1999 Ends on a Positive Note for Biotechnology

Contents

The Window Opens

The Burrill Life Sciences Indices

Success and Failures in M & A

The Quarter's Product News

Other News of Note

The Year Ahead—Changes and Challenges

Burrill & Co.

1999 ended on a high note for the biotech industry with renewed interest in biotech stocks. Many stocks more than doubled in value during the year, and a number of companies completed successful IPOs during the fourth quarter. But even with all the industry's promise, the year 2000 looks to be another turbulent one for biotech, as it faces:

- Increased consumer anxiety over genetically modified organisms

- Election year politics about reforming the healthcare system

- Continued integration and dis-integration in the pharmaceutical industry (and the attendant question of the "life sciences" strategy for the big pharma/chemical companies)

- Volatile public equity markets

- Ethical challenges presented by increased access to information about the human genome changing drug discovery/development and disease diagnosis/treatment.

In recently completed research on the biotechnology industry, Burrill & Co. (San Francisco) found that top-tier and mid-tier biotech stocks continued to outpace many other high tech sectors by increasing by an average of 62% and 52%, respectively, for the fourth quarter, and 180% and 105%, respectively, for the year as a whole. And, surprisingly, unlike previous quarters, even the smaller biotech companies fared better as a whole, increasing 72% during the quarter. This dramatic turnabout (in previous quarters, the large- and mid-sized biotechs had performed better than the small ones) is due primarily to the renewed investor interest in genomics companies (many of which are small-cap companies). Abgenix (stock symbol: ABGX), Incyte (INCY), Millennium (MLNM), Human Genome Sciences (HGSI), and Celera (CRA) stock prices more than doubled during the quarter, as a result of investor interest in the advances made in deciphering the human genome.

On the financing side, it was another big quarter for biotech: the industry raised $7.24 billion in the fourth quarter of 1999, a 72% increase from the third quarter of the year ($4.21 billion) and a whopping 212% increase over the same quarter last year.

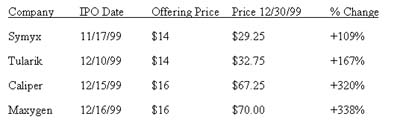

"As we close out the year and the century, we're in a biotech boom driven, in part, by the increased understanding of genomics,"' said G. Steven Burrill, CEO of Burrill & Co., a private merchant bank focused exclusively on life sciences. "Caliper (CALP) and Maxygen (MAXY), both 'toolbox' genomics companies, completed IPOs in December and their stocks sky-rocketed, increasing 320% and 338% in value, respectively, by the end of the year.

"We expect a flood of IPOs in the first half of 2000," continued Burrill. "The public interest in biotech is high and even venture capitalists are starting to turn their attention back to biotech. In the fourth quarter, almost twice the amount of VC dollars were invested in biotech, making it one of the best recent quarters for VC funding."

The Window Opens (Back to Top)

For the first time in many quarters, IPOs were back in fashion with several "seminal" offerings:

In addition, many successful secondary stock offerings were executed this quarter, including ImClone (IMCL; $81 million), Progenics Pharmaceuticals (PGNX; $35.2 million) and Alexion Pharmaceuticals (ALXN; $42 million). Going into the new year, several other biotechs have filed their IPOs (Antigenics, Diversa Corp., OraPharma, and Sequenom), and over 50 biotech companies are actively preparing to file in the near future.

Overall, the industry continued to reflect the positive impact of the giant third quarter Roche-Genentech (DNA) deal (a $4.2 billion acquisition and spinout). Then, during the fourth quarter, Roche executed a secondary offering of an additional 20 million shares of Genentech, which raised another $2.87 billion.

The Burrill Life Sciences Indices (Back to Top)

The Burrill Life Sciences Indices showed the large-capitalization stocks (representing the top 12 biotech companies with market caps greater that $1 billion) increasing 62% for the quarter; the Mid Cap Index (representing 20 mid-tier biotech companies with market caps between $300 million and $1 billion) rising 52% for the quarter; and the Small Cap Index (representing 100 of the small biotech companies with market caps less than that $300 million) rising an astounding 72%.

And while the small companies fared better in the fourth quarter than the large and mid-sized companies, for the year, the Large Cap Index nearly tripled in value (up 180%); the Mid Cap Index doubled (up 105%); and the Small Cap sector saw a modest 67.11% increase—all this still in a year where Internet stocks continued to get most of the attention.

