Biosimilars Paving The Way For Cost-Effective Bioprocessing

By Ronald A. Rader and Eric. S. Langer, BioPlan Associates, Inc.

As biosimilars finally move into mainstream commerce in the world’s major (bio)pharmaceutical markets, they are bringing with them some side benefits. Because biosimilars generally need to be manufactured cost-effectively, their sponsors frequently focus resources on production technologies that generate higher productivity and yields. Some of these cutting-edge technologies are applicable to mainstream pipeline biologics, so future biopharmaceuticals will benefit from this push for efficiency.

As biosimilars finally move into mainstream commerce in the world’s major (bio)pharmaceutical markets, they are bringing with them some side benefits. Because biosimilars generally need to be manufactured cost-effectively, their sponsors frequently focus resources on production technologies that generate higher productivity and yields. Some of these cutting-edge technologies are applicable to mainstream pipeline biologics, so future biopharmaceuticals will benefit from this push for efficiency.

This trend is advancing as biosimilars are being approved in the U.S. We expect the U.S. to be the major biosimilars market, as multiple biosimilars have received FDA approvals. Projections by industry observers and analysts regarding the expected size of the U.S. and world markets for biosimilars vary greatly, from a few tens of millions of dollars to a few billion dollars today. Many major variables that will shape the markets remain unresolved, particularly in the U.S., and these will shape the future market potential. For example, there are no precedents for interchangeable biosimilars. Further, biosimilars are evolving and becoming less standardized globally, and some countries’ regulations are becoming more unique over time. But over time, biosimilars will take a good portion of the current innovator products’ approximately $200 billion per year biopharmaceuticals market, and we expect to see sales of tens of billions of dollars per year in seven to 10 years.

There will be a large number of products, players, and much competition. The Biosimilars/Biobetters Pipeline Database reports over 850 “biosimilars” in development worldwide, including about 40 percent targeted for initial approvals in major markets, and most biosimilar manufacturers planning to eventually sell in major markets.1 These “biosimilars” include about 300 biogenerics (non-rigorously tested, non-GMP manufactured “biosimilars”) currently in lesser- and non-regulated international markets.

Within just five years, with several hundred biosimilars in major markets, biosimilars will outnumber innovative products. For most current blockbuster biologics, it is reasonable to expect at least 10 biosimilars to eventually enter the market. For example, Humira, which now has annual sales over $14 billion, has nearly 50 biosimilars in various stages of development. For this product, a biosimilar needs to attain just a fraction of the current revenue to, itself, be a blockbuster product.

Why Must Biosimilars Be Cost-Effectively Manufactured?

The unknown nature of future biosimilar competition (which products? from whom? when?), potentially including radical discounting of prices, makes lowest cost-effective manufacture of biosimilars a necessity. And, there is increased pressure for non-biosimilar manufacturers to follow and seek the most cost-effective manufacturing. Low(est) biosimilar manufacturing costs are needed to provide more latitude for discounts and profitability. And there will likely be spoilers: companies willing to sell at disruptively low prices. For example, the owners of a smaller developer might see more value in gaining FDA approval, likely resulting in stock valuation increasing by tens of millions of dollars or even more than $100 million, versus being concerned with actual sales. And, developers may forsake profits on specific biosimilars to establish a stronger overall presence in major markets or round out their product portfolios.

Lowest bioprocessing costs are required to compete effectively while still being profitable as prices are discounted. The future marketing mix includes an increasing diversity of product types, all competing against each other – legacy reference products, biosimilars, biobetters, and other new and old pharmaceuticals targeting the same indications. In major markets, biosimilars need to cost significantly less than their reference products, with biosimilars still perceived as second-rate and best-avoided, much like generic drugs. A 25 to 30 percent discount upon launch is currently common, but 50 percent or even more will be likely as competition increases. While price discounting is not expected to hit the 90 percent typical with generic drugs, even just-above-50-percent discounts will be a shock for the biopharmaceutical industry. In this context, the costs of manufacturing and bioprocessing become more important.

However, the costs of biopharmaceutical manufacturing vary greatly, depending on the bioprocessing platforms and facility. Over years, many reference product manufacturers have attained the current lowest costs for manufacturing. Reference product manufacturers generally have the benefit of more than 20 years of product manufacturing experience, enjoy significant economies of scale (from supplying the world market), and generally have the largest-scale stainless steel-based facilities that have long been fully paid for and been incrementally improved over the years (keeping up with new technology). And these companies often already market a follow-on product. So, the reference product manufacturers have considerable latitude to meet biosimilars’ discounting (although there is generally no reason for them to be the lowest-price product). So, biosimilars need to be manufactured at low costs to compete effectively and be profitable, even with significant price discounts.

Current Lowest Costs for Manufacturing

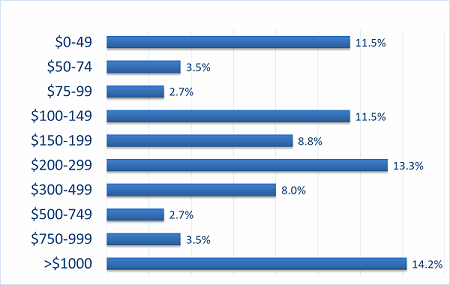

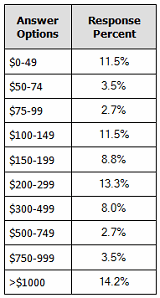

Our recent 14th annual survey of 227 biopharmaceutical manufacturing professionals found the average cost for recombinant protein manufacture to be $307 per gram.2 (See Figure 1.) Although we note there is a bimodal distribution for some outliner products (very low- and very high-cost), it can be seen that average costs are in the $300 per gram region.

