2026 CDMO Forecast: The 7 Shifts Sponsors Need To Prepare For

By Sarah Sink, Your Pharma Girl

The biotech and CDMO landscape is entering another year of recalibration. Demand for protein-based biologics continues to climb. Sterile fill/finish capacity remains tight. Regulatory expectations are intensifying, and sponsors are being asked to accelerate programs while managing fewer internal resources. At the same time, several macro shifts, including the rise and fall of AI-driven CDMO selection tools and a resurgence of internal manufacturing investments, are reshaping how outsourcing will evolve in 2026.

2026 is shaping up to be a year in which operational discipline, strategic alignment, and regulatory preparedness will differentiate high-performing sponsors from those facing avoidable delays. Based on industry data, regulatory trends, and real-world observations supporting biologics and sterile drug product programs, this forecast outlines the major forces that will influence CDMO partnerships in the coming year.

1. Biologics And Sterile Injectables Will Continue To Feel The Squeeze

One of the clearest indicators of 2026 pressure is the continued expansion of the biologics pipeline. Current analyses show more than 400 antibody-drug conjugates (ADCs) in development globally, along with a steady rise in bispecific antibody programs. Both categories have grown consistently across the past three years.¹ These modalities require specialized upstream capacity, downstream purification expertise, and highly trained sterile drug product teams and facilities. Their complexity places meaningful strain on development networks and GMP operations, particularly at CDMOs that support early- and mid-phase biologics.

Sterile injectables remain one of the most capacity-constrained segments of the outsourcing market. ISR benchmarking shows that on-time delivery and capacity availability have surpassed cost as the top decision drivers for sponsors for four consecutive years.² These priorities will carry into 2026 as biologics programs become more complex and as fill/finish timelines become increasingly sensitive to suite availability, operator constraints, and environmental monitoring requirements.

Insourcing trends also play a significant role. Several mid- to large pharmaceutical companies have expanded internal capabilities for biologics drug substance and sterile fill/finish operations.³ These investments aim to increase supply chain resilience, control regulatory readiness, and reduce long-term outsourcing costs. While this reduces demand for certain types of outsourcing, it affects early-phase programs differently. Most biotechs will continue relying on CDMOs during Phase 1 and Phase 2 because the cost, expertise, and specialized assets required for biologics development and aseptic operations are not economical to build internally.

Recent 2025 Insourcing Announcements Include:

- AstraZeneca: $2 billion expansion of biologics drug substance manufacturing in Maryland4

- Amgen: $650 million expansion of biologics production capacity in Puerto Rico5

- AbbVie: $70 million investment in new biologic production areas and labs in Massachusetts6

- Merck & Co.: $1 billion project in Delaware supporting a biologics facility and an additional $895 million on fill/finish and lyo capacity in Kansas7 8

- Novartis: $771 million expansion in North Carolina by adding biologics production and sterile filling/packaging capacity9

- Roche/Genentech: $700 million new sterile fill-finish facility in North Carolina10

- GSK: $1.2 billion new biologics manufacturing facility in Pennsylvania11

As a result, pressure on CDMO capacity continues to move upstream. Early-phase biologics and sterile fill/finish slots are becoming increasingly competitive, and sponsors that delay engagement risk selecting partners based on near-term availability rather than strategic fit. For biologics and sterile programs, sponsors often benefit from initiating CDMO engagement approximately six to eight months ahead of the intended start date, allowing sufficient time for technical alignment, proposal refinement, quality review, contracting, and realistic batch slot scheduling.

2. Global Regulatory Pressure Will Influence CDMO Operations In 2026

The EU GMP Annex 1 update took effect in 2023, and its operational impact is now becoming fully evident. CDMOs are refining contamination control strategies, strengthening environmental monitoring programs, updating aseptic operator qualifications, and revising media fill designs. In practice, these activities require additional documentation, training, monitoring, and batch execution discipline, which can temporarily constrain available capacity, increase the volume of planned deviations or investigations, and reduce scheduling flexibility as facilities absorb the operational changes. These adjustments will shape how sponsors evaluate CDMO proposals in 2026.

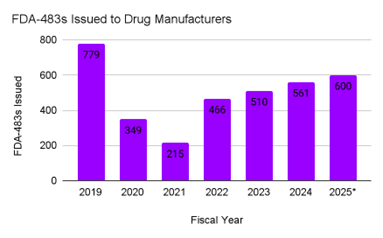

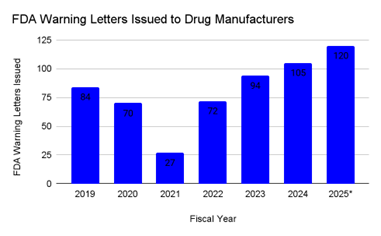

At the same time, FDA enforcement data shows a clear increase in regulatory oversight across the global manufacturing network. The FDA inspects both U.S. and ex-U.S. drug manufacturing facilities that supply the U.S. market, and inspection activity has now returned to pre-pandemic intensity. Form FDA 483 observations rebounded to 561 in 2024, and partial 2025 data already suggests totals exceeding 600.12 Warning letters follow a similar pattern. The FDA issued 84 cGMP-related warning letters in 2019, with counts falling sharply during 2020 and 2021, then rising to 105 in 2024. Partial 2025 totals are estimated at approximately 120 letters, indicating continued upward momentum.12 13

These enforcement patterns span all modalities and facility types, including biologics drug substance, sterile drug product, oral solid dose, and active pharmaceutical ingredient (API) operations. They reinforce that global manufacturing sites serving the U.S. market should expect heightened scrutiny related to contamination control, aseptic execution, data integrity discipline, and quality system maturity.

