An Approach And Checklist For Engineering Due Diligence In Pharma M&As

By Erich H. Bozenhardt and Herman F. Bozenhardt

The pharmaceutical industry has evolved dramatically over the past 40 years, constantly changing the manufacturing environment to accommodate products, processes, efficiencies, equipment development, and compliance. All of the companies have changed, and today they more frequently analyze their product portfolio, manufacturing business, and facility efficiencies to rationalize their manufacturing scheme. In addition, the steady rise of contract manufacturing firms has added another dimension to the pharmaceutical manufacturing equation, as those plants expand and renovate to attract and accommodate new manufacturing capability.

The pharmaceutical industry has evolved dramatically over the past 40 years, constantly changing the manufacturing environment to accommodate products, processes, efficiencies, equipment development, and compliance. All of the companies have changed, and today they more frequently analyze their product portfolio, manufacturing business, and facility efficiencies to rationalize their manufacturing scheme. In addition, the steady rise of contract manufacturing firms has added another dimension to the pharmaceutical manufacturing equation, as those plants expand and renovate to attract and accommodate new manufacturing capability.

The volume of mergers and acquisitions in our industry has created a continuous cycle of buying and selling of manufacturing plants. The decisions to buy or sell always come down to dollars and cents, but a stark awakening after the sale often brings a level of “buyer’s remorse.” The superficial price and apparent value never truly match up to what the buyer expected to purchase or to spend to renovate/remediate the “target” facility. This remorse happens later when the operating folks and quality assurance department physically move in and start up operations and begin the arduous task of tech transfer.

Pharmaceutical plants cannot be treated like real estate because of the intrinsic value of the architectural compliance, HVAC and “grade” compliance, utilities, and high-value equipment and its unified history of operational compliance. Pharmaceutical plants require a detailed assessment of where they are in “operational compliance and production readiness.” This is the core of our discussion and exploration of a methodology for providing a due diligence prior to an acquisition.

Rationale

Pharmaceutical plants can receive a “certificate of occupancy,” a clear title, and a clean coat of paint and yet be utterly useless, as well as a compliance, operational, and liability burden on the company. The key question to ask in any due diligence is whether the plant has the ability to accept a tech transfer of a product, complete the product validation, and, finally, to pass a PAI (pre-approval inspection) from the FDA.

As in all transactions, there is a selling party that wishes to sell as quickly as possible and for as much money as possible. Conversely, and different than in real estate, the buyer also wants a speedy transaction, and facility “delivery” is paramount, with price being the second priority. Herein lies the problem: With speed driving the transaction, coupled with the sales skills of the seller, many a facility transaction is not properly assessed by the buyer.

With speed being a major factor, every due diligence auditor feels immense pressure to wrap up the proceedings quickly. Knowing that everything included in the facility cannot be viewed and assessed, the focus must be on reviewing the facility as if it were a PAI and must be heavily weighted to the design engineering aspect.

Follow The Money

When faced with the due diligence on a pharmaceutical facility (from now on called the “target”), the auditor must work quickly and maintain control of the audit. The target personnel will assume this is more like a GMP audit and try to distract the auditor with SOPs, capability presentations, resumes, and office tours. The auditor does not have time for this and must come to the target site with an agenda of their own.

The following should set the tone and expectations of the due diligence:

- The acquiring organization will transfer its SOPs and practices to the target post-acquisition, so SOP review is not critical.

- Resumes and personnel are of no consequence at this point, as the nature of an acquisition will result in the turnover of personnel.

- Capabilities and future potential applications are valuable; however, the target is being selected and evaluated for a specific application, of which the auditor should be well aware.

- Office areas and the ability to scale personnel can be added inexpensively at any point in time.

- Non-classified areas, shops, and facilities are easily built at $150 per square foot and are not critical.