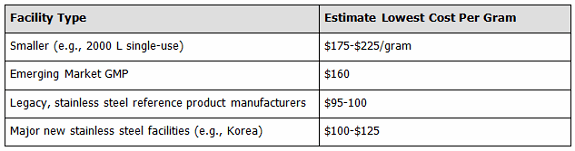

Figure 1: Distribution, average $ cost per gram for recombinant protein, 2017

In a separate study we examined lowest costs reasonably attainable at different types of facilities, presuming ≥100 kg per year monoclonal antibody manufacture (see Figure 2). The lowest costs, ≤$100 per gram, are typically being attained by those operating the longest at the very largest scales — the legacy, fully paid for, multi-10,000 L bioreactor-anchored facilities of Big (Bio)Pharma companies, with many now making the same reference products for decades. They were very closely followed by the new Korean supersized facilities — Celltrion and Samsung. Contrary to presumptions of many, the lowest costs are not attainable in developing countries, including India and Asia, with many hidden costs involved, including management considerations, quality systems, equipment, and culture media being imported with high customs duties, etc.

Figure 2: Summary of lowest facility manufacturing costs, by facility type (assuming a minimum mAb manufacture of 100 kg per year)

These are the lowest/best, not average, costs for manufacturing. Our analyses have also found that a majority of bioprocessing professionals are often satisfied attaining ≤$500 per gram cost of mAb manufacture, with even low-$1,000s per gram considered acceptable (e.g., in the context of single doses often costing $1,000s).

Get an inside look at changing regulations, approvals, uncertainties, and opportunities to shed light on how your biopharmaceutical business should best adapt its approach in this webinar:

Biosimilars: Preparing For Opportunities And Challenges

To attain such low costs, bioprocessing must generally be fully optimized, from start to finish, including each unit process. Related to this, biosimilars targeted to major markets, all being new products, are almost all being manufactured using current, more efficient, not legacy, technology and equipment. Nearly all biosimilars are being manufactured using single-use systems, but with some established product manufacturers using their big vats for biosimilar manufacture and a few midscale stainless steel multi-product facilities coming online. Cost-wise, stainless steel remains unbeatable by single-use at the largest commercial scales, but these scales are rarely applicable for biosimilars. Another factor pushing most biosimilar manufacturers to single-use (versus stainless steel), besides it being more cost-effective at all but the largest scales, is the need for biosimilar manufacturing facilities to be flexible, supporting commercial manufacture of multiple products, usually other biosimilars.

Bioprocessing productivity, particularly upstream titers, have improved and will continue to do so incrementally, while downstream yields remain largely unchanged. The recent BioPlan survey found the average titer being attained for commercial manufacture to be 2.80 g/L. As other BioPlan research has shown, almost every reference products’ bioprocessing has been periodically updated, such that reference products are likely now all being manufactured at >2 g/L or other healthy upstream titers, while most started their manufacture back when titers of a few 100 mg/L were the best attainable. Average late-stage clinical production titers, indicative of the titers when these products will enter the market, are now 3.29 g/L. But with downstream processes reported by survey respondents to very commonly be their manufacturing bottleneck, expected further improvements in titers may not result in much or any significant overall improvement in productivity, besides higher titers potentially causing problems such as particulate formation.

Paradoxically, smaller players tend to be satisfied with less bioprocessing optimization and higher costs due to lack of resources to fully optimize their bioprocessing. Those with the largest established capacity, and the biggest cost advantages, can more aggressively seek cost savings through bioprocessing optimization. If a company can save just $50 per gram on 1,000 kg (2,200 lb.) or 1 million grams per year, that equates to $50 million per year, likely >$500 million over the life of the product. We do note, however, that saving $50 per gram may be trivial in the context of markups where sales price may be $1,000 per dose or more.

Optimizing biosimilar manufacturing costs is critical for all biosimilar players and, as more products enter the market, costs of manufacturing will increasingly become a determinant in setting biosimilar discounts and price floors.

References:

- Rader, R.A., Biosimilars/Biobetters Pipeline Directory, Biotechnology Information Institute, at www.biosimilarspipeline.com.

- 14th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, BioPlan Associates, Inc.: Rockville, MD, April 2017.

About The Authors:

Ronald A. Rader, senior director of technical research at BioPlan Associates, Inc. and president of the Biotechnology Information Institute, has 30+ years of experience as a biotechnology, pharmaceutical, and chemical information specialist/analyst. He is editor/publisher of the Antiviral Agents Bulletin, Federal Bio-Technology Transfer Directory, and BIOPHARMA: Biopharmaceutical Products in the U.S. Market (biopharma.com). Mr. Rader has also worked for companies including Porton International, Gillette, MITRE Corp., and Biospherics. You can reach him at (301) 921-5979 or info@bioplanassociates.com.

Ronald A. Rader, senior director of technical research at BioPlan Associates, Inc. and president of the Biotechnology Information Institute, has 30+ years of experience as a biotechnology, pharmaceutical, and chemical information specialist/analyst. He is editor/publisher of the Antiviral Agents Bulletin, Federal Bio-Technology Transfer Directory, and BIOPHARMA: Biopharmaceutical Products in the U.S. Market (biopharma.com). Mr. Rader has also worked for companies including Porton International, Gillette, MITRE Corp., and Biospherics. You can reach him at (301) 921-5979 or info@bioplanassociates.com.

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD, in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. You can reach him at elanger@bioplanassociates.com or www.bioplanassociates.com.

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD, in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. You can reach him at elanger@bioplanassociates.com or www.bioplanassociates.com.

Survey Methodology:

The 2017 Fourteenth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trend analysis from 227 responsible individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) in 25 countries. The methodology also included over 131 direct suppliers of materials, services, and equipment to this industry. This year's study covers such issues as: new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the major markets in the U.S. and Europe.