The Top CROs By Therapeutic Indication Share Strong Regulatory And Productivity Performance

By Kate Hammeke, VP of Market Research, Industry Standard Research (ISR) @ISRreports

Sponsors often look for a CRO with specific therapeutic experience, including a track record of successfully completed projects. For a sponsor, therapeutic experience inspires confidence that the CRO’s project team has familiarity with data points specific to the therapeutic category. While clinical trials are generally conducted the same way — according to the standards established by regulatory authorities — when it comes to detailed data specific to a disease, the metrics used can vary greatly.

Sponsors often look for a CRO with specific therapeutic experience, including a track record of successfully completed projects. For a sponsor, therapeutic experience inspires confidence that the CRO’s project team has familiarity with data points specific to the therapeutic category. While clinical trials are generally conducted the same way — according to the standards established by regulatory authorities — when it comes to detailed data specific to a disease, the metrics used can vary greatly.

In a recent market research study, therapeutic experience (59 percent) topped a list of attributes that influence CRO selection, edging out operational (57 percent) and methodological experience (49 percent), as well as geographic location (37 percent), financial stability (36 percent), risk sharing, (32 percent), and adaptability (27 percent). When asked how many studies need to have been conducted for a sponsor to regard a CRO as “experienced” in a therapeutic category, answers varied widely — the mean response was five studies. Many CROs have already acknowledged the importance of promoting therapeutic experience to potential sponsors, dedicating website space and marketing communications to conveying relevant qualifications by category.

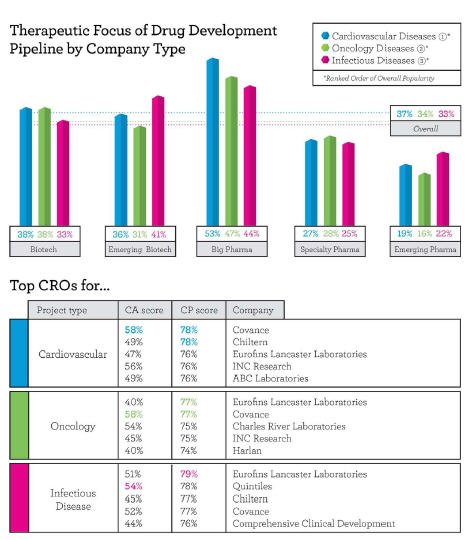

Respondents to Nice Insight’s annual pharmaceutical and biotechnology outsourcing survey indicated their companies would engage outsourcing partners for projects across an average of 2.1 therapeutic categories. The most popular areas of focus for outsourced projects are cardiovascular disease (37 percent), oncology (34 percent), and infectious diseases (33 percent). Not surprisingly, the most common therapeutic categories correspond with the leading causes of death worldwide — heart disease, cancers, and infectious diseases.

Big Pharma companies tend to have a higher spread of projects across therapeutic categories (2.8), while emerging pharma companies typically demonstrate a narrower focus, with projects covering an average of 1.2 therapeutic categories. Specialty pharma companies fall in the middle, responding that they plan to outsource projects across an average of 1.6 therapeutic categories. Established (2.1) and emerging (2.2) biotechs showed less variance, with each looking to outsource projects in approximately two therapeutic categories.

Regardless of the type of company you work for, there is a good chance that its drug development pipeline includes compounds in one of the most common therapeutic categories. To help sponsors make an informed decision when selecting a CRO for the project, Nice Insight collects data on CROs, and what follows are some of the results, including the top performers as indicated by peers for each of the leading therapeutic categories.

Top Cardiovascular CROs

According to buyers of CRO services, the preferred CROs for cardiovascular projects are Covance, Chiltern, Eurofins, INC Research, and ABC Labs. Covance received the highest overall customer perception (CP) score from respondents outsourcing cardiovascular projects at 78 percent and received “excellent” scores for productivity and regulatory compliance. Chiltern closely followed, also at 78 percent, with an “excellent” score for regulatory compliance. INC Research, with a customer perception (CP) of 76 percent, received an “excellent” score in innovation — reflecting the ability to improve upon a sponsor’s in-house capabilities by developing customized solutions — which is likely influenced by the “specialized recruitment and retention strategies” that the company deploys for cardiovascular trials.

The leading CROs for oncology projects based on customer perception were Eurofins and Covance, each with a CP of 77 percent, followed by Charles River Labs and INC Research, both at 75 percent, and Harlan Labs (74 percent). Covance and Eurofins received their strongest scores in productivity and regulatory compliance. Charles River Labs and INC Research had the highest quality scores in the group and likely lost the top rankings due to their low scores in affordability. Harlan Laboratories, while not particularly wellknown, is highly regarded for its early development oncology portfolio, including rodent models and diet.

For infectious disease projects, Eurofins — with a customer perception score of 79 percent — along with Covance and Chiltern (77 percent each), were once again among the top five CROs. Quintiles, at 78 percent, landed in second place and received “excellent” scores in three customer perception categories — innovation, productivity, and regulatory compliance. Comprehensive Clinical Development rounds out the top five CROs for infectious disease projects, with the company’s strongest scores coming in innovation, followed by regulatory compliance.

After a deeper examination of the strengths specific to the leading CROs by therapeutic category, it has become clear that strong regulatory knowledge is highly valued for facilitating study execution (and later, market entry) across regulatory jurisdictions. Expecting the path to market with inventive methods of increasing productivity — such as rodent model diets or recruiting methods for in-patient clinical research — is another factor.

Survey Methodology: The Nice Insight Pharmaceutical and Biotechnology Survey is deployed to outsourcing-facing pharmaceutical and biotechnology executives. The 2012-2013 report includes responses from 10,036 participants. The survey comprises 500+ questions and randomly presents ~30 questions to each respondent in order to collect baseline information with respect to customer awareness and customer perceptions on the top 100+ CMOs and top 50+ CROs servicing the drug development cycle. Over 900 marketing communications, including branding, websites, print advertisements, corporate literature, and trade show booths are reviewed by our panel of respondents. Five levels of awareness from “I’ve never heard of them” to “I’ve worked with them” factor into the overall customer awareness score. The customer perception score is based on six drivers in outsourcing: Quality, Innovation, Regulatory Track Record, Affordability, Productivity, and Reliability.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Salvatore Fazzolari, director of client services, at Nice Insight by sending an email to niceinsight.survey@thatsnice.com.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Salvatore Fazzolari, director of client services, at Nice Insight by sending an email to niceinsight.survey@thatsnice.com.