- A typical aseptic facility costs (gross number) about $1,000 per square foot, broken down as: 40 percent HVAC, 35 percent architectural, 25 percent piping and power. We need to first focus on the building, the architectural compliance with FDA/EU grades, HVAC systems (ISO 14644), and the electrical and control systems that support the building.

- The next step is the key operating equipment, specifically the large capital equipment that is not replaceable by SUS (single-use systems/disposables), such as isolators, autoclaves, lyophilizers, and packaging lines.

- The utility systems (WFI [water for injection], USP water, clean dry air, nitrogen, etc.) are not easily replaced and need to be in proven working order.

- The validation documents, while in themselves are easily replicated, tell a profound story of the equipment delivery, setup, testing, as well as the limits of the testing and the results.

- Finally, the maintenance records on the major equipment indicate the level of care, monitoring, and reliability.

Assessing The Facility And Equipment

The single most important activity in a due diligence is the physical inspection via walk-through of the entire operating area. This should be done with an architectural layout in hand and a camera to document the observations.

Architectural Layout

The essential aspect in the layout is to identify the flow path of the operators, equipment, materials in, product out, and the waste materials out. From there, the auditor must clearly see the following:

- Clear definition of CNC space and Grade D, Grade C, and Grade A/B spaces

- An airlock separating each grade

- Grades go from CNC to Grade A/B inward and from A/B to CNC outward

- Materials and equipment airlocks are separated from the personnel airlocks at critical grade changes into and out of processing suites

Make sure the operational paths are clear and can accommodate the traffic and that airlocks and hallways are not used as storage closets.

Architectural Finishes

While walking the internal processing and classified spaces, critical factors to notice and photograph are the wall, floor, and ceiling finishes. These quickly show the quality of construction and the quality of maintenance. The following are some key points to consider and document in the inspection:

- Floors should be a monolithic epoxy terrazzo or epoxy polymer system with an “orange peel” finish. The finish should be smooth, without any significant pits or chips. There should not be any seams or long cracks in the floor where dirt and micro contamination can collect. There should be no brass drains or drain cleanouts, only stainless-steel plates that are gasketed down and tightened. There should be no circular discoloration or “bubble-like” sections in the floor, which is called “blooming,” where the floor’s chemical composition is breaking down. This is serious and could require a floor replacement.

- Walls should be monolithic polymer wall systems with sealed seams within all the classified areas. While we might see some walls that are epoxy-coated gypsum board, we need to be critical and keenly aware of this within Grade D or higher spaces, as they degrade with cleaning and become sources for mold contamination. These need to be examined for wear, cuts, swelling at seams, joints, floor, and ceiling. Gyp board can be covered with various films and, if need be, replaced.

- Ceilings need to be inspected like the walls for use of polymer ceiling systems or epoxy-coated gyp board. However, ceilings are notorious for having fixtures (other than lights), such as access panels, power outlets, etc. As a rule, ceilings should have no fixtures other than lights because of the lack of the ability to seal the fixtures and prevent gravity from allowing particles and micro contaminants to filter down from the interstitial space. Alarms, strobes, signs, sprinklers, smoke detectors, intercom speakers, and the like should be mounted on the walls.

- As part of the review of the finishes, door seals, fasteners, and door opening systems must be appropriate for the environment -- not commercial hydraulic systems, roll up doors, exposed screws, etc.

Process Space

- Within the process space we need to focus on the major capital equipment, its current condition and use, maintenance records, and performance.

- Drains are a frequent source of pain. This includes drains in the wrong classification, leading to EM hits, and drains located where they are not appropriate and not needed. Installation of new drains can be an expensive and disruptive retrofit.

- We also need to understand the use of SUSs and, if they are not being used, the readiness for conversion from stainless steel to SUS.

- Many times, the process equipment in a facility for sale is nearing the end of its useful life, so the cost and effort required to replace it must be considered.

Civil/Structural

- The building slab is generally never an issue; however, a review should be made of the building slab thickness relative to the traffic now and as projected in the future. The slab under the warehouse should generally be 2 inches thicker than the main building. In some cases, warehouses or “big shell” facilities were built without consideration of loading/unloading and heavy equipment movement of a pharmaceutical facility.

