How Health Systems Will Manage Biosimilars: Implications For Manufacturers

By Jeremy Schafer, Precision for Value

The FDA recently approved Inflectra (infliximab-dyyb), a biosimilar to Remicade (infliximab), for multiple indications, including rheumatoid arthritis, psoriatic arthritis, plaque psoriasis, ankylosing spondylitis, ulcerative colitis, and Crohn’s disease.1 Despite being studied in clinical trials only for rheumatoid arthritis and ankylosing spondylitis, the FDA granted infliximab-dyyb nearly all of Remicade’s indications based on the infliximab-dyyb clinical package. The FDA stopped short of determining the biosimilar to be “interchangeable,” as standards for interchangeability have not yet been finalized.2

Infused medications are frequently managed at the health system or provider level. They are made available through different distributors, purchased by providers or health systems, and infused in the healthcare or home setting. Large systems and group purchasing organizations (GPOs) frequently extract discounts on infused products, particularly in competitive categories.

Infliximab-dyyb represents the first of several biosimilar infliximab infused products that are likely heading to the United States within the next two years. Significant research has documented the attitudes of payers and individual providers on biosimilars,3,4 but how health systems will engage the biosimilar opportunity has not been established, particularly in the infused space. Precision for Value (PFV) conducted a survey of healthcare delivery systems designed to understand how they may manage biosimilars.

Survey Methodology and Respondent Demographics

PFV launched a nine-question, multiple-choice survey with 27 respondents representing 27 different health systems across the country. The survey was initiated on June 8, 2016, and closed to responses two days later. Approximately 75% of health systems represented in the survey owned clinics and infusion centers, 44% owned a specialty pharmacy, and nearly 60% owned a health plan. All but one of the health systems represented owned at least one hospital.

Results

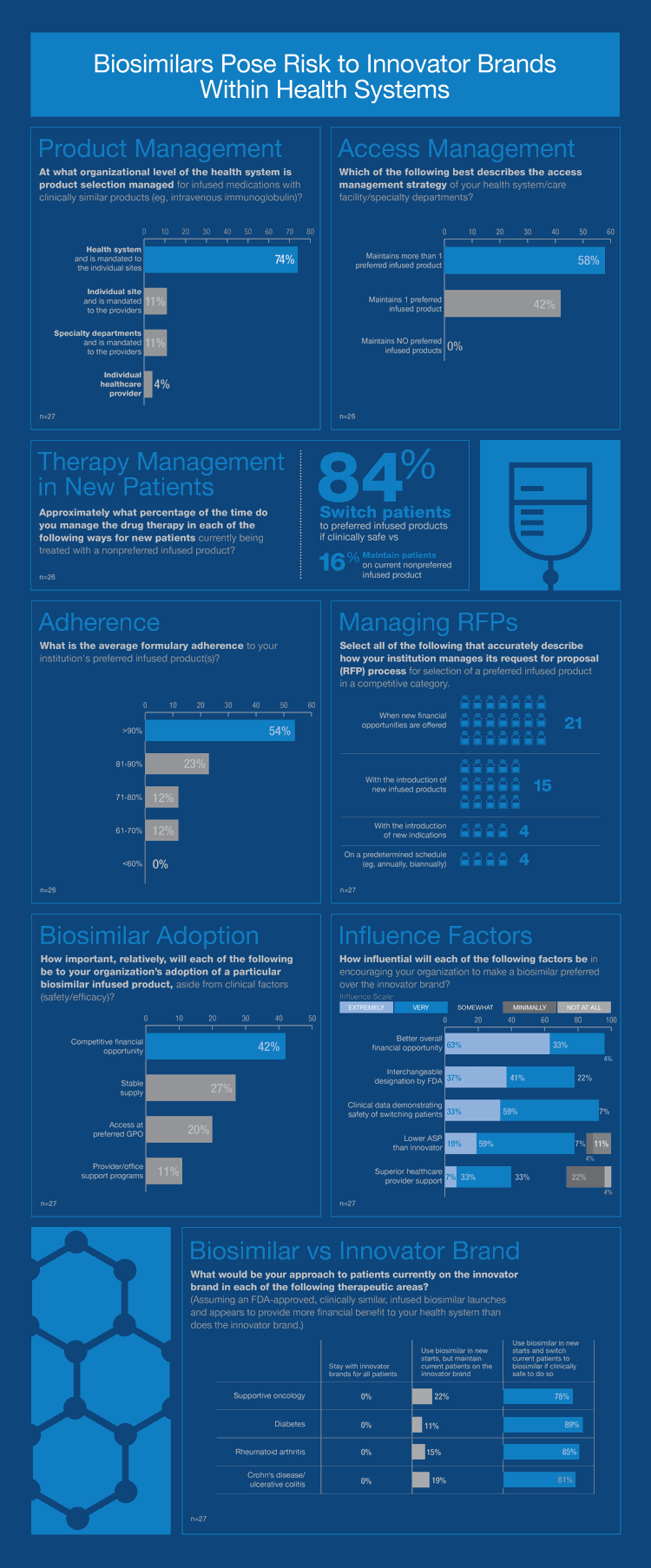

Click on the infographic to view a full-size version.

