Innovation In Disposable Connectors

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

The single-use application market in biopharmaceutical manufacturing is rapidly expanding and highly innovation-driven. Adoption of single-use equipment in early manufacturing has reached a level of maturity that will spill into commercial scale manufacturing in the near term. Indeed, results from our 10th Annual Report and Survey of Biopharmaceutical Manufacturers (www.bioplanassociates.com/10th) indicate that nearly half of biopharmaceutical manufacturers and CMOs either strongly agree (18 percent) or agree (28 percent) that they expect to see 100 percent single-use facility in operation within five years.

The single-use application market in biopharmaceutical manufacturing is rapidly expanding and highly innovation-driven. Adoption of single-use equipment in early manufacturing has reached a level of maturity that will spill into commercial scale manufacturing in the near term. Indeed, results from our 10th Annual Report and Survey of Biopharmaceutical Manufacturers (www.bioplanassociates.com/10th) indicate that nearly half of biopharmaceutical manufacturers and CMOs either strongly agree (18 percent) or agree (28 percent) that they expect to see 100 percent single-use facility in operation within five years.

Those are big expectations — and if they are to be met, some critical hurdles may need to be crossed. One of them is developing standardized applications and connectors. Connectors are needed because they permit interconnectability between various components and between different vendors’ devices. This plug-and-play approach ultimately enables further adoption of disposable devices and reduces the risk of being locked into a single component supplier.

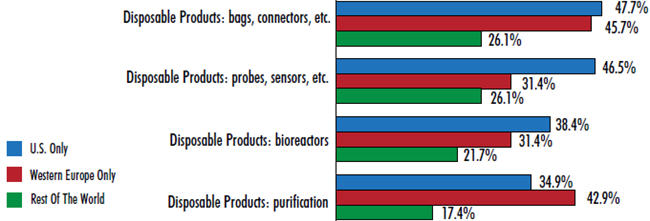

It’s no surprise, then, that disposable bags and connectors top the areas in which the industry is demanding innovation and better products. When we asked respondents where they want their suppliers to focus their new product development efforts, a leading 44 percent pointed to basic devices such as disposable bags and connectors. This response ranked 4 percent above the next mostdesired innovation (disposable probes and sensors, at 40 percent). Other disposable devices also appear near the top of the list, including innovation in disposable bioreactors and disposable purification products.

Interest in disposable-bags-and-connectors innovation is higher in established biomanufacturing hubs, with U.S. respondents and Europeans leading the way (47.7 percent and 45.7 percent, respectively). Respondents from the rest of the world have expressed less interest in innovation in this area (26.1 percent) — this year they’re more concerned with process development services. This difference is likely due to the fact that early pipeline products in the U.S. and EU, made using single-use devices, are now reaching laterstage production. As such, the need for better products for commercial scale production is now becoming more acute.

Increased Interest in Connectivity over Time

The biopharmaceutical manufacturing community’s interest in innovative disposable connectors appears to have risen over the past couple of years, perhaps as the industry recognized what a crucial role the devices can play by introducing them into existing single-use product lines (e.g. substrate feeds via novel bags, molded manifolds, and plastic connectors to enable fed-batch, repeated batch, or perfusion modes of bioreactor operation). This year’s 44 percent expressing an interest in connectors innovation is a step up from 40 percent last year and 37 percent in 2011.

Interest in connectors innovation is increasing alongside adoption of these devices. Among respondents to our study who use disposables, 8 in 10 already say they’re using connectors and clamps at some stage of manufacturing. The data in the study shows these devices have become more critical over time, growing from 68.3 percent adoption in 2007 and 47.6 percent in 2006, the early years of single-use product introduction. In fact, the compound annual growth rate in adoption for these products between 2006 and 2013 stands at a healthy 7.5 percent, the fifth-fastest growth rate of the 14 single-use products we identified in our study.

Looking Forward

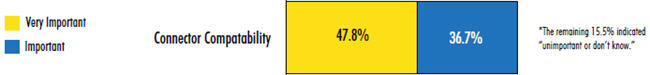

When we evaluated the importance of single-use connectors, we found that nearly all bioprocessing professionals (84 percent) are relying on their suppliers to develop and standardize better connector compatibility (See Fig 2). This demand is likely to push suppliers to consider more “open” designs that do not lock end users into a single format or supplier.

Growing adoption of and interest in disposable connectors means that vendors will likely enjoy a healthy demand for their new products. However, these small devices also command only small budgets: When we estimated the average budget per facility on different single-use components, we found that the average respondent budgets just over $25,000 for connectors and clamps. That’s far below other more complex single-use applications such as filter cartridges, depth filters, bioreactors, and buffer containers. While that may suggest that vendors may find better margins with other innovative products, it also means that connectors — as smaller lineitems — may find an easier path into the budget. Indeed, effective integration into both process and business systems defines successful applications of single-use systems versus unsuccessful ones, and so far at least, most of the focus has been on physical connections such as tubing and connectors, giving them a leg up on other products.

Given healthy penetration of disposable connectors — and growing end user desire for innovation — it’s likely that the industry will continue to see a number of innovations in this area. Vendors will need to consider standardizing these devices to satisfy end user demand. With disposable devices continuing to make inroads into commercial biomanufacturing, we can expect that the importance of connectors and clamps will only rise over time. These devices enable the shift towards disposable usage, and innovation should continue as vendors recognize that their use (and standardization) is crucial in the continued maturation of the disposables market.

Figure 1: Selected New Product Development Areas Of Interest

U.S. vs. Western Europe vs. Rest Of The World

Figure 2: Single Use/Disposables Standardization Factors

“In my opinion, single use/disposables vendors need to work harder to standardize.”

Survey Methodology: The 2013 10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production is an evaluation by BioPlan Associates, Inc. that yields a composite view of and trend analysis from 300 to 400 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The respondents also include more than 185 direct suppliers of materials, services, and equipment to this industry. Each year the study covers issues including new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.