Analysis Of The Trastuzumab Biosimilar Market As Herceptin Exclusivity Nears An End

By Robert Browne, Fuld + Company

Genentech’s Herceptin (trastuzumab) is a monoclonal antibody for HER2/neu receptors for use in HER2-overexpressing adjuvant and metastatic breast cancer and metastatic gastric or gastroesophageal junction adenocarcinoma.1 Herceptin has successfully cemented itself as a standard of care therapy and represents a multibillion-dollar pillar that centrally supports Roche’s oncology juggernaut, but this is changing. Since its original approval in 1998, Herceptin has enjoyed an exclusivity that has a fast-approaching terminus, with key patent expirations expected before the end of 2019.2

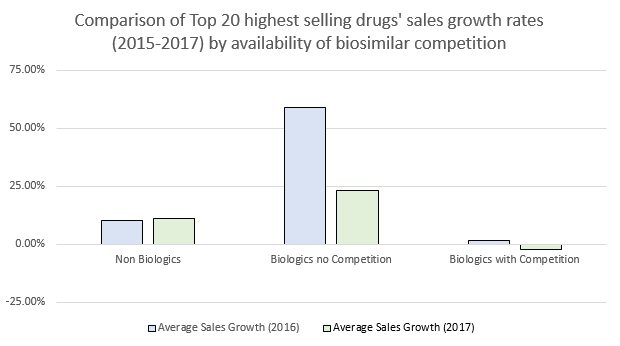

Biosimilar competition includes an effort to significantly reduce the financial burden of biologic treatments on the healthcare system. Without direct competition within their treatment spaces, the prices of biologics have aggressively risen to an extent that underscores the need for increased biosimilar competition.3 Within the last few years, the FDA has taken steps to approve more biosimilar products and has committed to providing for a competitive landscape.4 The three latest biosimilars to be approved by the FDA have all been biosimilars to Herceptin. Further, Pfizer’s Trazimera, the most recently approved trastuzumab biosimilar,5 has sparked intrigue. As a result, Genentech is bracing for Herceptin biosimilar commercial launches in 2019.

Based on SEC filings, company websites, and annual reports accrued by IgeaHub6

The Trastuzumab Biosimilar Competitive Landscape

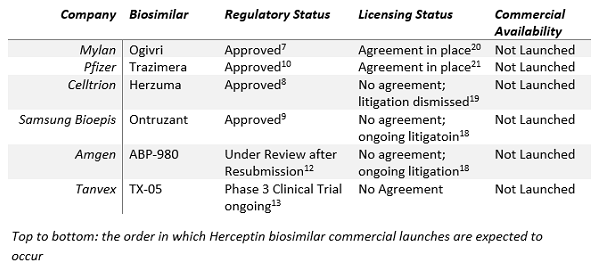

To better understand what’s happening, it’s important to review the FDA’s approvals. So far, there have been four Herceptin biosimilars approved by the FDA. In chronological order, they are:

- Mylan and Biocon’s Ogivri (trastuzumab-dkst) was approved in December of 2017 for treatment of patients with HER2-overexpressing breast or metastatic stomach cancers.7

- In December of 2018, the FDA approved Celltrion’s Herzuma (trastuzumab-pkrb), but the treatment is only indicated for HER2-overexpressing breast cancer in adjuvant and metastatic settings. Celltrion has partnered with Teva to market Herzuma.8

- A Samsung Biologics and Biogen joint venture dubbed Samsung Bioepis joined this list in January of this year with Ontruzant (trastuzumab-dttb), which shares all indications with Herceptin. Ontruzant will be marketed in the U.S. by Merck & Co.9

- In March, Pfizer received FDA approval for Trazimera (trastuzumab-qyyp), which shares all indications with Herceptin as well.10

There are also two pipeline candidates that may join the field in the future.

- Amgen has developed its own Herceptin biosimilar asset (ABP 980), marketed as Kanjinti outside of the U.S., in collaboration with Allergan. Previously, the FDA rejected Amgen’s Herceptin biosimilar.11 Amgen resubmitted its BLA to the FDA in late December 2018 and expects to hear back from the FDA after a six-month review.12 ABP 980 may be approved in late Q2 2019.

