Battelle Forecasts Significant Year 2000 Increase in R&D Spending

R&D Resurgence

Industrial Support

Outsourcing Growing

Major Trends and Conclusions

About Battelle

R&D Resurgence (Back to Top)

"A combination of situations has created what could very well be the continuation of a major resurgence in R&D support and activity in the United States," said Jules J. Duga, a Battelle senior researcher and co-author of the report. Industrial support continues to dominate both the amount and the growth of R&D spending with expenditures that are growing at a rate that significantly exceeds inflation.

Although total R&D investment stalled in the early 1990s, the anticipated increase in 2000 continues a pattern that had been suggested at the beginning of the decade. Furthermore, following recent significant increases in total R&D expenditures, and barring major economic downturns, the increase in 2000 is expected to continue a trend that will last into the 21st century, although the rate of growth may diminish slightly.

The turnaround in R&D spending follows the same patterns that had been observed in the early 1970s: a reduction in both government and industrial support for R&D followed by recovery and growth. However, the present trends are being more positively influenced by industrial actions, while government support for R&D continues at a level that is well below previous investments, never having recovered (in constant dollar terms) from the peak of 1988.

The continued growth of total R&D funding is largely the result of industry's growing realization that structural and operational changes are not the only road to profitability: A continued research investment is required for long-term survival.

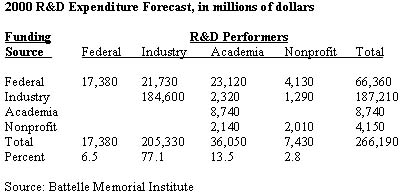

According to the report, federal spending will change very little—$66.4 billion R&D in 2000 vs. $65.9 billion spent in 1999. Industry, by contrast, will increase its R&D commitment, spending $187 billion in 2000—10% more than the $169 billion spent in 1999. The remainder of R&D support—more than $12.6 billion—will be provided by universities and other nonprofit organizations (most of which comes, ultimately, from taxes), representing a more than 6% increase over 1999 funding.

Government was once the dominant supporter of R&D, providing more than 50% of total funding, but by the end of 2000 Washington's R&D contribution will fall to about 25%. There is little indication that this trend will be reversed in the near future.

In fact, the federal budget continues to give very mixed signals about its support of R&D, with major differences between budget authorization and actual expenditures of funds. Although present budget initiatives promote optimism relative to R&D support, the balance between short-term tax revenue enhancement and long-term R&D actions will influence the amounts and character of federal investment.

Industrial Support (Back to Top)

Over the past few years, R&D support by private industry has been growing steadily and, in fact, to a greater degree than had been accounted for in earlier surveys. There are now clear indications that the recent stronger commitment will continue. While much attention continues to be paid to the relatively short-term payoff of all manner of investments, there is an abiding concern for the establishment and fostering of those activities which will provide the technology platforms of the future.

Growth in industrial funding can be attributed to factors that generally influence technological growth: improved sales, earnings, and stock prices, as well as expanding markets. As expected, the increases in industrial funding will not be uniform across all sectors. Significant increases are expected in electronic components, pharmaceuticals, office computing and accounting machines, and communications equipment.

Outsourcing Growing (Back to Top)

Continued outsourcing by industry is being driven by a number of considerations, not the least of which include costs, productivity, decreased overhead, and an emphasis on the need for on-time and on-budget deliverables. The decision to out-source has been influenced in no small way by the changing character of the corporate (or even business-line) research capacity. The downsizing of captive industrial laboratories—with the concomitant dedication to only those core competencies which are deemed to be absolutely essential for corporate survival—has forced the development of new relationships between the technology provider and the technology user.

Perhaps the most significant change is that which now treats research, development, science, and technology as commodities that are sought on a "just in time" basis, obtaining the output when it is needed and when it can be incorporated into operations. This is in sharp contrast to the "just in case" science and technology capability, an apt and distinguishing description of the former broadly capable captive laboratory.

As has always been the case, outsourcing will generally be pursued in the early stages of research that has an "exploratory" nature to it: not "exploratory" in the scientific sense of basic research, but more in the business sense, willing to make the front-end external investment in the development before committing to the longer-term investment in in-house capabilities.

The practice of widespread outsourcing can have its drawbacks, particularly as they apply to the development and maintenance of those capabilities that are truly thought of as supporting the core competencies and business thrusts of the corporation. Long-term planning of R&D requires close collaboration among various components of complex corporations, with consistent and well-understood strategic plans. To the extent that long-term corporate goals are dependent upon, or will be strongly influenced by, technological change, one can make the argument that the corporate research entity shall either have the internal capabilities to undertaken long-range programs, or have the capabilities to direct and orchestrate such focused research as performed by external resources. The need for continuity and the ability to integrate research findings suggests that a strong wholly owned corporate research facility be maintained. Lacking that, a strong "virtual corporation" must be established, albeit with the risks associated with a lack of control predictability.

Major Trends and Conclusions (Back to Top)

- Industrial support of R&D will continue to increase, rebounding from a combination of cost-cutting and organizational structure modifications, and benefiting from the recent strong expansion of the national and international economy. However, significant upheavals in foreign economic or political stability could influence U.S. business positions and have an ancillary effect on R&D funding.

- Industry will continue to emphasize various forms of partnering and collaborations, including relationships with other industry, federal laboratories and offshore facilities. Such partnering will most likely concentrate on those aspects of basic and applied research which are necessary for the establishment of stronger platforms for future technology growth.

- The battles over the federal budget will continue to dominate, with major impacts on R&D through the negotiations within the bounds of discretionary spending. While increased revenues arising from a strong economy may alleviate some of the stress, there will likely be a movement toward reduction of national debt, reduction of taxes or bolstering the Social Security system. The use of surpluses to enhance R&D investment will not find broad support.

- The collaboration between industry and academia will proceed as a continuing experiment—in spite of the fact that there are many years of experience—emphasis will be on the manner in which the competing and sometimes conflicting goals of the two types of institutions can continue to be met. The trends that have been established over the past few years indicate that the U.S. R&D enterprise has worked its way out of its second peak-and-trough-and-recovery cycle in recent history. This latest move toward expansion in funding may be expected to last for several years, provided there are sufficient personnel available to pursue research careers.

"The shape of the R&D enterprise will continue to evolve, and the successful organization will seek both positions and procedures that will permit flexibility. No fixed recipe will suffice over the next decade," Duga said.

About Battelle (Back to Top)

Battelle focuses on technology and product development as well as commercialization. With 7,000 employees at more than 60 locations, Battelle develops technologies and products for industry and government. Annual revenues are approximately $1 billion.

For more information: Jules J. Duga, Senior Analyst, Battelle Memorial Institute, 505 King Ave., Columbus, OH 43201. Fax: 614-424-6512.

Angelo DePalma