Figure 1: FDA 483 Inspectional Observations Issued to Drug Manufacturing Facilities, 2019 to 2025 (partial): FDA 483 observations issued by the U.S. FDA during inspections of human drug manufacturing facilities worldwide, including both U.S. and ex-U.S. sites supplying the U.S. market. 2025 data represent partial-year totals based on publicly posted enforcement activity.12

Figure 2: FDA Warning Letters Issued to Human Drug Manufacturers, 2019 to 2025 (partial): Counts represent cGMP-related warning letters issued by the U.S. FDA to human drug manufacturing facilities worldwide, including U.S. and ex-U.S. sites regulated for the U.S. market. 2025 totals reflect partial-year activity based on available FDA postings.12,13

These enforcement patterns signal a sustained regulatory focus on contamination control, documentation rigor, deviation management, and aseptic discipline. Sponsors should expect CDMOs to apply more rigorous internal scrutiny and adopt more conservative scheduling assumptions in 2026, particularly for biologics and sterile programs that require high operational maturity.

3. The Industry Is Moving From Transactional Outsourcing To True Partnership

Outsourcing relationships are shifting away from batch-by-batch engagements. Sponsors increasingly expect structured scientific dialogue, transparent communication, and defined escalation pathways. CDMOs likewise prefer engagements that span multiple phases or programs because these allow more accurate forecasting of personnel, materials, and suite availability.

Insourcing trends add nuance. As larger organizations internalize later-stage or commercial operations, CDMOs may compete more aggressively for early development biologics and sterile work. In practice, this raises expectations around responsiveness, deviation transparency, and cross-functional collaboration.

For early-phase sponsors, the benefit of a long-term, partnership-driven model is predictability. Even when unexpected challenges occur, a relationship grounded in transparency and scientific alignment promotes faster problem-solving and more stable timelines.

4. Tech Transfer Readiness Will Be A Gatekeeper For Timeline Success

Tech transfer readiness is becoming one of the strongest predictors of CDMO scheduling. CDMOs are evaluating not only program fit but also the completeness of a sponsor’s data package. BioPlan’s 2024 survey highlights the most common causes of delay during scale-up and manufacturing readiness: unclear process assumptions, incomplete analytical strategies, and disorganized historical records.14

Sponsors that structure tech transfer internally, with well-organized documentation, defined analytical methods, and clear expectations around scope, secure earlier slots and achieve more predictable timelines. This is especially important in biologics, where small upstream variations can influence downstream purification, filtration performance, or sterile fill/finish behavior.

5. Why AI Tools For CDMO Selection Are Failing To Deliver

Between 2023 and 2025, several platforms attempted to automate CDMO selection through artificial intelligence. These tools claimed to match sponsors with optimal CDMOs by analyzing capability matrices, performance metrics, and capacity indicators. Many gained attention during broader digital transformation initiatives in 2023.16

However, adoption slowed sharply as sponsors recognized the limitations. AI can process structured data effectively, but it cannot evaluate the relational and qualitative factors that determine real-world outsourcing success.

Key limitations include:

- Capability data that is fragmented, inconsistent, and often self-reported, which reduces model accuracy.17

- Inability to evaluate quality culture, escalation discipline, or communication responsiveness.

- Lack of insight into how a CDMO behaves when deviations occur or how teams collaborate under pressure.

- Inability to capture trust, transparency, subject matter expertise depth, and real-time problem-solving.

- Limited access to interoperable data systems, which restricts contextual comparisons.18

Looking ahead to 2026, AI tools are expected to mature and improve in areas such as data aggregation and early screening. However, they are unlikely to replace human-led evaluation. In my view, AI will continue to support early-stage due diligence and information gathering, but the selection of a CDMO partner will remain dependent on human judgment, technical interpretation, and relationship-based insight that cannot be fully modeled or automated.

6. Supply Chain Pressure Has Eased Since 2021 But Remains Uneven

Compared to peak disruption levels in 2021, supply chain pressure has eased through 2024 and into 2025, but it has not fully stabilized. Several supply categories continue to face vulnerability, including single-use assemblies, sterile filters, chromatography resins, and certain biologics excipients. BioPlan data confirms persistent procurement delays for materials required in both upstream and downstream operations.14

These constraints directly influence scheduling. A delayed filter or long-lead resin can stall an entire batch. As a result, CDMOs may request earlier material commitments or ask sponsors to supply specialty components directly.