- Insulation is a forgotten area that needs to be checked. Many insulation systems and applications can leave gaps next to walls that have a propensity to collect moisture. Also, in some installations, ground cellulosic fiber (wood shavings) were used in the wall and roof insulation. Wood is never acceptable around a pharma/biotech plant, as it is a continuous source of mold.

Electrical

Although the electrical area is taken for granted, it is critical that the auditor checks the power service into the facility and the presence of redundant feeders and backup generators and their capabilities (full plant power vs. HVAC only vs. instrument and emergency lighting). It is a good rule that the facility be able to maintain the HVAC, lighting, and control systems when external power drops out. Inquiries should be made as to the blackout/brownout frequency, and the plant’s reaction time and production outages when those have occurred.

HVAC

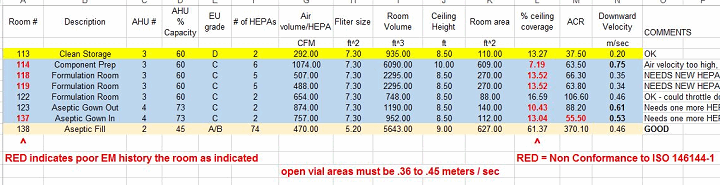

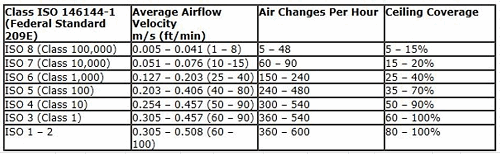

Probably the single most capital-intensive part of any pharmaceutical facility is the HVAC system. In a biotech or aseptic facility, it is critical that the HVAC and the AHUs (air handling units) are operating within a range of 30 percent to 70 percent and are not constrained. A room by room inspection is the best way to evaluate the performance of the facility. Below is an example of a “mechanical evaluation,” which must be matched with a room by room particle count and EM study. The auditor will find that the particle counts done by an outside certifying firm will generally pass on each HEPA; however, they will not be privy to the mechanicals or the EM results. The most interesting point in the rooms with poor mechanical characteristics are the rooms with poor EM results. The chart below is an example of a room by room survey that matches the EU grade requirements for the ISO 14644 standards against the actuals. The key areas to cross check in each room are:

- % Ceiling Coverage

- ACR (air change rate per hour)

- Downward velocity

From here you can compare the three key performance areas against the ISO standards, below:

Clean Utilities

The utility area is often tucked into a back area or mezzanine of the facility; however, the health of the systems is critical to the ability to produce product. The key systems are the WFI, clean steam, clean dry air, nitrogen, and chilled water. These systems need a physical check for leaks, noise, and corrosion. The preventive maintenance (PM) records need to be examined, along with vendor/supplier records and notes. In addition, the vent and drain systems need to be reviewed through both the PM records and a physical review of the primary piping.

Equipment

Every major piece of equipment valued over $250,000 needs to be reviewed in operation, paying close attention to the actions of the operators and the use of the SOPs or forms. In the case of the filling lines, a short water batch will suffice to demonstrate the WFI acquisition, formulation handling, washers, tunnels, filling, capping, sealing, lyo transfer, and lyo cycle. In the case of the autoclaves, freezers, and refrigerators, reviewing the equipment and the last week of operational records should suffice. Finally, a review of the validation documentation is a useful exercise for an off-site activity.

Packaging lines should be reviewed with the focus on serialization. Serialization is a major area of investment, and a review of the flowchart of the line, vial marking, unit of sale application/verification, and shipper application/verification needs to be done. If there are any flaws or incompleteness in the system, this must be discussed with the acquirer, as serialization is an expensive and lengthy capital expenditure.