The survey data indicates that health systems could be an influential stakeholder in the infused biosimilar space. Health systems represented in the survey demonstrated a high degree of formulary control, with preferred products often made at the system or institution level. For biosimilars, factors such as adequate supply or interchangeability designation were overshadowed by financial considerations. Most important, health systems seemed very willing to convert existing patients to biosimilars if financially viable and clinically safe to do so. The implications of this finding are significant, as health systems could rapidly transition entire patient groups to the preferred biosimilar if desired and without payer influence.

A Predictive Model

A surrogate of health system behavior for infused biosimilars may be intravenous immunoglobulin (IVIG), where numerous products are on the market that vary by manufacturing process, indication, and/or inert composition. Despite product differences, health systems and other infusion stakeholders regularly put out requests for proposals in the IVIG class and may utilize only one or two preferred products for all their patients. This model drives competition in IVIG, pushing average sales price (ASP) for most IVIG products within the $75 to $80 per gram range, despite wholesaler acquisition prices (WAC) that are much higher and can vary by a factor of 100% between products.5

For manufacturers of both brand and biosimilar agents, understanding the market dynamics of infused drugs will be key, and they may find success by delivering value important to health system stakeholders. Reliable supply and provider office support were two areas cited as influential in the decision-making process — these are areas where established brand manufacturers may have an edge due to prior experience supplying the market. Financial metrics such as low average selling price (ASP) and overall financial opportunity are extremely important. These require a manufacturer to understand the economics of the health system and how that health system maximizes value (low cost, margin, etc.).

Predicting Reactions to Biosimilars

Understanding controlling influences will be vital for manufacturers. In the survey population, product choice of infused drugs was made predominantly at the health system level, with the formulary requirements filtering down to all entities beneath. Individual providers, particularly if employed by the health system, may be limited in product choice. In addition, many of the health systems in the survey owned both specialty pharmacies and health plans, meaning that formulary decisions could spill outside the system into broader populations and self-administered products. Manufacturers have to understand which entity within each health system has control and how that influence impacts other areas both within and outside the system.

Conclusion

Biosimilars will change therapeutic categories within oncology and autoimmune diseases by providing multiple, highly similar product choices for stakeholders. As health systems continue to grow in size and influence, they will be a key stakeholder in the biosimilar space. They have the opportunity to drive savings and product market share to the extent that they exert control over product choice through aggressive, system-wide formularies. In categories with highly similar products, health systems have demonstrated a willingness to switch from preferred products, converting existing patients when deemed clinically safe to do so. Manufacturers of biosimilar and brand products need to understand the hierarchy of control and motivating factors for health systems, including financial opportunity, stable supply, and provider support offerings.

References:

- US Food and Drug Administration. FDA approves Inflectra, a biosimilar to Remicade. http://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm494227.htm. Updated April 20, 2016. Accessed August 16, 2016.

- Bloomberg. FDA stays mum on interchangeable biosimilar guidance. http://www.bna.com/fda-stays-mum-n57982069888/. Published April 14, 2016. Accessed August 16, 2016.

- Felix AE, Gupta A, Cohen JP, et al. Barriers to market uptake of biosimilars in the US. Generics Biosimilars Initiative J (GaBI J). 2014;3(3):108-115.

- Schafer JA, Tapella M, Kantarelis T. Biosimilars:why deep discounts may become the dominant paradigm. Pharm Commerce. 2015;10(6):14-15,30. http://www.nxtbook.com/nxtbooks/pharmcomm/20151112/#/14.

- Centers for Medicare & Medicaid Services. 2016 ASP drug pricing files. https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Part-B-Drugs/McrPartBDrugAvgSalesPrice/2016ASPFiles.html. Modified May 31, 2016. Accessed August 16, 2016.

About The Author:

Jeremy Schafer, PharmD, MBA, is the senior VP and director of specialty solutions at Precision for Value. He provides enterprise leadership on specialty strategy across the Precision payer team organization and leads integration with other enterprise teams including health economics outcomes research, provider marketing, access and analytics, and media outreach in the specialty space.

Jeremy Schafer, PharmD, MBA, is the senior VP and director of specialty solutions at Precision for Value. He provides enterprise leadership on specialty strategy across the Precision payer team organization and leads integration with other enterprise teams including health economics outcomes research, provider marketing, access and analytics, and media outreach in the specialty space.

Prior to his time at Precision, Jeremy served as a corporate account manager for Grifols, where he engaged accounts including national payers, national pharmacy benefit managers (PBMs), and significant regional payers to educate decision-makers on Grifols’s portfolio and enhance access for providers and patients.

Jeremy has experience in specialty pharmacy programs and networks, pharmacy and therapeutics (P&T) committee processes and review, prior authorization programs, fee schedule management, medical and pharmacy benefit integration, Medicare Part D, health outcomes research, contracting (rebate and specialty pharmacy), health plan and PBM strategy, and payer data analysis. He is a regular speaker at managed care conferences and has authored numerous published manuscripts on specialty pharmacy topics, including biosimilars, oncology value tools, and specialty drug management.

Jeremy received his MBA from Bethel University (St. Paul, MN) and his PharmD degree from the University of Minnesota (Minneapolis). He can be reached at jeremy.schafer@precisionforvalue.com.