- Tanvex Biopharma, a relatively new Taiwan-based company, is developing TX-05, a proposed trastuzumab biosimilar.13 Tanvex Biopharma previously submitted a BLA to market its first biosimilar in the U.S., where, if it is approved, it will attempt to hold its own within the filgrastim product space, which is filled with familiar faces such as Sandoz, Amgen, Teva, and Pfizer.14 Tanvex is currently evaluating TX-05 in a Phase 3 clinical trial.

Licensing Agreements And Order To Market

While there are many hurdles to overcome, it’s important to call out that the biosimilar market access bottleneck is not solely regulatory. Uptake of approved biosimilar products has been consistently decelerated, hindered, and/or thwarted through challenges presented by patent and intellectual property (IP) thickets. Litigation battles over Herceptin IP have been ongoing since September 2016, when Mylan originally filed a petition for inter partes review (IPR). Since then, Celltrion, Pfizer, Boehringer Ingelheim, and Samsung Bioepis have joined the list15-17. The primary point of concern has been patent ’213 (actual patent number shortened for brevity) for a “method for making humanized antibodies,” which has been labeled as broad and non-specific to the Herceptin antibody. These petitions have been somewhat successful so far, with 18 claims from the ‘213 patent having been found unpatentable by IPR proceedings brought by Pfizer and Celltrion, and several cases having been dismissed or settled. Today, there are still several IPRs and litigations persisting.

For example, as of Dec. 5, 2018, Amgen and Samsung Bioepis are still being sued for patent infringement under the Biologics Price Competition and Innovation Act (BPCIA), based on their submissions of aBLAs.18 Samsung Bioepis will not be able to launch its Herceptin biosimilar at least until its cases have ended. Based on analogous situations for (trastuzumab and non-trastuzumab) biosimilar manufacturers, it is likely that there will be an out of court settlement and licensing agreement between the biosimilar manufacturer and Genentech, or there will be no movement until the full lapse of exclusivity granted to Herceptin is reached. Celltrion and Genentech have agreed upon a Joint Stipulation of Dismissal of all claims and counterclaims, though neither company has announced any licensing agreement.19

However, Mylan20 and Pfizer21 have reached licensing agreements with Genentech to market Ogivri and Trazimera, respectively. As Mylan reached an agreement with Genentech first, Ogivri will be the first Herceptin biosimilar to launch commercially in the U.S. market and will be an early-mover beneficiary. Current expectations are that Mylan will launch Ogivri mid-2019.22 Pfizer will be the second to market and may look to leverage its brand power, ever-increasing expertise, and reliability as a biosimilar manufacturer to carve its own place in the Herceptin space.

Genentech’s Market Defense Strategy

Meanwhile, Genentech will not stand by idly as it loses market exclusivity. Biosimilars have struggled to surpass their reference products in market share in the U.S., which may reduce some worries about the impact of biosimilar entry.23 With increasing physician awareness of and confidence in biosimilars, Genentech has taken on a more active role to potentially combat biosimilar entrance. The FDA approved a subcutaneous injection version of Herceptin in combination with Hylecta (hyaluronidase-oysk) in combination with paclitaxel or alone in people who have received one or more chemotherapy regimens for metastatic disease.24, 25 All four of the approved Herceptin biosimilars (Mylan/Biocon, Celltrion, Samsung Bioepis, and Pfizer) are limited to intravenous infusion as a route of administration.

