing of pipelines on financially viable products.

In the dynamic realm of cell and gene therapy, 2024 promises to bring innovation, resilience, and transformative strides. As the industry embraces tools, ventures beyond traditional territories, and sharpens its focus on manufacturability, we’ll be eagerly watching as these groundbreaking therapies potentially reach new heights.

About The Author:

Carl Schoellhammer leads DeciBio’s advanced therapies practice. He has experience across biopharma, manufacturing/bioprocessing, and supply chain considerations. He has executed on projects related to pipeline prioritization and life cycle management, indication road mapping, growth strategy, and M&A, across healthcare, life science tools, and pharma (cell and gene therapies). Previously, he co-founded and led Suono Bio, a therapeutics startup. Schoellhammer holds a B.S. from the University of California, Berkeley, and a Ph.D. from MIT, where he trained with Prof. Robert Langer.

Carl Schoellhammer leads DeciBio’s advanced therapies practice. He has experience across biopharma, manufacturing/bioprocessing, and supply chain considerations. He has executed on projects related to pipeline prioritization and life cycle management, indication road mapping, growth strategy, and M&A, across healthcare, life science tools, and pharma (cell and gene therapies). Previously, he co-founded and led Suono Bio, a therapeutics startup. Schoellhammer holds a B.S. from the University of California, Berkeley, and a Ph.D. from MIT, where he trained with Prof. Robert Langer.