Success and Failures in M & A (Back to Top)

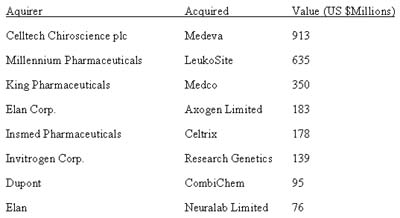

Mergers and acquisitions also continued to be an important mechanism for companies to access cash and products. Interestingly, some of the larger acquisitions during the quarter occurred outside the U.S., with the U.K.'s largest biotech company, Celltech Chirosciences, acquiring Medeva plc for $912 million, and Elan absorbing both Axogen (an Irish biotech firm that specializes in the development of therapeutic products for the treatment of neurological disorders and for pain management) and Neuralab (a Bermuda-based biotech that identifies therapeutic compounds for use in the treatment of Alzheimer's disease) in deals totaling $259 million.

On the U.S. side, Millennium Pharmaceuticals began its forward integration strategy acquiring Leukosite (LKST) for $635 million and Genzyme (GENZ) tendered to acquire Cell Genesys (CEGE) for $350 million. Unfortunately for Genzyme, Cell Genesys' 23% ownership in Abgenix went from $100 million to $460 million in value during the quarter, causing Cell Genesys to tell its shareholders to not approve the acquisition.

And while there were a number of successful mergers (see chart below), several of the planned giant merger/acquisition deals began to fall apart during the quarter. The biggest surprise fall-out was the Abbott-ALZA deal, which cratered over Abbott's FDA/FTC problems and the attendant decrease in Abbott's stock price, making this all-stock deal unattractive for ALZA shareholders.

Announced mergers during the quarter included:

At the beginning of November, American Home Products (AHP) and Warner-Lambert (WLA) announced their intention to merge, creating the world's largest pharmaceutical company valued at $145 billion, and then, barely two days later, Pfizer (PFE) offered to buy Warner-Lambert stock for $82.4 billion. The battle is still in progress at quarter-end.

Another major deal announced during the quarter was Pharmacia & Upjohn's (PNU) planned merger with Monsanto (MTC), one that would create a $50 billion life sciences giant. Almost simultaneously, both AstraZenenca (AZN) and Novartis indicated that their "life sciences strategies" might not be generating the expected results, as they announced a spinout and a combination of their respective agricultural units.

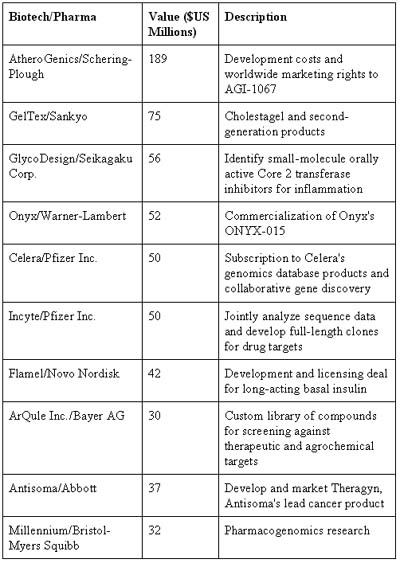

This quarter's major alliances included:

Other selected pharma/pharma alliances included:

- Teva/H. Lundbeck A/S—Develop and market two compounds to treat Parkinson's

- Abbott/Wakunaga—Abbott will develop and market two of Wakunaga's respiratory and urinary tract infection treatments

- Allergopharma/Pharmacia & Upjohn—Allergopharma to acquire rights to immunotherapeutic applications of P & U's birch pollen allergen

- H. Lundbeck A/S/Novo Nordisk A/S—Develop a library of compounds.