7. The Onshoring Conversation Will Continue, But The Reality Is Nuanced

United States onshoring activity is increasing, particularly in oral solid dose and small molecule active pharmaceutical ingredient operations.15 However, biologics and sterile injectables require advanced facilities that cannot be quickly expanded or replicated. For this reason, early-phase biologics and sterile fill/finish will continue to rely heavily on global CDMOs.

Tariffs may influence some outsourcing decisions. However, they rarely outweigh the temperature-control logistics, transit risk, and stability considerations that govern biologics movement. In my opinion, early-phase sponsors will maintain a balanced outsourcing model that includes both domestic and international CDMOs, with technology transfer into the United States occurring later in development when appropriate.

How Sponsors Should Adjust Their Planning For 2026

Sponsors that perform best in 2026 will approach CDMO engagement proactively, with clear internal alignment and realistic assumptions. Industry reports show increasing scrutiny around contamination control, material lead times, and analytical readiness. These expectations shape how CDMOs evaluate new programs.1,2 Sponsors that engage early, coordinate cross-functionally, and define expectations before requesting proposals will secure stronger timelines and more reliable partnerships.

To position themselves for success, sponsors should:

- Begin conversations 6-8 months earlier, particularly for biologics and sterile programs where capacity constraints and long-lead materials affect scheduling.¹

- Align cross-functionally before requesting proposals. This ensures CMC, analytical, regulatory, and supply chain teams share the same assumptions.³

- Pressure-test schedules by asking about environmental monitoring trends, raw material lead times, and lyophilization cycle feasibility.²

- Invest in a strong tech transfer package, supported by organized historical data and clear analytical strategies.¹

- Evaluate quality culture through deviation history, communication patterns, and escalation behavior.³

- Treat the CDMO as a long-term partner. This fosters transparency, faster issue resolution, and more predictable timelines.³

Sponsors that engage early, communicate clearly, and prioritize scientific and operational alignment will move through 2026 with fewer surprises and stronger outcomes.

Conclusion

The forces shaping the CDMO environment in 2026 include biologics demand, sterile capacity constraints, increased regulatory scrutiny, insourcing trends, supply chain instability, and the limitations of AI-based selection tools. Sponsors that prepare early, align internally, and cultivate strong CDMO partnerships will move through 2026 with greater confidence. Protein-based biologics and sterile injectables remain the clearest indicators of industry trajectory, and understanding these trends will help sponsor teams make informed decisions as they advance their programs.

References

- BCG. Emerging New Drug Modalities. 2025.

- ISR Reports. CDMO Selection Criteria Trends 2020 through 2024.

- FDA Warning Letters Database. Aseptic and CGMP related observations, 2019 through 2025 (partial).

- AstraZeneca. “AstraZeneca Announces $2 Billion Expansion of Biologics Manufacturing in Maryland.” Company Press Release, 2025.

- Amgen. “Amgen to Invest $650 Million to Expand Biologics Manufacturing Capacity in Puerto Rico.” Company Press Release, 2025.

- AbbVie. “AbbVie Announces $70 Million Expansion of Biologics Manufacturing Capabilities in Massachusetts.” Company Press Release, 2025.

- Merck & Co. “Merck Announces $1 Billion Investment in Delaware Biologics Manufacturing Facility.” Company Press Release, 2025.

- Merck & Co. “Merck Expands Sterile Fill-Finish and Lyophilization Capacity in Kansas with $895 Million Investment.” Company Press Release, 2025.

- Novartis. “Novartis Announces $771 Million Expansion of Biologics and Sterile Manufacturing Operations in North Carolina.” Company Press Release, 2025.

- Roche. “Genentech to Build $700 Million Sterile Fill-Finish Manufacturing Facility in North Carolina.” Roche Media Release, 2025.

- GSK. “GSK Announces $1.2 Billion Investment in New Biologics Manufacturing Facility in Pennsylvania.” Company Press Release, 2025.

- FDA. Form FDA 483 Inspectional Observations. Public data for drug establishments, 2019 through 2025 (partial).

- Pharmaceutical Online. “Trends in FDA Inspection Based Warning Letters, 2019 through 2025 (partial).”

- BioPlan Associates. 20th Annual Report and Survey of Biopharmaceutical Manufacturing. 2024.

- Think Global Health. Tracking Pharma’s Progress on U.S. Onshoring. 2024.

- McKinsey & Company. “Digital and Analytics in Biopharma Operations.” 2023.

- Pharma Manufacturing. “Why AI Vendor-Matching Platforms Struggled in Biopharma.” 2024.

- Deloitte. “AI Adoption in Life Sciences: Barriers and Enablers.” 2023.

About The Author:

Sarah Sink, MBA, is the founder of Your Pharma Girl and an experienced business development leader in the biotech and pharmaceutical services industry. With a background spanning biologics, sterile fill-finish, and oral solid dose development and manufacturing, she has guided numerous biotech sponsors through the complexities of CDMO selection, negotiation, and partnership management.

Sarah Sink, MBA, is the founder of Your Pharma Girl and an experienced business development leader in the biotech and pharmaceutical services industry. With a background spanning biologics, sterile fill-finish, and oral solid dose development and manufacturing, she has guided numerous biotech sponsors through the complexities of CDMO selection, negotiation, and partnership management.