Genentech will push the Herceptin treatment paradigm away from intravenous administration. This shift will provide for preference-based selection of Herceptin over biosimilar products, as demonstrated in the prefHER study, in which 86 percent of patients preferred subcutaneous Herceptin over intravenous administration. There are benefits such as time savings through subcutaneous administration — which was cited as a key preference driver – because subcutaneous administration of Herceptin would take patients approximately 2 to 5 minutes, whereas intravenous administration takes approximately 60 to 90 minutes.25 Additionally, studies have shown that on top of time, subcutaneous trastuzumab administration can also save money and, therefore, it offers an attractive option to healthcare professionals, patients, and payors compared to IV Herceptin and its biosimilars.26-29

Competitive Insights

The anticipated conclusion of Herceptin’s market exclusivity will lead to a sequential launch of Mylan’s Ogivri, followed by Pfizer’s Trazimera. Genentech will continue to have the upper hand, leveraging 20 years of strength in providing trastuzumab treatment and a complex system of multiple stakeholders that continues to benefit reference product manufacturers over biosimilar manufacturers, despite policy changes to support biosimilars by the FDA. Additionally, providing an alternative route of administration may soften the blow to Genentech; however, any competitive price reductions will continue to humble biologic manufacturers. Herceptin is not the only pillar of Genentech’s financial strength that is under siege, and its bottom line will feel the pressure of biosimilar competition, though perhaps not immediately. The later entry of Celltrion’s Herzuma will not be as impactful as others due to its indication limitation, but the addition of Samsung Bioepis and, potentially, Amgen to the mix should make for an extremely competitive arena as the oncology space prepares for the entrance of disruptive Herceptin biosimilars.

Key Questions For Consideration

Given Roche’s defense strategy, what can biosimilar companies learn/apply to successfully position their products in the market?

In the case of biosimilar developers, time is most certainly on their side. Where Herceptin Hylecta (the subcutaneous administration option) was only just approved in late February, there is little time for Genentech to move the physician and patient community away from intravenous injection. Additionally, the differentiation between subcutaneous and intravenous administration may not be as strong in oncology as compared to more chronic conditions in immunology. The biosimilar developers are likely to position themselves on three key messaging points:

- A strong history of biologic safety and reliability,

- An ongoing emphasis on biosimilar education to all stakeholder communities, and

- Biosimilars as a necessity to reduce the financial burden on the healthcare system

How are companies approaching the innovation gap?

As we are still in the prelaunch stages for trastuzumab biosimilars, it is unclear how biosimilar developers will try to address the innovation gap. Genentech will be able to offer the option of either subQ or IV Herceptin treatment, and biosimilar developers will not be able match or improve upon this offer without research and development of their own subcutaneous (or other more preferable) offerings. Companies that have experience with developing subcutaneous administration options of their biologics, such as Pfizer, may be able leverage their existing capabilities to address these concerns through their currently available technology platforms.

What other market challenges might biosimilar makers need to be prepared for in terms of this molecule, and what best practices might they rely on to overcome hurdles?

Pfizer and Mylan have successfully navigated the market access blockade, achieving both FDA approval and licensing agreements with Genentech, but there remains a question of how to navigate payors. This has subsequently diminished the success of previous biosimilar launches, so will biosimilars compete with Herceptin or between themselves for breathing room?

References:

- https://www.accessdata.fda.gov/drugsatfda_docs/label/2010/103792s5250lbl.pdf

- https://www.forbes.com/sites/greatspeculations/2017/10/12/roches-blockbuster-oncology-drugs-losing-steam-as-they-approach-patent-expiry/#7c714b485d13

- https://www.forbes.com/sites/theapothecary/2019/03/08/biologic-medicines-the-biggest-driver-of-rising-drug-prices/#2b93d8fe18b0

- https://www.fda.gov/downloads/Drugs/DevelopmentApprovalProcess/HowDrugsareDevelopedandApproved/ApprovalApplications/TherapeuticBiologicApplications/Biosimilars/UCM613761.pdf

- https://pipelinereview.com/index.php/2019031370747/Antibodies/U.S.-FDA-Approves-Pfizers-Oncology-Biosimilar-TRAZIMERA-trastuzumab-qyyp-a-Biosimilar-to-Herceptin1.html

- https://www.igeahub.com/2018/04/07/20-best-selling-drugs-2018/

- http://newsroom.mylan.com/2017-12-01-U-S-FDA-Approves-Mylan-and-Biocons-Ogivri-TM-the-First-Biosimilar-for-Trastuzumab-for-the-Treatment-of-HER2-Positive-Breast-and-Gastric-Cancers

