BioInsights reports on emerging protein chip market

Research indicates market could expand more than ten-fold in the coming years

Table of Contents

Protein chips defined

The players

Challenges and opportunities

Market assumptions and market model

With more than a dozen companies poised to enter the market, sales of protein chips are likely to balloon from $45 million in 2000 to almost $500 million in 2006, according to a new study by BioInsights of Redwood City, California. In its report, Protein Chips: The Race for High-Throughput Protein Analysis, BioInsights has identified and analyzed 20 companies that are likely to join current protein chip makers Biacore and Ciphergen to meet the strong demand for high-throughput analysis of proteins. BioInsights interviewed leading academic researchers and company representatives to provide the foundation for a comprehensive technology and strategy evaluation of the emerging players in the market.

Protein chips defined

A protein chip is a flat surface on which proteins or capture agents are immobilized. The key components of a protein chip system are:

- Surface chemistry—the chemical bonds that immobilize proteins or capture agents.

- Purified proteins—proteins used as probes to study interactions or expression levels.

- Capture agents—agents used to capture and quantify target proteins.

- Detection methods—methods used to detect proteins that bind to or interact with proteins or capture agents on the surface of chips.

The players

BioInsights identifies six companies with platforms either in the market or soon to be. In addition to Biacore and Ciphergen, this group includes HTS Biosystems, Phylos, SomaLogic, and Zyomyx. BioInsights identified twice as many companies in the early stages of protein chip development, including CombiMatrix, Dyax, Packard BioScience, and Proteome Systems. BioInsights also identified six leading academic research programs that deserve watching, including Joanna Albala's group at the Lawrence Livermore National Laboratory, Patrick Brown's group at Stanford University and Gavin MacBeath's group at Harvard University.

Challenges and opportunities

Presently, protein chip technology on the market is limited by low throughput and the lack of capture agents. The continued development of genomics and proteomics will only serve to drive the demand even more for high-throughput systems for analyzing proteins.

Unlike the situation with DNA, which is for the most part immutable, proteins are expressed in various forms and patterns of expression can be quite complicated and sensitive to small changes in the environment. In addition, post-translational modifications and the fact that some of the most interesting proteins are expressed at very low levels adds to the challenge of studying protein expression on chips. BioInsights reports that the success of protein chip companies depends on their ability to overcome technical hurdles, but that advances in technology are likely to make them successful. New surface chemistries have the potential to immobilize a wide range of proteins in their active conformations. New high-throughput methods for expressing and purifying proteins should help companies build vast libraries of recombinant proteins to place on chips. New capture agents will allow researchers to specifically bind and quantify target proteins. And the incorporation of proven detection methods should allow the development of reliable and easy-to-use systems. If all these technologies prove successful, BioInsights projects that the protein chip market will grow at a compound annual growth rate of 49% from 2000 to 2006.

Market assumptions and market model

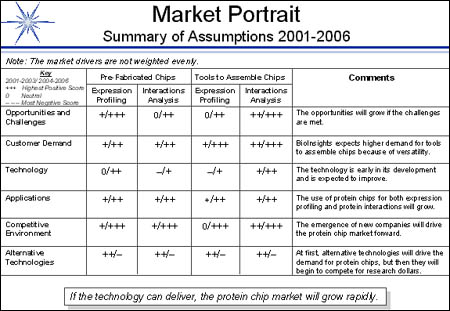

The report divides the protein chip market into two categories: (a) pre-fabricated protein chips, which according to BioInsights research represents a small portion of today's market, and (b) tools to assemble protein chips, which are currently preferred because of the versatility and "first mover advantage" that this approach provides. Each category is examined for effectiveness and likely success in two types of applications: (a) protein expression profiling, and (b) protein interaction profiling.

BioInsights then analyzes each category and application across six market drivers: (1) opportunities and challenges, (2) customer demand, (3) technology, (4) applications, (5) competitive environment, and (6) alternative technologies. From this, BioInsights derives a market model for the next six years, from 2000 to 2006.

Protein Chips: The Race for High-Throughput Protein Analysis is the fourth in a series of reports from BioInsights, a research and consulting firm that specializes in emerging technologies and markets in biotechnology and pharmaceuticals. For more information on this report and to request a table of contents, contact BioInsights at 650-701-0280 or at marketing@bioinsights.net.

Related articles:

Edited by Laura DeFrancesco

Managing Editor, Bioresearch Online

ldefrancesco@vertical.net

Source: BioInsights