The Quarter's Product News (Back to Top)

As is usual for the fourth quarter, the Food and Drug Administration was busy approving a host of new drugs and treatments. Some of the more noteworthy approvals included:

- Hoffman-LaRoche's oral neuraminidase inhibitor for flu, Tamiflu, developed by Gilead Sciences (GLD)

- Centocor's approval to use Remicase with methotrexate to treat rheumatoid arthritis in patients who don't respond to methotrexate alone

- Dusa Pharmaceuticals' (DUSA) clearance to market its Levulan Kerastick and BLU-U light source as a treatment for actinic keratoses (a precancerous skin condition) for the face and scalp

- Ligand Pharmaceuticals Inc.'s Targretin for a rare form of lymphoma

- INO Therapeutics Inc.'s INOmax (nitric oxide), a new treatment that can help critically ill newborn infants breathe more effectively and reduce their need for a surgery

- Searls and Pfizer's Celebrex—previously used for arthritis—now given approval by for treating patients with a rare genetic disorder that causes them to develop large numbers of intestinal polyps

- Aventis' Taxotere, which treats locally advanced or metastatic non-small-cell lung cancer in patients whose disease has progressed despite treatment with prior platinum-based chemotherapy.

Other News of Note (Back to Top)

Harold Varmus resigned as Director of the National Institutes of Health (NIH) in October after heading the nation's leading medical institution for six years. Varmus moved on to head up Memorial Sloan-Kettering Cancer Center in New York City. Uncertainty in the leadership at the NIH will not make for a more predictable 2000.

In November, Genentech agreed to pay the University of California $200 million to settle a 9-year-old dispute over a patent for human growth hormone, helping both UCSF with its programs and resolving one of the industry's longest intellectual property (IP) battles.

The Year Ahead—Changes and Challenges (Back to Top)

Notwithstanding the currently receptive public equity markets (which will hopefully continue into 2000), the biotech industry faces a variety of new challenges as it heads into the new century:

- GMOs: The European uneasiness over genetically modified organisms (GMOs) is now getting U.S. attention, with the Federal Drug Administration (FDA) having just completed hearings in three U.S. cities about public concerns regarding GMOs and suggested policy changes. Don't be surprised to see "GMO labeling" become the recommendation this year.

- The Healthcare System: With 2000 elections in just ten months, cost and access to healthcare are high on the candidates' agendas. The capital markets concern over some form of price controls, reimbursement limits, discounting, etc., has historically driven investors away from the big pharma stocks—so it's clear that both biotechs and big pharma face a major "political" challenge in this election year.

- Integration and Dis-Integration: Acquisitions/mergers/spinouts continue to reformulate bigger companies, each trying to find the right strategy to drive growth, profitability and innovation. We still haven't seen the massive consolidation that's been predicted—but we will continue to see companies reorganize, adding new capabilities and divesting units not consistent with new management focus, and strategic partnerships continuing to increase, in both size and number.

- Genomics and Genetics: With sequencing of the human genome expected to be completed in 2000, the race to "mine the data" to alter and improve drug discovery and development, and then improve disease diagnosis and treatment, is just beginning. These new tools also apply to agriculture, animal health, nutraceuticals and biomaterials. This major "new" understanding of plant/animal/human genomics will make the new century the Biotech Century.

Burrill & Co. (Back to Top)

Burrill & Co. is a private merchant bank, focused exclusively on life science companies (biotechnology, pharmaceuticals, healthcare, related medical technologies, agricultural technologies, animal health, nutraceuticals, and bioprocess/biomaterials).

The Burrill family of venture capital funds, with over $135 million under management, includes the Burrill Biotechnology Capital Fund, the Burrill Agbio Capital Fund, the Burrill Animal Health Capital Fund, the Burrill Bioprocess/ Biomaterials Capital Fund, the Burrill Nutraceuticals Capital Fund, and the Burrill Life Sciences Capital Fund.

Burrill's strategic partnering business involves close collaboration with life science companies seeking strategic partnerships to access markets, to broaden scope and to augment scientific, technical and development capabilities. Companies benefit from Burrill & Co.'s extensive networks and unique ability to structure partnerships to achieve maximum value. Burrill & Co. has negotiated and structured more than 15 strategic partnerships with a value in excess of $500 million.

Burrill & Co. works closely with large life science companies to maximize value from internal assets by "partnering them" (spinning out) with other companies. These spinouts range from outright divestments, in which Burrill manages an "auction" process, to strategic collaborations for drug or technology development, to the creation of entirely new companies around the technology or products being spun out.

For more information: Burrill & Co., 120 Montgomery St., Suite 1370, San Francisco, CA 94104. Tel: 415-743-3160. Fax: 415-743-3161.