- https://www.celltrion.com/en/pr/reportDetail.do?seq=534

- http://www.samsungbioepis.com/en/newsroom/detail/Samsung-Bioepis-First-Oncology-Medicine.html

- https://www.pfizer.com/news/press-release/press-release-detail/u_s_fda_approves_pfizer_s_oncology_biosimilar_trazimera_trastuzumab_qyyp_a_biosimilar_to_herceptin_1

- https://wwwext.amgen.com/media/our-perspective/amgen-statement-on-complete-response-letter-from-the-us-fda-for-abp-980/

- Amgen Q4 2018 Earnings Call

- https://www.centerforbiosimilars.com/news/tanvex-submits-bla-for-proposed-filgrastim-biosimilar

- http://www.tanvex.com/PDF/News/100118.pdf

- https://www.biosimilarsip.com/2017/10/17/genentechs-carter-%CA%BC213-patent-continues-draw-ipr-challenges/

- https://www.biosimilarsip.com/2018/03/05/genentechs-carter-213-patent-asserted-challenged/

- https://www.biosimilarsip.com/2018/12/11/claims-of-genentechs-carter-213-patent-found-unpatentable/

- https://www.bigmoleculewatch.com/2018/12/05/trastuzumab-patent-litigation-updates/?rel=0

- https://www.bigmoleculewatch.com/wp-content/uploads/2019/01/2018-12-20-Genentech-v.-Celltrion-DI-100-Joint-Stipulation-of-Dismissal-SO-ORDERED.pdf

- http://newsroom.mylan.com/2017-03-13-Mylan-Announces-Global-Settlement-and-License-Agreements-with-Genentech-and-Roche-on-Herceptin-R

- https://biosimilarsrr.com/2018/12/10/pfizer-signs-licensing-agreement-with-roche-on-trastuzumab-biosimilar/

- http://newsroom.mylan.com/2017-03-13-Mylan-Announces-Global-Settlement-and-License-Agreements-with-Genentech-and-Roche-on-Herceptin-R

- https://accessiblemeds.org/sites/default/files/2018-02/Doug%20Long.pdf

- https://www.fda.gov/Drugs/InformationOnDrugs/ApprovedDrugs/ucm632294.htm?utm_campaign=Oncology%202/28/2019%20trastuzumab%20and%20hyaluronidase-oysk%20injection&utm_medium=email&utm_source=Eloqua&elqTrackId=e967a2b121854b5a9db69469fef6f7bf&elq=7ac054309ba1441ba73aeaf555868d13&elqaid=6962&elqat=1&elqCampaignId=5704

- https://www.roche.com/media/releases/med-cor-2019-02-28.htm

- https://www.accessdata.fda.gov/drugsatfda_docs/label/2017/761074s000lbl.pdf

- https://www.accessdata.fda.gov/drugsatfda_docs/label/2018/761091s000lbl.pdf

- https://www.merck.com/product/usa/pi_circulars/o/ontruzant/ontruzant_pi.pdf

- https://www.accessdata.fda.gov/drugsatfda_docs/label/2019/761081s000lbl.pdf

About The Author:

Robert Browne is an analyst in the Health + Life Science practice at Fuld + Company, where he focuses on methodological evaluation, data management, and project implementation within biological constructs. His subject matter expertise in areas such as oncology, biosimilar, rheumatology, ophthalmology, rare diseases, laboratory digitalization, and neurology enable him to support clients’ branded and pipeline assets by delivering competitive strategy and intelligence insights. Browne graduated from Bowdoin College with a major in neuroscience and a minor in music theory and composition. You can connect with him on LinkedIn.

Robert Browne is an analyst in the Health + Life Science practice at Fuld + Company, where he focuses on methodological evaluation, data management, and project implementation within biological constructs. His subject matter expertise in areas such as oncology, biosimilar, rheumatology, ophthalmology, rare diseases, laboratory digitalization, and neurology enable him to support clients’ branded and pipeline assets by delivering competitive strategy and intelligence insights. Browne graduated from Bowdoin College with a major in neuroscience and a minor in music theory and composition. You can connect with him on LinkedIn.