Supporting Systems

Material management, including logistics, weighing/dispensing using the GMP systems of receiving, sampling, release, quarantine, rejection, and shipping, needs to reviewed off-site first for understanding and terminology, followed by a physical walk-through of the warehouse area. The auditor will quickly see the reality of the system, the feasibility of the logistics and space, and how transactions work. The key is the warehouse space, aisle spacing, security of all the materials, and the control exercised by the systems.

Reporting The Findings

The auditor will never have enough time to review and critique everything. They must review all the plant documents and drawings (architectural, HVAC, utility, and process) prior to the initial due diligence visit. This will position them for quick familiarity and an ability to control the agenda. This is also true for equipment validation reports and the logistical transaction systems. Asking key questions before arriving forces the target to be better prepared and to know what it has to deliver.

In the end, the assessment of the target is based upon the facility, equipment, utilities, and its ability to produce. The priority must focus on answering these questions:

- Can it pass a PAI or an EU inspection?

- In what condition are the facility and the equipment, based upon the priorities of the acquirer?

- How robust is the plant in terms of options, backup, and failure modes?

- How easily will the plant handle a tech transfer and re-validation?

Cost Of Ownership

In the end, the acquirer will settle on a cost for the facility that will be a depreciated value of the capital cost, depending on the age and value. A biotech facility newly constructed is $700 per sq. ft. and an aseptic facility is about $1,000 per sq. ft. The present value of a facility generally ranges from 20 percent to 50 percent of the facility based upon age. The major equipment and any technological innovation included are evaluated separately, and a depreciated value is added based upon the auditor’s report.

The next step is the renovations and the cost thereof. The auditor must be meticulous in identifying each observation for renovation and providing an estimate. The rules of thumb for renovation:

- New CNC space = $150/sq. ft.

- New Grade D space = $300/sq. ft.

- New Grade C space = $700/sq. ft.

- New Grade B/A space = $1,000/sq. ft.

- New HVAC only = $350/sq. ft. of the covered area/cost of a new AHU.

Conclusion

The key to performing due diligence on a target is to gather and review documents prior to coming on-site and be prepared. Once on-site, the focus should be on the engineering standards, operational capabilities, compliance with EU GMP Annex 1 and Annex 2 and the ability to pass a PAI. If time is constrained, the priority must focus on the facility and the high-dollar equipment systems.

About The Authors:

Herman Bozenhardt has 41 years of experience in pharmaceutical, biotechnology, and medical device manufacturing, engineering, and compliance. He is a recognized expert in aseptic filling facilities and systems and has extensive experience in the manufacture of therapeutic biologicals and vaccines. His current consulting work focuses on aseptic systems, biological manufacturing, and automation/computer systems. He has a B.S. in chemical engineering and an M.S. in system engineering, both from the Polytechnic Institute of Brooklyn.

Herman Bozenhardt has 41 years of experience in pharmaceutical, biotechnology, and medical device manufacturing, engineering, and compliance. He is a recognized expert in aseptic filling facilities and systems and has extensive experience in the manufacture of therapeutic biologicals and vaccines. His current consulting work focuses on aseptic systems, biological manufacturing, and automation/computer systems. He has a B.S. in chemical engineering and an M.S. in system engineering, both from the Polytechnic Institute of Brooklyn.

Erich Bozenhardt, PE, is the process manager for IPS-Integrated Project Services’ process group in Raleigh, NC. He has 11 years of experience in the biotechnology and aseptic processing business and has led several biological manufacturing projects, including cell therapies, mammalian cell culture, and novel delivery systems. He has a B.S. in chemical engineering and an MBA, both from the University of Delaware.

Erich Bozenhardt, PE, is the process manager for IPS-Integrated Project Services’ process group in Raleigh, NC. He has 11 years of experience in the biotechnology and aseptic processing business and has led several biological manufacturing projects, including cell therapies, mammalian cell culture, and novel delivery systems. He has a B.S. in chemical engineering and an MBA, both from the University of Delaware.